Bitcoin (BTC) traders see its supreme assistance trendline entering play as part of a brand-new macro BTC cost bottom.

Bottom line:

-

Bitcoin is nearing a long-lasting trendline retest for the very first time given that late 2023.

-

Weekly moving averages are on the radar as a BTC cost safeguard ought to the marketplace fall once again.

-

Market outlooks put focus on trader strength in spite of a 40% drawdown.

BTC 200-week pattern line “ought to be the bottom”

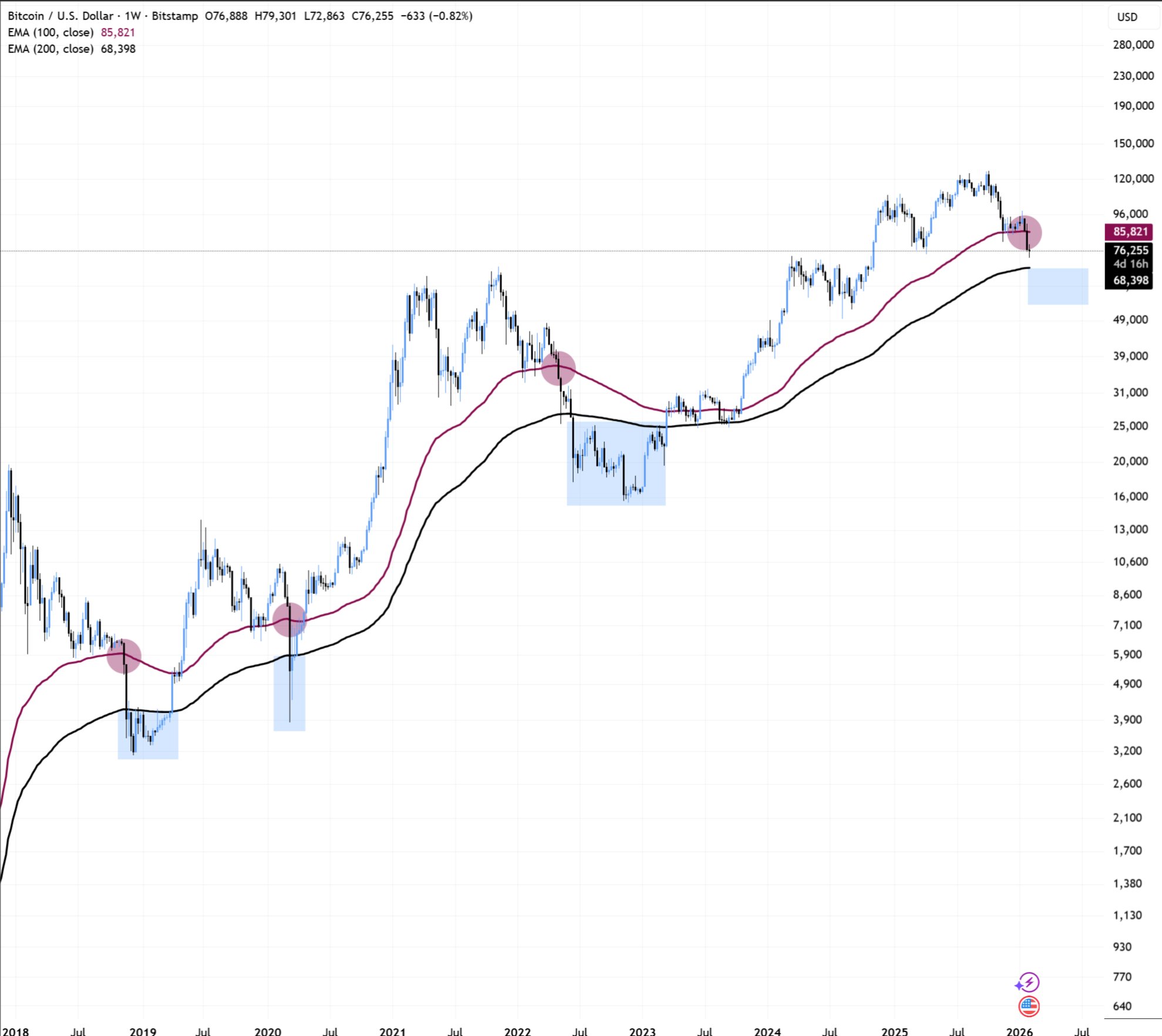

The current analysis progressively anticipates Bitcoin to evaluate its 200-week rapid moving average (EMA) at $68,400.

After 4 straight red month-to-month candle lights, BTC cost is fielding fresh drawback targets, that include sub-$ 50,000 levels.

Regardless of dropping to its least expensive levels given that late 2024 today, BTC/USD might be saved by timeless assistance pattern lines in the end.

” We’re presently trading at Technique’s expense basis & & are close [to] the April lows at $74.4 k. If we break below, the next essential level is $70k which is simply above the previous ATH of $69k,” Nic Puckrin, CEO of crypto education resource Coin Bureau, composed in an X post Wednesday.

” Breaking listed below that suggests we head to a bearishness low target. The location to enjoy here $55.7 k – $58.2 k. That’s simply in between the typical understood cost of all coins & & the 200w MA. That ought to be the bottom.”

Puckrin referenced the 200-week basic moving average (SMA), which forms a $10,000-wide assistance band with the EMA equivalent, information from TradingView programs.

