Bitcoin (BTC) is teasing a breakdown listed below old all-time highs at $109,300; where will BTC rate action head next?

Crypto traders are all set with BTC rate targets as bulls nurse a 13% pullback from all-time highs.

Bitcoin’s crucial trendlines in risk

Bitcoin’s newest dive took BTC/USD listed below previous all-time highs initially seen in January 2025.

That mental level now hangs in the balance, however is not the only neighboring level that observers are worried about.

Numerous easy (SMA) and rapid (EMA) moving averages run the risk of getting turned from assistance to resistance as rate has a hard time to stop its decrease.

” BTC has actually broken listed below the 100 EMA on the everyday chart. That’s not an excellent indication and might unlock for a much deeper correction towards $103K,” popular trader Cryptorphic alerted in an X post Tuesday.

” Historically, every drop listed below this EMA has actually resulted in a short-term pullback. I’m seeing carefully and hoping Bitcoin recovers the level quickly to keep the uptrend undamaged.”

Information from Cointelegraph Markets Pro and TradingView reveals the 100-day EMA at $110,820.

The 200-day SMA, on the other hand– a timeless booming market assistance line– sits lower at simply under $101,000. The last time that BTC/USD traded listed below that pattern line remained in mid-April.

Speculators tipped as BTC rate safeguard

As Cointelegraph continues to report, some market individuals have much lower BTC rate targets in mind.

These consist of a retest of the $100,000 mark and even a hang back into five-figure area. This is thanks to a mix of damaging onchain metrics such as trade volume and relative strength index (RSI) divergences.

