Secret takeaways:

-

Bitcoin cost combines around $105,000 as liquidity develops on either side of the area cost.

-

After stopping working to turn $106,000, BTC/USD is backtracking to develop assistance, however $100,000 is an essential level of interest for Bitcoin traders.

Bitcoin’s (BTC) cost trades 6% listed below its all-time highs of $111,900, and traders caution the possession might see a “bigger correction” in June as $100,000 ends up being an essential level of interest.

Bitcoin cost crucial assistance stays $100K

In a repeat of the relocation that followed its increase above $100,000 on Might 8, Bitcoin has actually effectively held above this level for more than 3 weeks.

This is the crucial point on traders’ radars and one that has actually not gotten a persuading retest just recently.

MN Capital creator Michael van de Poppe found Bitcoin hovering at $104,300 stating that after being declined from the $106,000 level, BTC might drop lower before restoring upward momentum.

An accompanying chart revealed $100,000 was the crucial level to see on BTC’s four-hour timeframe.

” Clear rejection on #Bitcoin indicating that we’re visiting lower costs before we see up-wards momentum.”

Pseudonymous expert CrypNuevo shared a chart revealing that Bitcoin stopped working to turn the resistance at $106,000 into assistance.

” So we might likely head to $100K mental level + 150EMA.”

On the other hand, popular expert AlphaBTC forecasted a much deeper correction that might see BTC cost drop as low as $90,000, if the assistance at $100,000 is lost.

“$ BTC is most likely to go sideways for a long time as this bigger correction plays out in the very first weeks of June, awaiting more difficult information and the FOMC on June 18.”

As reported by Cointelegraph, BTC cost action might maintain $100,000 as assistance based upon Glassnode’s market price understood worth (MVRV) bands.

Related: Bitcoin cost dips under $104K as Russia-Ukraine concerns rile United States stocks

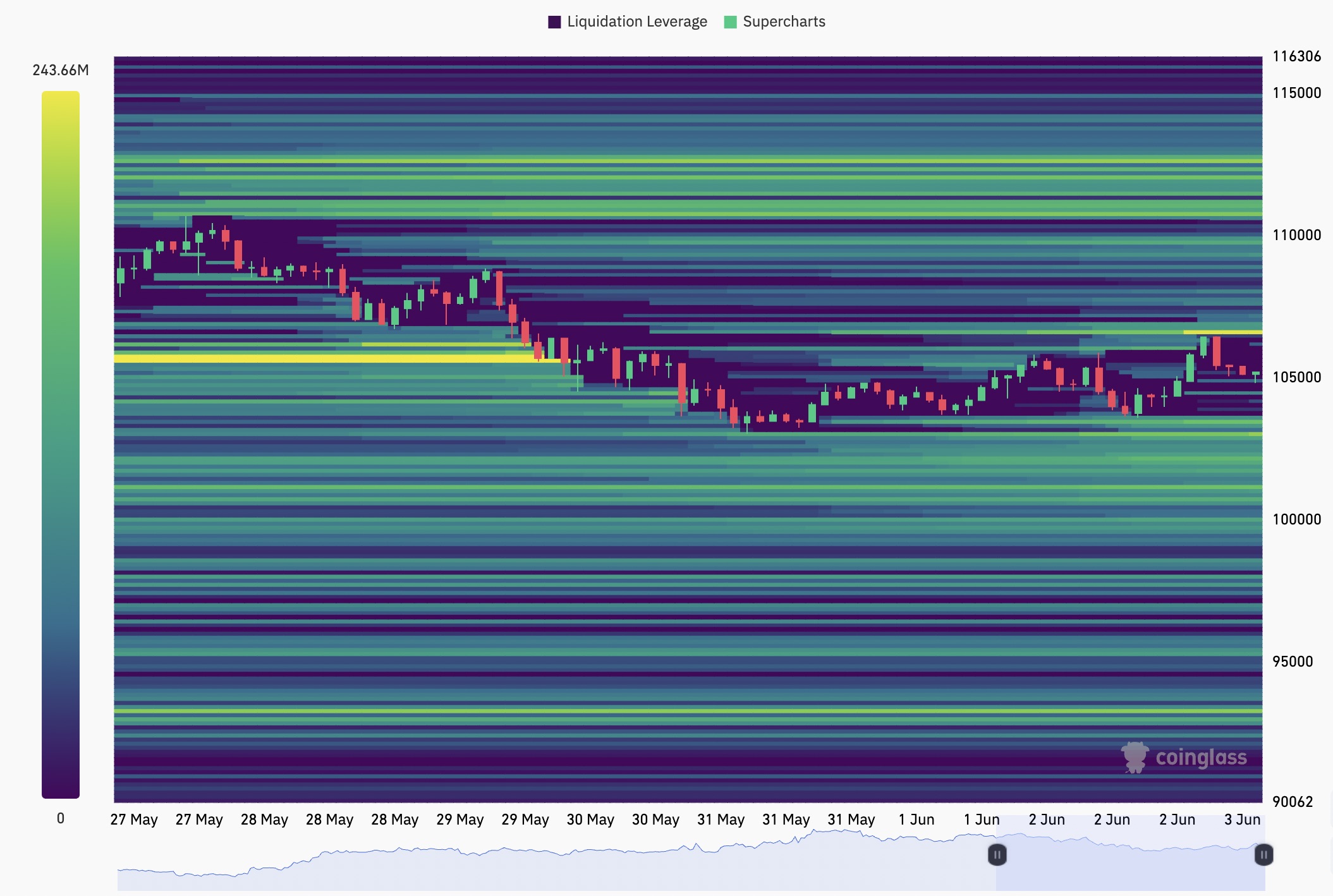

Liquidations waiting at $100K and listed below

A number of traders considered a prospective disadvantage liquidity grab with quote orders thickening listed below the area cost, and others clustering listed below $100,000.

“$ 100K is a strong mental level and liquidity tends to stack in these levels,” stated CrypNuevo in a different post on X.

The most recent information from keeping track of resource CoinGlass revealed cost eating away at quotes around $105,000, with the bulk of interest clustered in between the area cost and $100,000.

High quote orders were likewise developing listed below $100,000, with $170 million worth of liquidity relaxing $93,200.

On the advantage, the $112,500-$ 113,500 cluster was the primary liquidity location.

” There is substantial liquidity in both instructions, with a more focused develop listed below the lows of the last couple of days,” AlphaBTC stated on X.

” I would not be shocked if $BTC ran the lows and after that rallied back up to take what’s left above.”

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.