Secret takeaways:

-

BTC should clear the next substantial resistance level to open targets at $127,000–$ 137,000.

-

On-chain information reveals space to run, with $122,000 and $138,000 as the crucial danger levels.

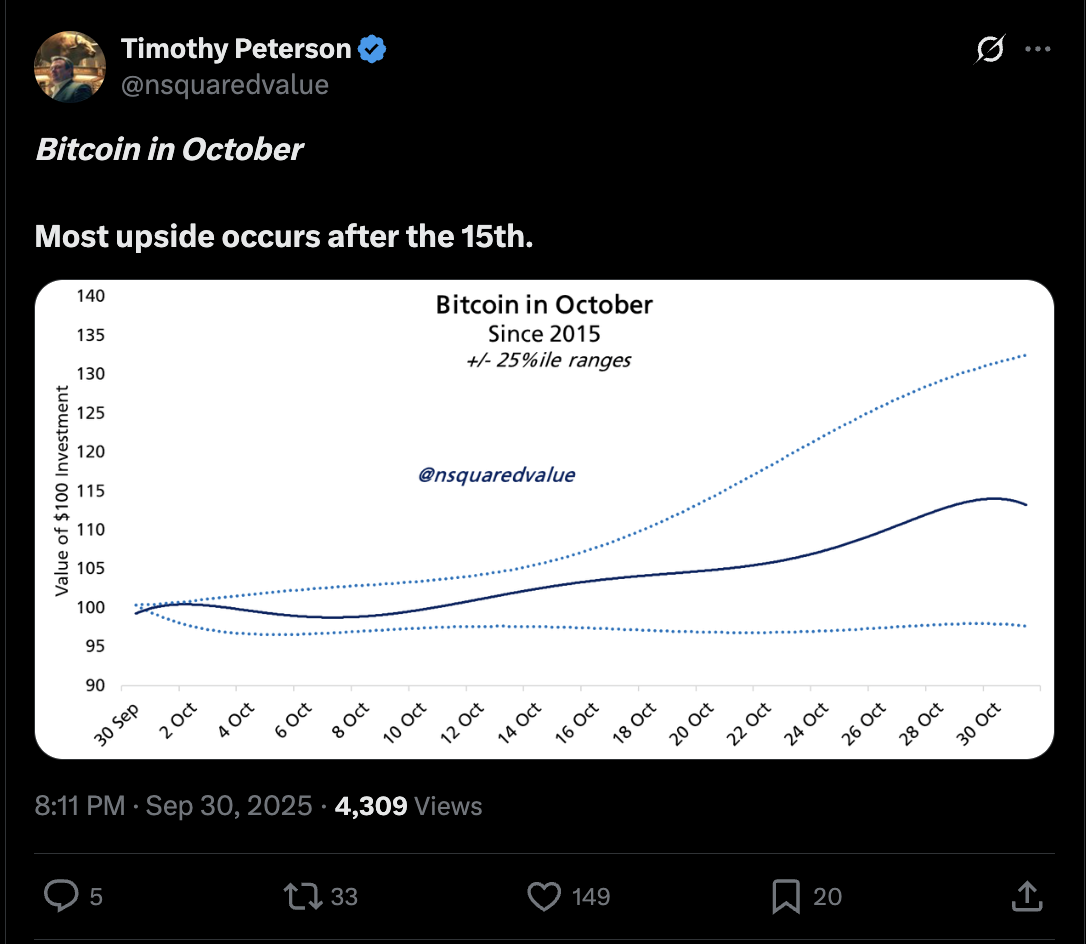

Bitcoin (BTC) closed September with a 5.35% gain, getting rid of a late-month correction. Historically, such green Septembers have actually set the phase for a bullish “Pumptober,” according to onchain information resource Lookonchain.

With Bitcoin currently up today, will history repeat with enormous BTC gains in October when again?

BTC rate double bottom targets $127,000

Bitcoin’s day-to-day chart is flashing a traditional double bottom setup, a bullish turnaround pattern that forms when rate bounces two times off a comparable assistance level before breaking greater.

In BTC’s case, the 2 troughs have actually appeared near $113,000, with a neck line resistance relaxing $117,300.

The structure’s technical target points towards approximately $127,500 if bulls handle to press the rate decisively above the neck line resistance. That forecast is obtained by determining the depth of the pattern and including it to the breakout level.

Bitcoin’s relative strength index (RSI), on the other hand, has actually turned higher from neutral area, recommending that the bulls are beginning to restore momentum.

