At the start of the week, Bitcoin (BTC) rate caught press from sellers, decreasing from $84,500 on March 17, to $81,300 at the time of composing. This down motion was probably a sell-off associated to the Federal Free market Committee’s (FOMC) two-day conference, which occurs on March 18-19.

Federal Free Market Committee (FOMC) conferences tend to function as market resets. Each time the FOMC satisfies to ponder on United States financial policy, crypto markets brace for effect.

Historically, traders de-risk and minimize take advantage of ahead of the statement, and after the conference and interview from Federal Reserve Chair Jerome Powell the marketplaces can be similarly reactive.

Journalism release of the present FOMC conference set up for Wednesday, March 19, at 2:30 pm ET, and it might set off significant motions in the Bitcoin market. Examining market habits resulting in its release might use hints about Bitcoin’s next relocation.

To traders, FOMC indicates volatility

Traders are carefully keeping an eye on the FOMC minutes for any shifts in the Fed’s position on inflation and rate of interest.

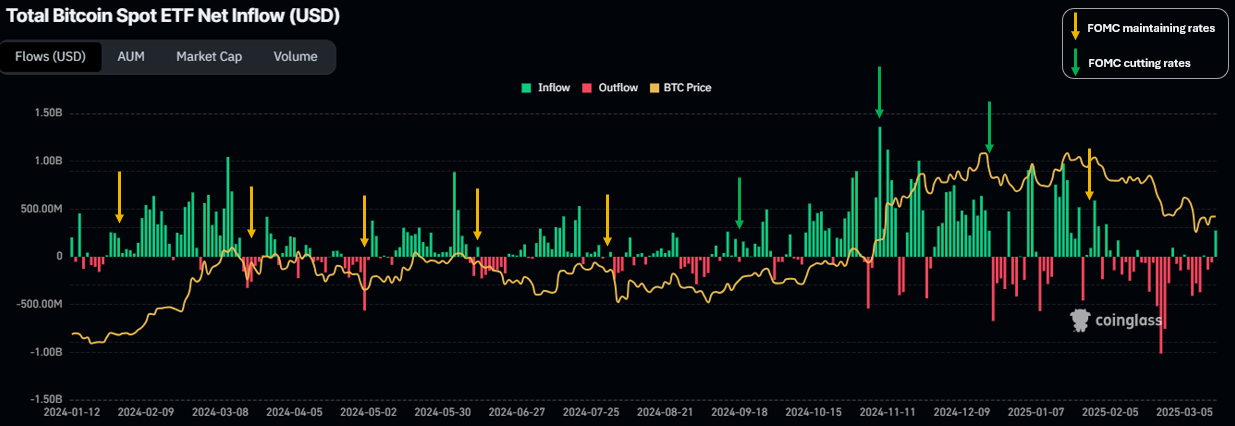

After the FOMC statement, Bitcoin rate tends to respond dramatically. Considering that the start of 2024, BTC rates primarily decreased after the FOMC chose to preserve rates, as can be seen on the chart below.

The significant exception was the pre-halving rally of February 2024, which likewise accompanied the launch of the very first area BTC ETFs. When United States rate of interest were cut on September, 18, 2024 and November 7, 2024, Bitcoin rallied.

Nevertheless, the 3rd cut on December 18, 2024, did not yield the very same outcome. The modest reduction by 25 basis indicate the 4.50%– 4.75% variety marked the regional Bitcoin rate top at $108,000.

BTC/USD 1-day chart with FOMC dates. Souce: Marie Poteriaieva, TradingView

Markets deleverage before FOMC, other than this time

An essential sign that offers insight into market belief is Bitcoin open interest– the overall variety of acquired agreements, primarily $1 continuous futures, that have actually not been settled.

Historically, Bitcoin open interest falls before FOMC conferences, revealing that traders are decreasing take advantage of and threat direct exposure, based on the chart based upon CoinGlass information.

Bitcoin futures open interest and FOMC dates. Source: Marie Poteriaieva, CoinGlass

Nevertheless, this month another pattern has actually emerged. In spite of Bitcoin’s $12 billion open interest shakeout previously this month, in the days preceding the FOMC there was no obvious reduction in Bitcoin’s open interest. BTC rate, nevertheless, decreased, which is uncommon and might show a strong directional bet.

This might likewise be an indication that traders feel less stress and anxiety about the Fed’s choice, perhaps anticipating a neutral result. Supporting this view, CME Group’s FedWatch tool shows a 99% likelihood that the Fed will preserve rates at 4.25%– 4.50%.

If the rates stay the same, it is possible that Bitcoin rate will continue its present drop. This might be precisely what the HyperLiquid whale was wishing for when it opened a 40x leveraged brief position worth over $500 million at its peak. Nevertheless, this position is now closed.

Related: Bitcoin stalls under $85K– Secret BTC rate levels to enjoy ahead of FOMC

How are the area Bitcoin ETFs responding?

Unlike Bitcoin whales, financiers in the area Bitcoin ETFs have actually traditionally unloaded BTC holdings before FOMC conferences.

Considering that the area BTC ETFs released in January 2024, most FOMC occasions have actually accompanied ETF outflows or, at best, modest inflows, according to CoinGlass information. The significant exception was the previous all-time high of January 2025, when even the area Bitcoin ETF financiers could not withstand the desire to purchase.

Bitcoin area ETF net inflows and FOMC dates. Source: Marie Poteriaieva, CoinGlass

On March 17, the area Bitcoin ETFs saw $275 million in net inflows, marking a shift from a month of outflows. This might indicate a shift in financier belief and expectations relating to the Fed’s policy choices.

If area ETF inflows are increasing before the FOMC, financiers may be preparing for a more dovish position from the Fed, such as signifying future rate cuts or keeping liquidity-friendly policies.

Financiers might likewise be packing up on Bitcoin as a hedge versus unpredictability. This recommends that some institutional financiers think Bitcoin will carry out well despite the Fed’s choice.

Financiers might likewise be preparing for a possible brief capture. If traders were anticipating Bitcoin to drop and located brief, an unexpected boost in ETF inflows might contribute in traders’ habits and set off a brief capture.

Following the FOMC, BTC’s rate action, together with onchain information and area ETF circulations will reveal whether the current activity belonged to a long-lasting build-up pattern or simply speculative positioning.

Nevertheless, something that lots of traders settle on now is that BTC might experience a substantial rate motion after the FOMC statement. As crypto trader Master of Crypto put it in a current X post:

” The FOMC is tomorrow, and a Huge Move is anticipated.”

Even without rate cuts, the possibility of the Fed releasing dovish declarations might raise markets, while the lack of them might drive rates lower.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.