Bottom line:

-

Bitcoin go back to $112,000 as bulls stage an essential resistance retest.

-

BTC rate action protects the “booming market assistance channel” in a traditional dip to support.

-

Gold strikes brand-new all-time highs as point of views on Bitcoin applaud its status as a macro hedge.

Bitcoin (BTC) tapped $112,500 after Wednesday’s Wall Street open as traders gradually turned bullish on BTC rate action.

BTC rate penalizes shorts with $112,000 rebound

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD trying to recover crucial assistance levels.

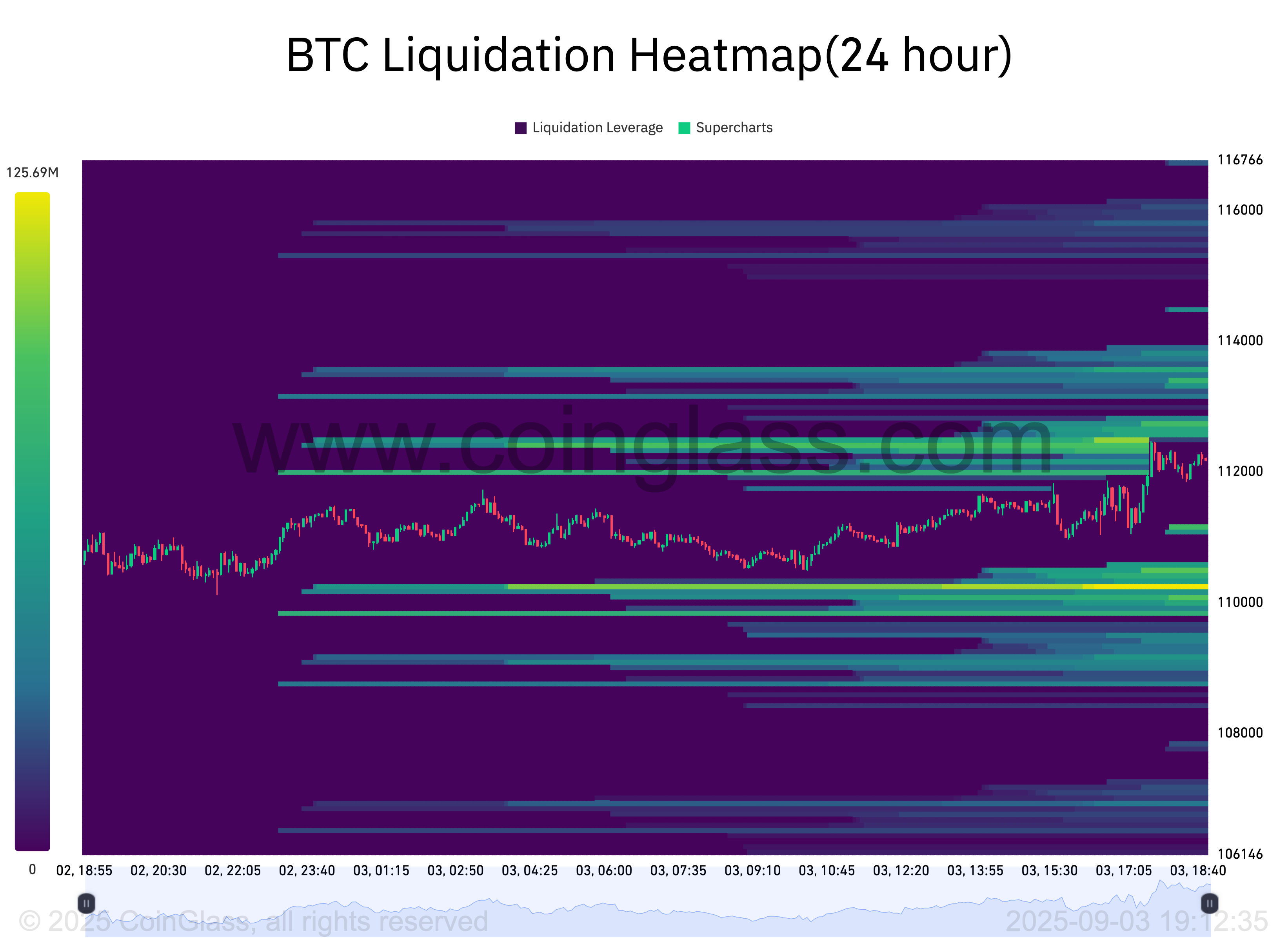

These consisted of $112,000 itself, which formed the bottom of a big spot of ask liquidity on exchange order books.

