Bitcoin (BTC) hovered at $90,000 around Friday’s Wall Street open as markets braced for United States trade tariff news.

Bottom line:

-

RIsk-asset traders wait for news over United States trade tariffs, as bets see the Supreme Court overruling the procedures.

-

United States joblessness information misses out on expectations, with the Federal Reserve seen holding rates this month.

-

Bitcoin traders require clearer signals to end the rangebound rate deadlock.

United States tariff judgment might come Friday

Information from TradingView revealed indecisive BTC rate action ahead of a possible Supreme Court judgment over the tariffs, referred to as a risk-asset volatility driver.

Commenting, trading resource The Kobeissi Letter kept in mind that bets preferred President Donald Trump’s trade procedures being ruled prohibited.

BREAKING: The United States Supreme Court’s judgment on President Trump’s tariffs is anticipated as quickly as today, with a 74% possibility of tariffs being ruled prohibited, per Polymarket.

Trump has actually asked Americans to “hope” that the Supreme Court does not rule his tariffs to be prohibited. pic.twitter.com/ei2iTSVjJY

— The Kobeissi Letter (@KobeissiLetter) January 9, 2026

” The choice might improve trade policy and ripple throughout international markets, consisting of crypto,” crypto education platform Coin Bureau included a post on X.

The upcoming news indicated that United States joblessness information, which can be found in lower than anticipated, took a rear seat.

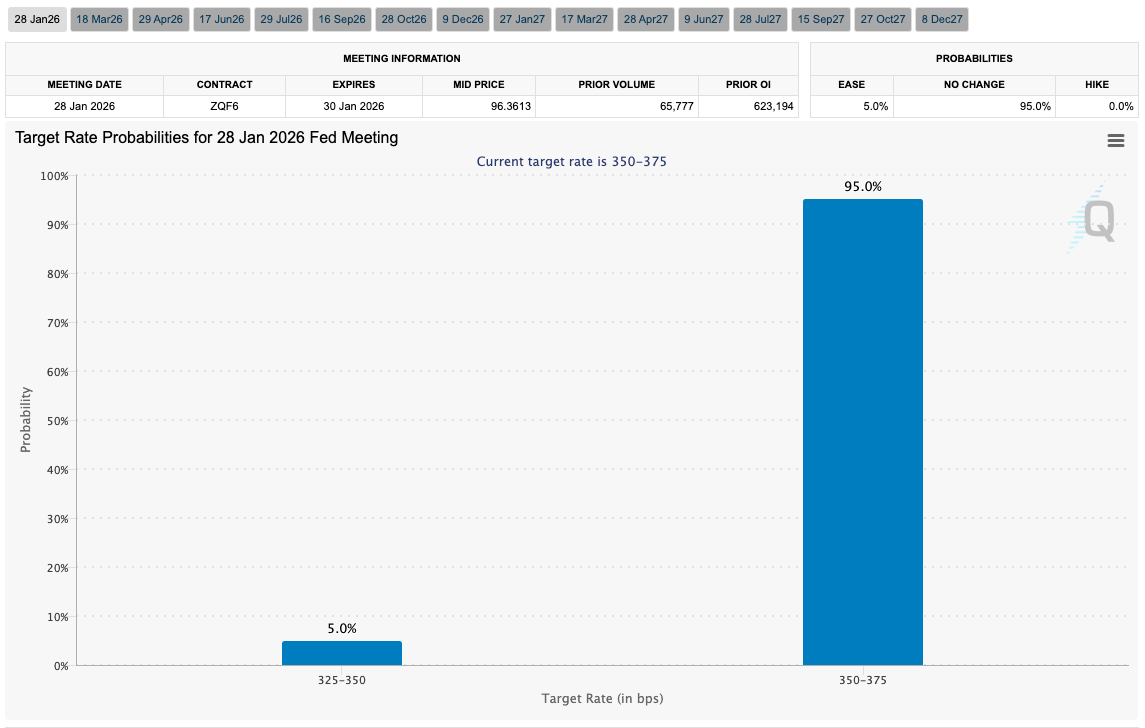

As Cointelegraph reported, the Federal Reserve was currently anticipated to hold rates of interest at existing levels at its January conference.

” The Fed is set to stop briefly rates of interest cuts,” Kobeissi validated on the back of the information.

Bitcoin rate inertia keeps traders away

Amongst traders, BTC/USD stayed a “no trade” set amidst an absence of a clear pattern.

Related: Bitcoin RSI mean $105K BTC rate rebound as bull signals increase

” Still varying as has actually held true for the previous ~ 2 months. I am not thinking about attempting to trade the next 5% proceed this at all,” Daan Crypto Trades informed X fans on the day.

” Simply cooling up until the start of the year slice is over and we see a definitive breakout to either side.”

An accompanying chart revealed rate connected with its 200-period moving average (MA) cloud on four-hour timeframes.

Trading account Due date flagged $88,000 and $92,000 as bottom lines of interest while referencing an unfilled “space” in CME Group’s Bitcoin futures market from the brand-new year.

$BTC is presently in a no trading zone.

Either Bitcoin requires to recover the $92,000 level to show the bulls are back, or it’ll likely drop towards the $88,000 zone to fill that staying CME space.

Perseverance is the just play today. pic.twitter.com/wfL0Gfo5NK

— Due Date ☠ (@cryptodeadline) January 9, 2026

Little difficult market scenarios here, as Bitcoin is fixing once again,” crypto trader, expert and business owner Michaël van de Poppe included.

” Nevertheless, holding the 21-Day MA would be excellent, as that would avoid a more waterfall.”

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.