Secret takeaways:

-

Bitcoin market information reveals that professional traders are playing it safe and paying additional to safeguard versus a rate drop.

-

Gold is striking record highs, however Bitcoin stays stuck as financiers prefer standard safe houses.

Bitcoin (BTC) increased 1.5% following a retest of the $86,000 level on Sunday as traders weigh the threats of a United States federal government shutdown by Saturday. Today includes several high-stakes drivers, consisting of profits reports from worldwide tech giants and the United States Federal Reserve’s financial policy choice on Wednesday.

Regardless of gold striking record highs, Bitcoin traders stay mindful. Derivatives metrics recommend hesitation relating to more gains; need for leveraged bullish positions is weak, and expert traders are presently pricing in greater chances of an unfavorable cost swing in the choices markets.

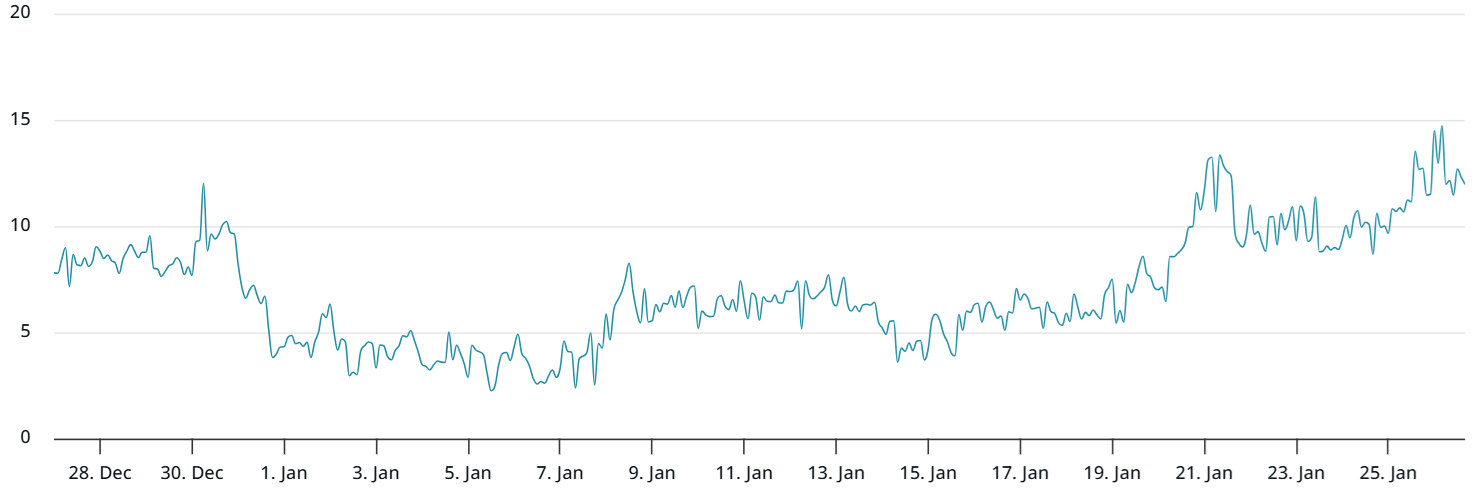

The annualized BTC futures premium (basis rate) stood at 5% on Monday. This level is hardly adequate to make up for the longer settlement durations fundamental in these acquired agreements. Normally, when traders turn bullish, this indication leaps above 10%. Alternatively, bearish durations can trigger the rate to turn unfavorable. In general, market belief has actually stayed neutral-to-bearish for the previous 2 weeks.

Likewise, the BTC choices delta alter reached 12% on Monday. This shows that put (sell) choices are trading at a premium, showing a strong unwillingness amongst traders to hold drawback direct exposure. In a neutral market, this indication normally varies in between -6% and +6%. The last time the alter reached these levels was Dec. 1, when Bitcoin dropped from $91,500 to $83,900 in simply a couple of hours.

Bitcoin lags as gold rises amidst increasing United States debasement worries

Associating Bitcoin’s bearish momentum exclusively to the United States financial standoff appears counterproductive, particularly as the S&P 500 climbed up 0.6% on Monday. On the other hand, gold rose to $5,100 for the very first time in history. This rally has actually led experts to question if a “debasement trade” is speeding up. While the United States dollar declining versus limited properties is a typical style, it presently shows a more comprehensive absence of trust that is not always equating into instant gains for Bitcoin.

Financiers have actually ended up being significantly risk-aware after the Federal Reserve Bank of New york city signified a prospective rescue of the Japanese yen– a relocation not seen because 1998. Over the previous year, other significant fiat currencies have actually exceeded the United States dollar, making United States imports more pricey and putting in upward pressure on inflation. If the Fed continues with an intervention, traders might translate the relocation as a desperate procedure to support worldwide markets.

The United States Dollar Strength Index (DXY) dropped listed below 97 for the very first time in 4 months on Monday as traders looked for security in competing fiat currencies.

Remarkably, even with 5-year United States Treasury yields going beyond those of Europe and Japan at 3.8%, financiers are still bracing for greater United States inflation. It is ending up being significantly obvious that the United States will embrace a softer financial policy, especially as Fed Chair Jerome Powell’s required ends in April.

United States President Donald Trump has actually made it clear that Powell’s follower should concentrate on cutting Fed funds rates. Such a relocation would supply more breathing space for the United States Treasury by minimizing interest expenditures. While a more expansionary financial policy usually supports the stock exchange, it does not constantly produce an instant or direct reward for Bitcoin financial investment.

Related: Crypto funds see $1.7 B outflows, greatest because November 2025

If business profits from significant tech business amaze to the benefit today, there might be even less reward for financiers to turn into alternative limited properties. Eventually, Bitcoin’s course to recovering the $93,000 level depends upon expert traders restoring their self-confidence. This healing may take longer than anticipated as macroeconomic shifts and the business profits season control the spotlight today.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.