Bitcoin has actually published $2.3 billion in understood losses in what an expert states is among the biggest capitulation occasions in history, matching its crash in 2021.

Bitcoin’s (BTC) seven-day average understood bottom lines struck $2.3 billion, expert IT Tech stated in a note on CryptoQuant on Thursday, which it called “among the biggest capitulation occasions in BTC history, measuring up to the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction.”

” This puts us in the leading 3-5 loss occasions ever tape-recorded,” IT Tech included. “Just a handful of minutes in Bitcoin’s history have actually seen this level of capitulation.”

Bitcoin has actually dropped almost 50% from its all-time high of over $126,000 in October to trade around $66,600, having actually climbed up from a low of of $60,000 on Feb. 6.

Deep and sluggish bleed-out might follow

IT Tech stated that formerly, “severe loss spikes like this triggered rebounds,” and kept in mind that Bitcoin had briefly rallied above $70,000 on Tuesday, however included, “this might still be the start of a deep and sluggish bleed-out. Relief rallies occur even in extended bearishness.”

Related: Crypto’s ‘age of speculation’ might be ending: Galaxy’s Novogratz

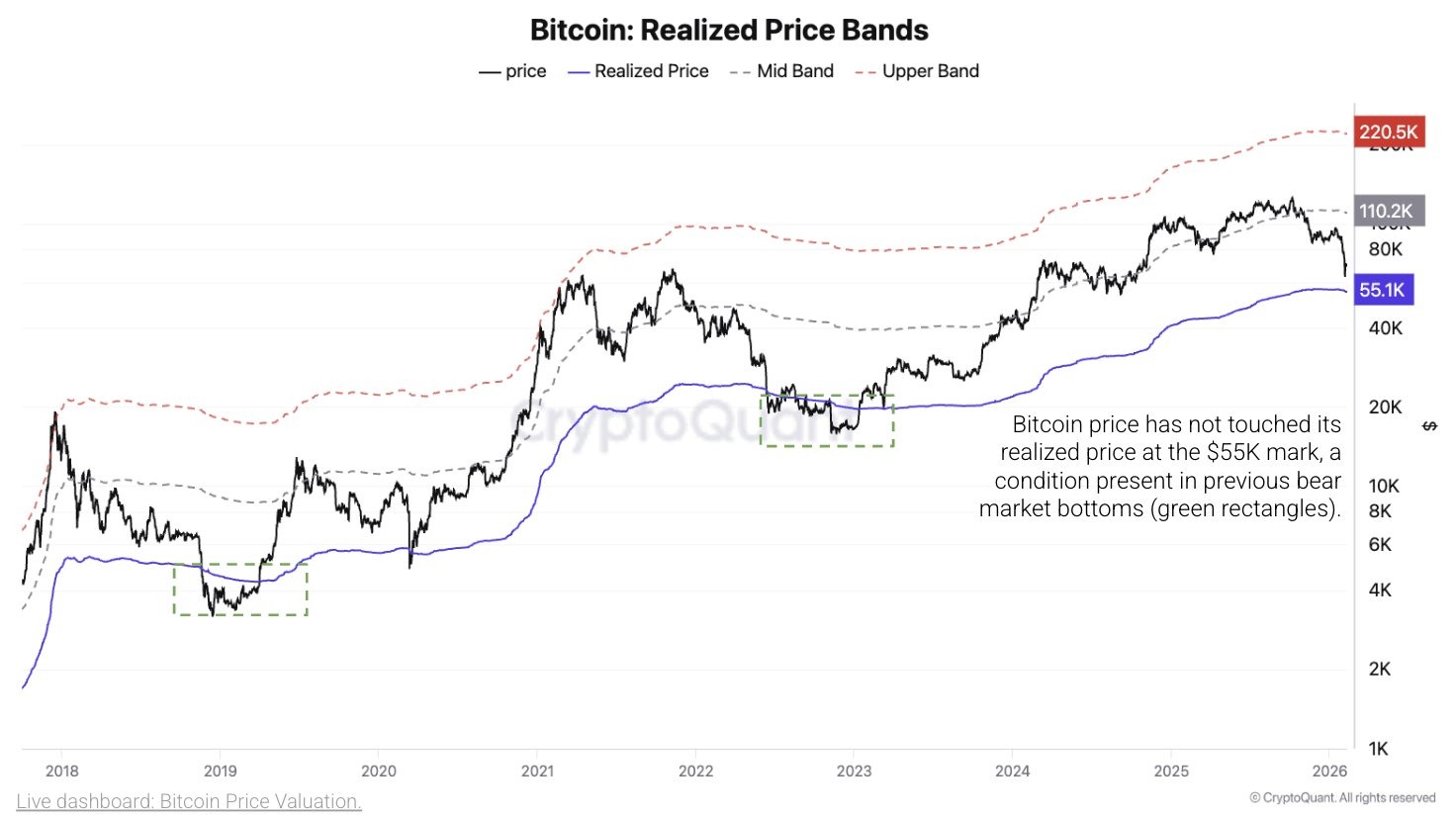

CryptoQuant published to X on Thursday that $55,000 marks Bitcoin’s understood rate, which is “traditionally connected to bearish market bottoms.”

” Previous cycles saw BTC trade 24% to 30% listed below this level before supporting,” it specified. “When BTC reaches this location, it generally moves sideways before recuperating.”

More time to reach the bottom

Nick Ruck, the director of LVRG Research study, informed Cointelegraph that the current capitulation occasion “shows extreme short-term holder panic and washout in the middle of more comprehensive macro pressures and a shift into bearish market area.”

” While this level of oversold conditions traditionally precedes healing stages, reaching the complete bottom might still need extra time and signals from metrics like continual institutional purchasing or miner stabilization,” he included.

Ruck targeted possible assistance emerging in the $40,000 to $60,000 variety, “depending upon developing market characteristics,” a figure in line with forecasts from other experts.

Publication: Bitcoin trouble plunges, Buterin sells Ethereum: Hodler’s Digest