Bottom line:

-

Bitcoin and gold sell lockstep on low timeframes as macro volatility sets off increase.

-

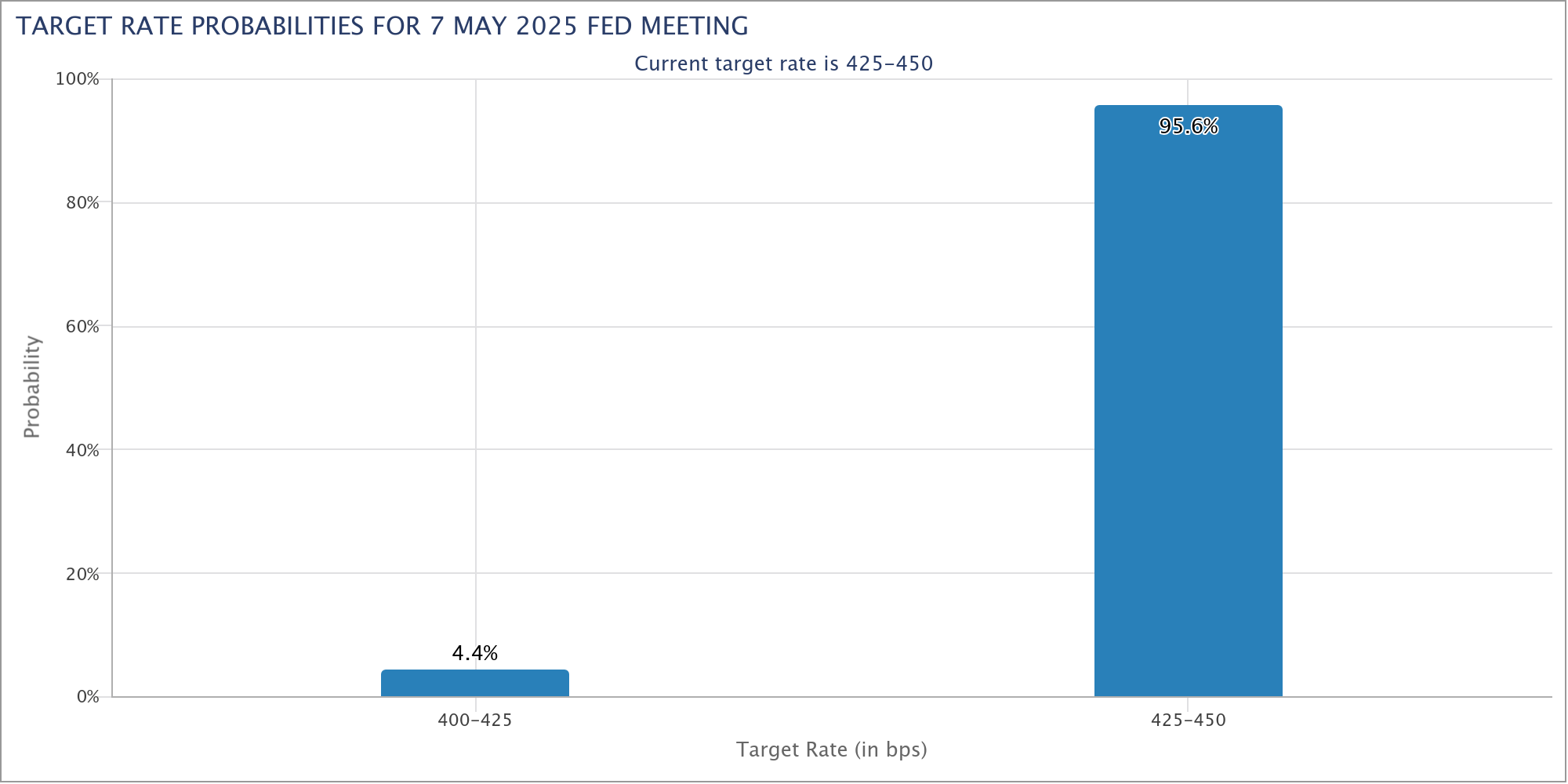

The Federal Reserve rate of interest choice and press conference are simply hours away.

-

Market belief for rate cuts in 2025 reductions dramatically ahead of the FOMC conference.

Bitcoin (BTC) saw a flash short-term pattern modification on Might 7 as geopolitical triggers offered danger possessions fresh volatility.

Bitcoin traders eye Fed for “tone modifications”

