The 2-year and 10-year United States Treasury yields dipped on Monday, April 14, after Bitcoin (BTC) closed its finest weekly efficiency given that the 2nd week of January. Bitcoin acquired 6.79% over the previous week, however suffice elements lined up to support ongoing cost benefit?

The 10-year treasury yield decreased by 8.2 basis indicate 4.40% throughout the New york city trading session, while the 2-year treasury saw an 8 basis point slip to 3.88%. The drop in yields took place on the back of possible tariff exemptions on mobile phones, computer systems, and semiconductors, which were presented to provide United States business time to move production locally. Nevertheless, United States President Donald Trump stressed these exemptions were momentary in nature.

United States 10-year treasury bond yields chart. Source: Cointelegraph/TradingView

The tariff exemptions revealed on April 12 came at completion of a bullish week for Bitcoin. After forming brand-new annual lows at $74,500, BTC cost leapt 15% to $86,100 in between April 9-13.

Relieving United States treasury yields might be a double-edged sword for Bitcoin. Lower yields lower the appeal for fixed-income possessions, enhancing capital injection into risk-on possessions like BTC. Still, the unpredictability of “momentary exemptions” and the continuous trade war with China keeps Bitcoin vulnerable to additional cost volatility.

As an “inflation hedge,” Bitcoin continues to draw blended viewpoints, however current unpredictability over trade policies increases inflation worries, enhancing BTC’s shop of worth story. Yet, current United States inflation information recommended a cooling pattern, as the Customer Rate Index (CPI) for March 2025 suggested a year-over-year inflation rate of 2.4%, below 2.8% in February, marking the most affordable given that February 2023, which might be indirectly bearish for Bitcoin in the short-term.

Related: Trade war vs record M2 cash supply: 5 things to understand in Bitcoin today

Bitcoin cost difficulties present at $88K to $90K

Trading resource Product Indicators kept in mind that Bitcoin kept a bullish position above its 50-weekly moving typical and quarterly open at $82,500. A strong weekly close indicated a greater possibility that Bitcoin is less most likely to re-visit its previous weekly lows anytime quickly. The analysis included,

” Bitcoin bulls now deal with strong technical and liquidity-based resistance in between the pattern line and the 200-day MA. Anticipating “Spoofy” to move asks at $88k and $92k before they get filled.”

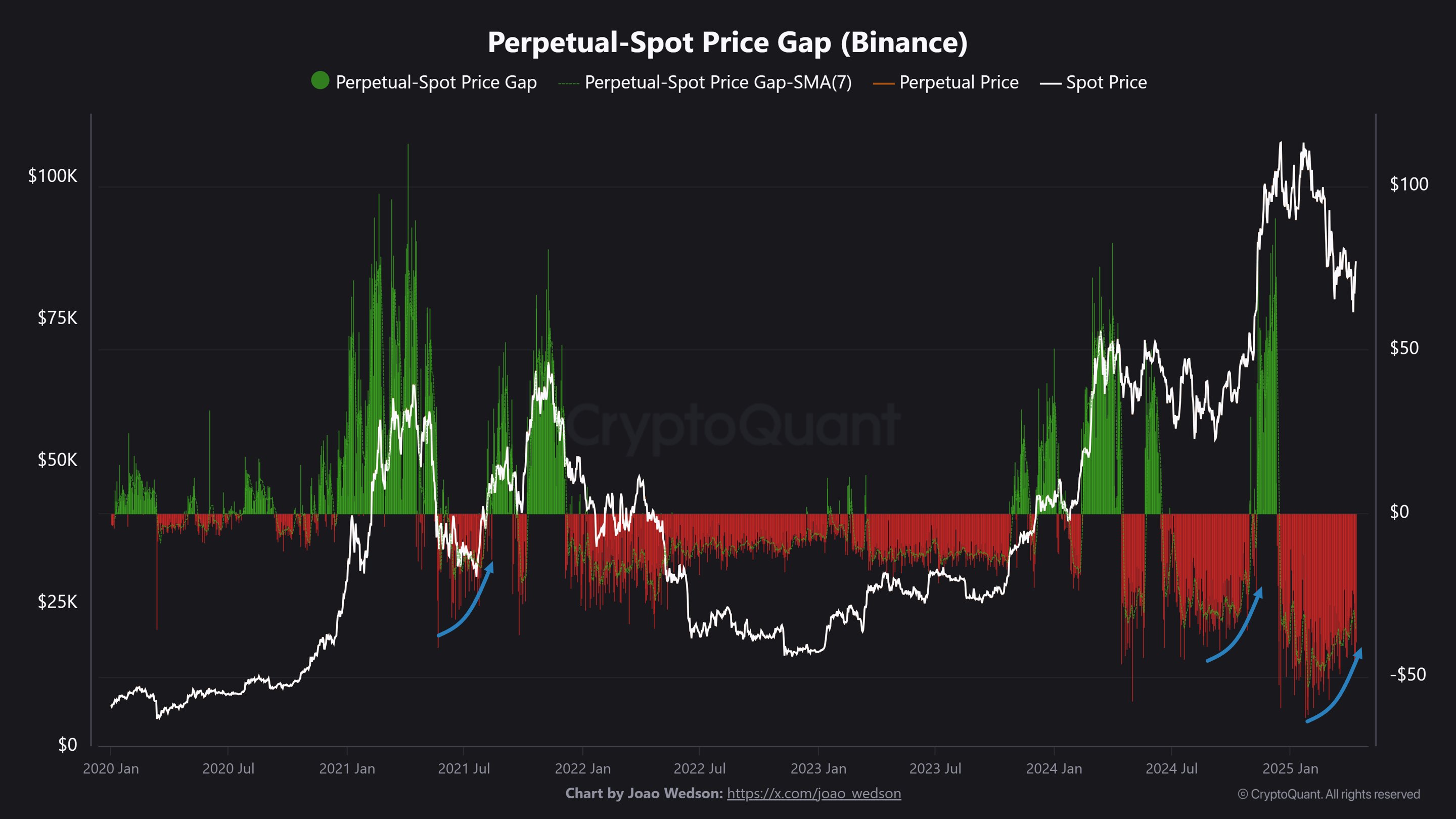

Similarly, Alphractal creator Joao Wedson recommended that Bitcoin might be nearing a bullish turnaround, as the Perpetual-Spot Space on Binance– a crucial indication tracking the cost distinction in between Bitcoin’s continuous futures and area markets, has actually been narrowing given that late 2024.

Bitcoin Perpetual-spot cost space chart. Source: X.com

In a current X post, Wedson highlighted that this diminishing space, presently unfavorable, signals fading bearish belief, with historic patterns from 2020– 2021 and 2024 revealing that a favorable space typically causes a Bitcoin rally. Wedson kept in mind that a flip to a favorable space might show returning purchaser momentum. Nevertheless, he warned that such unfavorable spaces continued throughout the 2022– 2023 bearishness.

Related: Michael Saylor’s Method purchases $285M Bitcoin amidst market unpredictability

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.