After successive drawdowns of 17.39% and 2.3% in February and March, Bitcoin’s (BTC) Q2 is forming up well, with a return of 3.77% in April. While fresh annual lows were formed at $74,500, BTC is presently closer to $90,000 than its brand-new variety bottom.

Bitcoin 1-day chart. Source: Cointelegraph/TradingView

Bitcoin’s greater timespan (HTF) market structure has actually attained its very first breakout of 2025, sustaining optimism amongst bulls for substantial upward momentum. Nevertheless, the list below aspects might restrict BTC’s gains over the next 2 weeks, most likely topping its rate at around $90,000.

Related: Can 3-month Bitcoin RSI highs counter bearish BTC rate ‘seasonality?’

Bitcoin requires area volume, not simply leverage-driven

Cointelegraph recognized a cooldown duration in the futures market as the BTC-USDT futures utilize ratio come by 50%. De-leveraging in the futures market is a favorable advancement over the long term, however derivatives traders have actually taken control of the marketplace at the time too.

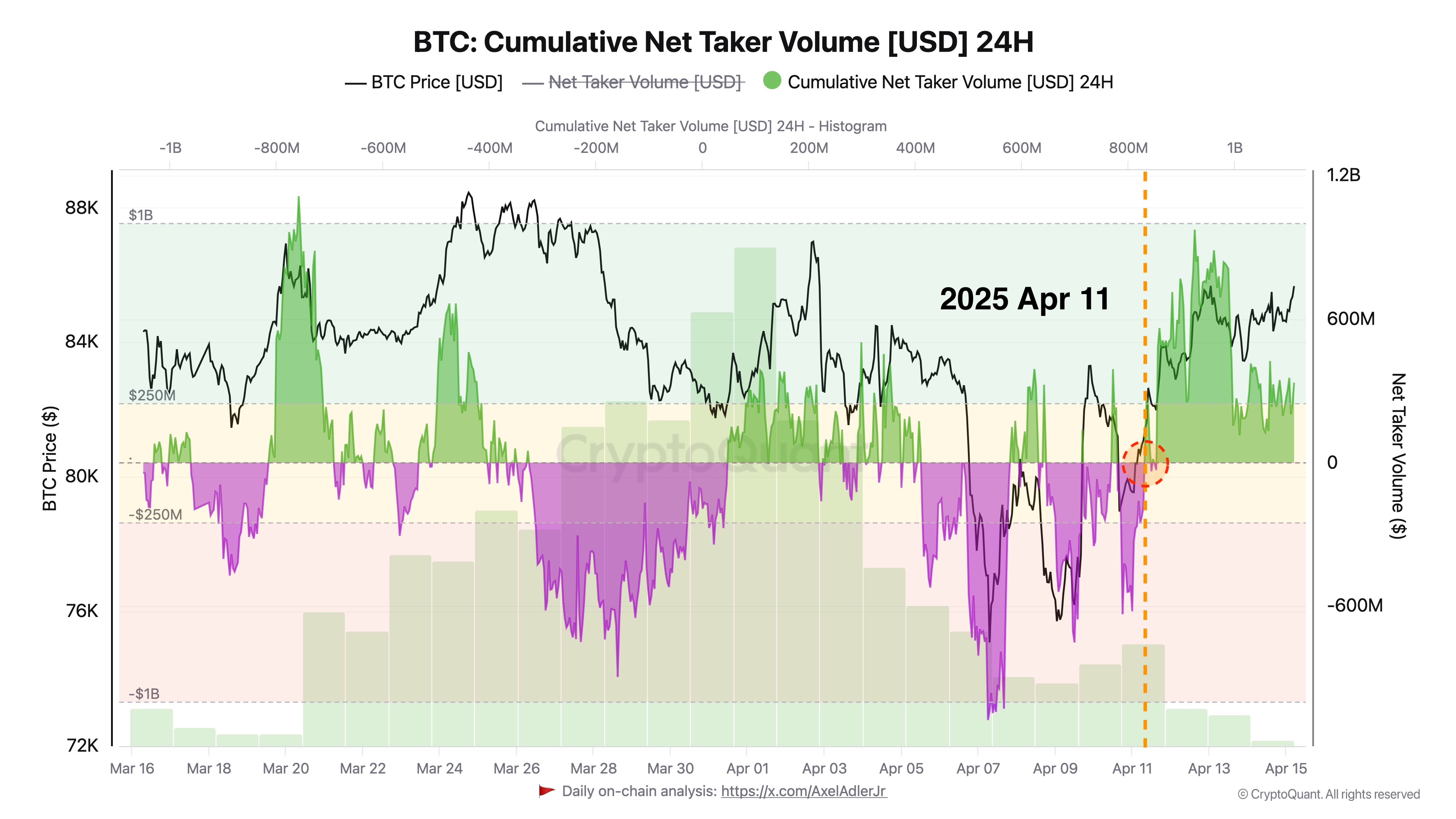

Bitcoin cumulative internet take volume. Source: X.com

Bitcoin scientist Axel Adler Jr. mentioned that Bitcoin’s cumulative net taker volume increased to $800 million on April 11, meaning a rise in aggressive purchasing. BTC rate likewise leapt from $78,000 to $85,000 within 3 days, validating previous historic patterns where high net take volume sets off rate rallies.

