Secret takeaway:

Bitcoin (BTC) is typically not considered a trusted financial investment throughout durations of geopolitical unpredictability, especially when oil rates surge in action to intensifying international stress. Nevertheless, historic information recommends that such minutes frequently present engaging purchasing chances for traders prepared to profit from market dislocations.

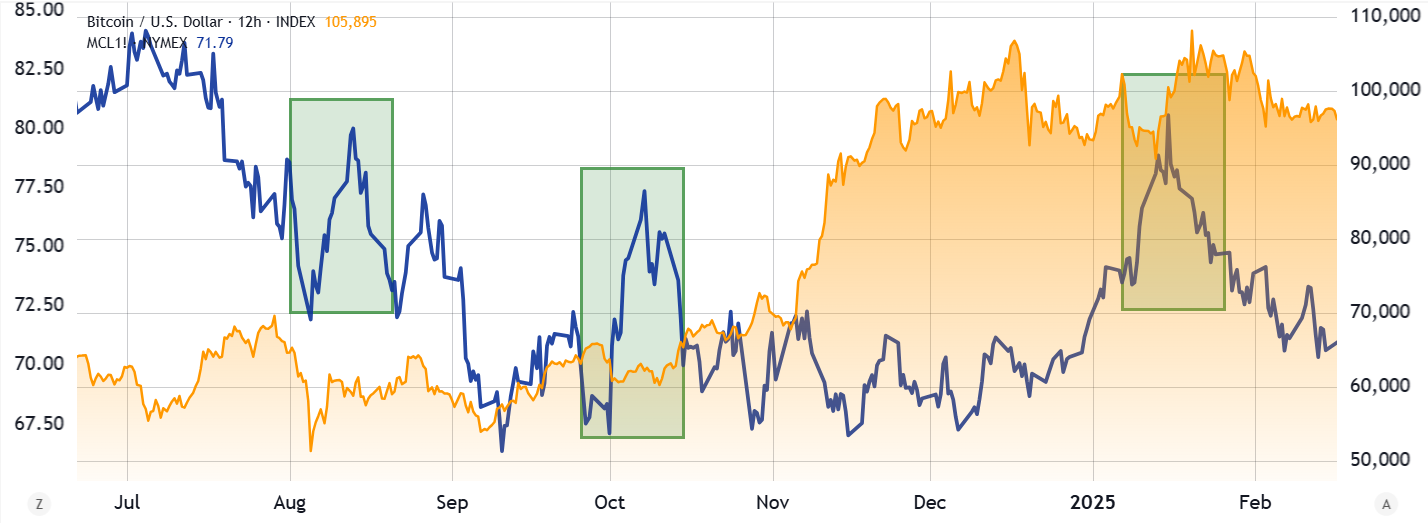

Oil spikes frequently line up with sharp, short-term Bitcoin cost corrections

In the face of impending dispute or instability, financiers generally turn into short-term federal government financial obligation and money, preferring security over volatility. Nonetheless, Bitcoin has actually traditionally exceeded in the week following abrupt oil cost rises, such as the current rally to $77 per barrel on Friday.

An evaluation of the 15-minute cost chart exposes an inverted relationship in between Bitcoin and oil. As WTI crude increased 19% in between Wednesday and Friday, Bitcoin decreased from $110,200 to $102,800. This pattern lines up with the dominating view of Bitcoin as a risk-on possession, not a protective hedge. Yet, a more comprehensive amount of time uses various insights.

Over the long term, information reveals no constant connection in between Bitcoin and oil rates, with the relationship changing significantly. Still, episodes of severe oil cost gratitude have actually accompanied sharp Bitcoin corrections– 3 times in the previous year alone. Each circumstances was followed by a rebound in Bitcoin’s cost, with gains varying from 16% to 24% within 8 days of the preliminary drop.

In the most current circumstances, on Jan. 15, 2025, oil rose to $80.50 from $72.50 simply 6 days previously. The spike accompanied a Bitcoin drop to $89,300 on Jan. 13, followed by a 22% rally to $109,300 by Jan. 20. The relocation followed the United States enforced sanctions on Russia’s oil sector, while United States unrefined stocks decreased for 8 successive weeks.

Previously, on Oct. 8, 2024, oil rates leapt to $77.50 from $68.00 the week in the past. Bitcoin at first remedied to $58,900 on Oct. 10 however then advanced 16% over the following 8 days. The rally to $68,960 rewarded traders who profited from the volatility set off by the Oct. 7 terrorist attacks in the Middle East.

Related: Panic or chance? What crypto capitulation informs clever financiers

A comparable pattern took place on Aug. 13, 2024, when oil increased to $80 from $74 after Libya briefly closed down crucial oil fields, apparently due to mobilization by armed groups. Bitcoin was up to $56,150 by Aug. 15 however rebounded 16% within days, reaching $65,000 by Aug. 23.

While there is no warranty the pattern will continue, oil rates have as soon as again reached five-month highs. Historic information recommends that Bitcoin’s existing level near $102,800 might provide another appealing entry, possibly targeting a 16% gain to $119,200 by June 21.

This short article is for basic info functions and is not planned to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.