Secret takeaways:

-

Bitcoin dip purchasers are back, however still being subdued by sellers in the futures and area markets.

-

Closed markets on the Labor Day vacation and the hazard of selling by OG Bitcoin whales might send out BTC cost to $105,000 and below.

Bitcoin (BTC) trades amidst rocky waters as the cost has a hard time to hold above $108,000, and at the minute, there are no indications of a healing in sight. Traders are working out care due to Wall Street being closed Monday for the Labor Day vacation and the overhang of a Bitcoin whale possibly dumping another billion-dollar tranche of BTC on the free market.

The Bitcoin OG whale offered another 4,000 $BTC to purchase $ETH.

In less than 2 weeks, this whale has actually offered over 32,000 BTC and purchased over 870K Ethereum worth $3.8 billion.

He still holds 50K+ BTC, which will more than likely be cost$ETH pic.twitter.com/AC3iyhoM4a

— Ted (@TedPillows) August 31, 2025

Noteworthy transfers and offering from long-dormant whale-sized Bitcoin wallets and the conversion of the earnings to Ether (ETH), decreasing inflows to the area BTC ETFs, and end-of-week weak point in the DOW, S&P 500, and Nasdaq are all weighing on financier belief. Contributing to the pressure are United States President Trump’s back-and-forth rhetoric on tariffs, and the marketplaces’ response to the president’s efforts to take control of the Federal Reserve board.

Some longer-out positives are market individuals’ expectations that the Fed will begin cutting rates of interest in late September or October, however these hopes have actually not sufficed to enhance short-term financier belief.

