Bottom line:

-

Bitcoin deals with a crucial weekly close with numerous crucial rate levels on the line.

-

The booming market’s future is still at stake, a trader states, in the middle of continuous whale selling.

-

Threat properties must get from a decrease in United States trade tariffs or completion of the federal government shutdown.

Bitcoin (BTC) wedged itself in a narrow variety ahead of a crucial weekly close with $100,000 assistance at stake.

BTC rate counts down to significant weekly close

Information from Cointelegraph Markets Pro and TradingView revealed BTC rate inertia defining weekend trading.

Volatility was doing not have, however market individuals were eager to see how the weekly candle light would close.

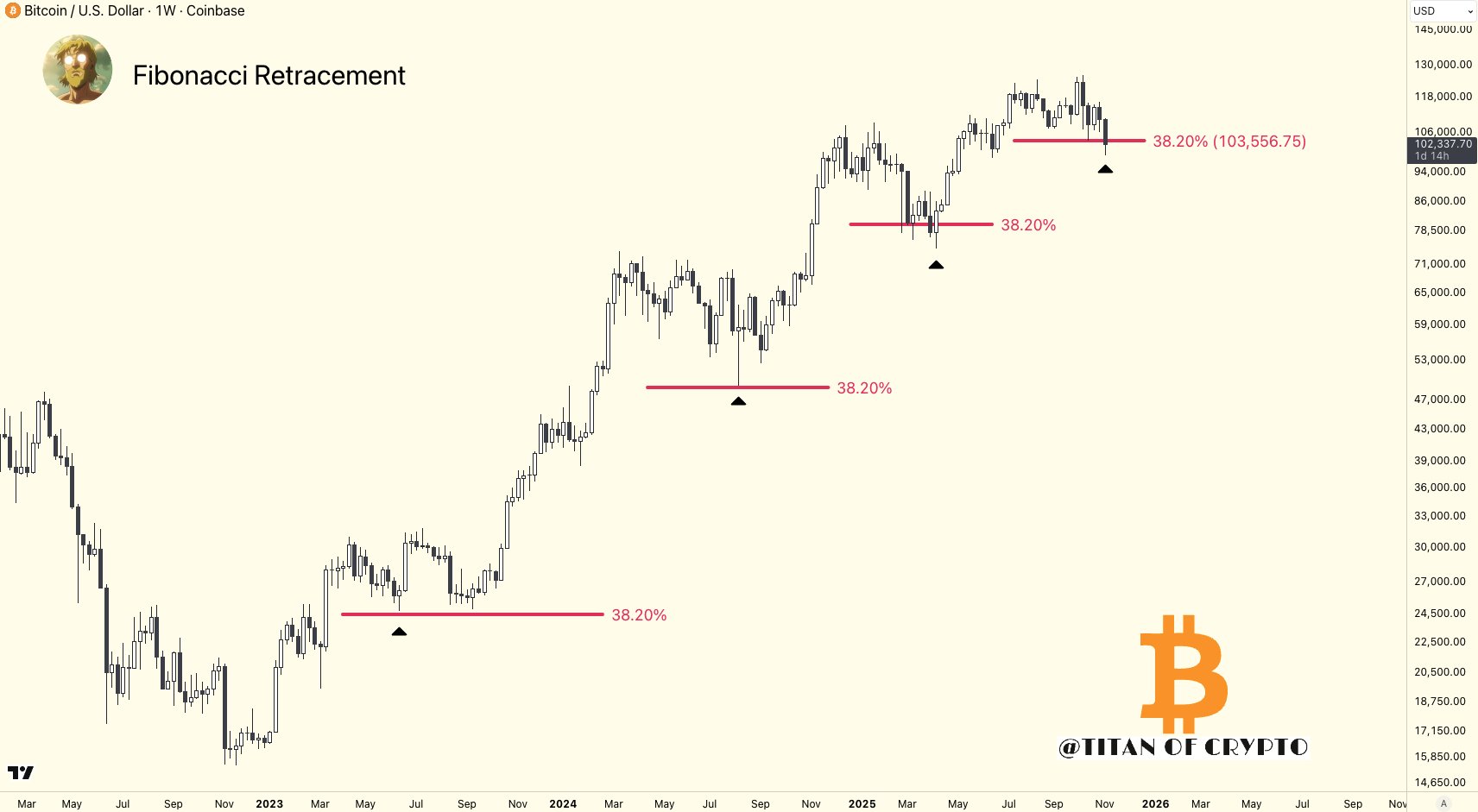

” Secret level of the week: $103.5 K,” trader Titan of Crypto composed in a post on X.

Titan of Crypto based the significance of that rate point on Fibonacci retracement levels, with the booming market possibly at stake.

” A weekly close listed below isn’t significant, however a validated breakdown next week would signify the booming market is most likely over. Not there yet,” he included.

Others considered a close above the 50-week rapid moving average (EMA), presently at $100,940, as an indication of strength.

” We do not desire a weekly close listed below this at any expense,” trader Max Crypto cautioned.

The threat of a “death cross” including easy moving averages (SMAs) on the day-to-day chart, on the other hand, was of interest to trader SuperBro.

Such a situation happens when the 50-period SMA crosses listed below the 200-period equivalent.

” The fourth ‘death cross’ of the bull cycle is approaching. Each time we have actually seen reversion to the mean and a continual bottom,” he informed X fans on the day.

