Secret takeaways:

-

Bitcoin’s long-lasting CAGR of 42.5% exceeds the Nasdaq and gold, however is predicted to drop to 30% by 2030.

-

The power-law and quantile designs keep BTC’s Q4 2025 target in between $150,000–$ 200,000, with $1.2 million to $1.5 million possible by 2035.

The long-lasting development of Bitcoin (BTC) stays extraordinary, according to a current Bitcoin Intelligence Report, keeping in mind that even in the context of other significant possessions, its trajectory stands apart.

The report compared the Nasdaq’s 10-year rolling substance yearly development rate (CAGR), which generally beings in the mid-single to low-teens, with the current years providing 16%. Gold has actually balanced 10.65% over the previous years, increasing to 12.88% when changed for its 2% yearly supply development.

On The Other Hand, the United States M2 cash supply has actually broadened at approximately 6% every year over the exact same duration. Versus this background, Bitcoin’s designed CAGR of 42.5% highlights its outsized efficiency.

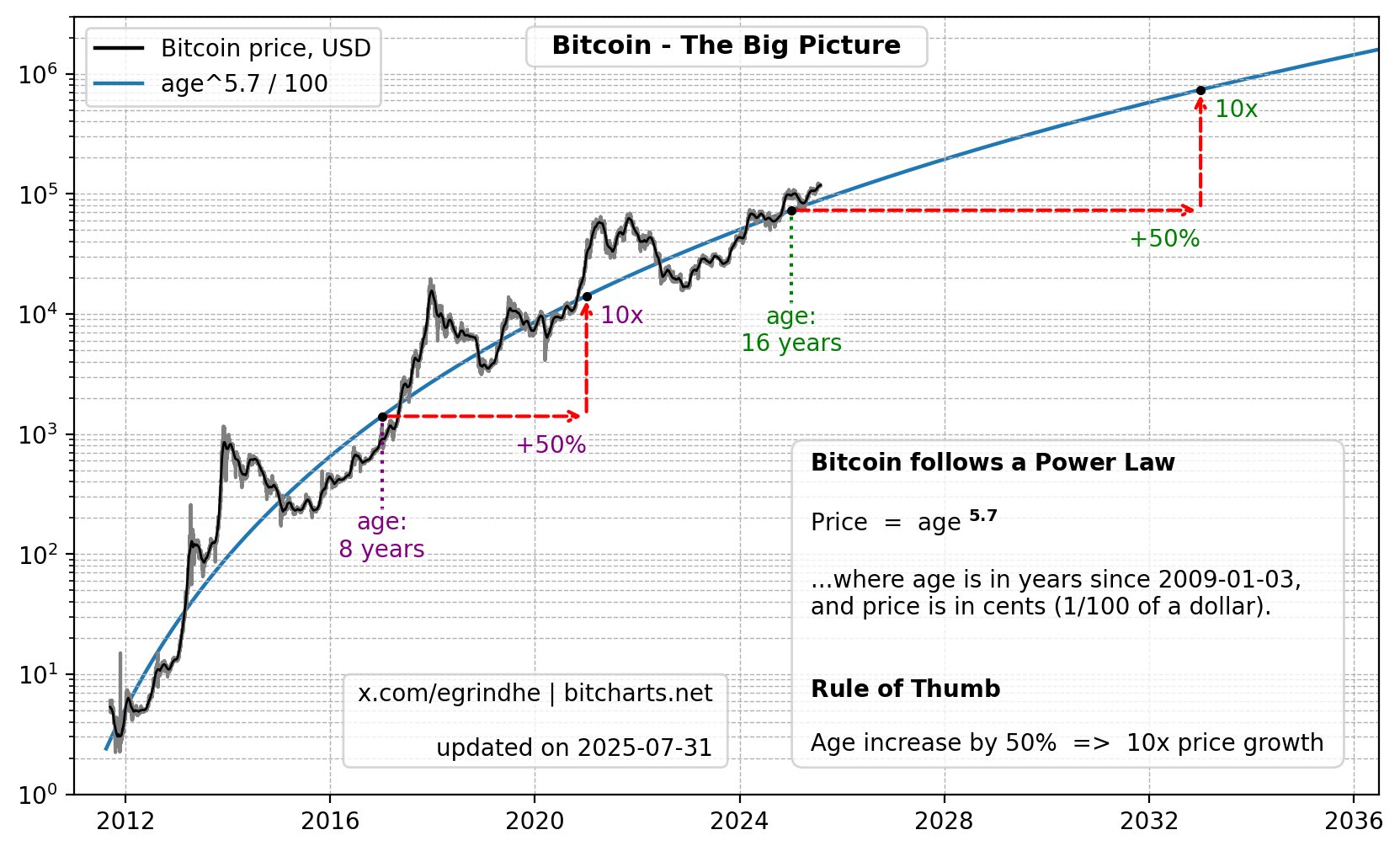

The company’s power-law design, which has actually tracked Bitcoin with “unmatched consistency” for 16 years, tasks a steady, adoption-driven deceleration towards 30% by 2030, still triple gold’s supply-adjusted development rate.

