Bottom line:

-

BTC rate weak point speeds up after the Wall Street open as analysis cautions of a “carpet pull” at $104,000.

-

Bitcoin bulls have actually done their finest to prevent panic responses to drawback volatility activates.

-

United States dollar strength eyes a resurgence after striking brand-new three-year lows.

Bitcoin (BTC) broke listed below $105,000 on June 17 as analysis alerted that a “huge relocation” was yet to come.

BTC rate relocation “developing”– Trader

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD striking intraday lows of $104,401 after the Wall Street open.

An unusual 11 red per hour candle lights in a row kept bulls strongly in check, with order book analysis cautioning that drawback might quickly snowball.

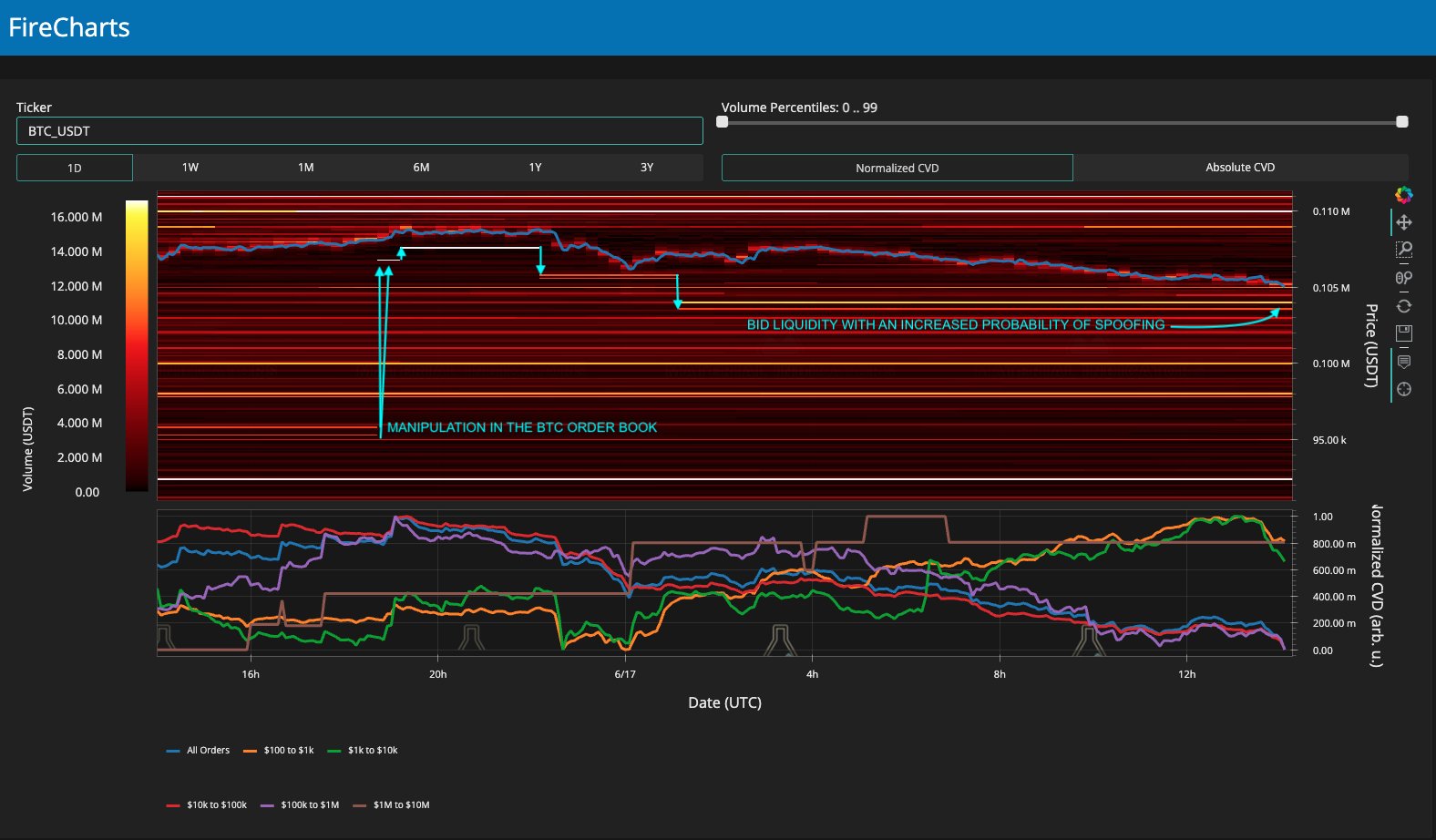

” This is what adjustment appears like in the $BTC order book,” trading resource Product Indicators summed up on X, describing moving quote liquidity as rate fell.

” If rate breaks listed below $105k, be gotten ready for a carpet pluck $104k.”

Liquidity “spoofing,” as Cointelegraph formerly reported, is a typical phenomenon on crypto markets when large-volume traders want to affect rate trajectory.

” If bulls can press above $108k, the door to $110k is open,” Product Indicators acknowledged the day prior.

Talking about total market strength, popular trader Alter was relatively positive. Bitcoin traders, he kept in mind, were showing more restraint than throughout other current market pullbacks in spite of significant geopolitical pressure.

Volatility, he alerted, was nevertheless around the corner.

