Bitcoin (BTC) rallied to $69,482 on Friday, and the rally accompanied information revealing stable build-up from smaller-sized holders in February.

Experts state the breakout might progress into a more comprehensive bullish pattern, although other information recommends that a longer duration of rate combination will underlie the emerging bull pattern.

Secret takeaways:

-

BTC broke above the $69,000 resistance and its coming down channel, activating $92 million simply put liquidations within 4 hours.

-

Little wallets included $613 million in February, while the whale wallets stalled with $4.5 billion in outflows.

-

Short-term holder profit-ratio indication struck its most affordable level because November 2022, highlighting weak belief over the previous couple of weeks.

Will the Bitcoin relief rally last?

Bitcoin has actually pressed above the upper limit of its coming down channel and retested $69,000. The relocation marks a possible bullish break of structure (BOS), if BTC holds above $68,000.

If BTC holds above this recovered level, the next internal liquidity zones sit near $71,500 and $74,000. The 50- and 100-period rapid moving averages (EMAs) are now compressing below the rate on the one-hour chart, enhancing the possibility of the short-term momentum continuing.

The most recent rate rise set off about $96 million in futures liquidations over the previous 4 hours, with almost $92 million originating from brief positions, indicating a brief capture on bearish traders.

BTC liquidations were mainly focused on Bybit (22.5%), Hyperliquid (22%) and Gate (15%), recommending these platforms represent a considerable share of active leveraged positioning in the market.

Related: Multi-day unfavorable Bitcoin financing signals ‘overcrowded’ brief trade: Turnaround coming?

BTC retail financier need backs the breakout

The breakout is supported by the stable purchasing from the smaller-sized financiers. Order circulation information from Hyblock reveals that the little wallets ($ 0–$ 10,000) have actually built up about $613 million in cumulative volume delta (CVD) in February, regularly bidding throughout the rate correction.

The mid-sized wallets ($ 10,000–$ 100,000) stay about -$ 216 million for the month, however the friend included about $300 million because BTC fell listed below $60,000, recommending selective build-up throughout marked down durations.

Whale wallets ($ 100,000 and above) saw their CVD bottom near -$ 5.8 billion earlier in February and have actually because moved sideways. This stabilization indicates that the aggressive circulation has actually stopped briefly, though a clear build-up pattern from the big holders has yet to emerge.

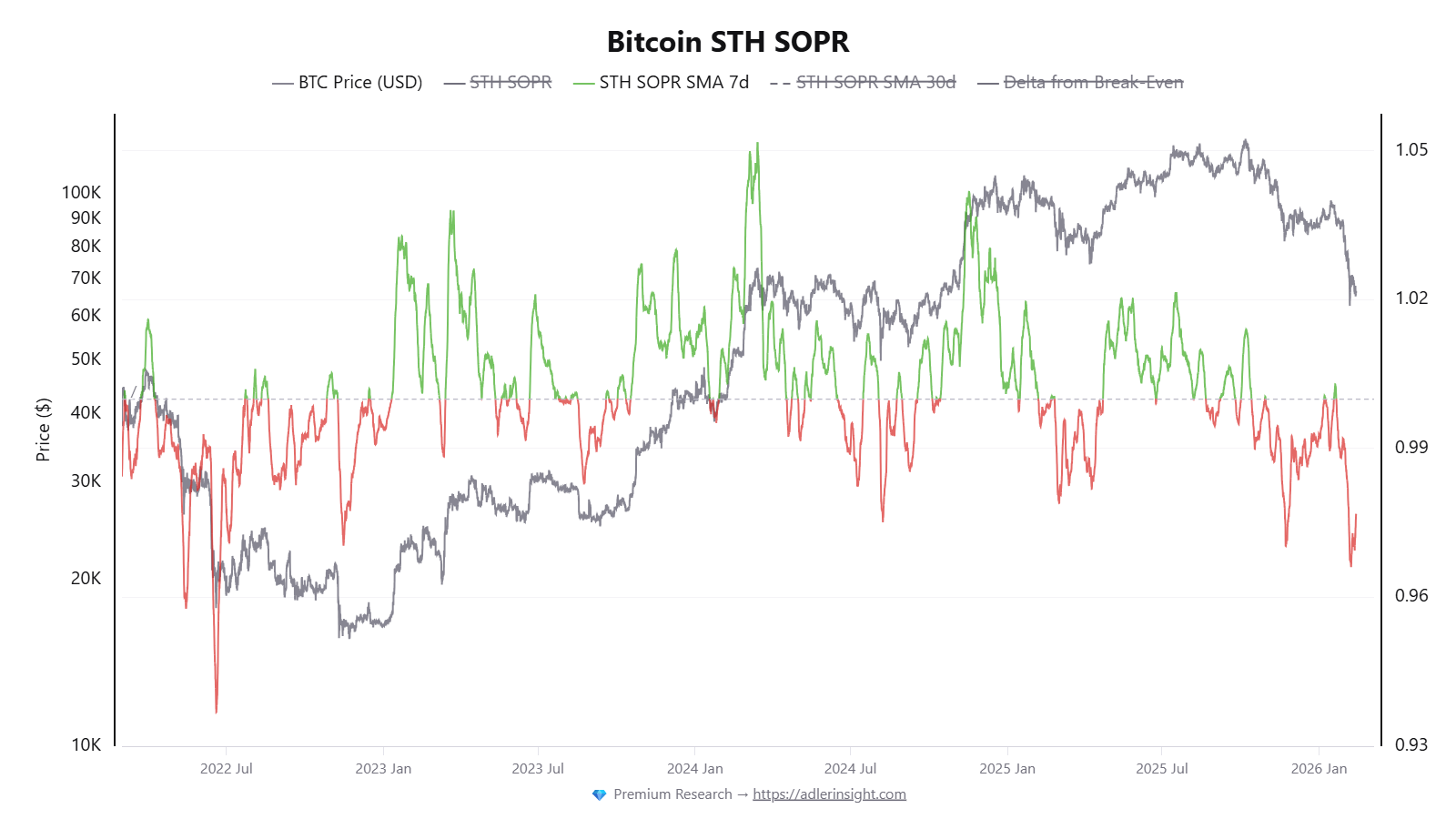

For the rally to continue, whale purchasing might require to return, and the short-term holder invested output revenue ratio (SOPR) might require to return above 1, indicating that the current purchasers are no longer costing a loss.

Especially, the short-term holder SOPR just recently was up to its most affordable level because November 2022, showing that numerous current purchasers have actually been understanding losses, an indication that conviction might stay delicate in spite of the rebound.

Related: Bitcoin passes $69K on slower United States CPI print, however Fed rate-cut chances remain low

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage developing from your dependence on this details.