Bottom line:

-

Bitcoin is “getting closer” to its next regional bottom after a journey listed below the $109,000 mark.

-

A favorable Coinbase Premium returns, raising hopes of a United States need healing.

-

ETF streams end Monday favorable in a surprise return regardless of the BTC cost drawback.

Bitcoin (BTC) combined around $110,000 at Tuesday’s Wall Street open amidst indications of a crypto market healing.

Coinbase Premium rebound follows $700 million liquidation

Information from Cointelegraph Markets Pro and TradingView revealed BTC cost volatility cooling after a fresh round of losses.

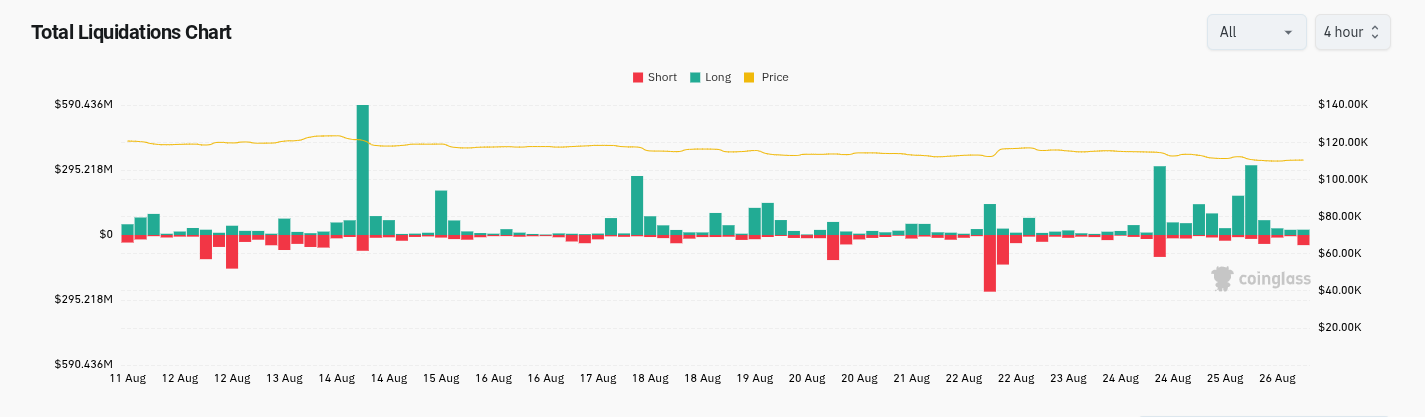

These had actually led to a wave of crypto long liquidations worth over $700 million for the 24 hr to the time of composing, per information from CoinGlass.

BTC/USD bottomed at $108,717 on Bitstamp, listed below old all-time highs seen at the start of the year.

Amidst worries of a $100,000 assistance retest or even worse, some market individuals saw factor for optimism.

” BTC is now getting closer to the bottom,” popular trader BitBull composed in part of his most current X analysis.

” There is still a possibility of $106K-$ 108K level retest, however for now I’m anticipating a bounceback.”

