Secret takeaways:

-

President Trump’s One Huge Stunning Costs might include over $2.4 trillion to the United States financial obligation, speeding up a looming financial obligation crisis and surging inflation.

-

Inflation and dollar decline stay the course of least resistance in the United States economy, deteriorating the genuine worth of money and bonds.

-

Bitcoin can provide a hedge, however just if kept in self-custody, as custodial platforms might not make it through a prolonged stage of monetary repression.

” Declines generally happen relatively quickly throughout financial obligation crises.” This quote from Ray Dalio’s book, “The Altering World Order,” strikes more difficult today than when the billionaire hedge fund supervisor initially composed it in 2021. And for great factor: the United States might be strolling directly into one.

The United States deficit spending surpassed $6 trillion in 2024, and Elon Musk, the previous head of the Department of Federal Government Performance (DOGE), saw his efforts to cut federal costs stop working, with simply $180 billion cut out of the $2 trillion that he guaranteed. Rates of interest stay at 4.5%, as the Federal Reserve frets about the trade war’s effect on inflation. Presently, the yield on 10-year Treasurys still hovers above 4.35%.

Let’s be sincere: the United States financial obligation spiral is deepening. What’s more, its most likely driver passed your home on May 22 and is now pending in the Senate.

The Huge Stunning Costs will trigger greater inflation

The Huge Beautiful Costs has actually been making headings and breaking star bromances considering that early May. At over 1,100 pages, the expense collects the best hits of previous GOP policies: extended 2017-era tax cuts, removal of previous President Biden’s green energy rewards, and tighter eligibility for Medicaid and breeze advantages. It likewise licenses a significant growth of migration enforcement and raises the financial obligation ceiling by $5 trillion.

According to the nonpartisan Congressional Budget plan Workplace (CBO), the expense would cut federal income by $3.67 trillion over a years while decreasing costs by just $1.25 trillion. That’s a net addition of $2.4 trillion to the currently jaw-dropping financial obligation stack of practically $37 trillion. Another nonpartisan forecaster, the Committee for an Accountable Federal Budget plan, included that when taking interest payments into account, the expense’s expense might increase to $3 trillion over a years or to $5 trillion if short-term tax cuts were made long-term.

A few of the expense’s advocates argue that tax cuts would promote the economy and “spend for themselves.” Nevertheless, the experience of the 2017 tax cuts revealed that, even consisting of favorable financial results, they had actually increased the federal deficit by practically $1.9 trillion over a years, according to the CBO.

The numbers matter, however what’s unfolding is larger than a trillion here or there. As Republican Politician Senator Ron Johnson of Wisconsin put it,

” The CBO rating is a diversion. You’re arguing over branches and leaves when you’re neglecting the forest that’s on fire.”

The spiral of deficit spending and financial obligation has actually currently absorbed the United States economy, and there is no reputable strategy to reverse it.

The United States can not “grow its escape” of financial obligation

Some argue the United States will amazingly “grow its escape” of this issue. However as Sina, the co-founder of 21st Capital, kept in mind on X,

” To outgrow this financial obligation without investing cuts or tax boosts, the United States would require genuine GDP development of 20%+ annually for a years.”

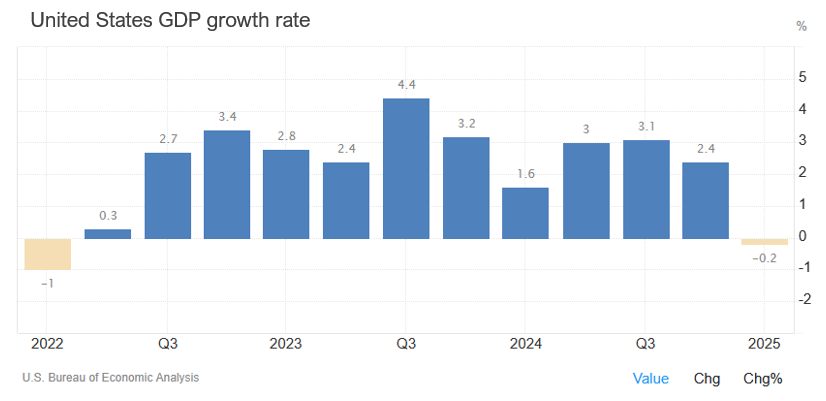

With Q1 2025 signing up -0.3% genuine GDP development, and the United States Federal Reserve approximating the Q2 2025 development at 3.8%, such a situation stays impractical.

As Harvard financial expert Kenneth Rogoff composed in the Financial Times, deficits are predicted to go beyond 7% of GDP for the rest of Trump’s term, which lacks a black swan occasion.

This suggests that the only development possible now is small.

In his book, Ray Dalio laid out the 4 tools federal governments have in a financial obligation crisis: austerity, defaults, redistribution, and printing cash. The very first 3 hurt and politically pricey. The 4th, printing and decline, is without a doubt the most likely. It’s quiet, nontransparent, and quickly camouflaged as a stimulus. It likewise eliminates savers, shareholders, and anybody depending on fiat. Dalio composes,

” Many people do not pay adequate attention to their currency threats. Many stress over whether their possessions are increasing or down in worth; they seldom stress over whether their currency is increasing or down.”

Related: Older financiers are running the risk of whatever for a crypto-funded retirement

Not your secrets, not your coins

This is where Bitcoin goes into the image– not as a speculative trade, however as a financial insurance plan versus the United States financial obligation crisis.

If, or when, the United States selects to inflate its escape of financial obligation, small Treasurys and money will see their genuine worth deteriorate. Synthetically reduced rate of interest and required bond purchases by organizations might even more drive genuine yields into unfavorable area.

Bitcoin is crafted to withstand this result. With its repaired supply and self-reliance from federal government financial policy, it uses what fiat can not: a sanctuary from monetary repression and currency debasement. Not to point out a yield that can put bonds to embarassment. As Bitwise experts have actually kept in mind, Bitcoin’s shortage and durability position it distinctively to take advantage of financial instability.

Nevertheless, not all Bitcoin direct exposure is equivalent. In a crisis circumstance, when the federal government can validate monetary repression in the name of “financial stability,” custodial threats are high. ETFs and any other custodial services might merely stop working to honor redemptions. The only real security originates from self-custody, freezer, personal secrets, and complete control.

Rogoff put it clearly:

” United States financial policy is running the rails, and there appears to be little political will in either celebration to repair it till a significant crisis happens.”

Up until now, the Republican-controlled Congress hasn’t turned down a single Trump proposition, making the chances of the Big Beautiful Costs ending up being law high. So is the possibility of a full-blown financial obligation crisis. Because world, tough possessions in self-custody will matter especially.

This short article is for basic details functions and is not planned to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.