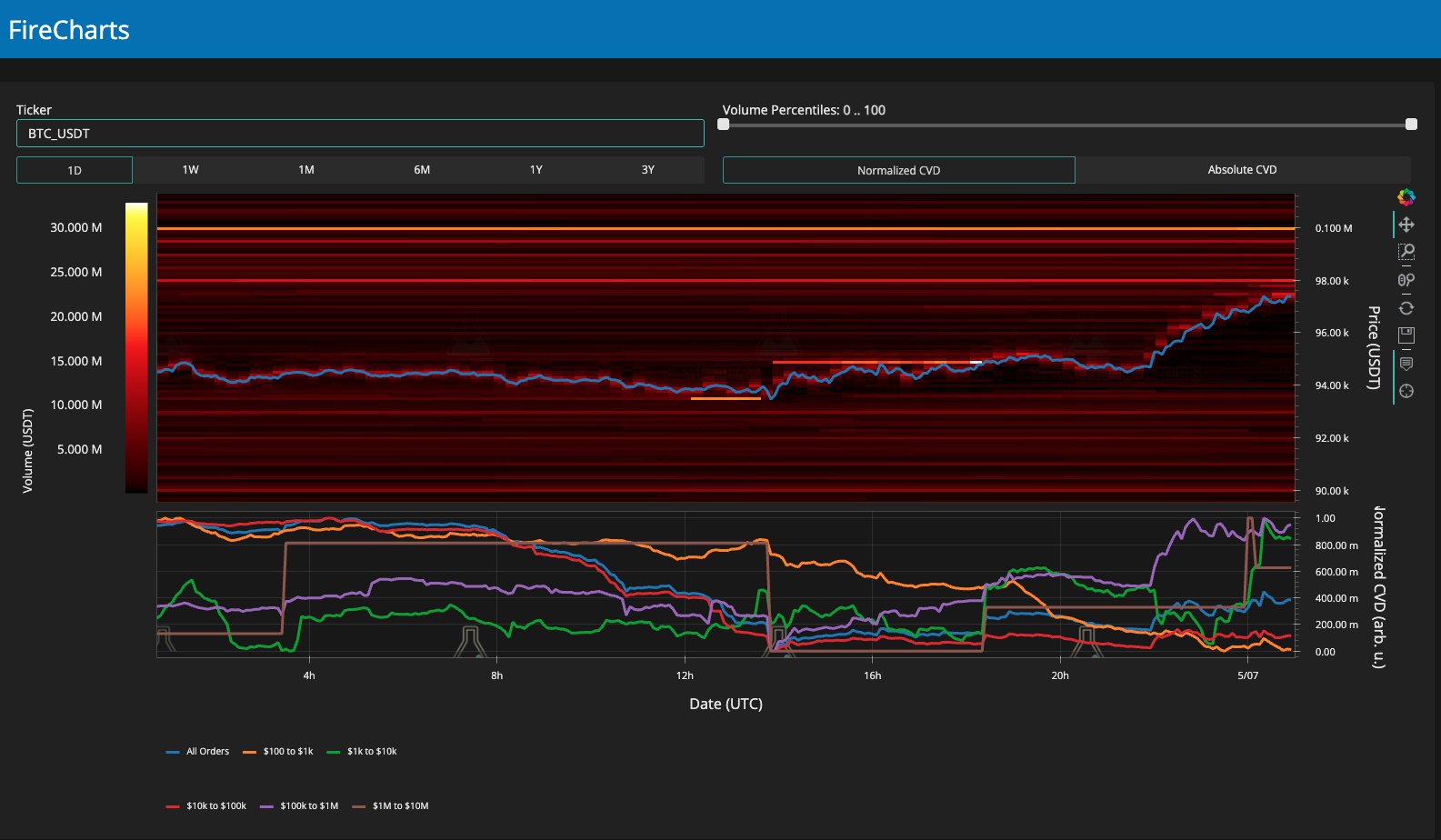

Information from Cointelegraph Markets Pro and TradingView revealed an abrupt turn-around for BTC/USD after the set dipped under $94,000 to set brand-new Might lows.

The previous day’s Wall Street trading session set the phase for a go back to strength, even as stocks completed lower.

Bitcoin and gold reached regional highs of $97,700 and $3,435, respectively, before combining.

News of stress boiling over in between India and Pakistan, together with possible development on a US-China trade offer, kept markets dynamic.

This response to US-China trade talks being arranged informs you all you require to understand.

A LOT is currently priced-in here. pic.twitter.com/jT6pKOdgiQ

— The Kobeissi Letter (@KobeissiLetter) May 7, 2025

Traders had no time at all to unwind, with the Federal Reserve rate of interest choice due later Might 7.

While market expectations for the Federal Free Market Committee (FOMC) conference were virtually consentaneous, as Cointelegraph reported, Fed Chair Jerome Powell’s subsequent declaration and press conference were of more interest.

” The marketplace will aspire to expect any dovish or hawkish modifications in their tone, which has actually been quite blended just recently,” popular trader Daan Crypto Trades summed up in a continuous X analysis along with information from CME Group’s FedWatch Tool.

Analyzing Bitcoin order book activity, Keith Alan, co-founder of trading resource Product Indicators, stated that close-by liquidity had actually been “cleaned out” before the occasion.

” Happily stunned BTC held above the YOU, however will not be shocked if cost big salami the variety before completion of the week,” he informed X fans, describing the annual open level at $93,500 as a possible disadvantage target.

” Plainly cynical”

Continuing, Darkfost, a factor to onchain analytics platform CryptoQuant, kept in mind decreasing chances of rate cuts coming earlier in 2025.

Related: Bitcoin might rally no matter what the Federal Reserve FOMC chooses today: Here’s why

At the time of composing, the June FOMC conference had actually integrated rate cut chances of around 30%– visibly lower than in current weeks.

” Expectations are plainly cynical in the meantime,” he concluded.

” If the Fed does choose to cut rates in this context, it will set off volatility and may trigger worry amongst financiers (depending about the number of Bps).”

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.