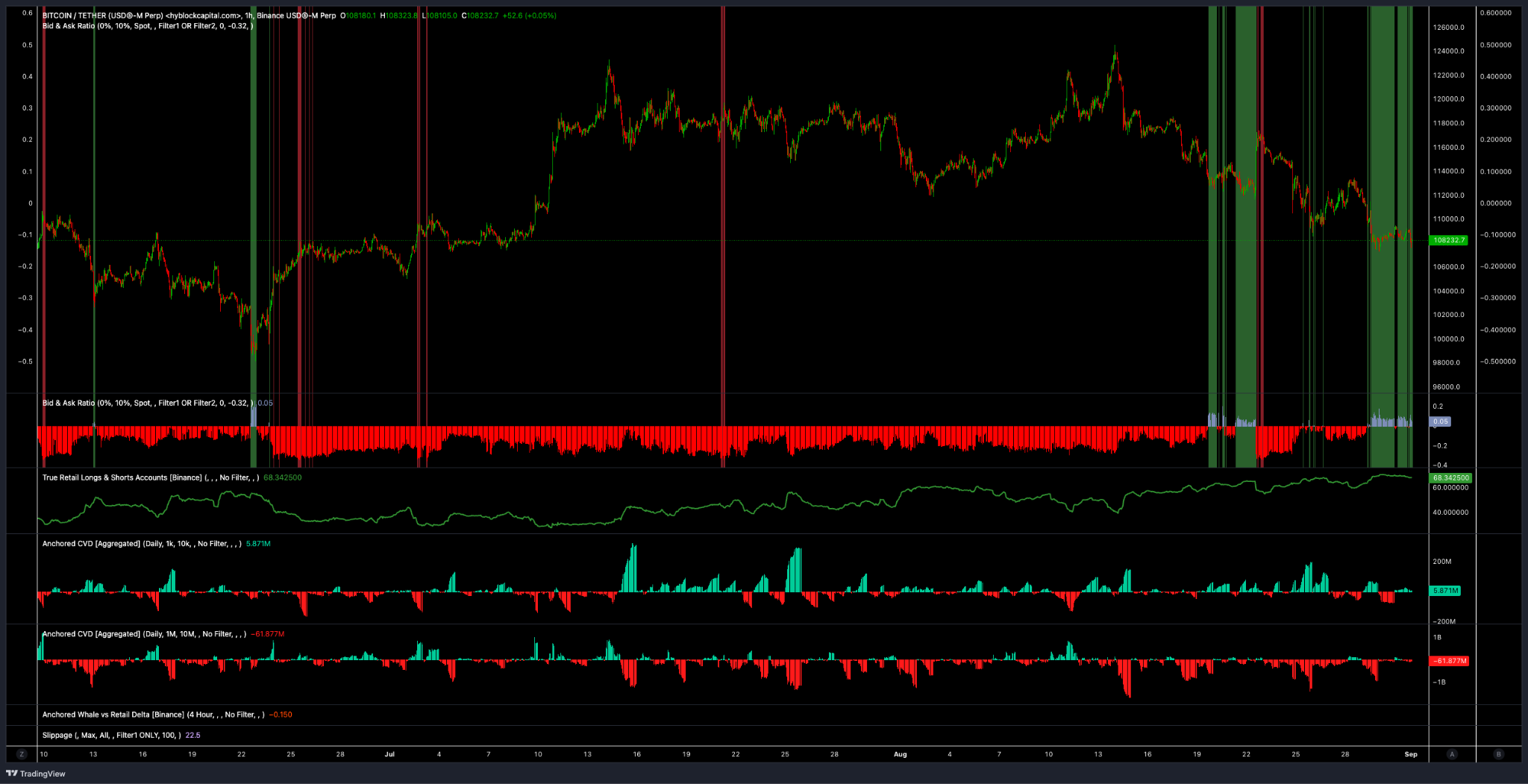

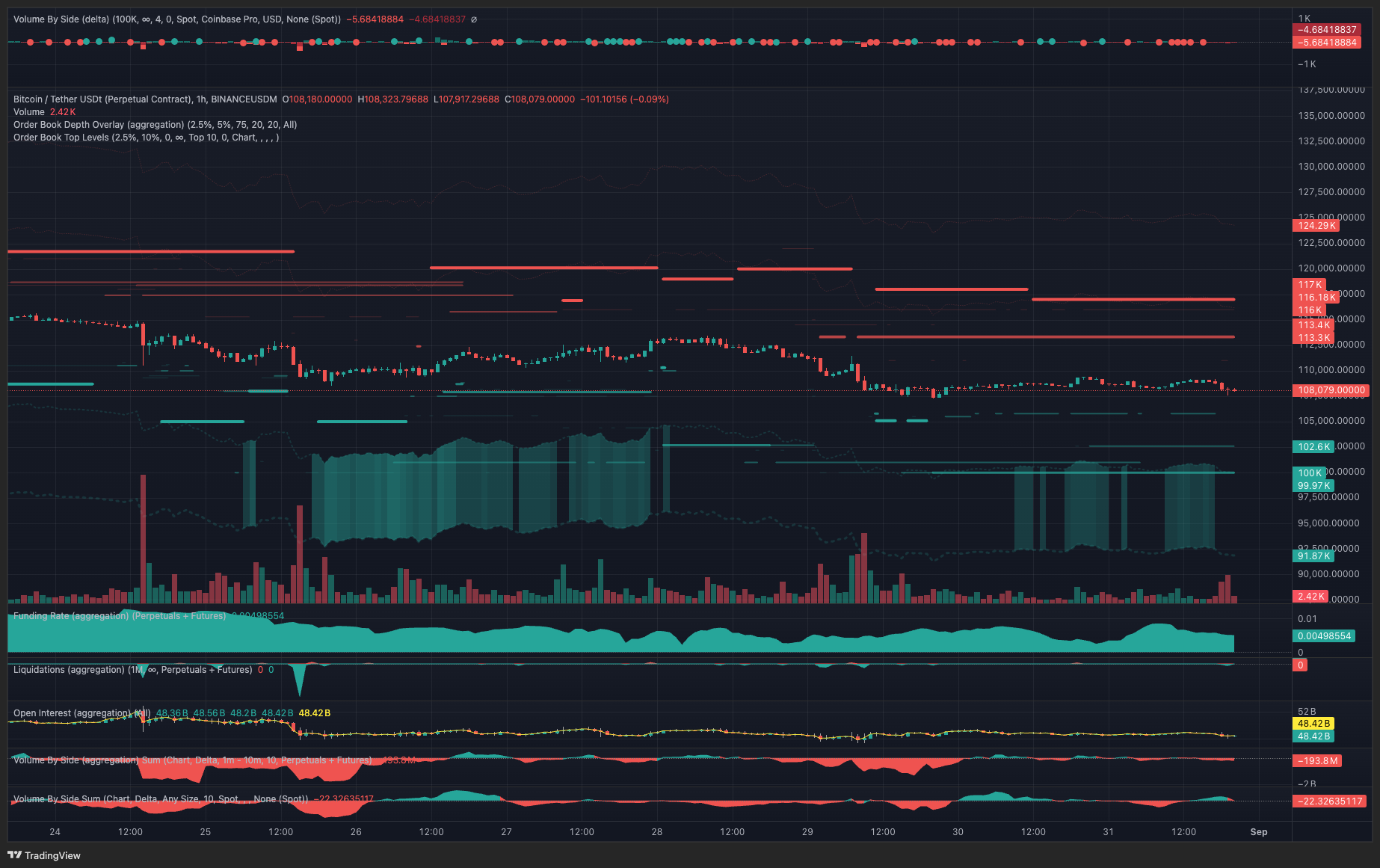

From a technical viewpoint, Bitcoin’s intraday cost action continues to be mainly driven by activity in the perpetuals futures market, where the cumulative volume delta reveals offering from the 10,000 to 10 million Binance associate far surpassing purchasing in the area and futures market at Binance and Coinbase.

While offering in futures continues to reduce Bitcoin cost breakouts, and information programs brief positions thickening up at each stopped working assistance resistance flip effort, area purchasers in the retail-size associate (100 to 10K) are purchasing each brand-new low.

Related: Will Bitcoin cost drop in September?