” However up until now, a lukewarm response at the 365 SMA. Let’s see if bulls can get it together and recover the Q3 low for the weekly close.”

Bitcoin expert sees “growth” if United States gov’ t shutdown ends

Beyond chart signals, crypto markets wished for favorable news on the United States federal government shutdown.

Related: Bitcoin’s ‘speed bump’ to $56K? Ripple declines IPO strategies: Hodler’s Digest, Nov. 2– 8

Anticipation that legislators would take actions to end the deadlock was increasing, as its results ended up being more bothersome for the United States economy.

Furthermore, expectations were that the United States Supreme Court overruling worldwide trade tariffs– a choice due quickly– would supply an instantaneous increase to stocks.

” If the United States federal government shutdown ends, we might see a growth quickly,” Cas Abbe, a factor to onchain analytics platform CryptoQuant, summed up.

Abbe submitted a chart to X, which recommended that completion of the shutdown might likewise mark completion of a “adjustment” stage for BTC rate action.

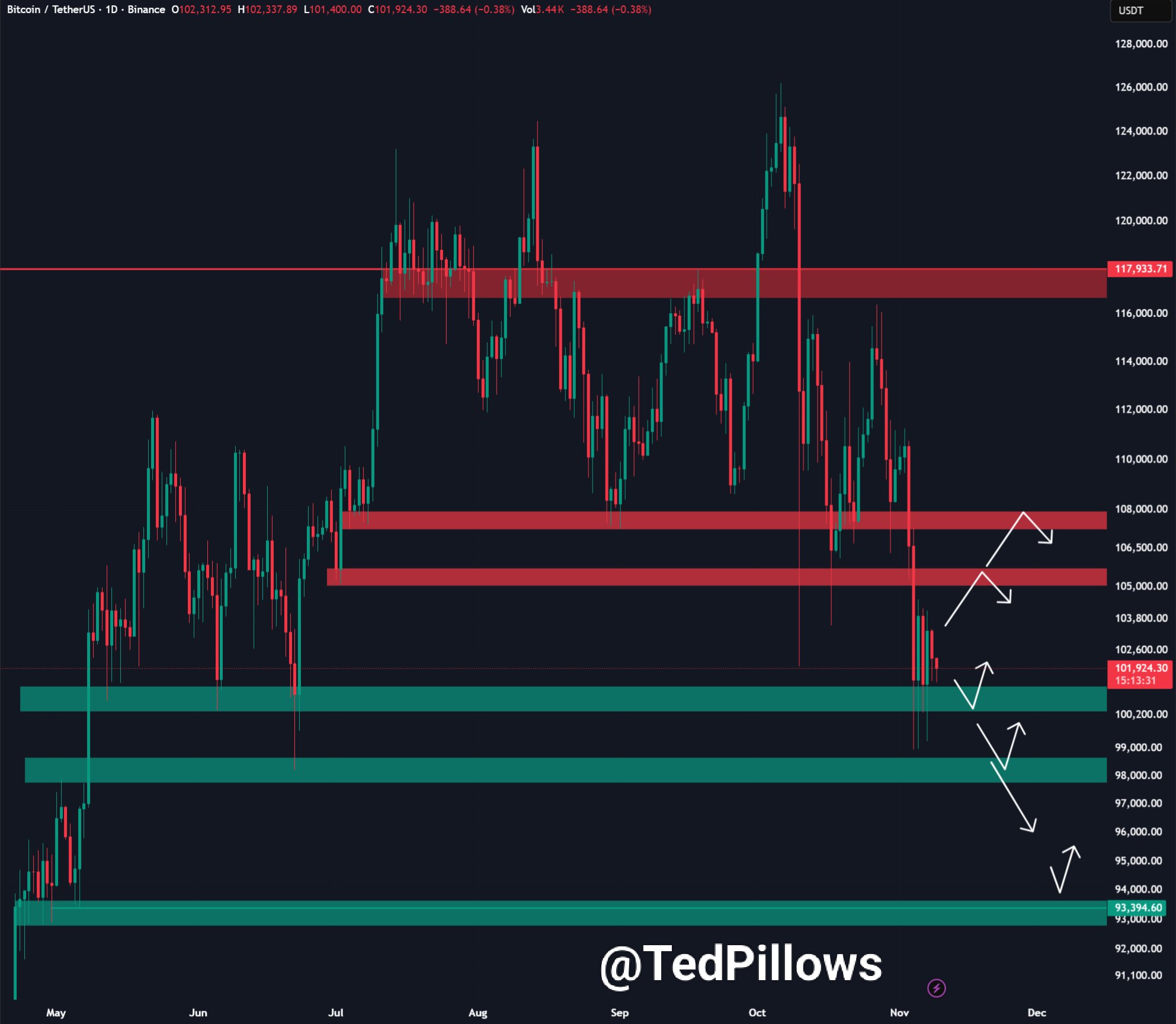

Crypto financier and business owner Ted Pillows bewared, anticipating that BTC rate might suffer if market expectations were not pleased quickly enough.

” BTC is still combining around the $102,000 level. The marketplaces were anticipating completion of the federal government shutdown this weekend, however it didn’t take place,” he mentioned.

” I still believe Bitcoin might go a bit lower, considered that institutional need has actually gone and OG whales are offering.”

Bitcoin whales, Cointelegraph reported, have actually produced continual selling pressure throughout 2025.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.