Information from CoinGlass revealed rate getting a piece of that liquidity on the day, with the rest reaching $114,000.

Commenting, popular trader CrypNuevo highlighted the crucial assistance fights presently in play.

” This appears like an effort to recover Assistance 1, which would cause a return inside the variety,” part of an X post described.

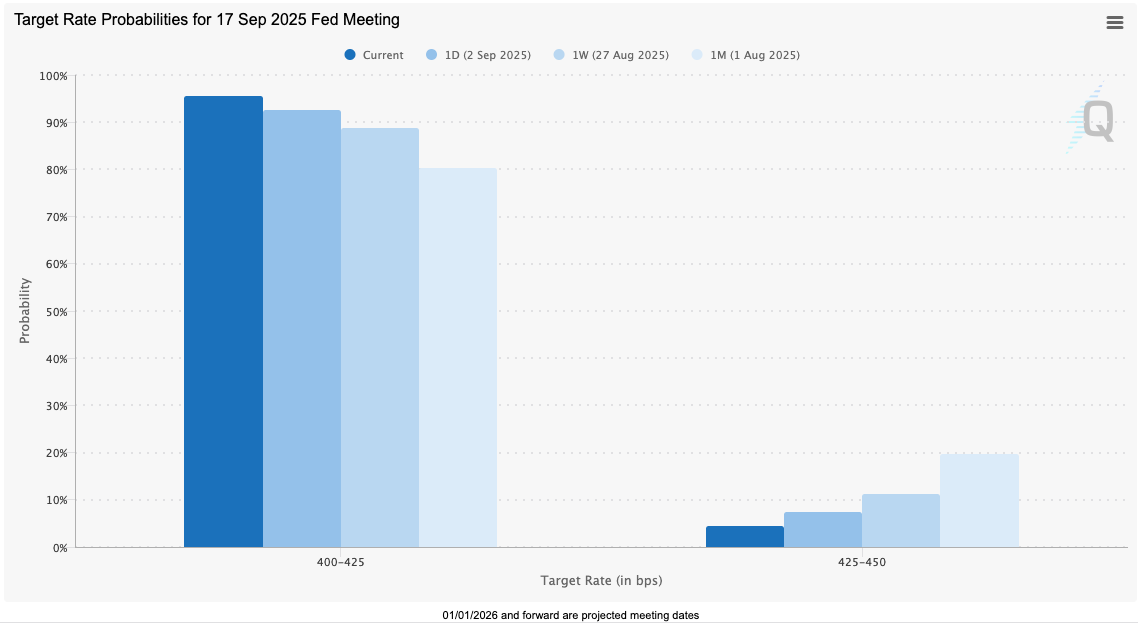

CrypNuevo kept in mind that there were simply 2 weeks left till a prospective bullish risk-asset driver went into– an interest-rate cut by the United States Federal Reserve on Sept. 17.

The post explained today’s regional lows at $107,270 as a “incorrect relocation,” while fellow trader BitBull flagged a traditional bounce at assistance.

“$ BTC completely recovered from its booming market assistance band,” he informed X fans, describing a channel formed by 2 moving averages.

” This is an indication that bulls are still in control.”

As Cointelegraph reported, lots of market individuals stay bearish throughout numerous timeframes, seeing a retest of $100,000 as quickly as today.

Bitcoin bull case increased as gold beats record highs

Concerning macro volatility, trading company QCP Capital saw the chances in Bitcoin’s favor moving forward.

Related: BTC vs. ‘extremely bearish’ gold breakout: 5 things to understand in Bitcoin today

” 2 cuts this year look sensible, however watch on breakevens, as brand-new tariffs might press expectations greater,” it summed up in its most current “Asia Color” market upgrade.

” With policy unpredictability remaining, a softer United States dollar is most likely so long as international development holds up. Gold and BTC stay uncomplicated hedges in this background.”

Information from CME Group’s FedWatch Tool validates that market expectations of an interest-rate cut in September are now over 95%.

Gold made fresh all-time highs on Wednesday, striking $3,567 per ounce.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.