Bitcoin (BTC) returned current gains on Wednesday as traders forecasted fakeout move the Federal Reserve interest-rate statement.

Bottom line:

-

Bitcoin stops working to hang on to its current journey past $94,500 as nerves accompany the Fed interest-rate choice.

-

Traders are gotten ready for undependable relocations in both instructions around FOMC.

-

Japan-centered risk-asset volatility is currently on the horizon as the next essential problem.

Bitcoin cost changes overlook the annual open

Information from Cointelegraph Markets Pro and TradingView revealed that the BTC cost trajectory was heading lower at the Wall Street open.

Having actually reached $94,650 the day prior, BTC/USD stopped working to hold greater levels, consisting of the 2025 annual open.

At the time of composing, the set traded around $92,000 as market individuals anticipated undependable cost maneuvers around the rates statement and interview.

” FOMC conferences can be quite challenging,” crypto trader, expert and business owner Michaël van de Poppe composed on X.

” The cost action normally traps everybody before the real relocation, so even if Bitcoin drops to $91K, I’m not putting excessive weight on it.”

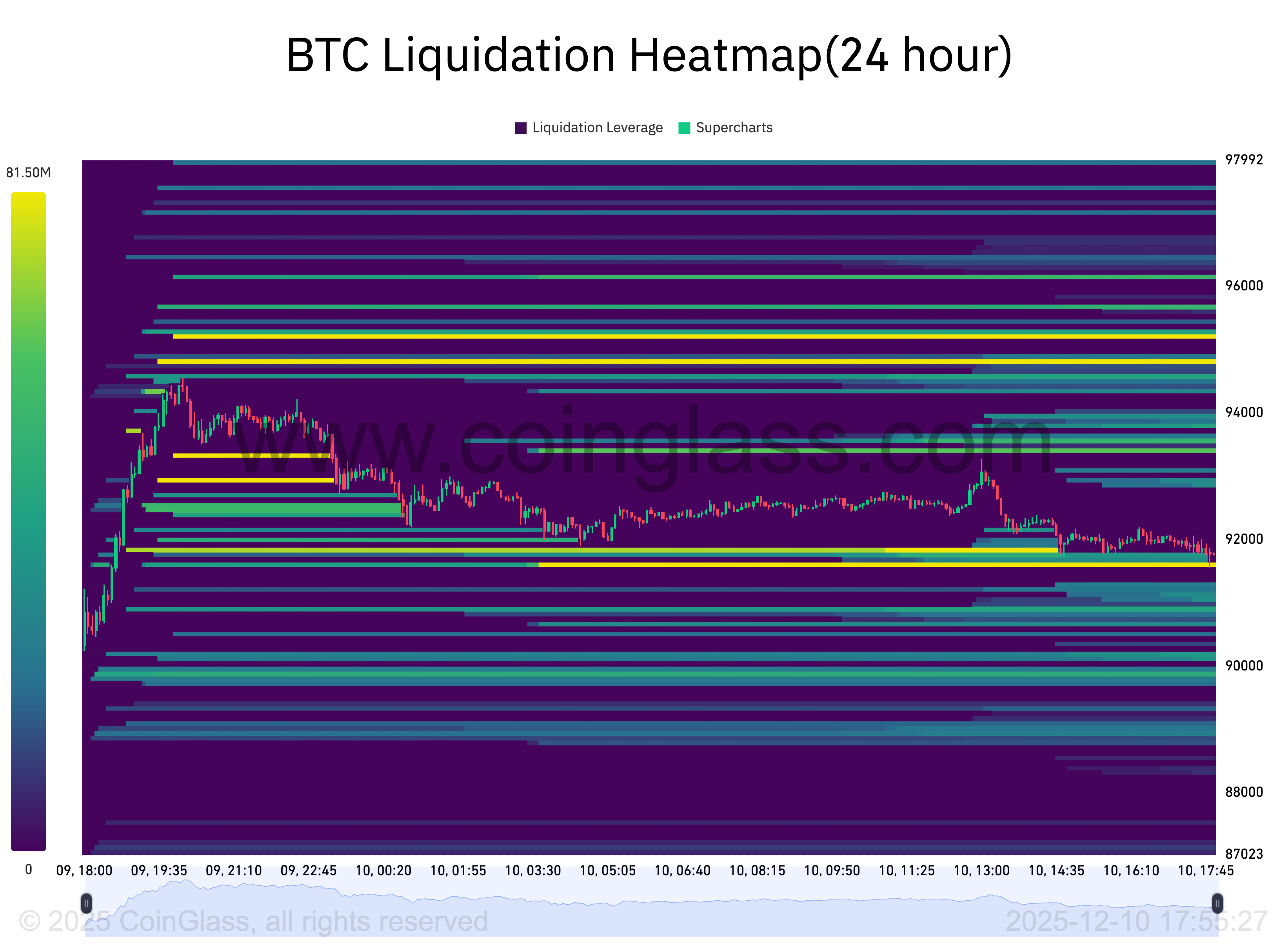

Trader Daan Crypto Trades kept in mind that exchange order books did not have significant liquidity clusters on either side of the cost after the relocation higher.

