Secret takeaways:

-

Bitcoin’s relocation above $97,000 does not have verification in derivatives markets, with the choices alter indicating care towards any continual rally.

-

Geopolitical dangers, falling treasury yields, and deteriorating equities enhance a risk-off setting that continues to restrict Bitcoin’s benefit.

Bitcoin (BTC) rate rose to its greatest levels in more than 60 days after publishing a 5.5% gain on Wednesday. The relocation followed $840 million in inflows into area Bitcoin exchange-traded funds (ETFs) on Monday and Tuesday. With Bitcoin finding footing on the benefit, are additional gains towards $105,000 most likely in the near term?

Bitcoin’s rally towards $97,000 contrasts with the ongoing weak point of the tech-heavy Nasdaq Index, which has actually consistently stopped working to recover the 26,000 level last seen in early November 2025. Financier belief stays blended, as Bitcoin still trades 23% listed below its $126,219 all-time high, while gold and silver costs reached record highs in 2026, indicating a more powerful quote for conventional safe-haven possessions.

Expert traders have yet to turn bullish, according to the BTC choices delta alter metric, as put (sell) choices continue to trade at a premium. The BTC choices delta alter presently stands at 4%, the same from one week previously, showing steady threat understanding in spite of the rally above $96,000 on Wednesday. Traders stay doubtful about continual gains above the $100,000 level.

Bitcoin’s benefit topped by increased sociopolitical issues

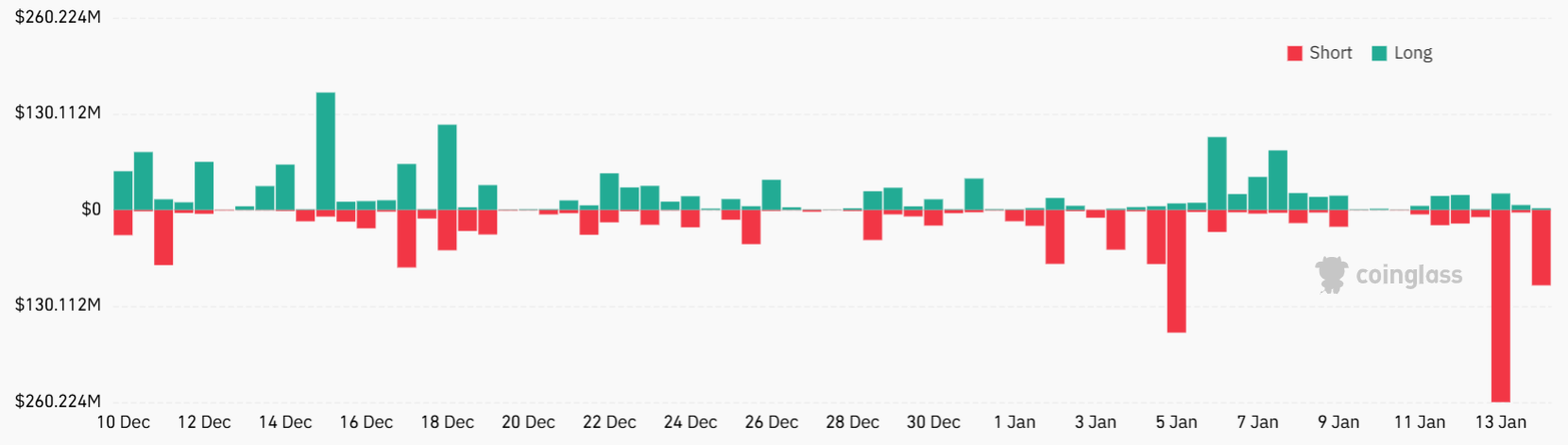

Normally, when whales and market makers grow positive, the alter turns unfavorable, showing increased need for neutral-to-bullish choice methods. Rather, Bitcoin bears were captured off guard, as the current rate advance set off $370 million in liquidations of leveraged brief (sell) positions over 2 days, the greatest overall considering that October 2025.

Part of the absence of optimism can be connected to geopolitical stress after demonstrations in Iran triggered military hazards from United States President Donald Trump, consisting of a possible extra 25% import tariff on nations “working with the Islamic Republic of Iran.” Financiers fear that United States relations with China and India might degrade if the proposition moves on.

Financier self-confidence has actually likewise been pressed by the Trump administration’s objective to acquire control of Greenland. Trump has actually argued that the independent area of Denmark is crucial to United States nationwide security. German Defense Minister Boris Pistorius has actually supposedly provided help to Denmark in case of a hostile takeover, according to Politico.

