Secret Takeaways:

-

United States GDP diminished -0.3% in Q1, far listed below +0.3% projections, triggering economic downturn worries.

-

Bitcoin deals with offering pressure with its area volume delta dropping $300 million in 3 days.

-

Whales are collecting BTC, however smaller sized holders are offering, meaning profit-taking.

Bitcoin’s (BTC) cost dropped under $93,000 on April 30, after the United States Gdp (GDP) information exposed a -0.3% contraction in Q1. While the GDP missed out on expectations of +0.3%, the GDP Cost Index skyrocketed to 3.7%– the greatest given that August 2023. Polymarket chances of an economic downturn in 2025 hit 67%, with customer self-confidence at its least expensive given that Might 2020.

On The Other Hand, in March 2025, PCE (Individual Intake Expenses) inflation was up to 2.3% (above the anticipated 2.2%), and Core PCE dropped to 2.6% (in line with expectations). Still, February’s Core PCE was modified from 2.8% to 3.0%, signifying blended inflation patterns.

Short-term bearish, long-lasting bullish for Bitcoin?

Throughout the 2020 COVID-19-induced market crash, BTC at first followed conventional markets before rallying over 300% by year-end as the worldwide M2 cash supply increased, showing its appeal throughout durations of financial growth. Nevertheless, stagflation, highlighted by the -0.3% GDP contraction in Q1 2025 and a 3.7% GDP Cost Index, position short-term threats.

Cointelegraph kept in mind that high inflation typically discourages retail crypto financial investment, as seen in 2022 when BTC fell 60% in the middle of Federal Reserve rates of interest walkings. The March 2025 PCE inflation information recommends cooling pressures that might reduce Fed rate trek worries and assistance Bitcoin.

On the other hand, February’s upward modifications (heading PCE from 2.5% to 2.7%, Core PCE to 3.0%) signal relentless inflation, keeping the Fed’s next relocations unsure. While worry of stagflation might press BTC in the short-term, its long-lasting hedge capacity stays legitimate.

Related: Bitcoin macro sign that forecasted 2022 bottom flashes ‘purchase signal’

Bitcoin sees $300 million in area selling pressure

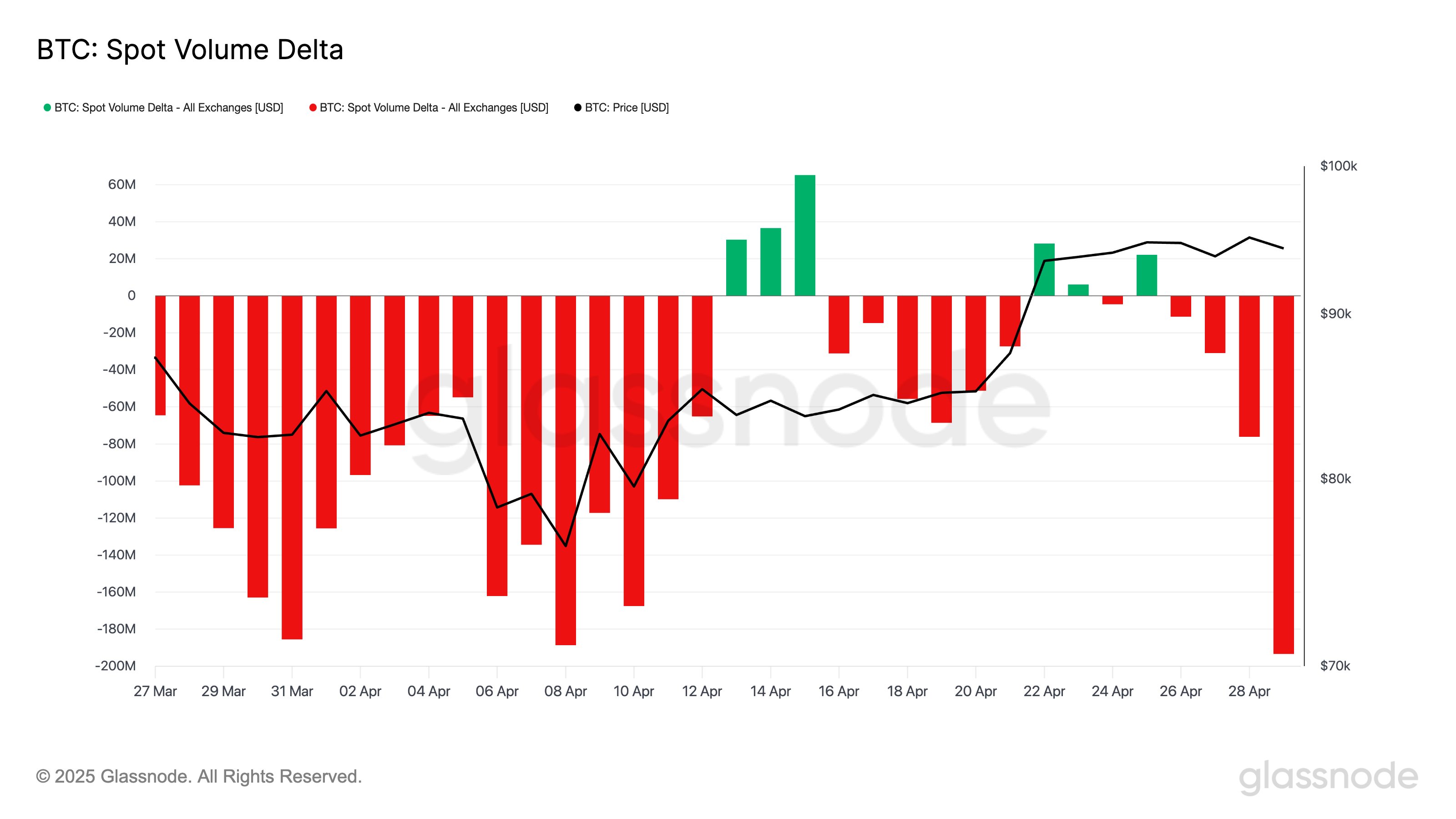

Bitcoin’s area volume delta dipped over $300 million over the previous 3 days, increasing prospective sell-off pressure for BTC around the $95,000 level.

