Bottom line:

-

Bitcoin hugs its old all-time highs from late 2024 as United States stocks absorb increased stress in Europe.

-

Traders brush off market nerves after BTC/USD drops 8% versus its most current record of $112,000.

-

June might wind up flat without another market driver.

Bitcoin (BTC) looked for a retest of 2024 highs at the June 2 Wall Street open as Russia-Ukraine stress went back to the marketplace.

Bitcoin wobbles as bulls defend 2024 peak

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD falling listed below $104,000.

United States stocks opened carefully amidst expectations of geopolitical volatility to come. Commenting, trading resource The Kobeissi Letter highlighted the unpredictability of the present scenario.

” This is efficiently the marketplace pricing-out the Russia-Ukraine peace offer that President Trump has actually been dealing with for 3+ months,” it composed in part of continuous X protection, describing United States President Donald Trump’s objectives to stop the dispute.

” Nevertheless, we have yet to get a single remark from the United States or President Trump. Plainly, something is going on behind the scenes. How will the United States react?”

Crypto voices had comparable issues, with independent expert Filbfilb forecasting an unwanted result for danger possessions.

” Markets appear like they are having a hard time to me, with gold looking strong & & stress with Russia intensifying lead me to believe offering today on the cards & & for the start of June,” he informed X fans on the day.

Filbfilb forecasted that ought to stocks discover fresh bullish momentum, Bitcoin would “most likely outperform” as an outcome, including that BTC “still looks bullish” long term.

Some traders shared that view, amongst them popular trader Jelle, who suggested that responses to the present retest of regional lows were excessively bearish.

#Bitcoin still hovering on top of regional assistance.

Timeline & & specifically my remark area appears filled with worry and quiting.

Relax. pic.twitter.com/BkgYVQCSzr

— Jelle (@CryptoJelleNL) June 2, 2025

Others matched the Might regular monthly candle light close, which wound up as Bitcoin’s greatest ever– albeit to little excitement.

” This is among the most stunning regular monthly closes you might want $BTC,” fellow trader Moustache reacted.

” Soft” BTC rate action anticipated

Looking ahead, market individuals were uncertain– after current volatility, they concurred, BTC/USD may require a sideways trading duration.

Related: $ 100K retest vs greatest regular monthly close ever: 5 things to understand in Bitcoin today

” Regardless of the volatility, BTC continues to hover above $102k, a testimony to underlying assistance. Volatility on the frontend has actually progressively compressed, and danger turnarounds have actually started to normalise throughout tenors,” trading company QCP Capital composed in its most current publication to Telegram channel customers.

” This signals expectations for soft rate action in the near term.”

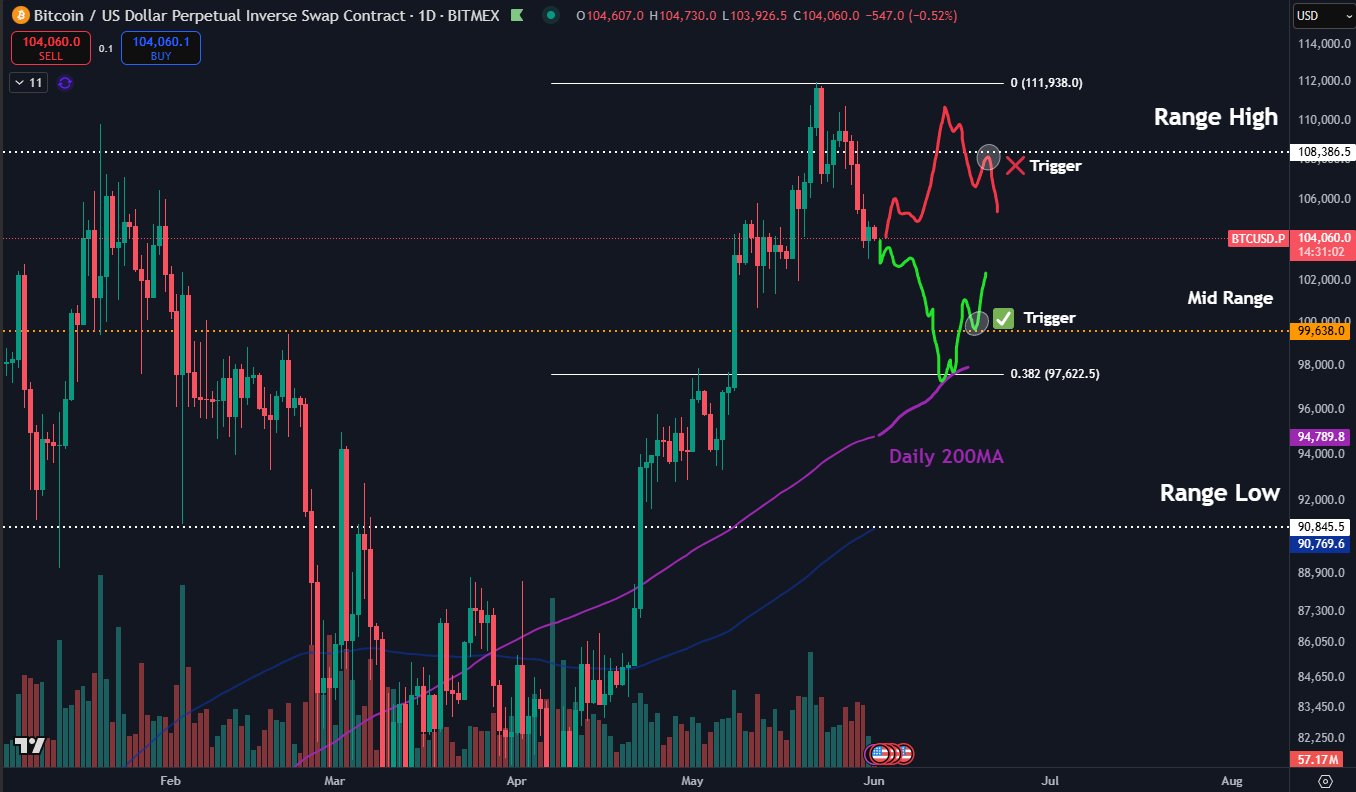

QCP offered a $100,000-$ 110,000 rate passage moving forward in the lack of additional volatility drivers.

Popular trader Daan Crypto Trades on the other hand sought to previous regular monthly opening habits for ideas.

” I believe there’s a likelihood that the very first week or two is most likely a relocation that can be faded upon seeing the very first indications of a regional turnaround. If this holds true, I will stick to that pattern for the rest of the month,” part of an X post on the subject read.

Daan Crypto Trades revealed “strong predisposition towards either instructions” for June as a whole.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.