Bottom line:

-

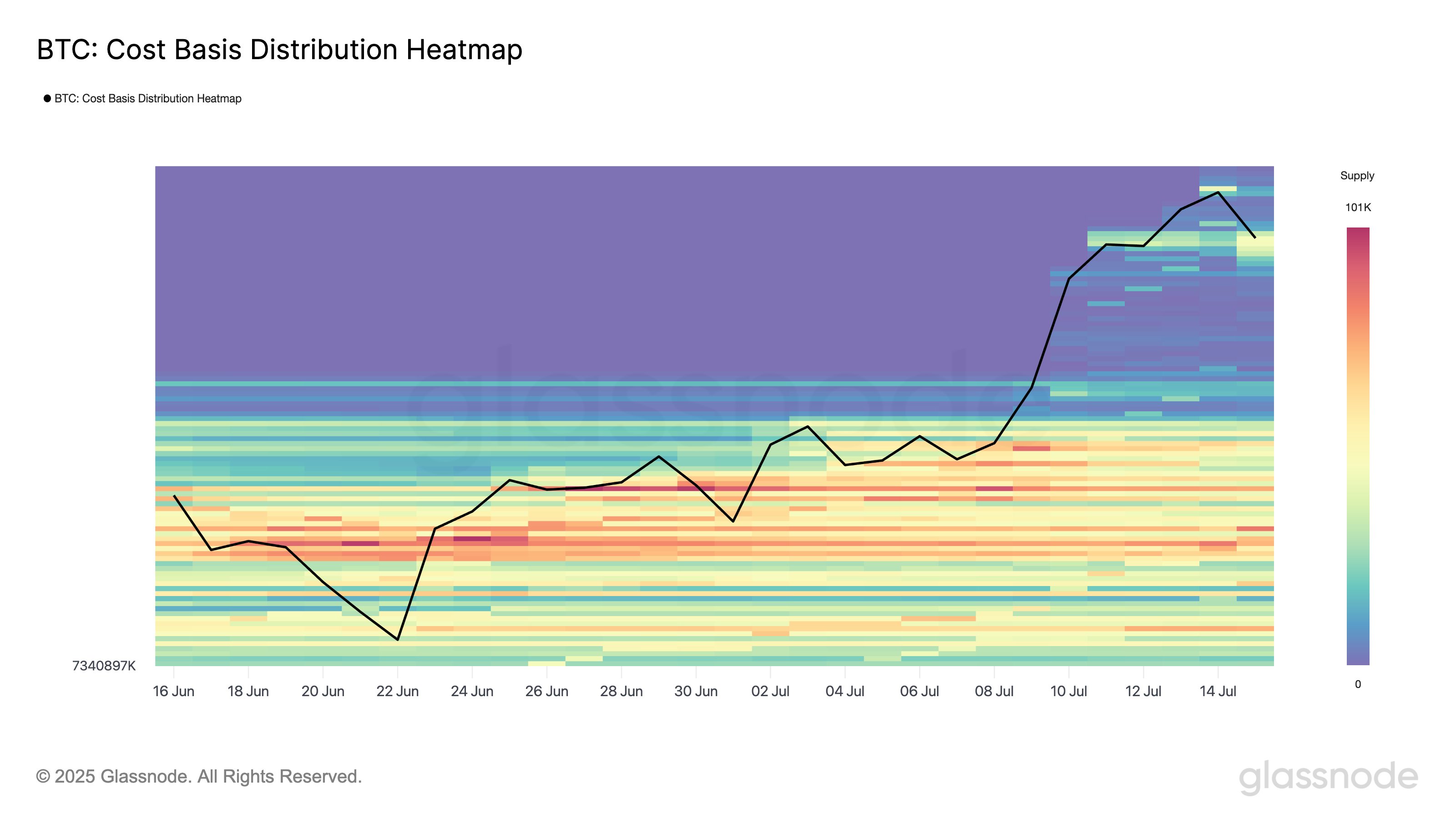

New Bitcoin market entrants have actually collected 140,000 BTC in July up until now, Glassnode information programs.

-

Purchasers throughout the board have “strongly” purchased up dips, particularly listed below $118,000.

