Bottom line:

-

Bitcoin reviews the bottom of its regional variety in a fresh dive after the Federal Reserve interest-rate cut.

-

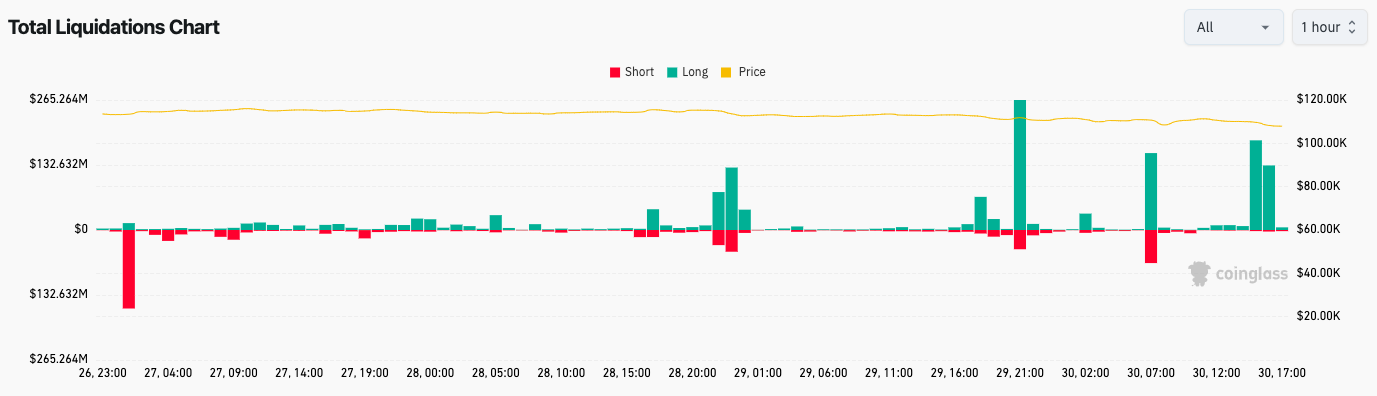

Traders banking on advantage get penalized, with long liquidations nearing $1 billion.

-

A much deeper thrashing for stocks might imply BTC rate losses of 30%.

Bitcoin (BTC) saw brand-new weekly lows at Thursday’s Wall Street open as stocks brushed off macro tailwinds.

BTC rate pressures $107,000 variety flooring

Information from Cointelegraph Markets Pro and TradingView revealed that the BTC rate action dipped to near $107,000.

That level marked the bottom of the regional variety for BTC/USD, and was hence crucial for bulls to protect.

$BTC Another test of $107K. Still in the variety as we speak.

All levels to enjoy from low to high:

$ 103K (Wick low).

$ 107K Regional variety low & & assistance.

$ 111K Mid variety & & high volume node.

$ 116K Variety high & & resistance.We’re simply playing ping pong in between those levels. One … https://t.co/obzd3PYwzf pic.twitter.com/XsxoGxHzqR

— Daan Crypto Trades (@DaanCrypto) October 30, 2025

Crypto signed up with United States stock exchange in a comedown from another 0.25% interest-rate cut by the United States Federal Reserve the day prior.

The prospective macro driver of the week, a trade offer in between the United States and China to prevent high tariffs from Nov. 1, did not have certainty regardless of enthusiastic commentary from President Donald Trump.

In a post on Fact Social following a conference with China’s Xi Jinping, Trump stated that the 2 “settled on numerous things.”

” I had a genuinely terrific conference with President Xi of China. There is massive regard in between our 2 Nations, which will just be improved with what simply occurred,” the post specified.

” We settled on numerous things, with others, even of high value, being extremely near to solved.”

The S&P 500 and Nasdaq Composite Index both opened down on the day, while gold acquired, climbing up back above $4,000 per ounce.

High liquidations defined Crypto’s battle as traders’ macro bets deciphered. Information from keeping track of resource CoinGlass suggests that 24-hour liquidations reached over $1.1 billion at the time of composing.

Bitcoin trader alerts stocks turnaround “coming”

Talking about the outlook, market individuals had varying views.

Related: Bitcoin area volume passes $300B in October as traders reveal ‘healthy’ pivot

Some, consisting of trader CrypNuevo, saw Bitcoin duplicating “typical” habits around Fed rate conferences.

” Absolutely nothing to stress over in regards to market structure or pattern – rate is now backtracking the brand-new imbalances produced this night,” he informed X fans.