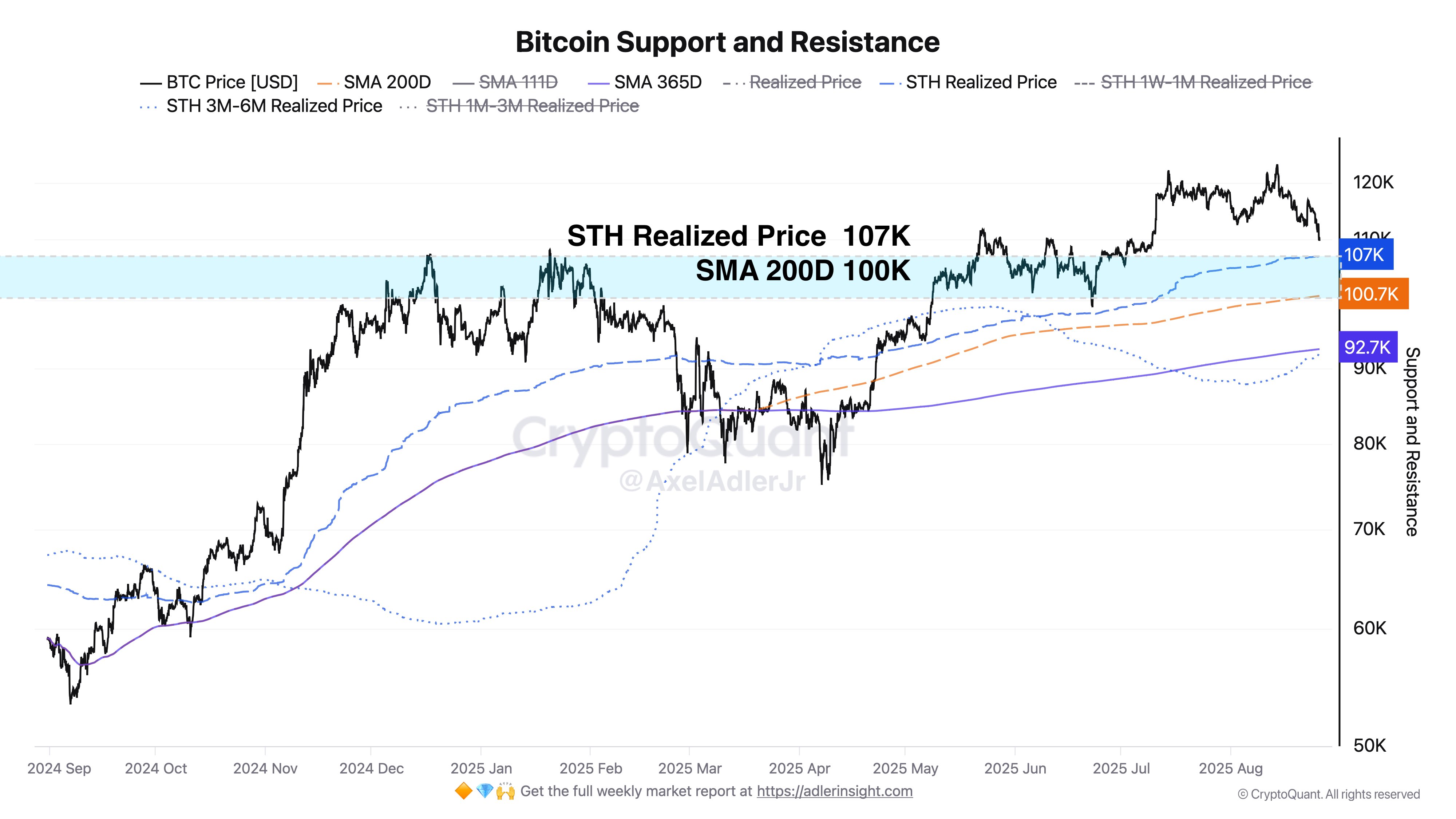

For Axel Adler Jr., a factor to onchain analytics platform CryptoQuant, Bitcoin’s speculative financier base might be what conserves the marketplace.

” The nearby strong assistance zone is the 100K– 107K variety, where the STH Understood Cost and SMA 200D intersect,” he kept in mind Tuesday.

Adler described the aggregate expense basis of short-term holders, specified as entities hodling for 6 months or less. In booming market, this expense basis typically operates as assistance throughout pullbacks.

” Listed below that is extra assistance around 92– 93K, a much deeper assistance level showing the expense basis of short-term financiers who held coins for 3 to 6 months. This will end up being a crucial 2nd line of defense if the marketplace loses the 100K– 107K level,” he included.

Brief capture to $114,000?

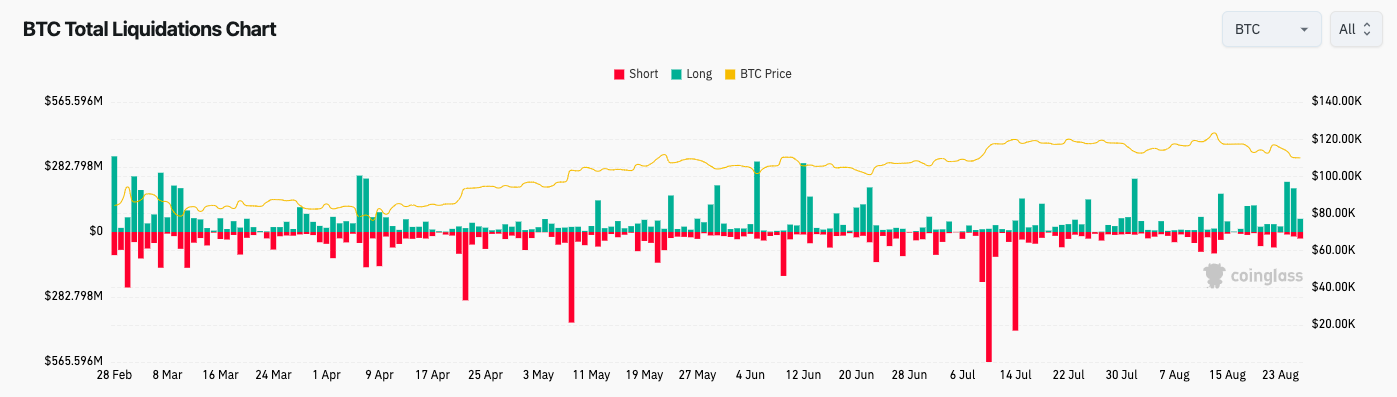

Bitcoin has actually stimulated a number of significant liquidation waterfalls in current days as long positions get penalized.

Related: BTC bull run over at $111K? 5 things to understand in Bitcoin today

Information from CoinGlass puts overall BTC long liquidations at almost $500 million given that Sunday.

Exchange order books expose that most of liquidity to the disadvantage has actually been taken, causing faint hopes of a market rebound.

