Bitcoin cost extended its decrease on March 28, succumbing to a 4th successive day to paint an intra-day low of $83,387. BTC’s (BTC) decrease mirrored the Wall Street sell-off, where the DOW closed 700 points lower, along with the S&P 500 index, which dropped 112 points.

The sell-off in equities is extensively credited to financiers increasing concerns over inflation after the core Individual Intake Expenses index information from February increased to 2.8% (a 0.4% regular monthly boost), which was greater than anticipated.

S&P 500 drops $1 trillion in market cap worth. Source: X/ The Kobeissi Letter

The sell-off was more magnified by the markets’ reaction to United States President Trump’s freshly imposed “mutual tariffs,” which used a 25% tariff to “all automobiles that are not made in the United States.”

The opportunities for a Bitcoin relief rally or oversold bounce are most likely decreasing as traders meticulously watch on April 2, the day Trump has actually identified “Freedom Day,” where extra tariffs, consisting of “pharmaceutical tariffs,” are anticipated to be revealed.

Bitcoin cost to be up to $65K?

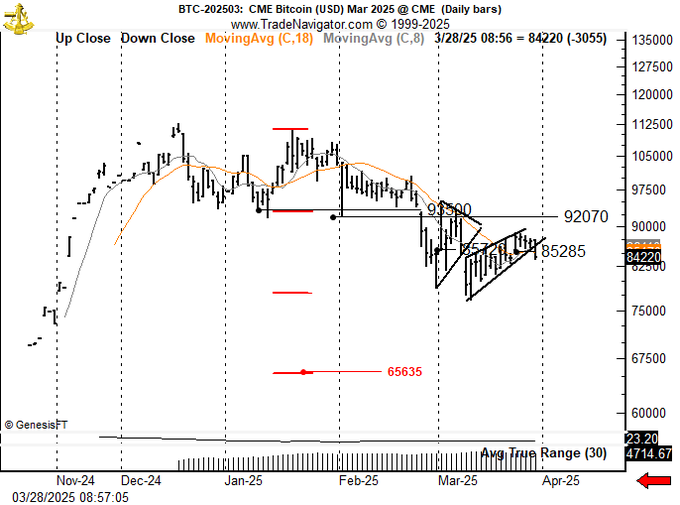

According to seasoned trader Peter Brandt, Bitcoin might be on the course to $65,635.

BTC/USD 1-day chart. Source: X/ Peter Brandt

In an X social post, Brandt validated the conclusion of a “bear wedge” pattern and stated,

” Do not shoot the messenger. Simply reporting on what the chart states up until it states something various. Bear wedge finished with 2X target from the double leading at $65,635.”

Crypto trader ‘HTL-NL’ concurred with Brandt, recommending that Bitcoin’s failure in “starting a conversation” of a long-lasting coming down trendline and the verification of the bear wedge are evidence that BTC is predestined to review its variety lows.

BTC/USD 1-day chart. Source: X/ HTL-NL

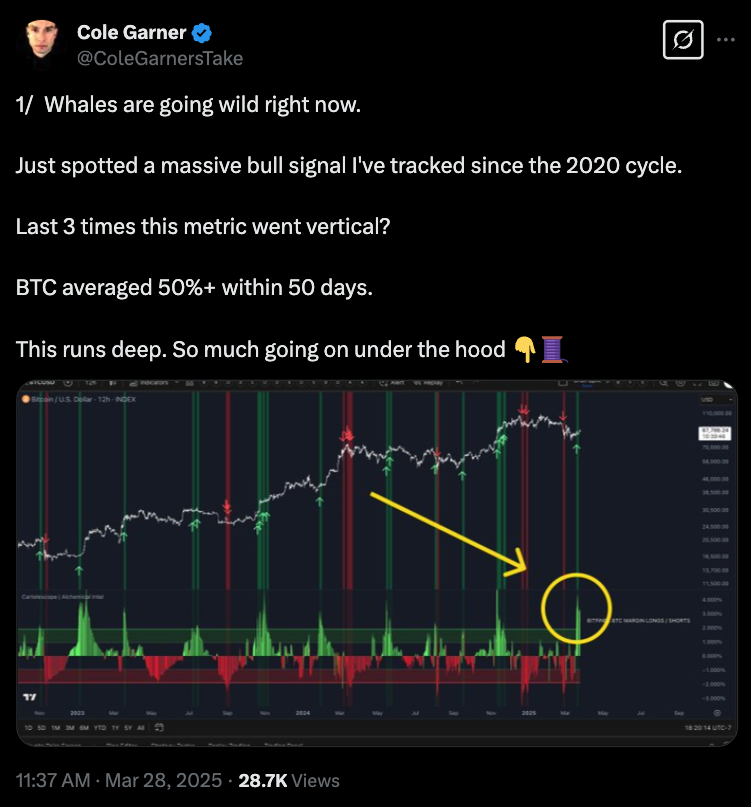

From a simply technical viewpoint, it’s challenging to forecast a speedy turnaround in Bitcoin’s cost action as a number of its day-to-day timeframe metrics are not oversold. In spite of the lack of strong area market need in the existing cost zone, crypto trader Cole Garner states that “whales are going wild today.”

BTC/USD 1-day chart. Source: X/ Cole Garner

According to Garner, the Bitfinex area BTC margin longs to margin shorts metric simply fired an effective signal which reveals historic returns of 50%+ returns “within 50 days.”

Related: United States regulators FDIC and CFTC ease crypto limitations for banks, derivatives

Beyond the daily cost changes, favorable crypto market advancements continue to take place on the regulative front.

On March 28, White Home AI and Crypto Czar David Sacks applauded the FDIC and its Performing Chairman Travis Hill for clarifying the “procedure for banks to participate in crypto-related activities.”

Source: X/ David Sacks

Basically, the Federal Deposit Insurance coverage Corporation’s letter to organizations under its oversight offered clear assistance on their capability to participate in and offer crypto-related services and products without requiring to inform the FDIC initially.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.