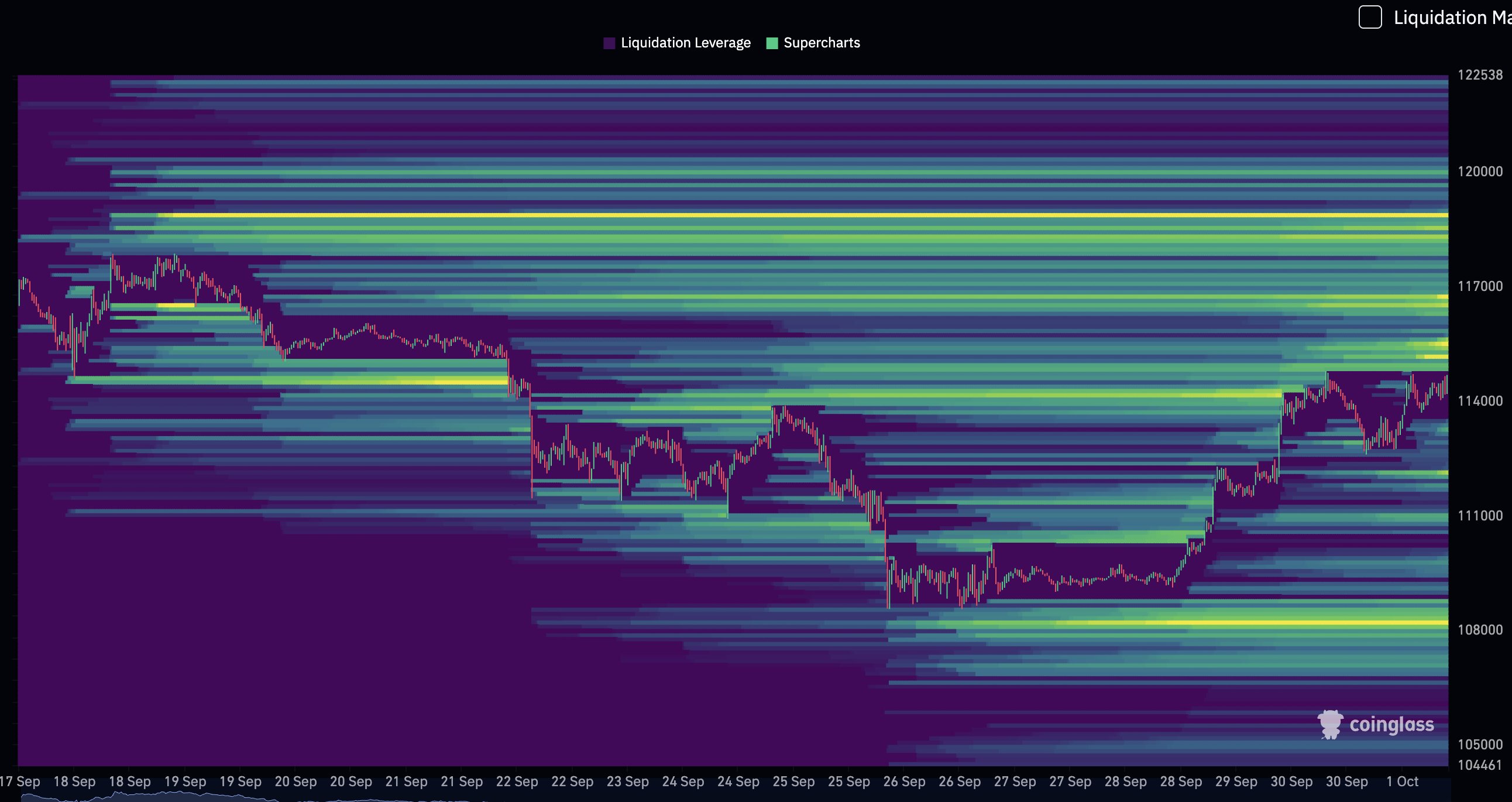

Cleaning the $118,000–$ 119,000 zone, where almost $8 billion in shorts sit susceptible, would even more verify the breakout and raise the chances of reaching the double-bottom target.

Balanced triangle sets Bitcoin up for $137,000

Bitcoin is likewise trading inside a big balanced triangle pattern on the day-to-day chart.

This structure, formed by assembling trendlines of lower highs and greater lows, generally precedes a sharp breakout as rate compresses towards the peak.

The triangle’s height tasks a target near $137,000, up by over 18% from existing costs. This target lines up carefully with the 1.618 Fibonacci extension level around $134,700.

Onchain information reveals BTC has actually not topped

Bitcoin is still trading listed below its “heated” danger level, recommending the rally might have space to extend before short-term traders end up being overextended.

The cryptocurrency’s Short-Term Holder Expense Basis Design puts the typical current buy rate at about $102,900, according to Glassnode information.

The design flags the heated zone at $122,000 as the very first substantial limit and the overheated zone at $138,000 as the level that has frequently significant cycle peaks in the past.

Related: Bitcoin restores gold connection as BTC rate nears $117K

Simply put, if this “Pumptober” rally has legs, then $122,000 is the next near-term test, and $138,000 is a possible ceiling before another possible correction occurs.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.