Bottom line:

-

Bitcoin tags fresh record highs into the weekly close as liquidations penalize shorts.

-

BTC cost locations of interest consist of an assistance test of $115,000.

-

Hopes construct that BTC/USD will copy its seven-week “discovery uptrend.”

Bitcoin (BTC) struck brand-new all-time highs on Sunday as BTC cost volatility returned into the weekly close.

BTC cost spikes to brand-new record near $19,500

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD reaching $119,444 on Bitstamp.

The set eclipsed its previous record peak from 2 days prior as it crossed the $119,000 mark for the very first time, liquidating shorts as it went.

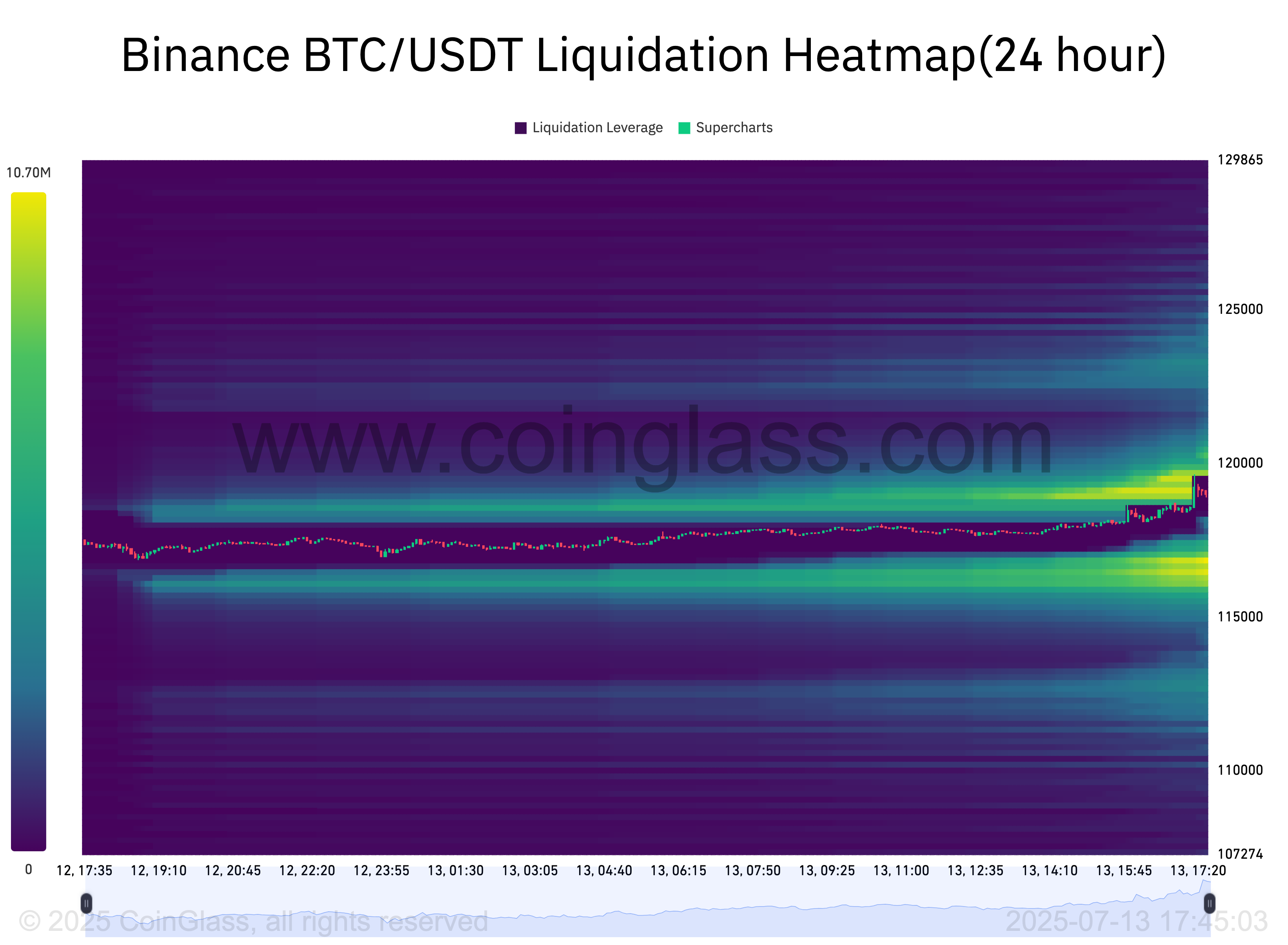

The most recent information from keeping track of resource CoinGlass put brief BTC liquidations at over $20 million in a single hour.

” Going to get fascinating next week. We have actually got a great deal of huge liquidity clusters above and listed below the existing cost. We simply secured an excellent lot at the $119K+ area,” popular trader Daan Crypto Trades responded in a post on X.

Daan Crypto Trades considered 2 essential liquidation-related zones to view next: $115,500-116,500 and the location above $120,000.

ALERT: 24h liquidations struck $208M as 95K traders trashed.

