Bottom line:

-

Bitcoin business treasuries included 630 BTC to begin the week, continuing a month-long inflow pattern.

-

The relocation contrasts with a continuous sell-off amongst the Bitcoin ETFs, which offered almost $300 million Monday.

-

Not everybody is bearish about “purchasing the dip” at present levels.

Bitcoin (BTC) business treasuries included over 600 BTC Monday regardless of crypto market nerves.

Information from quantitative digital possession fund Capriole Investments validated that business purchasers are disregarding the BTC rate dip.

Bitcoin treasuries buck ETF sell-off pattern

Bitcoin is still a strong “purchase” for some market individuals, even as numerous, consisting of institutional financiers, rush for the exit.

Capriole information reveals that on Monday, business Bitcoin treasuries included about 630 BTC ($ 72 million).

The figure marks a brand-new August high, and shows a divergence in belief in between treasuries and other massive financiers.

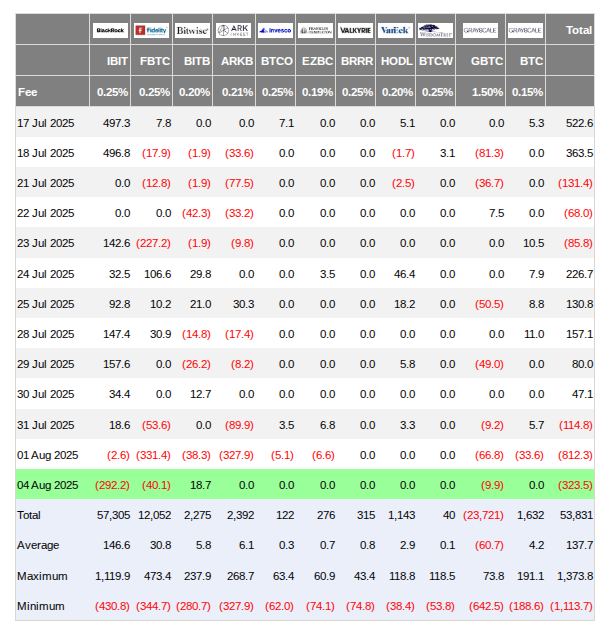

The exact same day, the United States area Bitcoin exchange-traded funds (ETFs) saw a net outflow of $323.5 million. The biggest ETF, BlackRock’s iShares Bitcoin Trust (IBIT), shed $292.2 million in among its biggest everyday outflows of 2025.

Capriole exposes business treasury interest remained strong throughout July, on the other hand, with the most significant day, July 21, seeing buys of over 26,700 BTC ($ 3 billion).

Talking about the information, Capriole creator Charles Edwards kept in mind that on the unusual celebrations that treasuries see big outflows, regional BTC rate bottoms neighbor.

” Each time Bitcoin treasury business’ everyday sales have actually gone beyond 1,500 over the last cycle, it’s been at the regional rate lows, i.e., a buy signal,” he informed X fans Tuesday.

The last time that such outflows were tape-recorded was on March 31, when treasuries offered over 1,700 BTC ($ 194 million). BTC/USD was up to lows of $74,500 about one week later on.

ETF expert shakes off market “dooming”

As Cointelegraph reported, expectations were high for Monday’s ETF outcomes, with trading company QCP Capital stating they would determine the short-term market state of mind.

Related: Is BTC duplicating course to $75K? 5 things to understand in Bitcoin today

” If inflows resume and vol metrics start to compress, it would supply more powerful proof that present conditions might support a buy-the-dip story,” it concluded in a publication to Telegram channel customers.

For Bloomberg ETF expert Eric Balchunas, nevertheless, present conditions might make up a timeless chance.

” Great deal of dooming going on, however do not be amazed if traders purchase the dip,” he composed on X together with a chart of dip-buying returns.

” Why? Due to the fact that it works- and has actually had for actually years.”

Great deal of dooming going on, however do not be amazed if traders purchase the dip. Why? Due to the fact that it works- and has actually had for actually years. Here’s a take a look at the avg weekly returns after a dip. Not as great a pop as it produced in 2021 and the ’90s, however still favorable. pic.twitter.com/IRrLrh2rWy

— Eric Balchunas (@EricBalchunas) August 4, 2025

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.