-

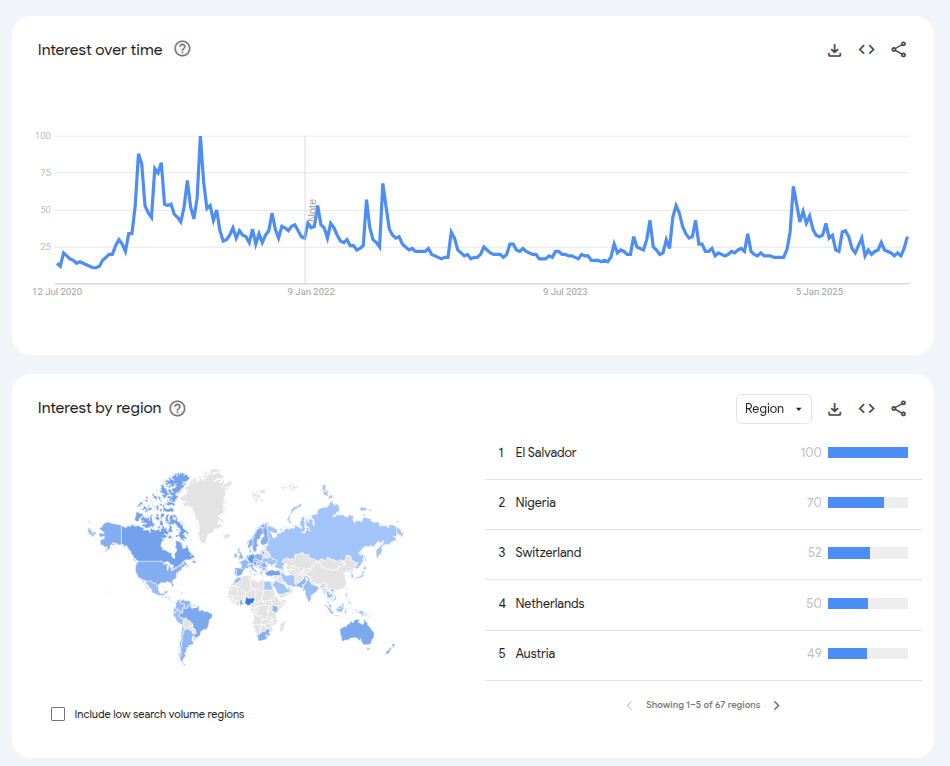

Google Trends reveals retail buzz around Bitcoin is still traditionally low.

Bitcoin (BTC) “FOMO” is gradually returning as brand-new purchasers upped their stakes by 140,000 BTC.

Brand-new research study from onchain analytics firm Glassnode submitted to X Thursday exposed how “fresh capital” got in Bitcoin markets.

Bitcoin: New purchasers satisfy “aggressive” dip-buying

Bitcoin retail interest had actually struck the headings throughout 2025, however for the incorrect factors; mainstream purchasers kept away regardless of the rate often striking brand-new highs above $100,000.

Glassnode’s newest figures recommend that the pattern is lastly beginning to move.

” Over the previous 2 weeks, the supply held by novice $BTC purchasers increased by +2.86%, climbing up from 4.77 M to 4.91 M BTC,” it reported.

” Fresh capital continues to go into the marketplace, supporting the most recent rate breakout.”

BTC/USD striking brand-new all-time highs above $123,000 has actually triggered crazy financier habits throughout more recent and older friends.

As Cointelegraph reported, short-term holders– entities purchasing within the previous 6 months and hodling because– now have an aggregate expense basis above $100,000 for the very first time.

Glassnode’s expense basis heatmap reveals purchasers “actioned in strongly” throughout today’s BTC rate dip listed below $116,000.

” That’s over $23B in worth included near the regional top, indicating strong conviction and possible placing for additional advantage,” it informed X fans after 196,600 BTC was purchased up in between $116,000 and $118,000.

Mainstream BTC interest requires more than all-time highs

Retail interest in Bitcoin however stays relatively soft.

Related: Bitcoin ETF inflows reveal organizations ‘doubled down’ on BTC at $116K

Information from Google Trends reveals a modest uptick in search activity for “Bitcoin” over the previous 2 weeks, however compared to five-year historic information, mainstream “FOMO” is noticeably doing not have.

