Method, a Bitcoin (BTC) treasury business, is building up Bitcoin at a quicker rate than overall miner output, providing the supply-capped possession a -2.33% yearly deflation rate, according to CryptoQuant CEO and market expert Ki Young Ju.

” Their 555,000 BTC is illiquid without any strategies to offer,” the expert composed in a Might 10 X post. “Method’s holdings alone indicate a -2.23% yearly deflation rate– likely greater with other steady institutional holders,” Ju continued.

Michael Saylor, the co-founder of Method, is an outspoken Bitcoin supporter who evangelizes the limited digital currency to possible financiers and has actually motivated lots of other business to embrace a Bitcoin treasury strategy.

Furthermore, Method functions as a bridge in between Bitcoin and standard monetary (TradFi) markets by funneling funds from TradFi financiers into Bitcoin through offering business financial obligation and equity, which the business utilizes to fund more BTC purchases. According to Michael Saylor, over 13,000 organizations hold Method stock straight in their portfolios.

Bitcoin financiers continue to enjoy the business and its impact on Bitcoin market characteristics. Method leads the charge towards institutional adoption of Bitcoin, additional limiting the supply of readily available coins and raising BTC costs, while moistening volatility.

Related: Bitcoin yet to strike $150K due to the fact that outsiders are ghosting– Michael Saylor

Method and business organizations alter the Bitcoin market dynamic

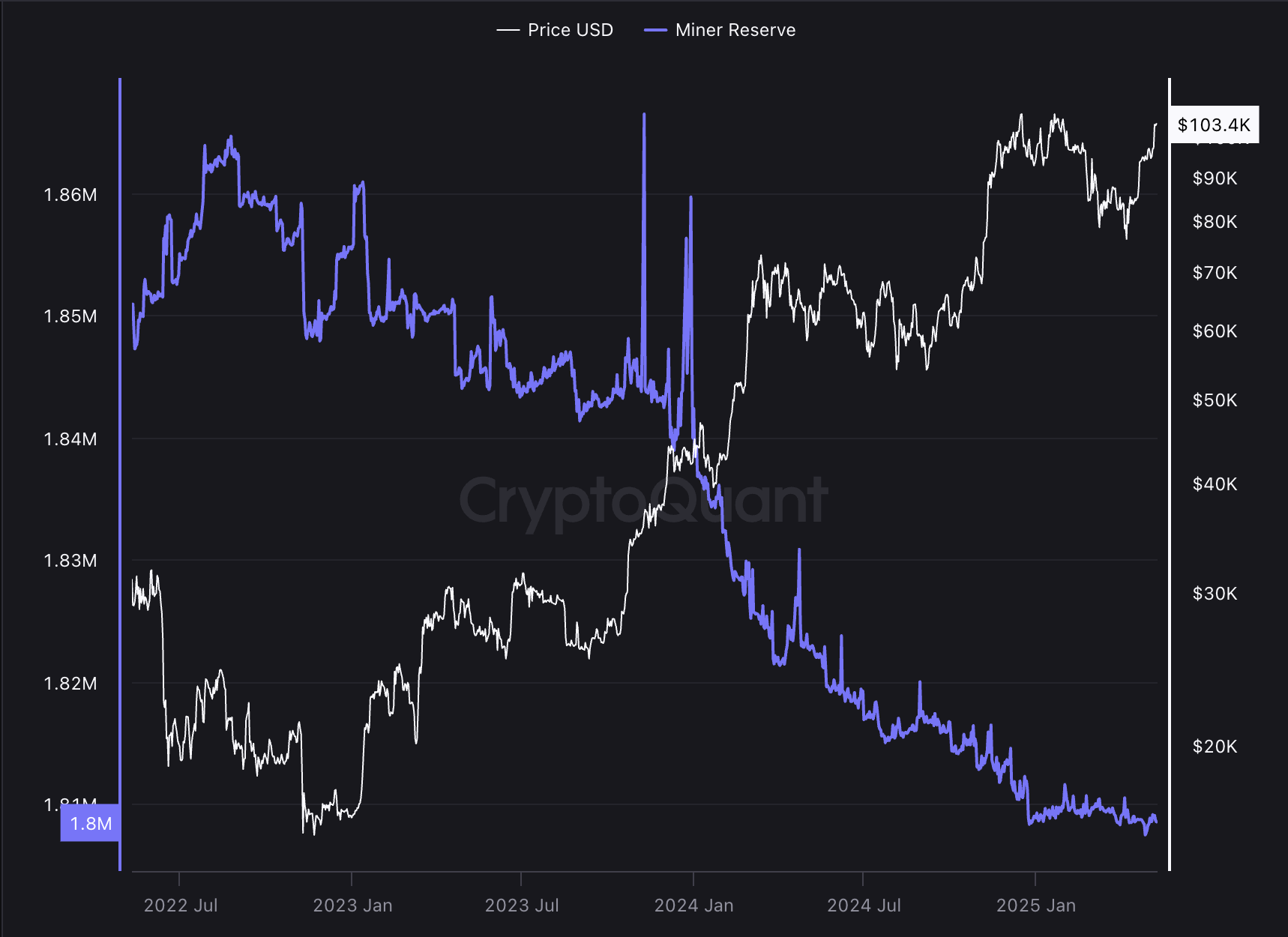

Adam Livingston, author of “The Bitcoin Age and The Terrific Harvest.” just recently stated that Method is artificially cutting in half Bitcoin by surpassing miner supply through high need.

According to the author, the existing cumulative day-to-day miner output is roughly 450 BTC, while Method collects approximately 2,087 BTC daily– over 4 times the day-to-day miner production.

Other organizations consisting of hedge funds, pension funds, possession supervisors, and tech business continue purchasing BTC as a portfolio diversifier or a treasury possession to hedge versus fiat currency inflation.

ETF inflows have actually likewise assisted to support Bitcoin’s cost by injecting fresh capital from standard monetary markets, raveling the volatility of Bitcoin and making recessions less serious.

Nevertheless, the most august institutional gamers– sovereign wealth funds– will not increase Bitcoin purchases till clear cryptocurrency policies are developed in the United States, according to SkyBridge creator Anthony Scaramucci.

As soon as an extensive regulative structure emerges in the United States, it will activate big blocks of Bitcoin purchases by sovereign wealth funds, increasing Bitcoin’s cost, Scaramucci included.

Publication: Bitcoin vs. the quantum computer system risk: Timeline and services (2025– 2035)