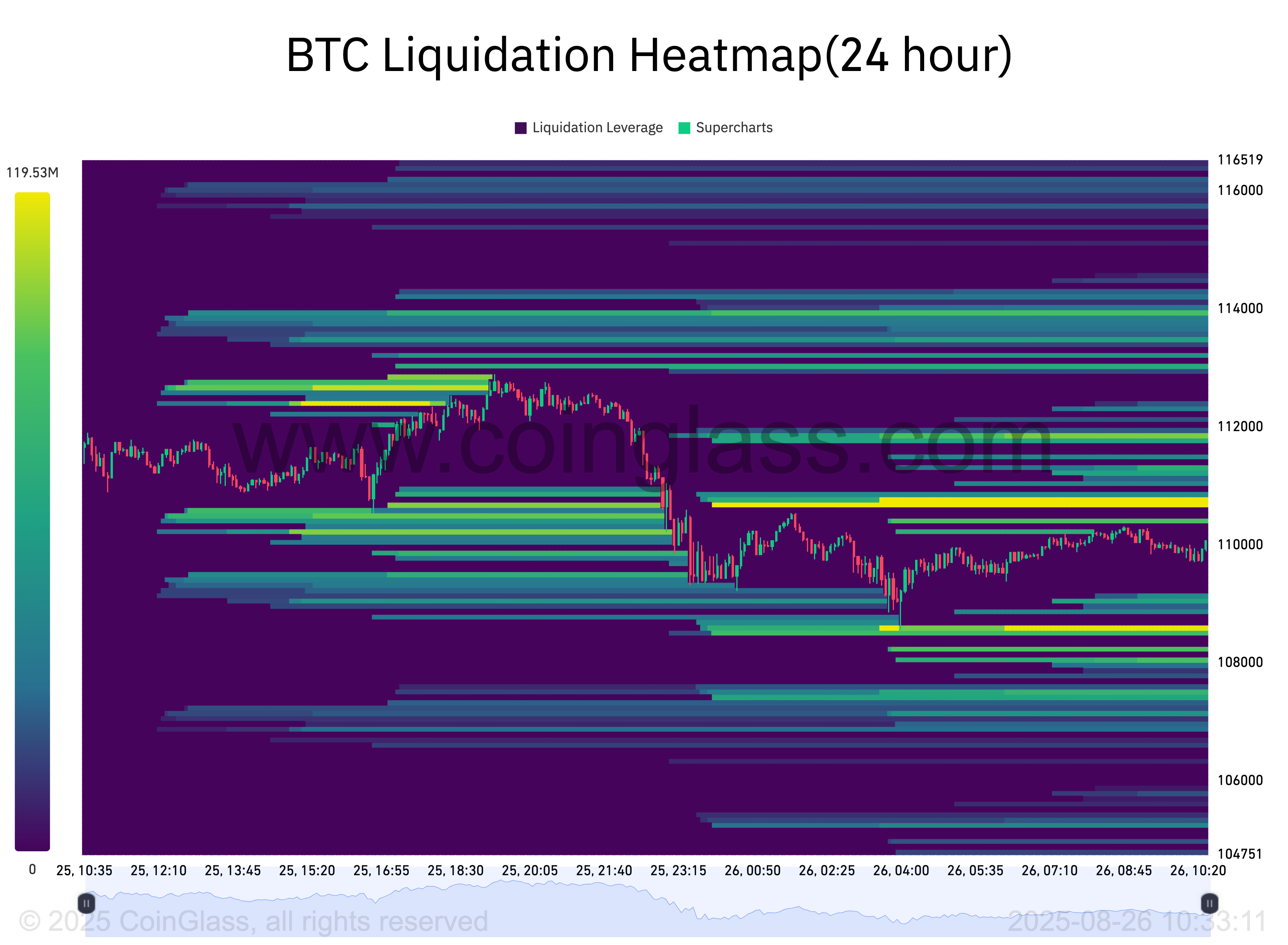

“$ BTC disadvantage liquidity has actually been hunted. And now, it looks like shorts will be liquidated next,” trader BitBull anticipated in an X post Tuesday.

” I believe $BTC will strike $114K-$ 115K today, causing a great rally in alts.”

$ 114,000 likewise forms a level of interest for analytics account TheKingfisher, who sees a “big wall” of brief liquidations coming need to price return there.

” Cost typically gets pulled to these levels. Smart cash is most likely utilizing this as fuel,” it informed X fans, recommending that it might take simply days for the liquidity capture to happen.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.