Secret takeaways:

-

The Bitcoin long-to-short sign at Binance struck a 30-day low, indicating a sharp decrease in bullish utilize need.

-

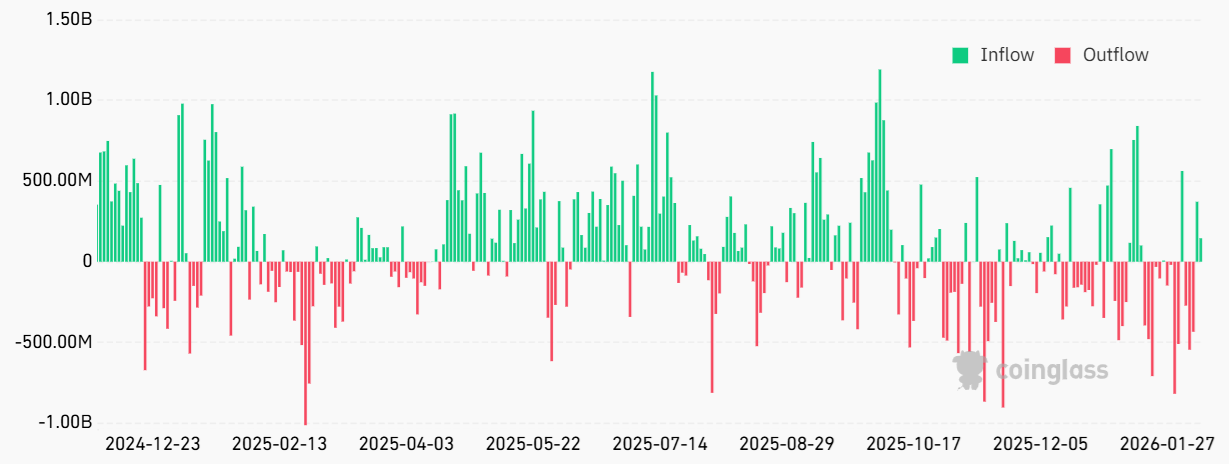

US-listed Bitcoin exchange-traded funds reversed an unfavorable pattern with $516 million in net inflows following a duration of heavy liquidations.

Bitcoin (BTC) has actually changed within a tight 8% variety over the last 4 days, combining near $69,000 after an abrupt slide to $60,130 on Friday. Traders are presently facing the main drivers for this correction, especially as the S&P 500 holds near record highs and gold rates have actually climbed up 20% over a two-month duration.

The unpredictability following the 52% retreat from Bitcoin’s $126,220 all-time high in October 2025 has most likely triggered an ultra-skeptical position amongst leading traders, stiring issues of additional rate decreases.

Whales and market makers on Binance have actually progressively pared back bullish direct exposure given that Wednesday. This shift is shown in the long-to-short ratio, which dropped to 1.20 from 1.93. This reading represents a 30-day low for the exchange, recommending that need for leveraged long positions in margin and futures markets has actually cooled, even with BTC striking 15-month lows.

On the other hand, the long-to-short ratio for leading traders at OKX struck 1.7 on Tuesday, a sharp turnaround from its 4.3 peak on Thursday. This shift lines up with a $1 billion liquidation occasion in leveraged bullish BTC futures, where market individuals were required to close positions due to insufficient margin. Significantly, this particular information point shows required exits instead of an intentional directional bet on additional drawback.

Strong ETF need recommends Bitcoin whales are still bullish

Need for area Bitcoin exchange-traded funds (ETFs) functions as strong proof that whales have not turned bearish, in spite of current rate weak point.

Because Friday, US-listed Bitcoin ETFs have actually drawn in $516 million in net inflows, reversing a pattern from the previous 3 trading days. Subsequently, the conditions that set off the $2.2 billion in net outflows in between Jan. 27 and Feb. 5 appear to have actually faded. A leading theory for that pressure indicated an Asian fund that collapsed after leveraging ETF alternatives positions by means of low-cost Japanese yen financing.