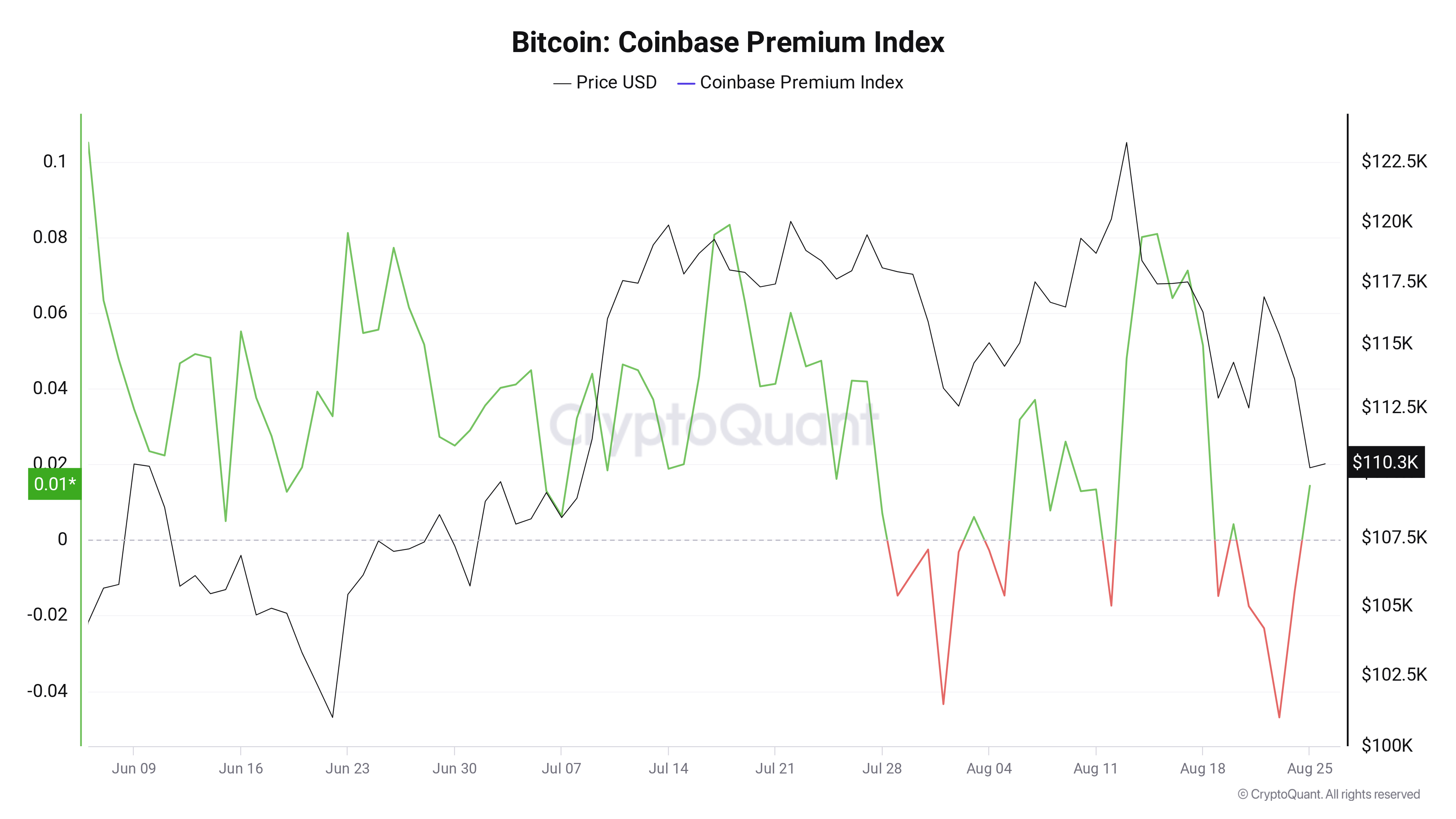

BitBull referenced motivating signals from the United States, where the Coinbase Premium Index reentered favorable area on Tuesday.

The Index determines the distinction in BTC costs in between the Coinbase BTC/USD and Binance BTC/USDT sets, and when green, it suggests enhancing United States market need.

” Coinbase Bitcoin Premium turned favorable throughout bottom and long liquidations were big. This reveals that max. discomfort is here and a brief rally is anticipated,” BitBull concluded.

Others likewise anticipated a rebound, with fellow trader Mister Crypto seeing a brief capture next thanks to a considerable accumulation of brief positioning above $115,000 on exchange order books.

Expert: Bitcoin in “astonishing” Q2 rerun

In Other Places, Cas Abbe, a factor at onchain analytics platform CryptoQuant, recommended that present cost action is, in reality, familiar.

Related: Bitcoin drops under $109K: How low can BTC cost go?

Bitcoin, he kept in mind, had actually acted likewise throughout a retracement in June, when BTC/USD reached all-time highs of $112,000 before dropping to around $98,000.

” BTC chart similarity to Q2 2025 fractal is astonishing. Comparable lower-lows and a capitulation which required whatever to believe ‘it’s over,'” he talked about the day.

An accompanying chart highlighted the resemblances.

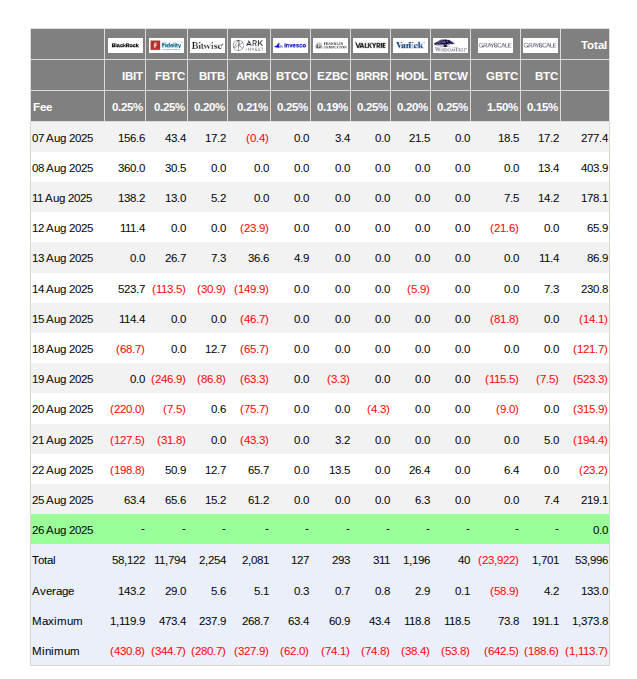

In typical with previous cost drawdowns, institutional circulations contributed to souring belief, with analytics resource Ecoinometrics accentuating the United States area Bitcoin exchange-traded funds (ETFs).

” The macro unpredictability of the previous couple of weeks is appearing straight in the circulations,” it concluded, including that ETF outflows were “pulling Bitcoin lower.”

On Monday, the ETFs however attained favorable circulations of simply under $220 million, per information from UK-based financial investment company Farside Investors.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.