Similarly, Maartunn, a neighborhood expert at CryptoQuant, verified that the present rally is a “leverage-driven pump.” The inconsistency occurs due to the fact that retail or area traders are still not as pertinent.

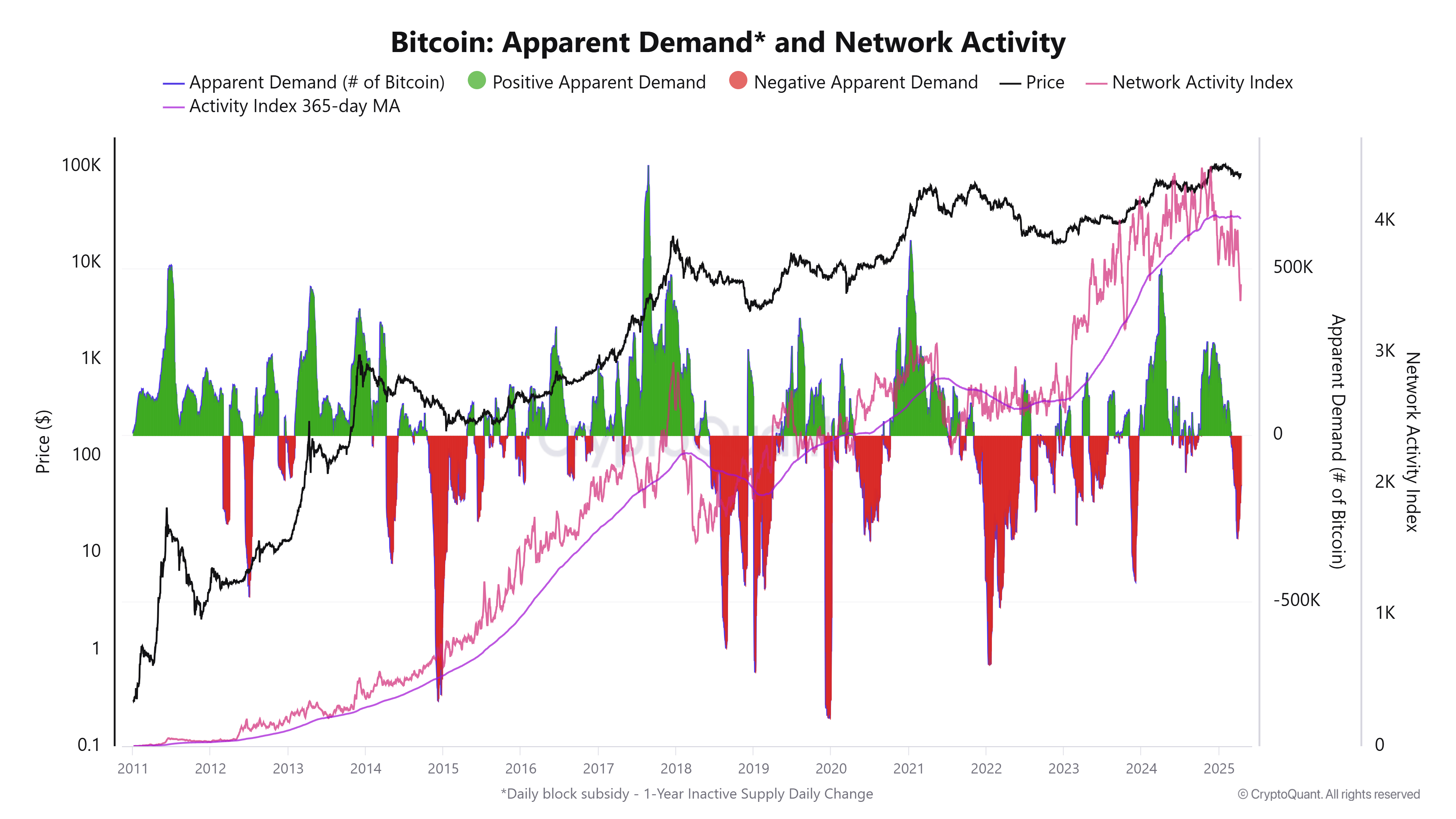

Bitcoin 30-day evident need. Source: CryptoQuant

As shown in the chart, Bitcoin evident need is on a healing course, however it is not net favorable yet. Historically, 30-day evident need can move sideways for an extended duration after BTC reaches a regional bottom, resulting in a sideways slice for the crypto.