Franklin Bi, a basic partner at Pantera Capital, argued that a non-crypto-native trading company is the most likely perpetrator. He kept in mind that a wider cross-asset margin loosen up accompanied sharp corrections in metals. For example, silver dealt with an incredible 45% decrease in the 7 days ending Feb. 5, eliminating 2 months of gains. Nevertheless, main information has yet to be launched to confirm this thesis.

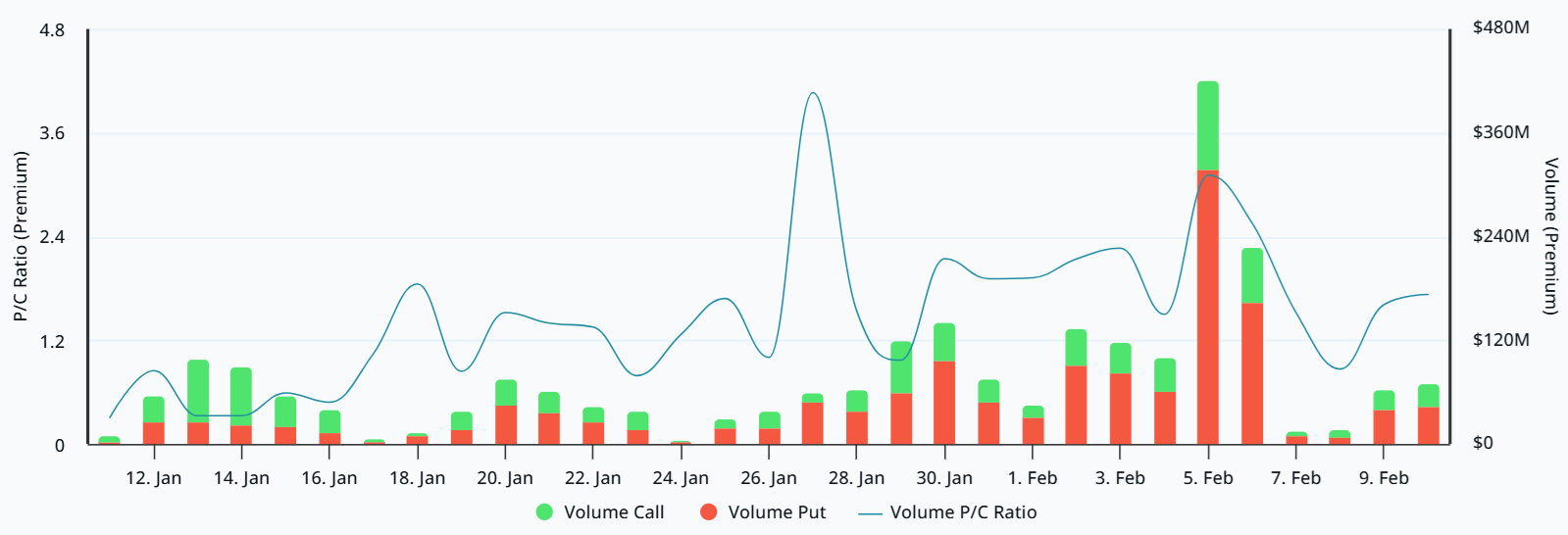

The Bitcoin alternatives market followed a comparable trajectory, with a spike in neutral-to-bearish methods on Thursday. Traders rotated after Bitcoin’s rate slipped listed below $72,000 instead of preparing for aggravating conditions.

Related: Bitcoin belief strikes record low as contrarian financiers state $60K was BTC’s bottom

The BTC alternatives premium put-to-call ratio at Deribit rose to 3.1 on Thursday, greatly preferring put (sell) instruments, though the sign has actually given that pulled away to 1.7. In general, the previous 2 weeks have actually been marked by low need for bullish placing through BTC derivatives. While belief has actually intensified, lower utilize offers a much healthier setup for sustainable rate gains once the tide turns.

It stays uncertain what might move financier understanding back towards Bitcoin, as core worths like censorship resistance and rigorous financial policy stay the same. The weak need for Bitcoin derivatives need to not be analyzed as an uncertainty. Rather, it represents a rise in unpredictability up until it ends up being clear that exchanges and market makers were untouched by the rate crash.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.