Secret takeaways:

-

Possible de-risking ahead of the May 13 CPI print might be contributing in today’s BTC rate correction.

-

Bitcoin market structure and qualitative basics stay bullish, recommending today’s correction might be temporary.

Bitcoin (BTC) rate briefly discovered Might 12, being up to $102,388 after striking an intraday high at $105,819 throughout the United States trading session. In the beginning look, the abrupt correction appeared unforeseen provided the favorable news of the day. Considering that Sunday night (Might 11), traditional media headings have actually reported on the favorable headway made in the US-China trade talks taking place in Switzerland, and throughout the night, President Trump ran his success laboratory by means of Reality Social posts declaring the positives of the offer.

BREAKING: U.S. Reveals China Trade Handle Geneva pic.twitter.com/JjgvYAvAGe

— The White Home (@WhiteHouse) May 11, 2025

As news of the tentative offer broke, United States equity futures markets skyrocketed, and these gains emerged into a 1,000-point rally in the Dow at the opening bell. Looking beyond the short-term resolution of the US-China trade war, Bitcoin has actually acquired back-to-back wins over the previous 2 weeks. On Might 12, Technique CEO Michael Saylor revealed that the business had actually gotten 13,390 Bitcoin, bringing its overall balance to 568,840 BTC.

On the exact same day, shares of health care business KindlyMD rose as much as 600% after revealing the merger with Nakamoto Holdings, a Bitcoin investment firm established by David Bailey, who is Trump’s present crypto advisor. The month of April followed a comparable trajectory to today, where regular Bitcoin treasury development statements were made by a variety of US-based and worldwide business.

Related: United States realty possession supervisor introduces $100M tokenized fund with institutional support

Revenue taking and de-risking drive the present Bitcoin rate correction

While Bitcoin’s mass adoption seems speeding up, information from Glassnode recommends that BTC rate might be in for a short duration of combination after acquiring 9% in the recently. The onchain analytics firm published the following chart and cautioned that:

” BTC Supply Mapping reveals continual strength in brand-new need. Novice Purchasers RSI has actually held at 100 all week. However Momentum Purchasers stay weak (RSI ~ 11), and Revenue Takers are increasing. If fresh inflows sluggish, absence of follow-through might result in combination.”

At significant crypto exchanges, there was an uptick in selling in continuous futures markets, and selling was likewise seen in area markets as BTC rate rallied into a sell wall near $106,000.

From a trader’s perspective, a part of the selling might be possible derisking ahead of the Might 13 Customer Rate Index (CPI) inflation report, together with the view that the Trump trade handle China is now priced in after BTC stopped working to rally and hold above $104,000 on such special news.

Leading into the trade war news, the United States Dollar Index (DXY) rallied and stock indexes skyrocketed. Seeing Bitcoin stopping working to break and hold $104,000 to $105,000 prior to stock futures opening and after that BTC being not able to follow equities opening bell gains in the NY session recommends some traders chose to close lucrative longs ahead of tomorrow’s CPI or before the present quote hunger shifts to lower rate levels.

This view can be analyzed by the chart above, revealing open interest increasing hour-over-hour, together with an abrupt spike in the financing rate as brief positions opened and longs were liquidated.

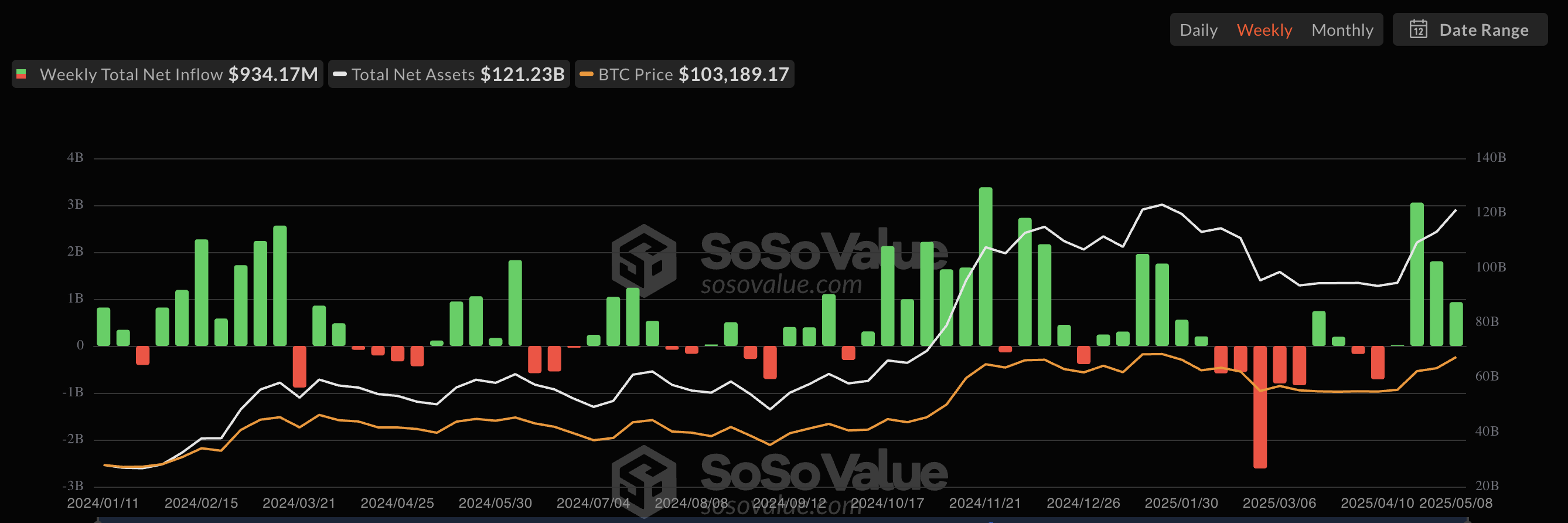

Area getting played a substantial function in recently’s Bitcoin rate rally, and the May 12 statement from Technique and area BTC ETF inflows of the previous 7 days raises more instant issues of whether the kind of purchasing hunger seen considering that late April will overflow into another week.

Thinking about the speeding up speed of Bitcoin adoption within standard financing and the quickly enhancing crypto regulative environment, the present rate action seems a short-term technical correction. Maybe, reliant upon tomorrow’s CPI print, area and margin longs will return in force when the marketplace absorbs the information of the report.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.