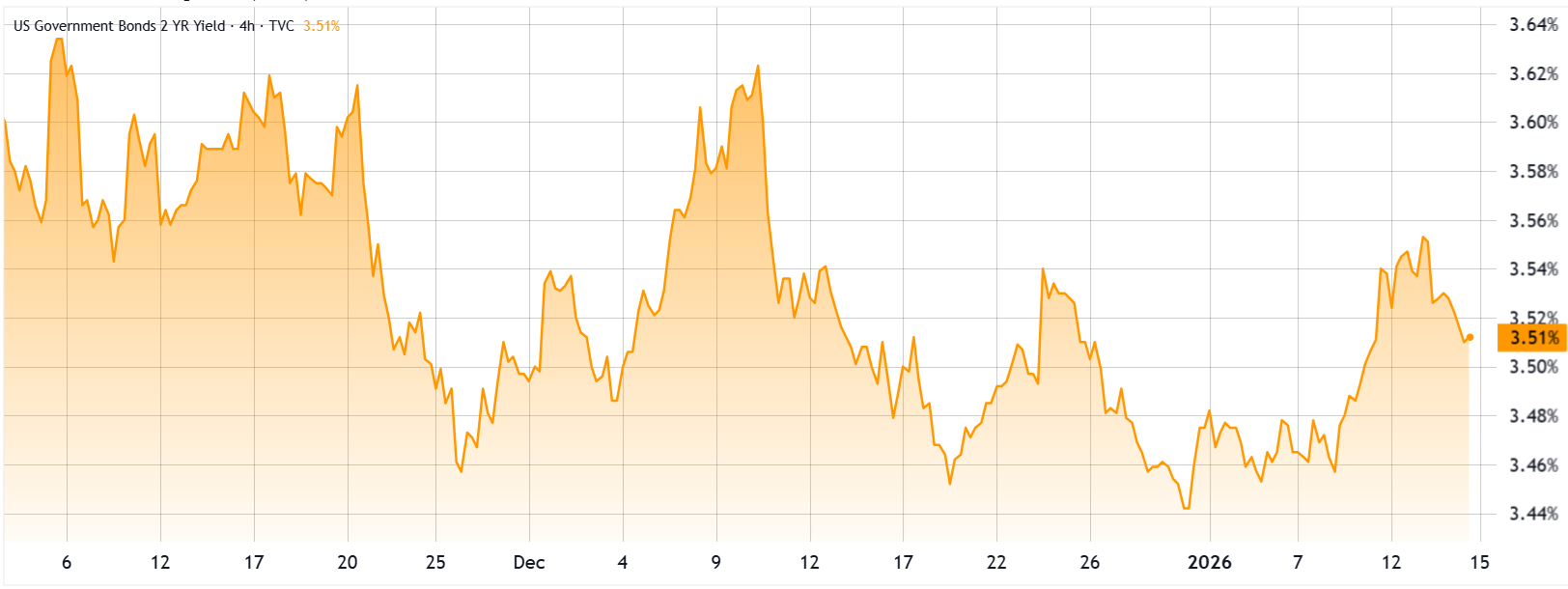

Yields on the United States 2-year Treasury was up to 3.51% on Wednesday, showing that traders are accepting lower returns in exchange for the security of government-backed bonds. This is particularly informing considering that the current United States customer rate inflation index (CPI) stood at 2.7% year over year, above the United States Federal Reserve’s target.

Warren Buffett, CEO of Berkshire Hathaway, supposedly alerted that the absence of clearness surrounding the future instructions of expert system is worrying. Showing this care, Berkshire’s money position reached a record $381.7 billion, up from $170 billion one year prior.

The Nasdaq Index decreased 1.6%, while Oracle (ORCL United States) shares dropped 5% after shareholders submitted a class action suit declaring the business stopped working to reveal the requirement for considerable extra financial obligation to broaden its expert system facilities.

Related: Bitcoin ETFs on rollercoaster as conventional funds draw in $46B in 2026

As unpredictability develops, traders have actually decreased equity direct exposure, indicating a lower tolerance for threat that likewise restricts hunger for cryptocurrencies.

It stays uncertain whether Bitcoin has actually decisively ended its two-month bearish market, however derivatives information reveal traders stay extremely doubtful of a fast rally towards $105,000. In the meantime, financiers’ focus stays on the wider sociopolitical dangers and on whether the United States Federal Reserve can support financial development without reigniting inflation.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.