Secret takeaways:

-

Bitcoin lags as financiers move towards stocks after the United States and China strike an offer that might end the present trade war.

-

Macroeconomic conditions are swinging far from gold investing and back to stocks.

Bitcoin (BTC) reached its greatest rate in over 3 months at $105,720 on Might 12, however was not able to preserve its bullish momentum. Remarkably, the drop to $102,000 followed a short-lived relieving in the US-China tariff dispute. This has actually left traders puzzled regarding why Bitcoin responded adversely to what looked like favorable advancements.

The 90-day truce decreased import tariffs, and United States Treasury Secretary Scott Bessent kept in mind that the arrangement might be extended, offered there is an authentic effort and positive discussion. According to Yahoo Financing, the subjects under conversation consist of “currency control,” “steel rate discarding,” and constraints on semiconductor exports.

Part of Bitcoin’s current absence of momentum can be credited to its 24% gains over the previous thirty days, throughout which S&P 500 futures increased 7% and gold stayed flat. Financiers see little factor for additional divergence in between Bitcoin and conventional markets, specifically because the 30-day connection with the stock exchange stays high at 83%.

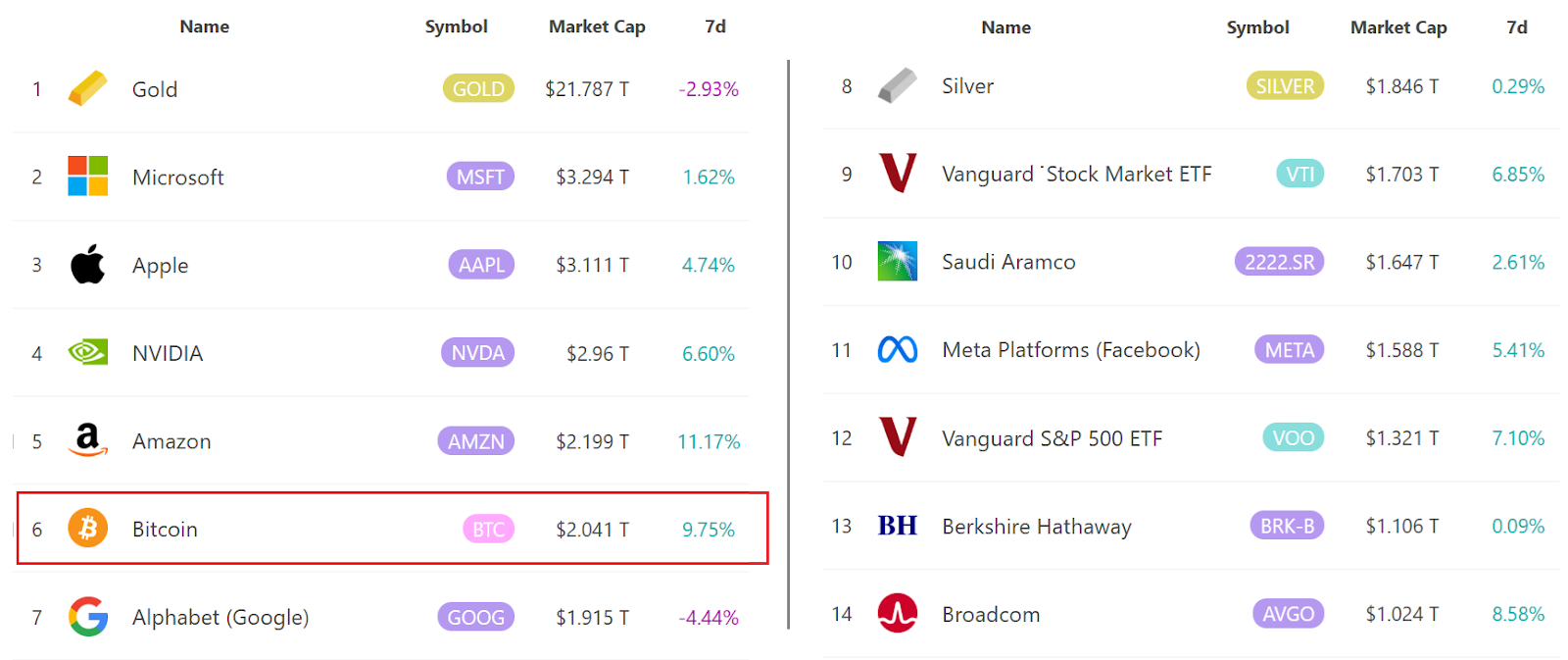

Furthermore, Bitcoin has actually now gone beyond the marketplace capitalization of both silver and Google, making it the world’s sixth-largest tradable possession.

News that Technique obtained another 13,390 BTC in between Might 5 and Might 11 has actually likewise raised issues amongst financiers. With BlackRock and Technique together holding 1.19 million BTC, about 6% of the distributing supply, some traders stress that Michael Saylor’s business is mostly accountable for supporting the rate.

Critics, such as Peter Schiff, anticipate that Technique’s ever-increasing typical purchase rate might ultimately result in losses and require the business to offer a few of its holdings to cover loaning expenses. Nevertheless, this circumstance appears not likely, as the business has actually doubled its capital boost limitation by $21 billion in stocks and another $21 billion in financial obligation.

Bitcoin stalls as macroeconomic occasions prefer stocks over gold

While traders typically concentrate on Bitcoin-specific occasions, the most likely factor for the weak point near $105,000 is wider macroeconomic conditions. Although the time out in tariffs straight benefits the stock exchange, the result on limited properties like Bitcoin is rather unfavorable. For instance, gold fell 3.4% on Might 12 as the need for safe-haven properties decreased.

Gold has actually normally revealed an inverted connection with the United States Dollar Index (DXY), which reached its greatest level in thirty days on Might 12. The reinforcing United States dollar signals financier self-confidence, regardless of a 0.3% decrease in United States first-quarter Gdp and a 6.1% dive in pending home sales in March compared to the previous month.

Related: Bitcoin short-term ‘technical sell-off’ under $100K possible ahead of Might 13 CPI print

The absence of conviction amongst Bitcoin financiers when costs traded near $105,000 is at least partially due to decreased need for limited properties, as financiers see the stock exchange as a more instant and direct recipient of the US-China trade offer. Lower import responsibilities recommend greater incomes and possibly enhanced earnings margins for business.

Provided the excellent $2 billion in inflows into United States area Bitcoin exchange-traded funds (ETFs) in between Might 1 and Might 9, the probability of a cost drop listed below $100,000 stays low. The stable need for Bitcoin following a 24% regular monthly gain indicate institutional adoption instead of retail-driven FOMO, which is a really favorable indication for the rate.

This short article is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.