“$ BTC Secured that $93K-$ 94K liquidity cluster as pointed out the other day. This was the most rational location to go from a liquidity viewpoint. With that gotten, there’s no significant location in close distance,” he informed X fans together with information from keeping track of resource CoinGlass.

” However as cost is now combining, we can see some clusters developing around the $90K & & $95K levels.”

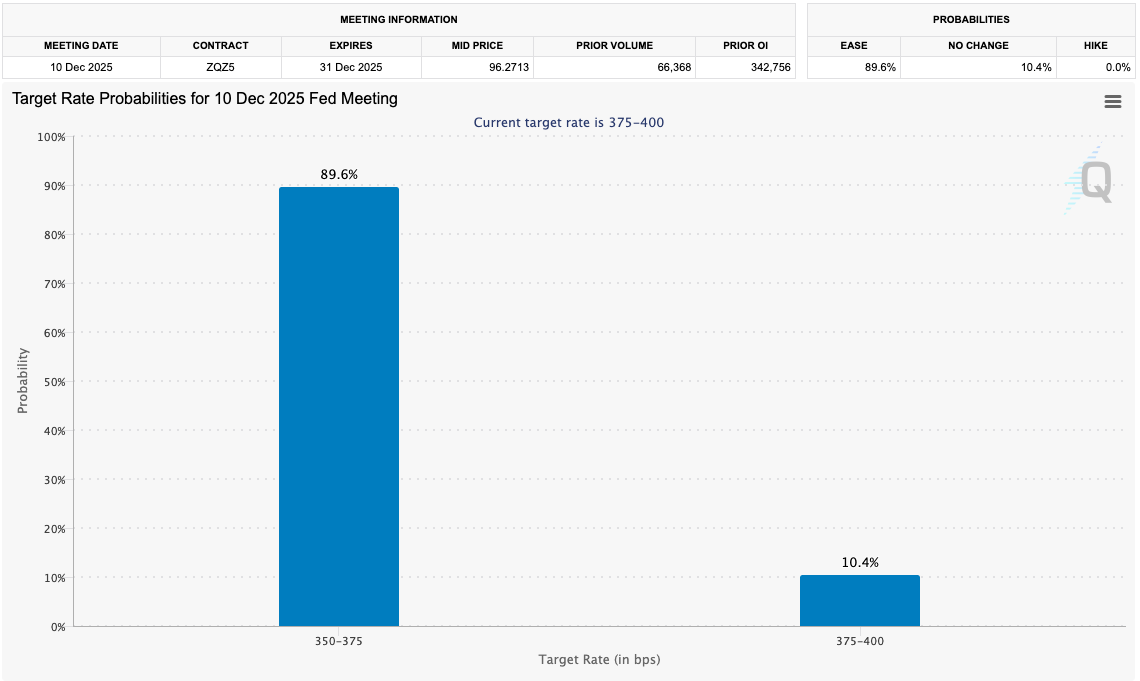

As Cointelegraph reported, markets currently saw a frustrating opportunity of the Federal Free Market Committee (FOMC) cutting rates by 0.25%. The outlook on future policy from Fed Chair Jerome Powell, nevertheless, stayed unpredictable.

” The rate choice is practically totally priced, however the genuine focus will be on Powell’s tone,” trading business QCP Capital described in its newest “Asia Color” market upgrade on the day.

” With little brand-new information given that the last conference, the Fed is not likely to pre signal a January relocation, leaving traders to dissect every subtlety of journalism conference.”

Japan revives familiar crypto danger

Continuing, QCP stated that after the FOMC response, risk-asset traders would change their focus to Japan, with its bond market in uncommon area.

Related: Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

” The BOJ conference on 19 December has actually ended up being the next significant danger occasion,” it described.

” JGB yields are sitting at multi years highs, with the 10Y near 1.95%, its greatest level given that 2007, and the 30Y around 3.39%, a record level and more than 100bps greater than a year earlier.”

Prospective volatility might arise from bonds affecting the yen bring trade– a concern currently seen in 2024, when crypto markets responded in genuine time to the phenomenon.

Japan’s reserve bank signified that it might diverge from the international pattern and raise rates of interest next.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.