” For a 3% or two pullback up until now market isn’t worried yet, although on LTF there’s clear hedge predisposition Previous dips were 5% or two however had aggressive shorting, area selling & & uptick in volatility with sell momentum/Volume,” part of an X post read.

” So this indicates the huge relocation has yet to happen & & is developing.”

” Deeply oversold” United States dollar teases resurgence

With gold falling and United States dollar strength revealing indications of bullish divergence, point of views on the Middle East dispute were far from worried.

Related: Bitcoin rate leading metric with 10-year record remains ‘neutral’ at $112K

In continuous X analysis, trading resource The Kobeissi Letter dismissed the concept that Israel-Iran stress might spiral into a worldwide war.

‘ While gold is strong, it continues to paint a constant story: We are not on the verge of World War 3,” it concluded on the day.

” Oil costs are up ~ 2% today in spite of continuous attacks in between Israel and Iran. On the other hand, the 10Y Yield is nearing 4.50%. Markets state this will not be a long-lasting headwind.”

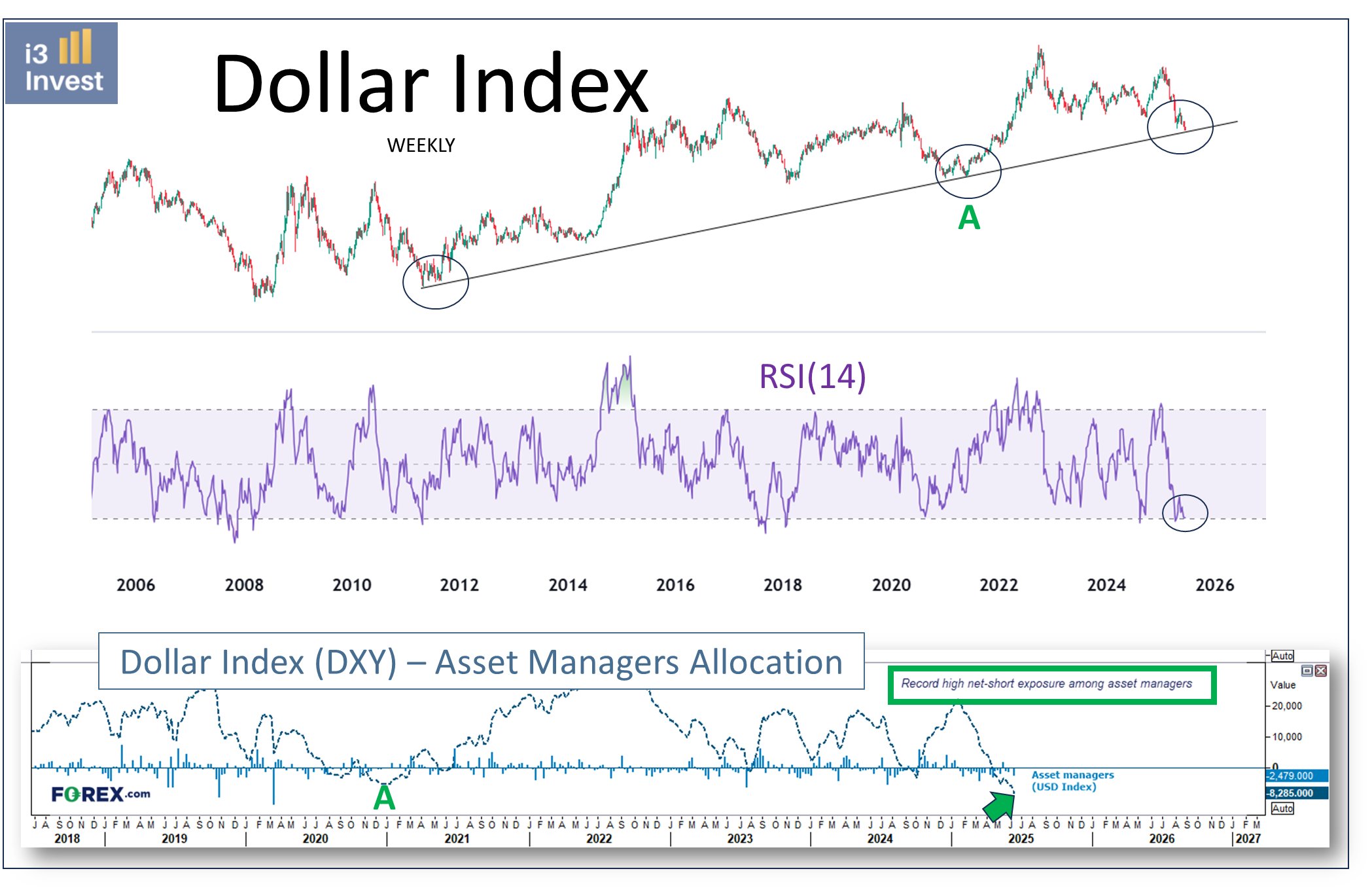

The United States dollar index (DXY), which generally trades inversely to Bitcoin, teased a healing from multiyear lows.

” Property supervisors are greatly brief on the USD. The last time placing was this bearish, the DXY staged a significant rally,” trader and market strategist Guilherme Tavares reported.

” Furthermore, the index is trading near a crucial assistance level, and the RSI (14) is deeply oversold, revealing indications of bullish divergence.”

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.