Bitcoin (BTC) rate action has actually painted bearish extension patterns on its everyday chart, which might move BTC to brand-new lows, according to experts.

Secret takeaways:

-

A sharp decrease in area purchasing and weakening ETF need recommends that the benefit might be restricted.

-

Bitcoin’s bear flag pattern on the everyday timespan targets $67,000 BTC rate.

BTC rate might bottom at $66,000

The BTC/USD set has actually formed a bear flag on the everyday chart, as displayed in the figure listed below. This bear flag formed following Bitcoin’s drop from $107,000 highs on Nov. 11, and the current rebound was turned down from the flag’s upper border around $93,000.

Related: Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

An everyday candlestick close listed below the flag’s lower border at $90,000 might break the ice for a drop towards the determined target of the pattern at $67,380, or around the 2021 rate top. This would represent a 25% drop from the existing rate.

” Indicators (MACD and RSI) were incredibly oversold, and this motion enables them to cool down so we can continue our drop,” stated trader Roman in a Tuesday post on X, describing Bitcoin’s debt consolidation inside the flag.

Pseudonymous expert Colin Talks Crypto stated that although a relocation down would be the anticipated result from the flag’s recognition, the $74,000-$ 77,000 zone “would be the likeliest bottom,” including:

” I would likewise anticipate an effective rebound if such a level is reached.”

On the other hand, crypto trader Aaron Dishner stated that BTC rate is most likely to review $92,200, then near $98,000 under the upper bear flag line, before continuing the drop.

” Volume stays too weak to drive greater highs.”

1/ Bitcoin nearly evaluated its very first resistance fan level the other day

It stays inside its bear flag and most likely to review assistance near $86k–$ 87k

If Bitcoin pumps it deals with resistance at $92,216 then near $98k under the upper bear flag line

Volume stays too weak to drive greater … pic.twitter.com/choWsb94Cz

— Aaron Dishner (@MooninPapa) December 9, 2025

As Cointelegraph reported, Bitcoin’s failure to effectively retest the annual open above $93,000, triggered by macroeconomic unpredictability, liquidations and stagnant area ETF streams, is triggering traders to pull back from Bitcoin.

Bitcoin might drop due to weaker need

Bitcoin’s capability to press past the annual open above $93,000 appears minimal due to the lack of purchasers.

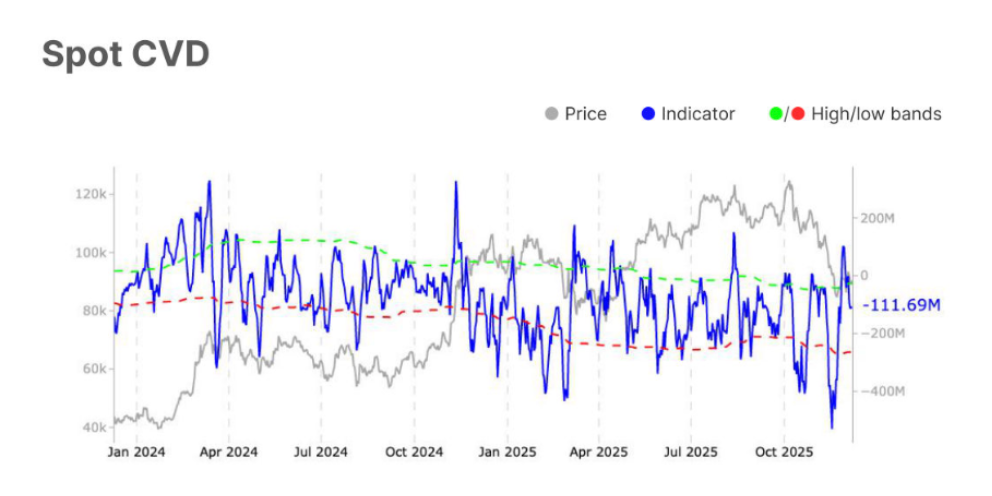

Bitcoin’s area cumulative volume delta (CVD), a sign that determines the net distinction in between purchasing and offering trade volumes, reveals net area purchasing on exchanges stays unfavorable even after Bitcoin’s current rebound.

Bitcoin’s Area CVD damaged from -$ 40.8 million to -$ 111.7 million over the recently, “indicating more powerful hidden sell pressure,” Glassnode stated in its newest Market Impulse report, including:

” This sharp drop signals a clear increase in aggressive selling, recommending softer purchaser conviction and a short-term tilt towards bearish belief.”

Area Bitcoin ETF need decreased recently, turning from a $134.2 million inflow to a $707.3 million outflow, the marketplace intelligence company composed, including:

” The shift indicate profit-taking or softer institutional need, showing a more careful tone as financiers reassess positioning.”

These financial investment items experienced another $60 million in outflows on Monday, according to information from Farside Investors.

ETF STREAMS: ETH, SOL and XRP area ETFs saw net inflows on Dec. 8, while BTC area ETFs saw net outflows.

BTC: – $60.48 M

ETH: $35.49 M

SOL: $1.18 M

XRP: $38.04 M pic.twitter.com/L4yMudTt3G— Cointelegraph (@Cointelegraph) December 9, 2025

As Cointelegraph reported, Bitcoin’s current rebound might be a bull trap, with some experts forecasting as low as $40,000 over the coming months.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.

This post does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.