The most significant single loss was a $1.49 M BTCUSDT position on Bybit. pic.twitter.com/0Rg6PXKHtP

— Cointelegraph (@Cointelegraph) July 13, 2025

“$ BTC has a significant resistance level in between $119K-$ 120K. However after that, there’s a great deal of upside,” trader and financier Niels, cofounder of Web3 accelerator and incubator Ted Labs, continued.

” If $BTC handles to break above $120K, the course towards $135K-$ 140K will open. In case of a rejection, BTC might retest $114K-$ 115K before turnaround.”

Space for 50% gains?

Others zoomed out, with trader BitBull remaining securely positive on the instant outlook for BTC cost action.

Related: Bitcoin $120K expectations fan to ETH, BUZZ, UNI and SEI

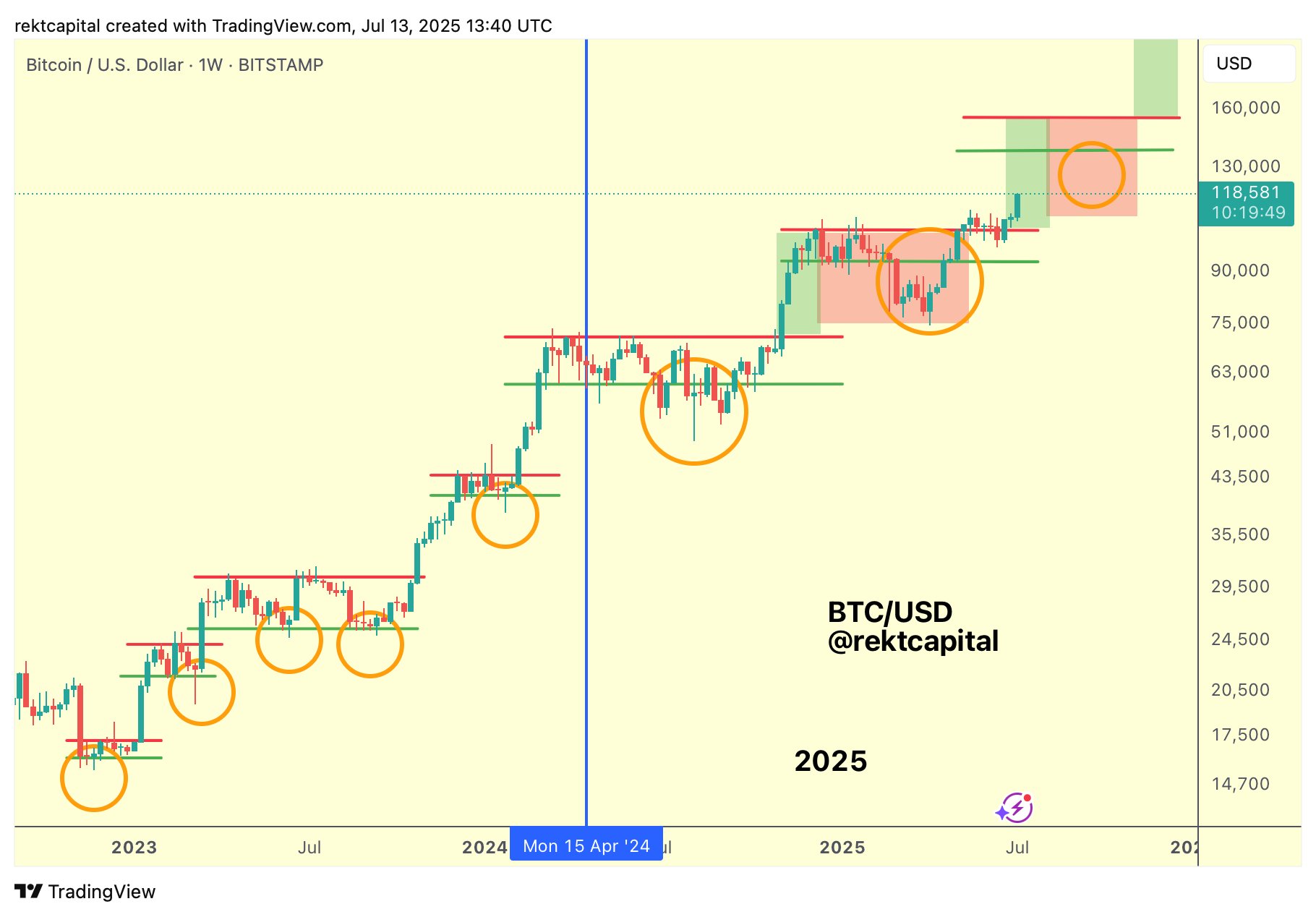

” There’s no factor to be bearish on $BTC here. The greatest weekly breakout given that November 2024, which resulted in a 50% pump last time,” he informed X fans.

BitBull flagged several bullish drivers affecting Bitcoin, consisting of record institutional inflows, the upcoming United States “Crypto Week” and reports over the resignation of Federal Reserve Chair Jerome Powell.

” Week 1 in Bitcoin’s Cost Discovery Uptrend 2 is gradually concerning an end. Week 2 starts tomorrow,” popular trader and expert Rekt Capital included.

” The very first Cost Discovery Uptrend lasted 7 weeks.”

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.