Bitcoin (BTC) passed $84,000 into the March 19 Wall Street open as markets gotten ready for the United States Federal Reserve interest-rate choice.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Bitcoin, risk-assets do not have “tailwinds” into FOMC

Information from Cointelegraph Markets Pro and TradingView revealed regional highs of $84,358 on Bitstamp.

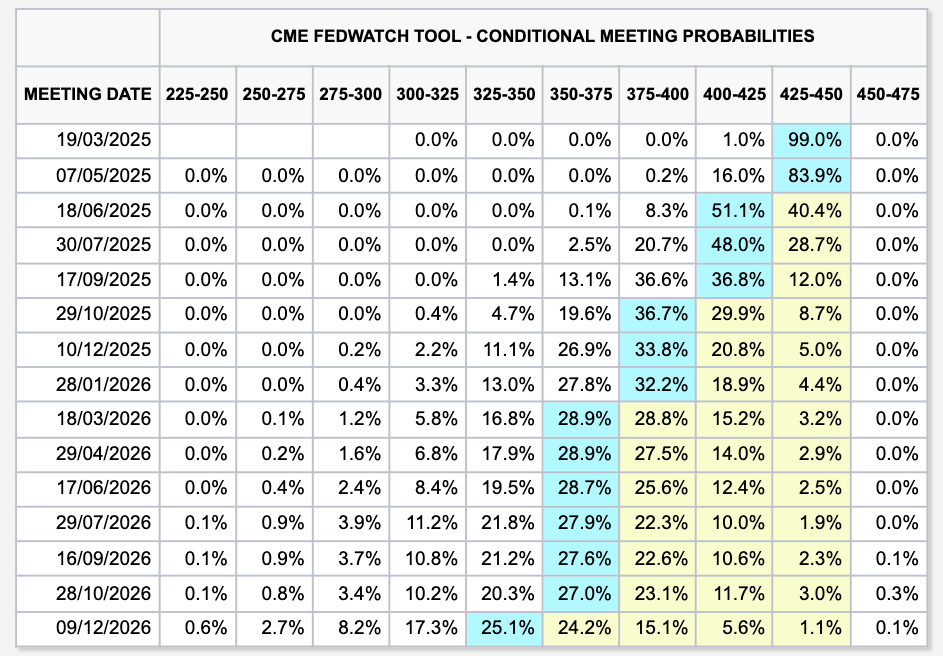

Threat properties were on edge ahead of the Federal Free Market Committee (FOMC) conference, with the Fed anticipated to hold rates constant up until a minimum of June, per information from CME Group’s FedWatch Tool.

Fed target rate likelihoods (screenshot). Source: CME Group

The nature of subsequent commentary from Fed Chair Jerome Powell was of more issue to traders. Currently hawkish, Powell deals with pressure from United States trade tariffs as inflation markets only simply start to fall.

” Tonight’s FOMC conference is extremely most likely hold rates constant. Nevertheless, we will be enjoying carefully for any dovish shifts, especially on development and inflation expectations,” trading company QCP Capital composed in its most current publication to Telegram channel customers on the day.

” Considered that it will take months for the effect of tariffs to ripple through the economy, we anticipate the Fed to stay in ‘wait-and-see’ mode. The 2 April tariff choice, while well-telegraphed, stays an essential unpredictability.”

While holding above $80,000 throughout the week, Bitcoin’s fate hung in the balance as United States stocks saw noteworthy disadvantage.

The S&P 500 and Nasdaq Composite Index traded down 4% and 8.7% year-to-date at the time of composing compared to 10% for BTC/USD.

” TC has actually discovered some assistance at the $80k, however that appears rare at finest in the middle of more comprehensive macro weak point,” QCP continued.

” We will not try to call the precise minute when the music stops, however in the short-term, we have a hard time to recognize significant tailwinds to reverse this thrashing.”

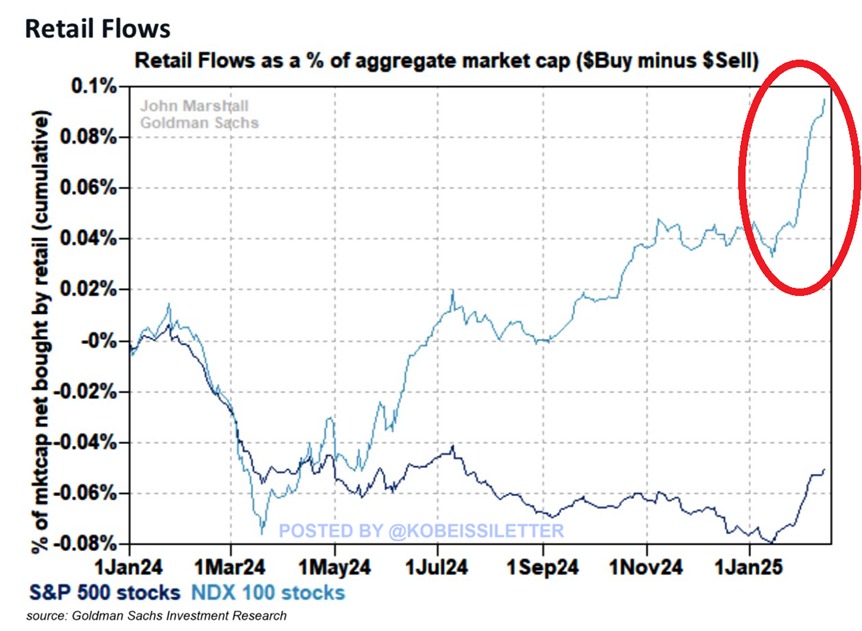

Trading resource The Kobeissi Letter recognized a prospective silver lining in the kind of increasing equities allowance by United States retail financiers.

” Retail net inflows into Nasdaq 100 index stocks as a portion of market cap have actually reached 0.1%, the greatest in a minimum of a year. Retail circulations have actually DOUBLED in simply a couple of weeks,” it composed in a post on X.

” In addition, JPMorgan’s retail financier belief rating struck a record 4 points. This is ~ 1 point greater than the peak of the meme stock mania in 2021. Tesla, $TSLA, and Nvidia, $NVDA, were the most popular names got by specific financiers. Retail financiers are all-in.”

United States stocks retail circulations information. Source: The Kobeissi Letter/X

Bad FOMC result dangers $76,000 BTC cost drop

Evaluating BTC cost action, popular trader and expert Rekt Capital hoped that the benefit space in CME’s Bitcoin futures market would be completely “filled” with a spike to $87,000.

Related: Bitcoin futures ‘deleveraging’ cleans $10B open interest in 2 weeks

Such spaces, as Cointelegraph reported, continue to function as short-term cost magnets.

” Bitcoin continues to effectively retest the CME Space as assistance (orange box, $78k-$ 80.7 k),” Rekt Capital discussed together with an illustrative chart.

” More, BTC has actually been doing so at a Greater Low (black).”

CME Bitcoin futures 1-day chart. Source: Rekt Capital/X

Keith Alan, co-founder of trading resource Product Indicators, on the other hand recommended that a dovish Powell might have a clear influence on cost momentum.

” A dovish tone that decreases recessionary worries might send out Bitcoin cost above the 200-Day and 21-Day MAs, and prevent what looked like an impending death cross in between those 2 crucial MAs,” part of an X post mentioned.

Alan described 2 neighboring easy moving averages, with the 200-day and 21-day MA sitting at $84,995 and $84,350, respectively.

BTC/USD 1-day chart with 21, 200MA. Source: Cointelegraph/TradingView

Problem, on the other hand, might trigger a retest of multimonth lows at $76,000, he alerted.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.