Bottom line:

-

Bitcoin is seeing a tussle in between buy and offer volume as BTC/USD strikes its greatest levels because the start of March.

-

BTC rate action is making traders progressively careful due to the rate of current gains.

-

$ 100,000 is most likely to stay out of reach for the short-term, numerous analysts state.

Bitcoin (BTC) headed into essential resistance after the April 25 Wall Street open as doubts over the BTC rate breakout continued.

Bitcoin sellers and purchasers fight for control

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD striking brand-new seven-week highs above $95,000.

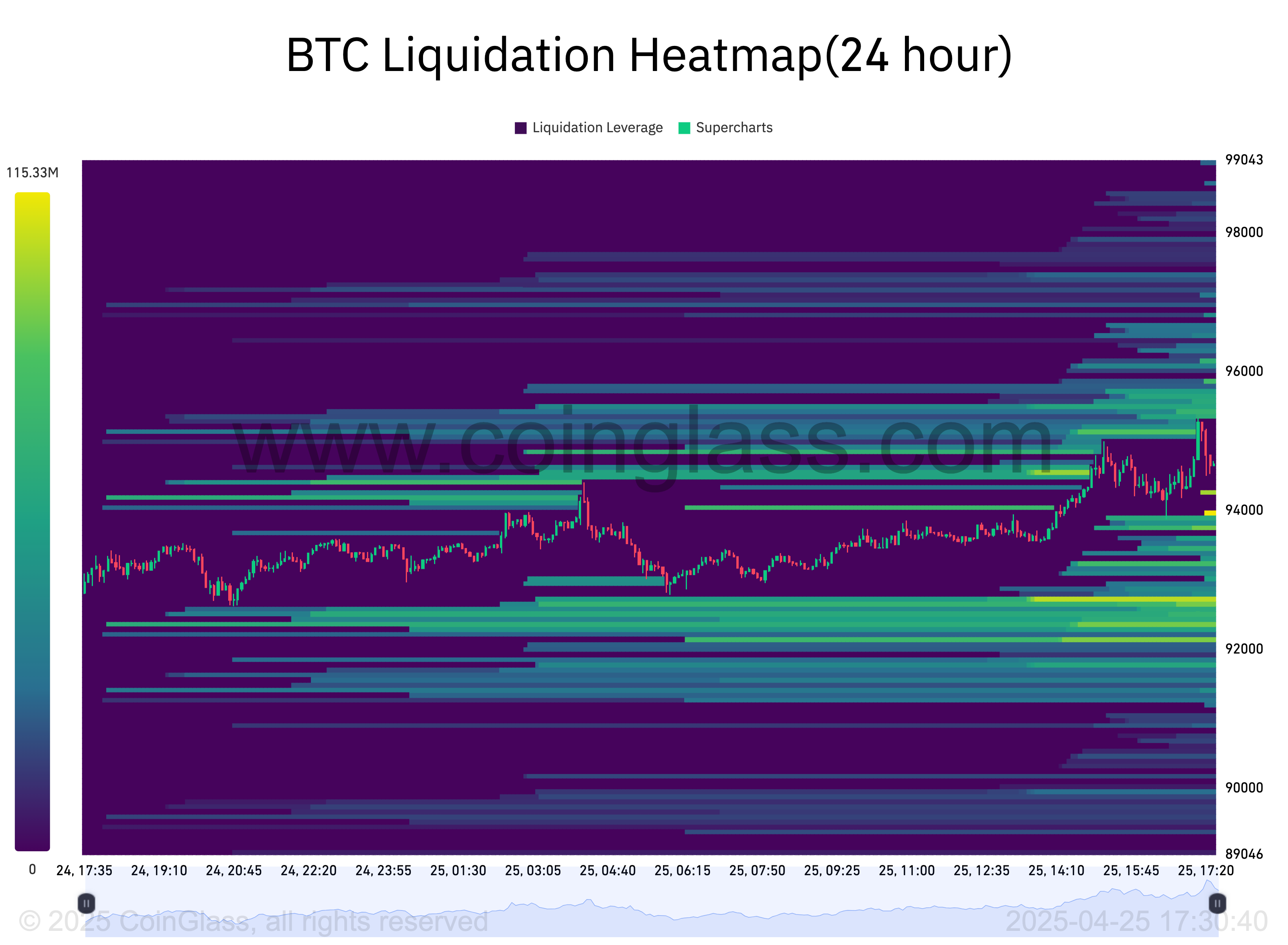

Having actually protected its annual open at $93,500 as intraday assistance, Bitcoin went on to liquidate leveraged shorts as $100,000 came more detailed.

The most recent information from keeping track of resource CoinGlass reveals development in taking upside liquidity throughout exchange order books.

