Bottom line:

-

Bitcoin short-term holders form crucial close-by BTC rate assistance levels– however a space stays in between $110,000 and $115,000.

-

Glassnode recommends that the rate might drop to “fill” that space next.

-

Short-term holder profit-taking might top BTC rate upside at around $140,000 in case of a breakout.

Bitcoin (BTC) might deal with a “crucial” assistance test, which takes BTC rate action to $110,000 next, states research study.

In the current edition of its routine newsletter, “The Week Onchain,” crypto analytics firm Glassnode exposed a brand-new BTC rate magnet.

Glassnode: Bitcoin cost basis space has “gravity”

Bitcoin’s short-term holders (STHs) might be accountable for the next BTC rate dip, one which takes the marketplace down 7%, back to $110,000.

STH financiers, specified as entities hodling for approximately 155 days, typically supply BTC rate assistance in locations where lots of go into the marketplace. Their aggregate purchase rate, otherwise referred to as expense basis or understood rate, is a referral point throughout Bitcoin booming market.

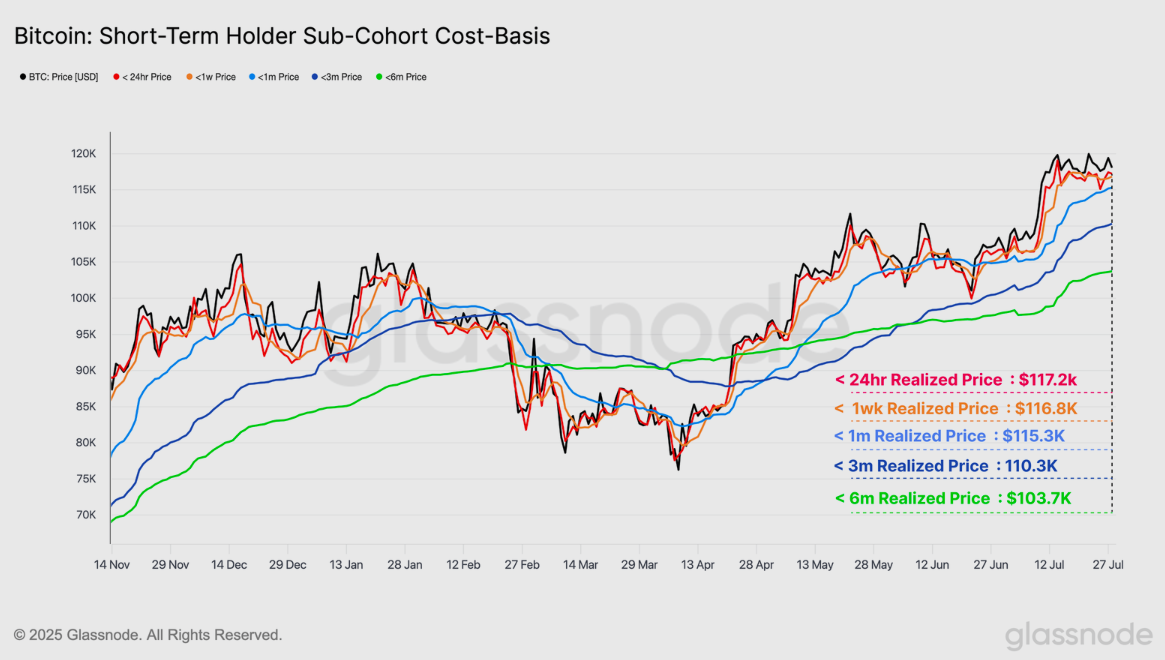

Glassnode keeps in mind that when BTC/USD increased rapidly from $110,000 to $115,000 this month, there was little time for financiers to action in and purchase.

” By analyzing Bitcoin’s Cost-Basis Circulation profile, we can see a substantial concentration of financier expense basis levels around the $117k-$ 122k area. This highlights a big volume of financier build-up has actually happened at this raised rate point,” it describes.

