Bottom line:

-

Bitcoin lastly sees financiers who want to “purchase the dip” at costs around $110,000.

-

Numerous assistance retests continue to get trader attention.

-

Bulls can still recognize a bullish RSI divergence with a strong day-to-day close.

Bitcoin (BTC) maintained pressure on crucial assistance Thursday as purchaser interest revealed indications of a resurgence.

BTC cost revives sub-$ 110,000 levels

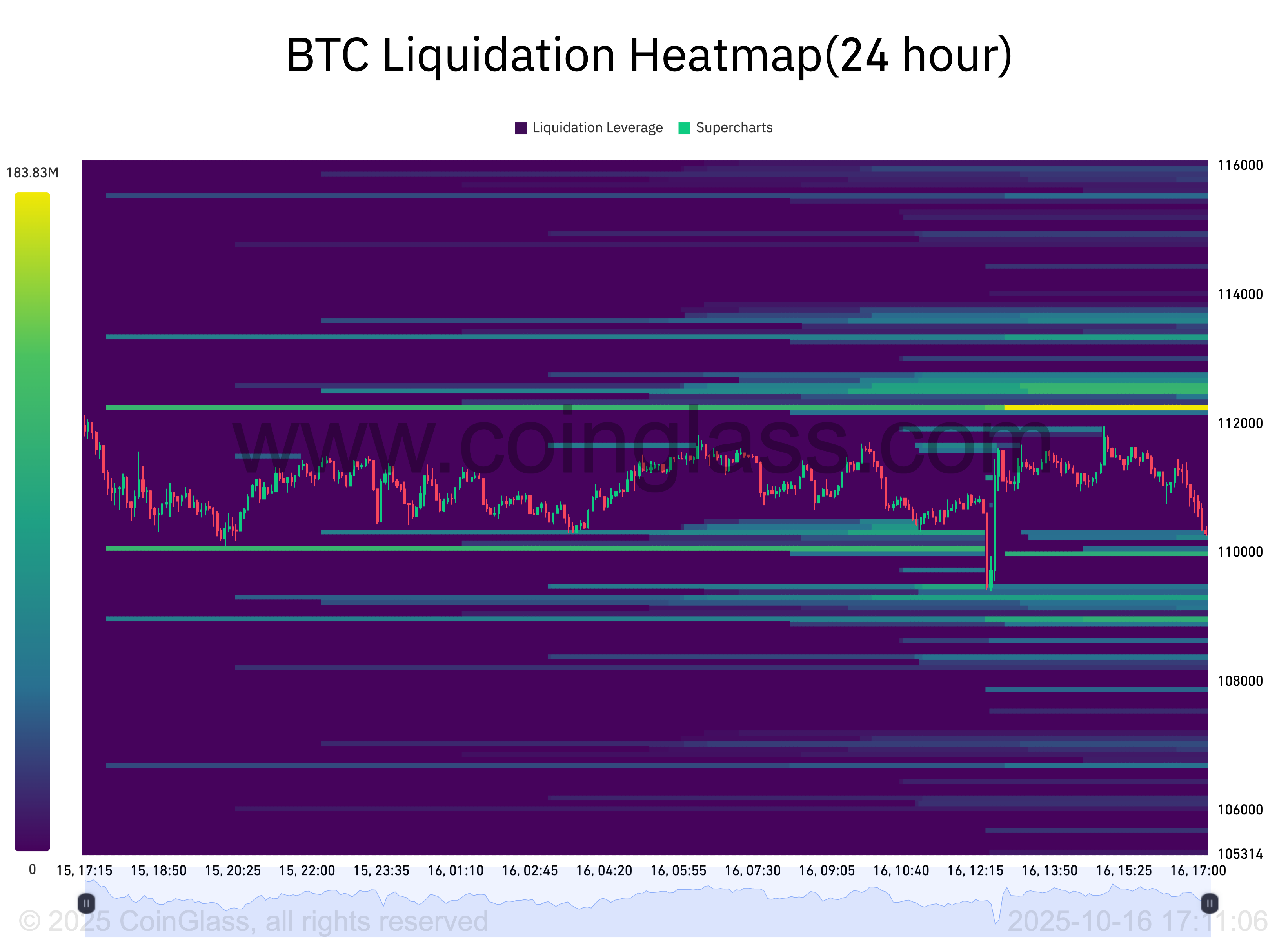

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD wicking listed below $110,000 on Bitstamp.