As displayed in the chart below, the quote and ask ratio (set to 10% area orderbook depth) reveals purchasers taking a bite as cost dropped into the $112,000 to $111,000 zone on Aug. 19 to Aug. 22 and once again as BTC came down to $107,200 on Friday through Sunday. It deserves keeping in mind that previous to Aug. 19, the metric had actually not flagged a circumstances of the order book having more quotes than sell orders considering that June 22, when BTC cost fell listed below $98,000.

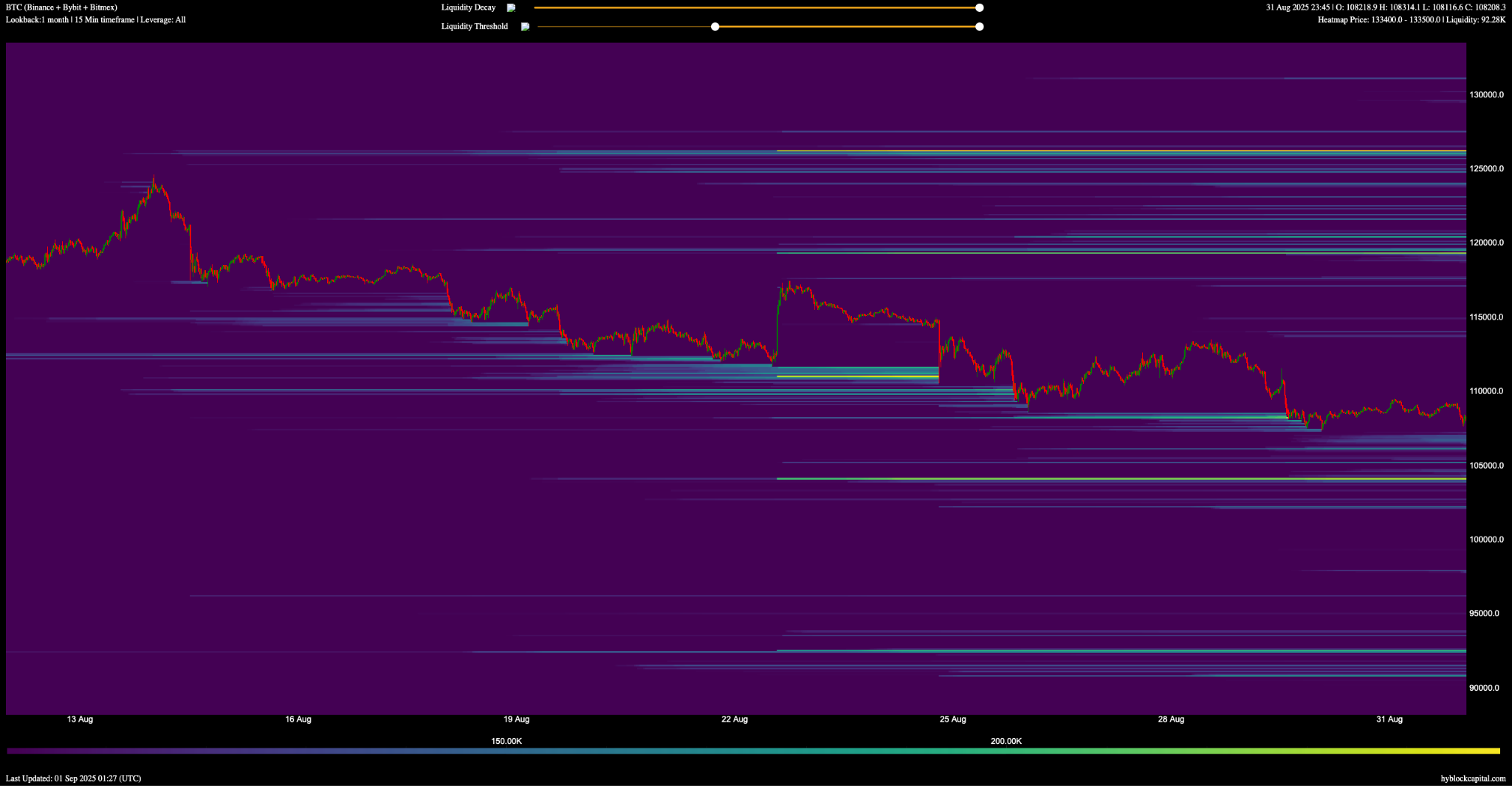

Bitcoin’s 30-day liquidation heatmap reveals disadvantage liquidity continuing to be soaked up, with the most popular cluster at $104,000.

On a much shorter timespan, the BTC/USDT 1-hour chart at TRDR.io reveals quotes appearing at $105,000, $102,600 and $100,000. Setting the order book to 10% depth, quotes in the $99,000 to $92,000 zone are likewise present.

While purchasers are showing eager to purchase dips to brand-new lows, orderbook liquidity integrated with BTC cost weak point prefers disadvantage and sellers continue to subdue dip purchasers. Wall Street (and the area BTC ETFs) will be closed on Monday, and the unfavorable overhang of OG whales offering outdoors market is most likely to continue weighing on cost in the short-term.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.