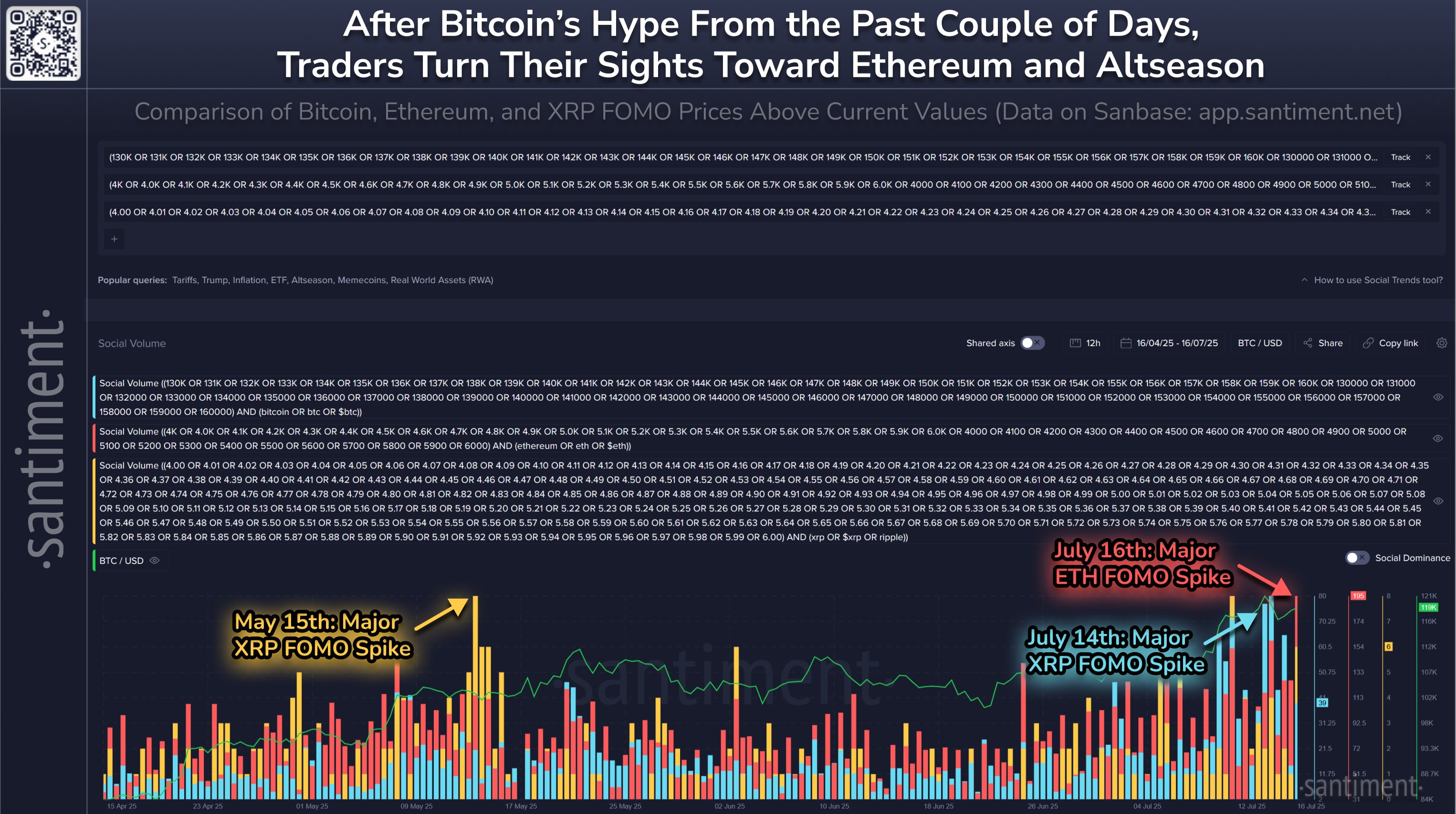

In a few of its newest X analysis, research study company Santiment recommended that interest amongst those retail financiers who did take note has actually currently moved to altcoins.

” With Ethereum blazing a trail, there has actually been a substantial dive in social networks points out of numerous altcoins and greater rate targets,” it reported Wednesday.

” With Monday’s Bitcoin all-time high resulting in mass retail FOMO resulting in the top, the mass FOMO has actually moved to Ethereum today (with $4K+ rate calls throughout X, Reddit, & & Telegram).”

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.