Exchange order-book liquidity on either side of the cost was targeted, with both regional lows and resistance at $112,300 now an essential focus.

” Time to secure once again, fourth time screening this need location,” trader Alter discussed the previous in an X post.

Trader and expert Rekt Capital kept in mind that BTC/USD had actually now filled an impressive “space” in CME Group’s Bitcoin futures market.

Bitcoin has now totally filled its Weekly CME Space in between $109680 and $111310$BTC #Crypto #Bitcoin https://t.co/NS86XQRgTn pic.twitter.com/zfvYml9hih

— Rekt Capital (@rektcapital) October 16, 2025

Dealing with the relative strength index (RSI), Rekt Capital considered an “emerging” bullish divergence with cost– a prospective indication of benefit to come.

” Rate requires to Daily Close much like this to crystallise it,” he included.

Crypto expert and business owner Ted Pillows utilized market belief as evidence that the Bitcoin cost was most likely developing a regional flooring.

“$ BTC has actually been combining after recently’s crash,” he informed X fans.

” Belief is at an all-time low, individuals are panic offering and ‘it’s all over’ is on the timeline. This does not occur at the top, however rather at the bottom.”

Pillows submitted a chart comparing present BTC cost action to that from the COVID-19 cross-market crash in March 2020.

As Cointelegraph reported, the Crypto Worry and Greed Index has actually turned to “fear” this month, matching six-month lows.

Bitcoin dip-buyers lastly emerge

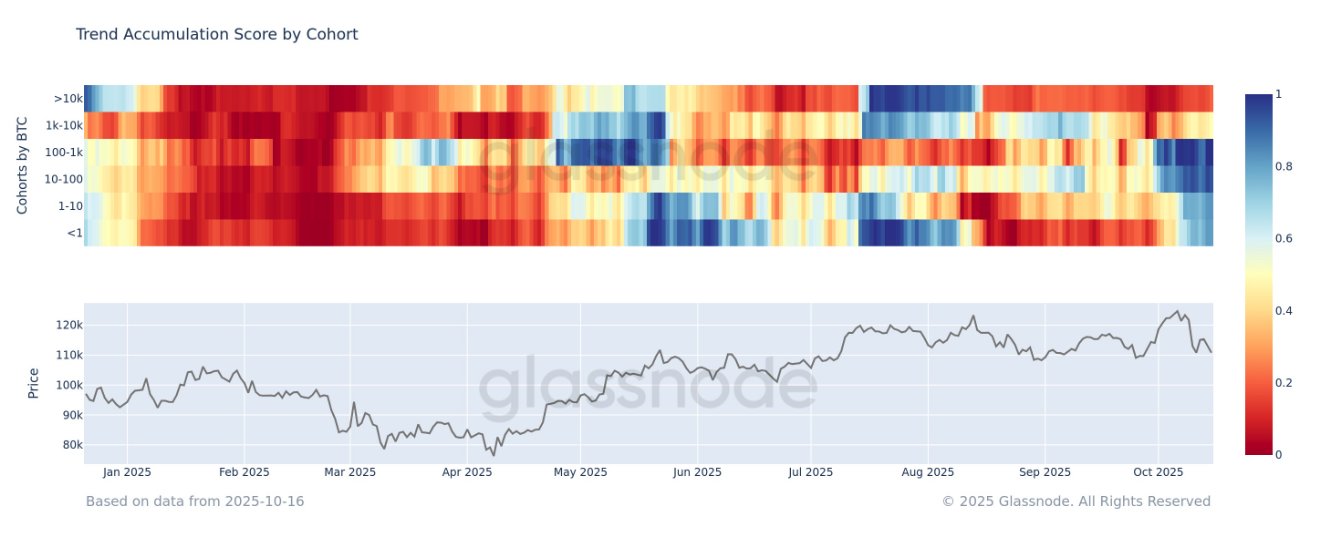

Looking into financier patterns, nevertheless, onchain analytics platform Glassnode had some excellent news for bulls.

Related: Bitcoin traders fear $102K BTC cost dive next as gold sets brand-new highs

Entities holding in between 1 BTC and 1,000 BTC, it exposed on the day, were revealing “strong build-up.”

Even whales, who dispersed big quantities of BTC to the marketplace in current weeks, were slowing their sales.

Glassnode stated that this was “indicating restored self-confidence in spite of the current shakeout.”

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.