” Visibly, there stays an air-gap of volume simply below the area rate, from $115k to $110k, an outcome of rate rallying through the area without much chance for coins to negotiate along the method.”

The lack of cost-basis assistance hence leaves the door open for rate to fill deep space, similar to it fills spaces in CME Group’s Bitcoin futures market developed at weekends.

” Not all air-gaps like this one need to be back-filled, however a gravity does exist there, and the marketplace might wish to re-confirm if assistance will action in. This marks this location as an essential zone to enjoy in case of a rate draw back,” Glassnode includes.

Speculator earnings produce BTC rate targets

The STH expense basis can be broken down to show the aggregate purchase rate of significantly brand-new financiers. This, in turn, uses a ladder of prospective assistance levels.

Related: ‘ Greatest trade offer ever’– 5 things to understand in Bitcoin today

Those levels are likewise utilized to determine future rates at which STH mates will take pleasure in a specific level of success, and possibly offer their BTC.

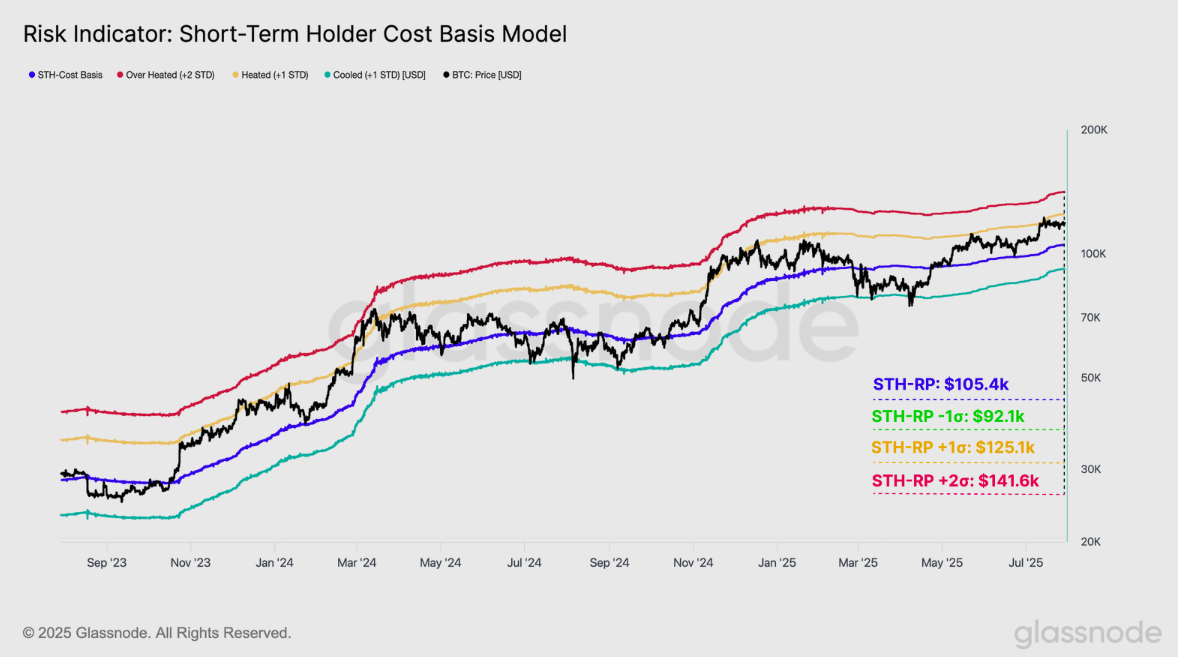

Glassnode uses basic discrepancy to forecast a possible regional leading level around $140,000 must BTC/USD go back to rate discovery.

” Need to the marketplace break convincingly greater, the $141K area is most likely to provide the next significant zone of resistance where sell-side pressure might heighten quickly, lined up with the +2 σ band,” it sums up.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.