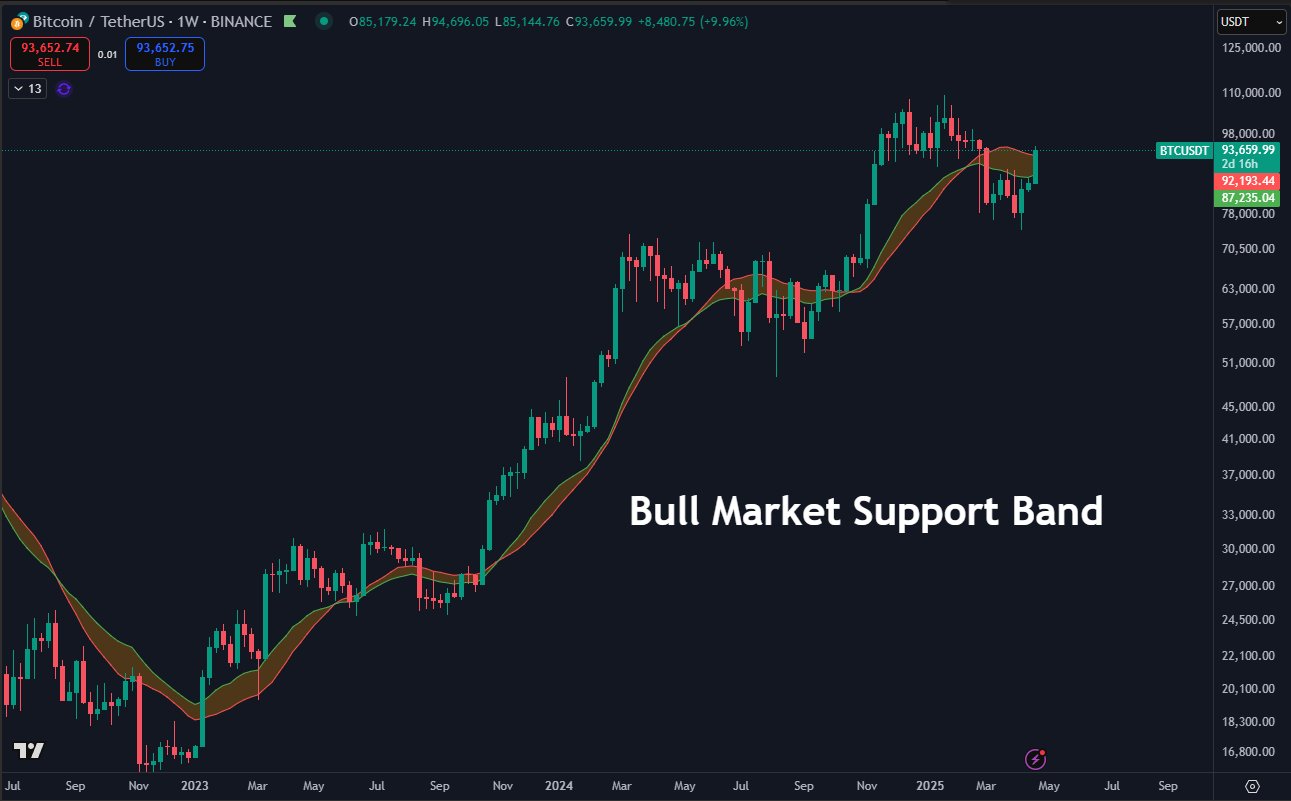

Responding, popular trader Daan Crypto Trades highlighted the value of the present rate variety in the context of the Bitcoin booming market.

” Trading back above the Booming market Assistance band as we speak,” he composed in an X post, describing a cluster of moving averages lost as assistance previously in 2025.

” A weekly close above this level would be a great try to find the bigger timeframe and I ‘d anticipate brand-new highs eventually as long as it holds above.”

Others bewared, with fellow trader Alter exposing a tug-of-war in between a large-volume purchaser and seller.

” Rate would be a lot lower than it is now without the passive purchaser matching this market selling,” he cautioned along with an order book print.

” Ultimately one will surrender & & volatility will follow through.”

Waiting on a $100,000 BTC rate “driver”

Continuing, Keith Alan, cofounder of trading resource Product Indicators, also questioned whether BTC/USD might sustain a journey above $95,000.

Related: Bitcoin exchange outflows imitate 2023 as whales purchase retail ‘panic’

Alan kept in mind decreasing volume as rate moved higher, duplicated wicks listed below the annual open and a “down” signal on among Product Indicators’ exclusive trading tools.

” For me, a pump above $95k would revoke the brand-new signal, however I ‘d most likely think about such a transfer to be a brief capture unless we have a driver with some compound behind it,” he summed up.

Macroeconomic point of views likewise preferred a duration of combination before BTC/USD went back to 6 figures.

In its newest publication to Telegram channel customers, trading company QCP Capital argued that Bitcoin did not have a $100,000 “driver.”

” Provided the rate of the current rally, we stay tactically careful,” it composed.

” Positioning has actually ended up being more congested, which might result in sharper responses around essential levels. Market individuals seem viewing carefully for indications of extension or fatigue.”

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.