CrypNuevo kept in mind that rate had actually filled its most current weekend “space” in CME Group’s Bitcoin futures market.

Other point of views were a lot less unwinded. Trader Roman cautioned that given that BTC/USD was stopping working to follow stocks even throughout durations of upside, their pattern turnaround might trigger another rate thrashing.

So when the $SPX lastly has some sort of retrace/correction, my guess is $BTC visits a strong margin. Possibly 20-30%.$BTC has actually been moving sideways while stocks have actually been going directly up 40%+. The absence of strength is extremely obvious.

It’s coming folks. https://t.co/bLL0fyqSkR pic.twitter.com/wYfTCN8m3l

— Roman (@Roman_Trading) October 30, 2025

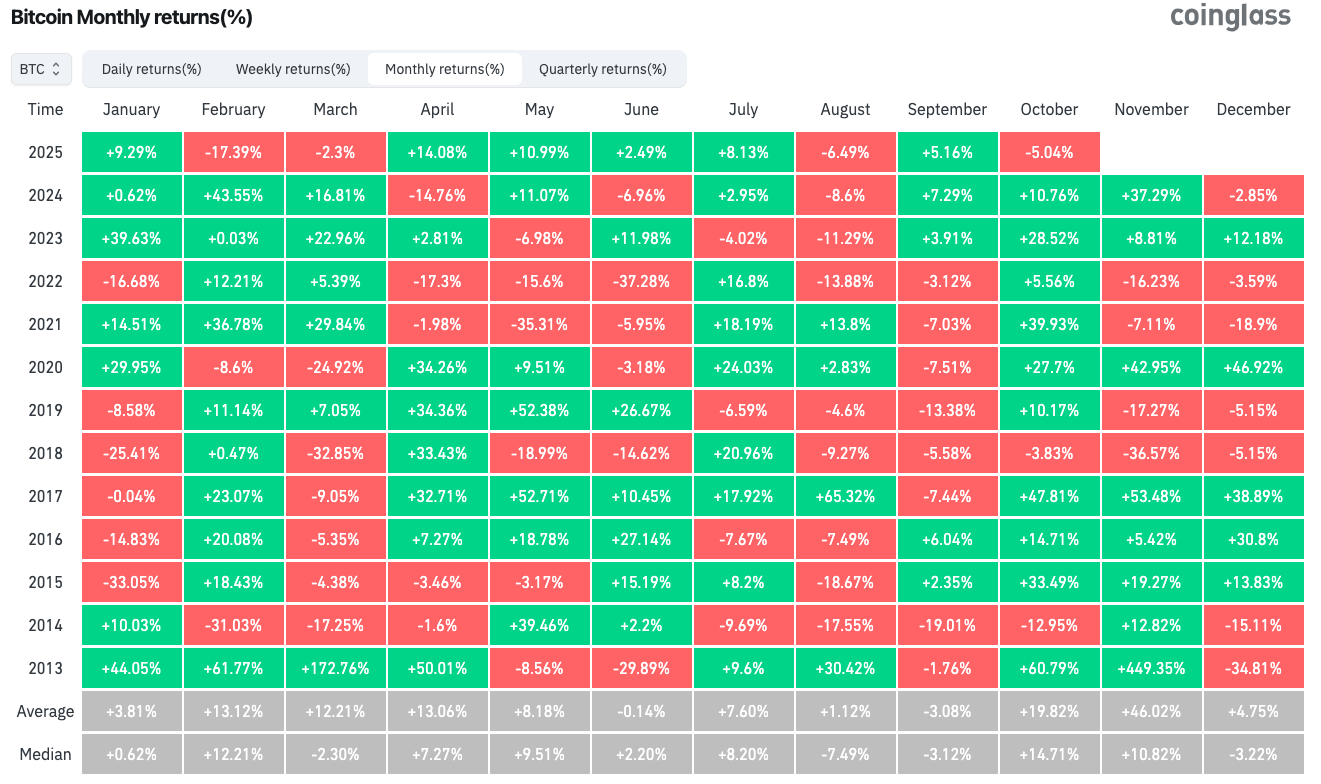

CoinGlass verified that October 2025 was now “red” for Bitcoin for the very first time given that 2018, with a single trading day delegated turn the circumstance around.

As Cointelegraph reported, the typical gain in October given that 2013 has actually been 20%.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.