Bottom line:

-

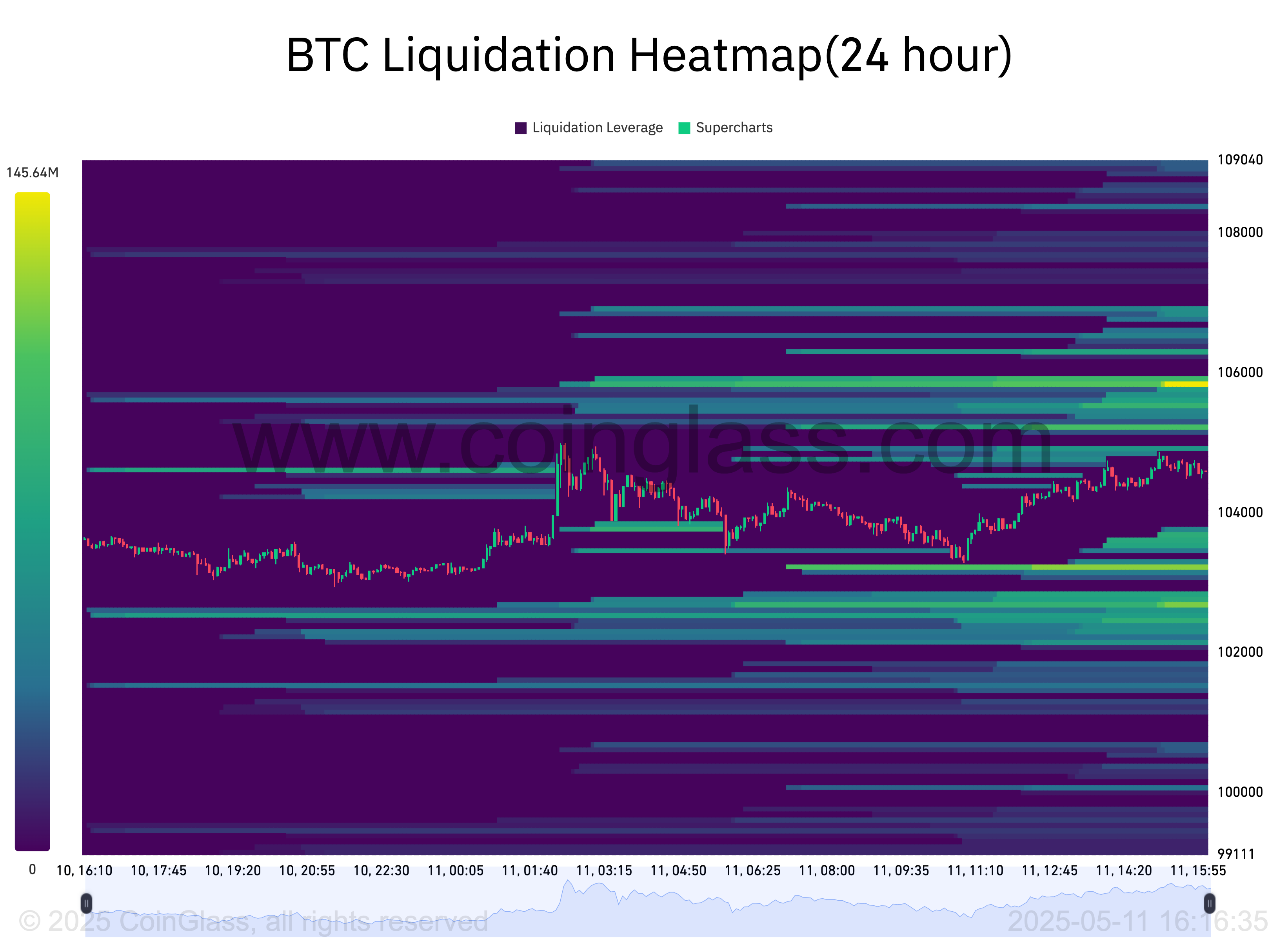

Liquidity is firmly clustered around present area cost, with $106,000 the most likely next battlefield.

-

Some traders are anticipating the quote to go into cost discovery to stop working.

Bitcoin (BTC) maintained huge gains into the Might 11 weekly close as analysis flagged the essential level to hold next.

