Bitcoin was up to its most affordable levels given that November 2024 after beating its previous bottom, with $70,000 BTC rate assistance and under entering into focus.

Bitcoin (BTC) saw a second dip below $73,000 after Wednesday’s Wall Street open as US sellers returned.

Key points:

-

Bitcoin falls further into territory not seen since late 2024, dropping under Tuesday’s prior low.

-

Macro assets lose steam as precious metals give back recent gains.

-

Traders lie in wait for deeper long-term lows on Bitcoin to come next.

Bitcoin joins precious metals in failed relief bounce

Data from TradingView showed characteristic BTC price weakness during the US trading session, with lows of under $72,500 on Bitstamp.

These beat the 15-month lows seen the day prior, and a relief bounce above $76,000 was short-lived.

Macro assets were subdued across the board, with gold failing to recapture $5,000 as support and US stocks heading lower at the open.

BREAKING: Silver prices post a massive reversal, falling nearly -$9/oz in under 3 hours.

Gold prices also fall -$220/oz in under 3 hours. pic.twitter.com/F6BaeFDWRl

— The Kobeissi Letter (@KobeissiLetter) February 4, 2026

“Crypto remains volatile,” trading company QCP Capital wrote in its latest “Asia Color” market update.

QCP said that the US government avoiding a fresh shutdown for the time being was “easing near-term headline risk” for markets.

“In macro, the shutdown overhang has faded, but the key takeaway is how quickly fiscal standoffs can return. Homeland Security funding was only extended through 13 February, keeping another deadline risk in play,” it added.

BTC is seeing “bear market price action”

Bitcoin traders thus remained on edge as uncertainty ruled sentiment. As Cointelegraph noted, the area around $50,000 was now a popular target.

Related: Bitcoin ‘reflation’ bets diverge after US PMI breaks three-year resistance

“Ugly interim weekly candle for bulls. IF we close sub 74k – its safe to say 50k area is next,” trader Roman wrote in his latest analysis on X.

“Notice how volume is high every time price moves down. That tells us when volume comes in – its selling AKA bear market price action!”

Trader CJ prepared for the spot price to drop by another $10,000 or more, subject to a potential relief bounce first.

Not sure if it will be a straight shot or we bounce first.

But 59-65k is the next major downside level of interest for me.$BTC pic.twitter.com/MFSmIIrCzg

— CJ (@CJ900X) February 4, 2026

Earlier, Cointelegraph reported on a potential safety net in the form of the 200-week exponential moving average (EMA), currently near $68,000.

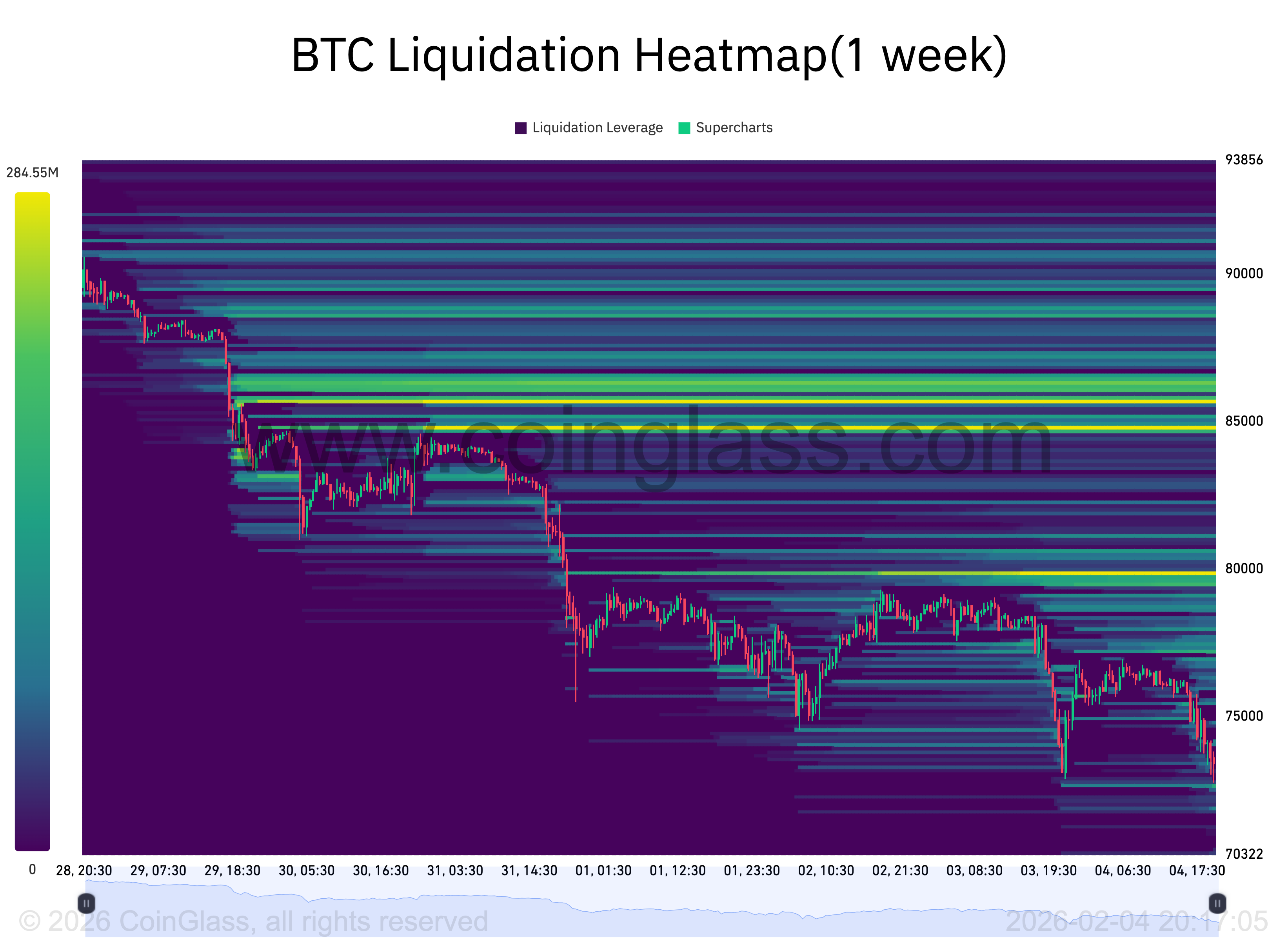

Data from monitoring resource CoinGlass showed future long liquidations building above $72,000, while total 24-hour crypto liquidations were at over $800 million.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might consist of positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage developing from your dependence on this details.