Secret takeaways:

Bitcoin (BTC) stays pinned listed below $120,000 after reaching a fresh all‑time high near $123,000 recently. As BTC cost combines, various market experts are persuaded that the cycle is not over.

Here are the reasons experts believe that the Bitcoin booming market has not peaked yet.

Bitcoin principles stay strong

Analytics company Bitcoin Vector stated that although Bitcoin’s momentum has actually slowed, several onchain metrics recommend that Bitcoin’s cycle is not over.

” Momentum has actually cooled, however structure and principles stay strong,” the company stated in a Tuesday post on X, including:

” This isn’t a top. It’s a coiled setup with assistance below it.”

Related: New Bitcoin analysis states ‘most explosive stage’ to $140K is close

The Bitcoin Basic Index (BFI) stays strong, showing increasing network development and liquidity, as displayed in the chart below.

With BTC cost compressed, “principles are stopping briefly, not deteriorating,” stated Bitcoin Vector, including:

” It’s the cost that requires to capture up.”

In the short-term, purchasers might merely be waiting on verification of the breakout as Bitcoin plays the “structural anchor” for the entire crypto market, stated personal wealth supervisor Swissblock.

On the other hand, BTC cost is “holding a bullish structure” in spite of combining in a tight variety in between $116,500 and $120,000 because July 15. Bitcoin Vector included:

” No breakdown. No breakout. Simply waiting on ignition. As soon as momentum lines up, the breakout continues.”

Onchain metrics recommend “space for growth”

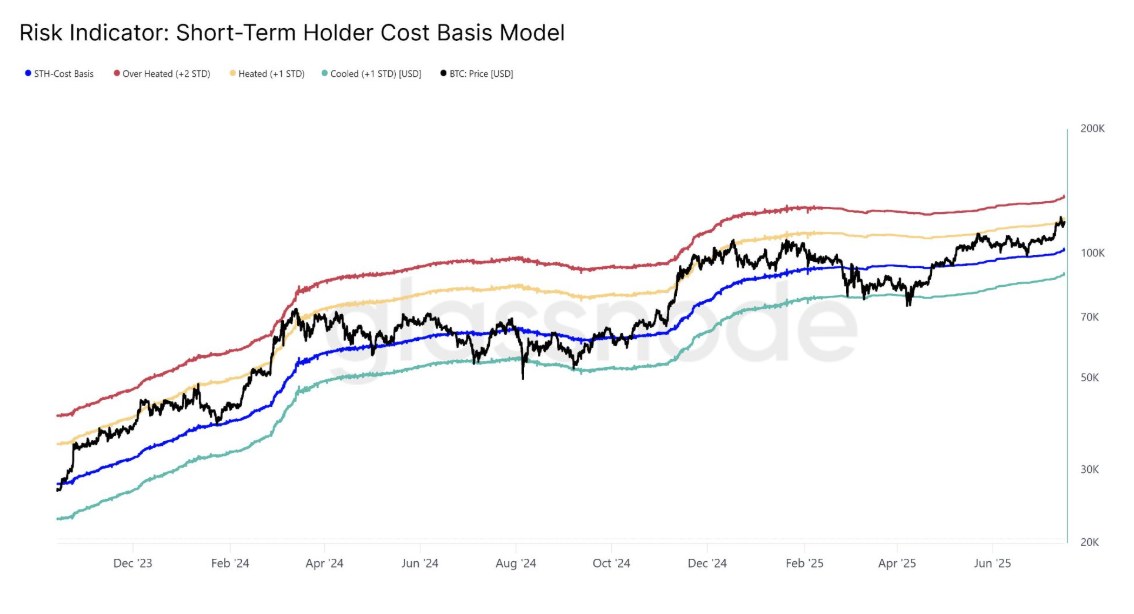

Taking a look at Bitcoin’s short-term holder (STH) expense basis, Swissblock stated that the STHs are still active and not tired.

STH expense basis describes the typical purchase cost of financiers who have actually held Bitcoin for less than 155 days.

The cost touched the “heated” band of this metric on July 14, when it struck its existing all-time high, however did not go into the overheated zone.

If it increases to retest the upper band– matching the 2 basic variances above the STH recognized cost– it might strike fresh all-time highs at $138,000.

” Profit-taking exists, however the STH threat zone at $138K hasn’t been reached,” Swissblock stated, including:

” This recommends there’s still space for growth before we see any panic offering or ecstasy.”

30 Bitcoin cost leading signs state “hold 100%”

Bitcoin might be combining listed below the all-time highs, however CoinGlass’ booming market peak signals reveal no indications of getting too hot.

The bull peak signals describe the choice of 30 prospective offering triggers and goal to capture long-lasting BTC cost tops. Presently, none of the signs is flashing a leading signal.

” 0 out of 30 leading signals have actually set off on CoinGlass’s Bitcoin Booming market Peak Control panel,” expert CryptosRus composed in an X post on Monday.

CryptosRus, in specific, highlighted 4 long-lasting signs– Pi Cycle Top, Market Price to Understood Worth (MVRV), relative strength index (RSI) and Reserve Danger– to show that the Bitcoin booming market has lots of space to go higher.

” Historically, the more boxes this list checks, the closer we get to a blow-off top. In the meantime? Thumbs-up.”

According to CoinGlass, Bitcoin is presently classified as a “hold 100%” property based upon hints taken from the leading 30 signs.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.