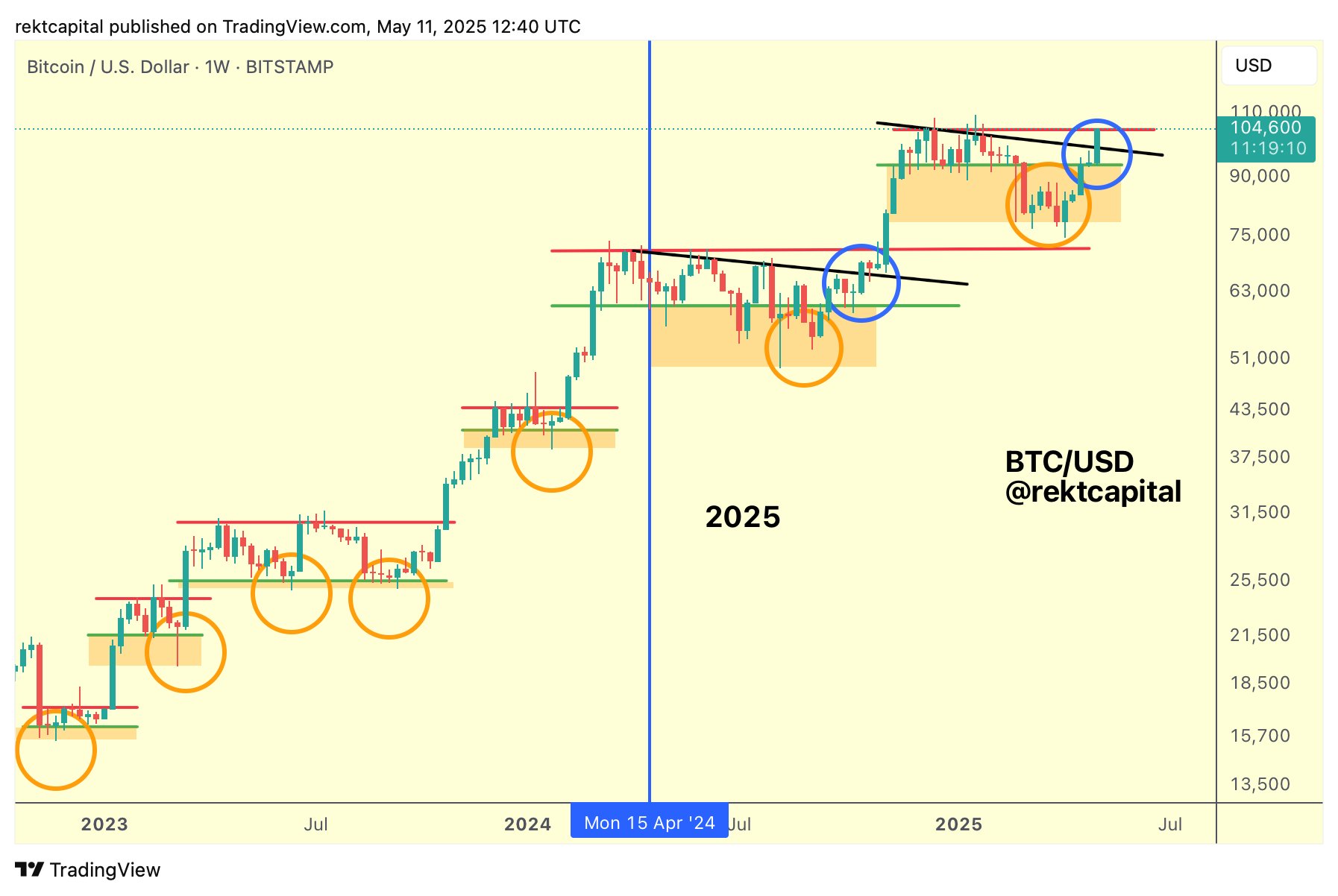

Analysis: BTC cost can “start the breakout procedure”

Information from Cointelegraph Markets Pro and TradingView revealed weekend benefit volatility, providing brand-new multimonth highs of almost $105,000.

An absence of liquidity throughout “out of hours” trading added to the relocation, which once again began the back of favorable reports over a US-China trade offer.

$BTC

nearly tagging $105K off once again headingsmarkets will wish to see fulfillment of Trumps remarks relating to a course forward with trade in between United States & & China

Delivering information does currently recommend experts understand for this reason container volume has actually quickly gotten once again pic.twitter.com/AijqalylwS

— Alter Δ (@ 52kskew) May 10, 2025

Now, popular trader and expert Rekt Capital validated that Bitcoin might even start a go back to all-time highs and cost discovery.

The critical weekly close level to turn to support, he stated, lay at around $104,500.

” Can Bitcoin do it? Can Bitcoin Weekly Close above the Variety High of its just recently recovered Re-Accumulation Variety to start the breakout procedure?” he queried in a post on X along with an explanatory chart.

” Bitcoin is on the cusp of starting Cost Discovery Uptrend 2.”

An extra upgrade computed the present Bitcoin booming market as 85.5% total, yet with the most unpredictable increases still to come.

#BTC Booming Market Development:

▓ ▓ ▓ ▓ ▓ ▓ ▓ ▓ ░ ░ 85.5%

( Development will accelerate on Parabolic advances)$BTC #Crypto #Bitcoin pic.twitter.com/Qe88NVmo2z

— Rekt Capital (@rektcapital) May 9, 2025

A take a look at the current exchange order book information from keeping track of resource CoinGlass revealed a big cloud of asks clustered around the location instantly listed below $106,000 at the time of composing.

Quotes were laddered to $102,000, developing a thickening band of liquidity around area cost into the weekly close.

Bitcoin can still backtrack “whole relocation”

Some market individuals stayed bearish on brief timeframes.

Related: Is Bitcoin ready to go parabolic? BTC cost targets consist of $160K next

On X, popular trader HTL-NL argued that the present push towards all-time highs would end as a “fakeout” to trap late longs.

” Will $BTC close/open the week staying within the variety, will it do a ‘phony out (UTAD)’ or was this actually a reaccumulation variety as numerous wish to think,” he composed on the day.

” To be truthful, although I still favour the very first 2 choices based upon M/Q charts, it being reaccumulation is possible.”

Another voice of care, one all too familiar in Bitcoin trading circles, was available in the kind of fellow trader Il Capo of Crypto.

In his newest X updates, the pseudonymous analyst alerted that BTC/USD might remedy to the degree that its whole rebound vanishes.

” This is the time to scale out, not in,” he argued on Might 10.

” Strong resistances are being checked, and if this is simply a correction of the sag given that January, the whole relocation might become totally reversed.”

Il Capo of Crypto initially acquired prestige for his $12,000 BTC cost targets at the start of the booming market in 2023.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.