Trader Altcoin Sherpa, on the other hand, stated that it would “make good sense” for the cost to drop to a minimum of the 200-week EMA.

on 1 hand it makes good sense for $BTC to tap the 200W EMA, an indication that hasn’t been touched given that 2023. This would be around 68k.

On the other, this is still an intriguing level as the 2025 low.

In any case, the bottom is closer than we believe imo pic.twitter.com/93DO4s4qlu

— Altcoin Sherpa (@AltcoinSherpa) February 4, 2026

” Whenever Bitcoin has actually lost 100W EMA, it has actually retested the 200W EMA,” trader BitBull advanced the subject.

” Today, 200W EMA is at $68,000 and this will probably be retested. As soon as the retest takes place, you might begin collecting for the long-lasting.”

Bitcoin financiers withstand complete capitulation

Other market summaries are likewise providing wish to panicking BTC financiers.

Related: BTC cost heads back to 2021: 5 things to understand in Bitcoin today

Fresh analysis launched Tuesday by Matt Hougan, primary financial investment officer of crypto possession supervisor Bitwise, anticipated that the existing “crypto winter season” would quickly be over.

” Retail crypto has actually remained in a ruthless winter season given that January 2025. Organizations simply papered over that reality for specific properties for a while,” he argued, keeping in mind that the average “winter season” lasted around 14 months.

Cointelegraph even more reported on strong conviction amongst Bitcoin derivatives traders after withstanding a drawdown of more than 40%.

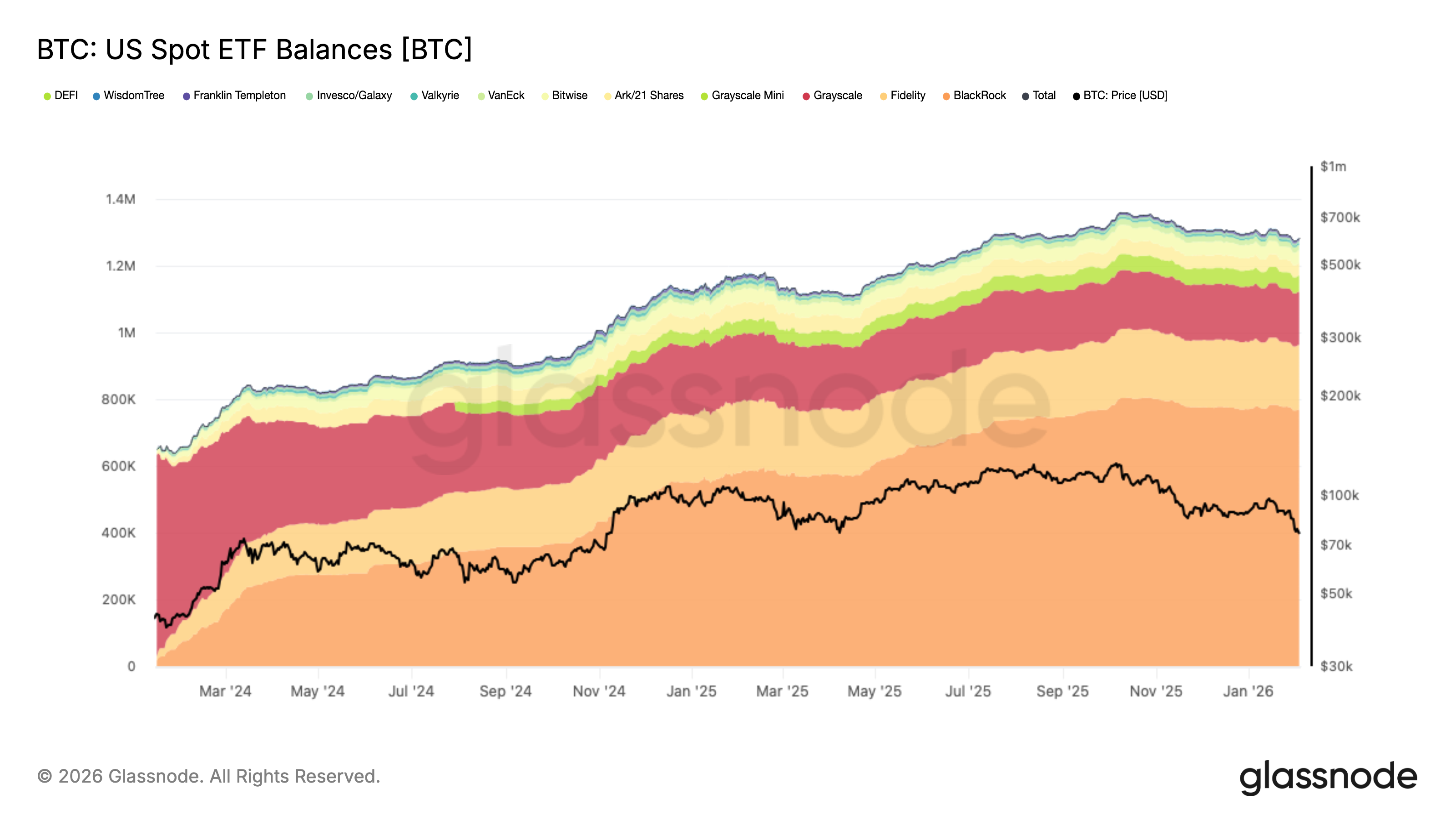

The United States area Bitcoin exchange-traded funds (ETFs) have actually seen net outflows of $3.2 billion given that mid-January– simply 3% of their overall properties under management.

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.