Therefore, it is less most likely that Bitcoin might breach $90,000 in the very first effort after dropping near 20% till there is cumulative purchasing pressure from both area and futures markets.

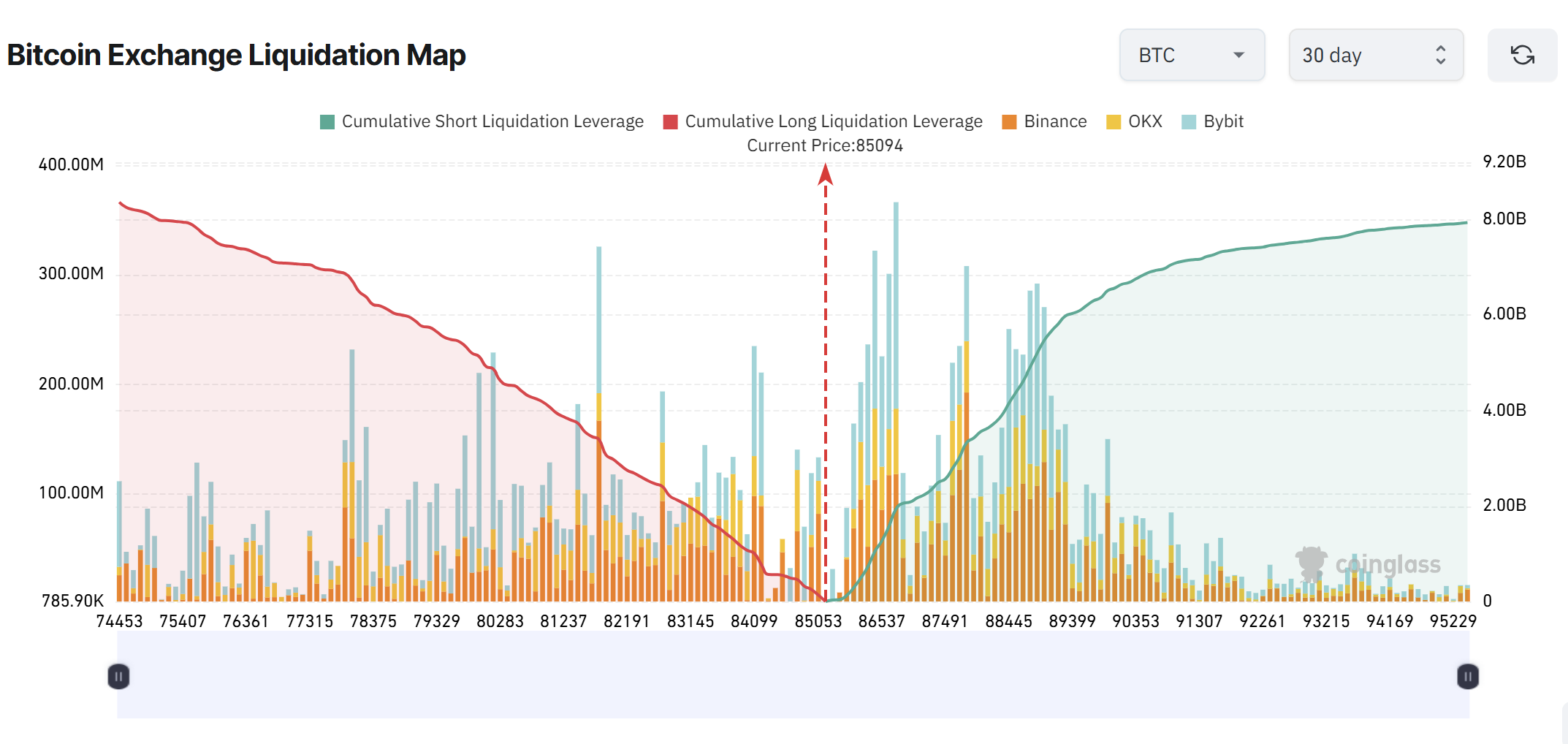

Big liquidation clusters in between $80-$ 90K might bait traders

With futures traders placing in either instructions, information from CoinGlass highlighted substantial cumulative long and brief liquidation utilize in between $80,000 and $90,000. Taking $85,100 at the base rate, overall cumulative brief positions at danger of liquidation are at $6.5 billion if BTC rate strikes $90,035.

Bitcoin exchange liquidation map. Source: CoinGlass

On the other hand, $4.86 billion in long orders will be erased if BTC drops to $80,071. While liquidation clusters do not identify directional predisposition, they can produce long or brief squeezes, baiting traders on either side of particular trades.

With such high capital at danger under $90,000, it is possible that Bitcoin might target each cluster before approaching the dominant side.

Related: Bitcoin traders target $90K as evident tariff exemptions relieve United States Treasury yields

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.