” Bitcoin stays the cleanest barometer of worldwide liquidity,” the report states, mentioning its smaller sized market size and function as a “liquidity sponge” in a structurally extensive financial routine.

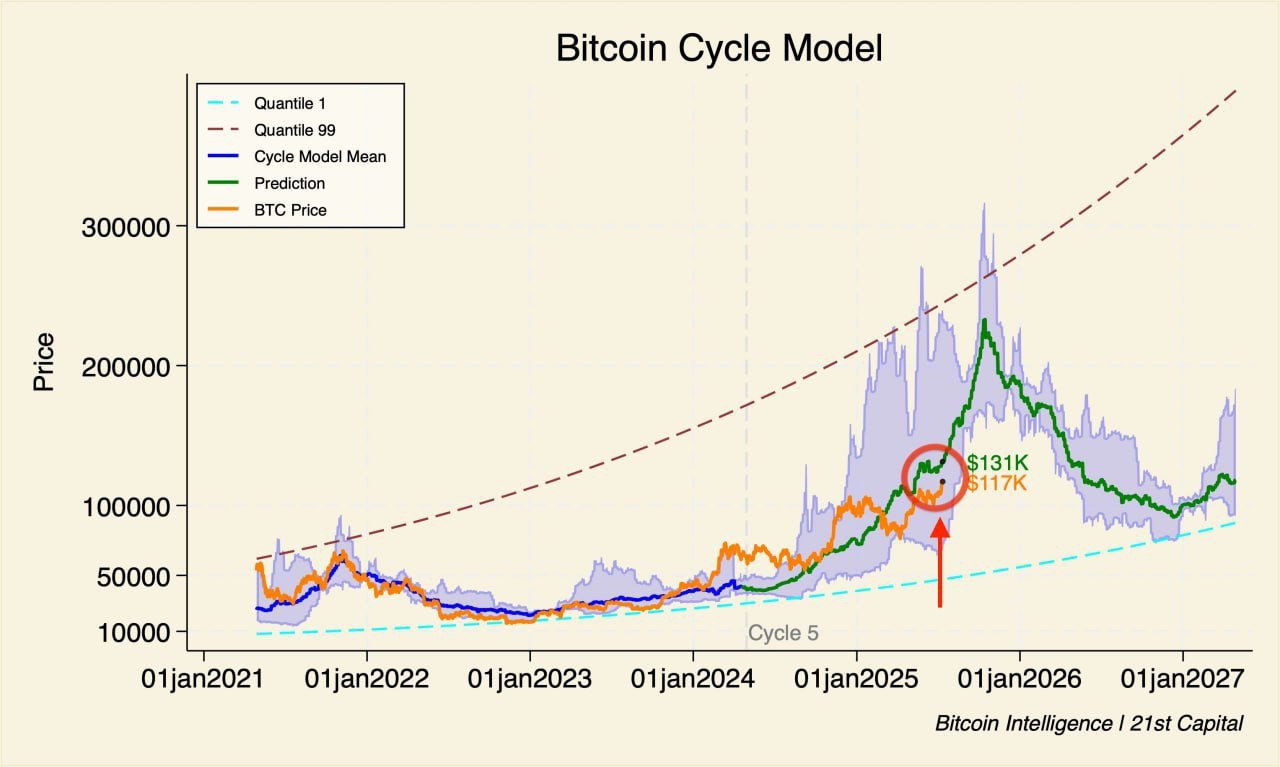

The report reveals that the $114,000–$ 117,000 build-up zone showed resistant, setting off a spot-led rebound to $122,000.

Related: Bitcoin institutional volume strikes 75% on Coinbase in brand-new BTC rate signal

Bitcoin $200,000 target by Q4 stays on track

While the instant resistance lies simply above $130,000, the year-end target for Bitcoin stays near to $200,000. Its rate forecast integrates the power-law method with quantile analysis to track Bitcoin’s historic development.

According to the design, the base pattern for Bitcoin by the end of 2025 relaxes $120,000. Factoring in the cyclical bull stage, the rate might reasonably reach in between $150,000 and $200,000. Looking even more out, by 2035, the design prepares for Bitcoin might reach $1.2 million to $1.5 million, a projection based upon rapid, network-like development instead of speculative buzz.

The chart reveals that every 50% boost in Bitcoin’s age has actually traditionally driven about a 10x dive in rate, a pattern the design has actually tracked with strong precision (R TWO > 0.95). This data-backed pattern, coupled with strong onchain strength and helpful macroeconomic conditions (future rates of interest cuts), recommends the very best might still be ahead for Bitcoin in 2025.

Bitwise primary financial investment officer Matthew Hougan suggests a comparable result. In an interview with Cointelegraph, Hougan stated that Bitcoin’s supply-demand balance is progressively manipulated towards need, with miners producing less coins than openly traded business and ETFs are jointly purchasing. In May, Hougan stated,

” I believe ultimately that will tire sellers at the $100,000 level where we have actually been stuck, and I believe the next stopping point above that is $200,000.”

Related: Bitcoin bulls charge at all-time highs as trader states $126K ‘critical’

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.