Information from Glassnode suggests the 7-day moving average of BTC area volume delta taped unfavorable circulations over successive days. The unfavorable inflows gradually increased with a small $16 million flush on April 26, followed by $30.9 million on April 27, $76.1 million on April 28, and $193.4 million on April 29.

This sharp decrease signals aggressive selling and weakening area need, a signal to profit-taking or a prospective short-term pattern turnaround. Regardless of the sell-off, the analytics platform kept in mind that build-up patterns amongst Bitcoin holders paint a more nuanced image. Whales holding over 10,000 BTC stay in a build-up mode, with a pattern rating near 0.95.

Nevertheless, smaller sized holders reveal indications of circulation. The 10– 100 BTC group is trending towards 0.6, while those with 1– 10 BTC (0.3) and less than 1 BTC (0.2) are net sellers.

This top-down build-up recommends the present selling pressure originates from short-term holders possibly taking earnings around the $95,000 level. Described as a “profit-taking pressure test” for BTC, the present market is at a crucial choice point, where profit-taking is a critical metric to keep an eye on.

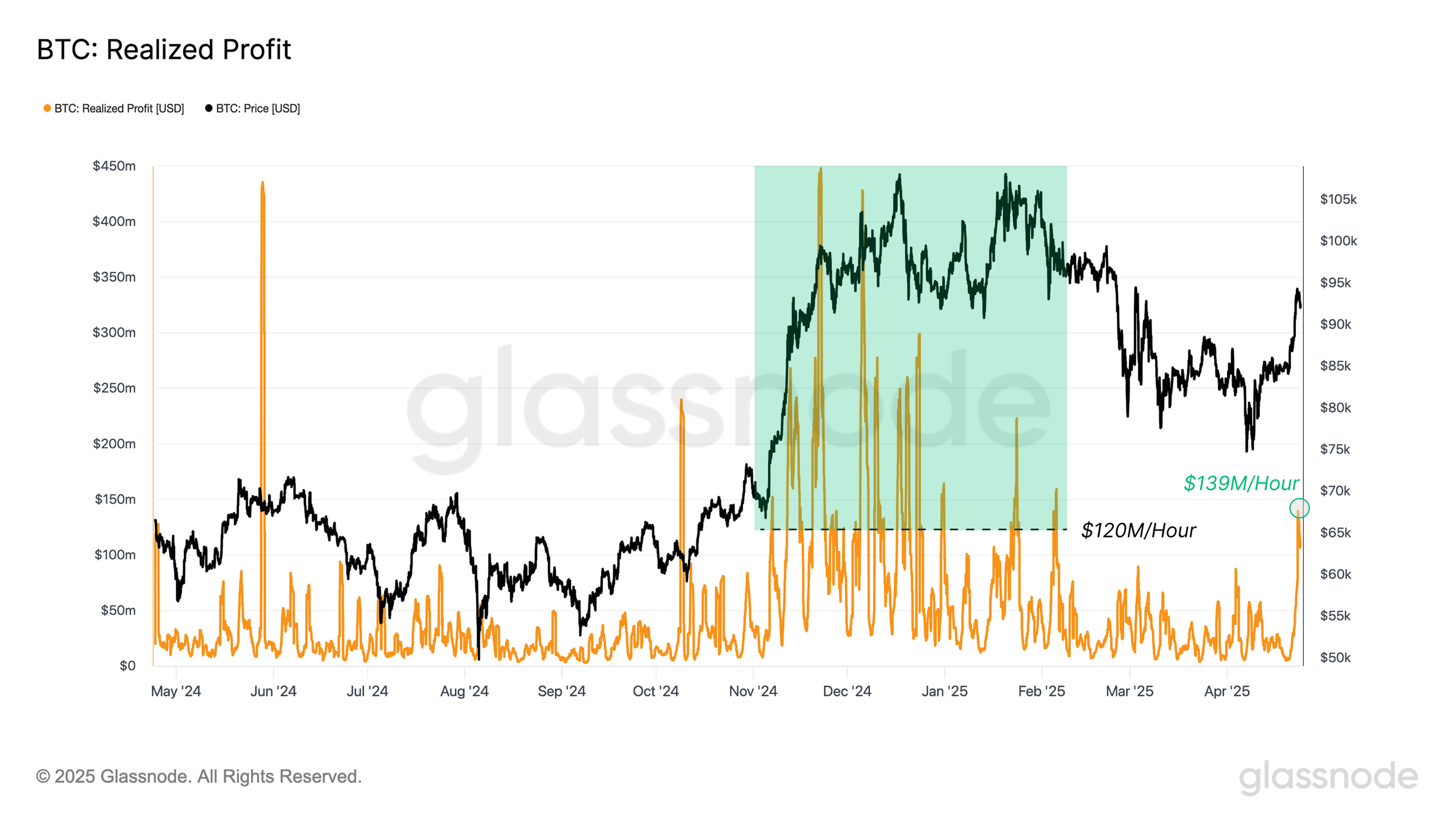

Recently, the overall understood earnings on a per hour chart rose to $139.9 M/hour, approximately 17% above its $120M/hour standard. With the present area delta outflows, the understood earnings might strike brand-new highs today.

Related: Bitcoin traders forecast BTC cost gains ahead of $96K liquidity clash

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.