Bottom line:

-

Bitcoin quits on its bull-market rebound as sellers remain strongly in control.

-

The notorious Bitcoin whale, who shorted BTC recently, continues to contribute to its BTC rate disadvantage bet.

-

$ 107,000 is gradually becoming a prospective near-term target.

Bitcoin (BTC) fell back to multi-week lows after Tuesday’s Wall Street open as traders recommended a low-risk technique.

Bitcoin whale remains brief BTC with $500 million

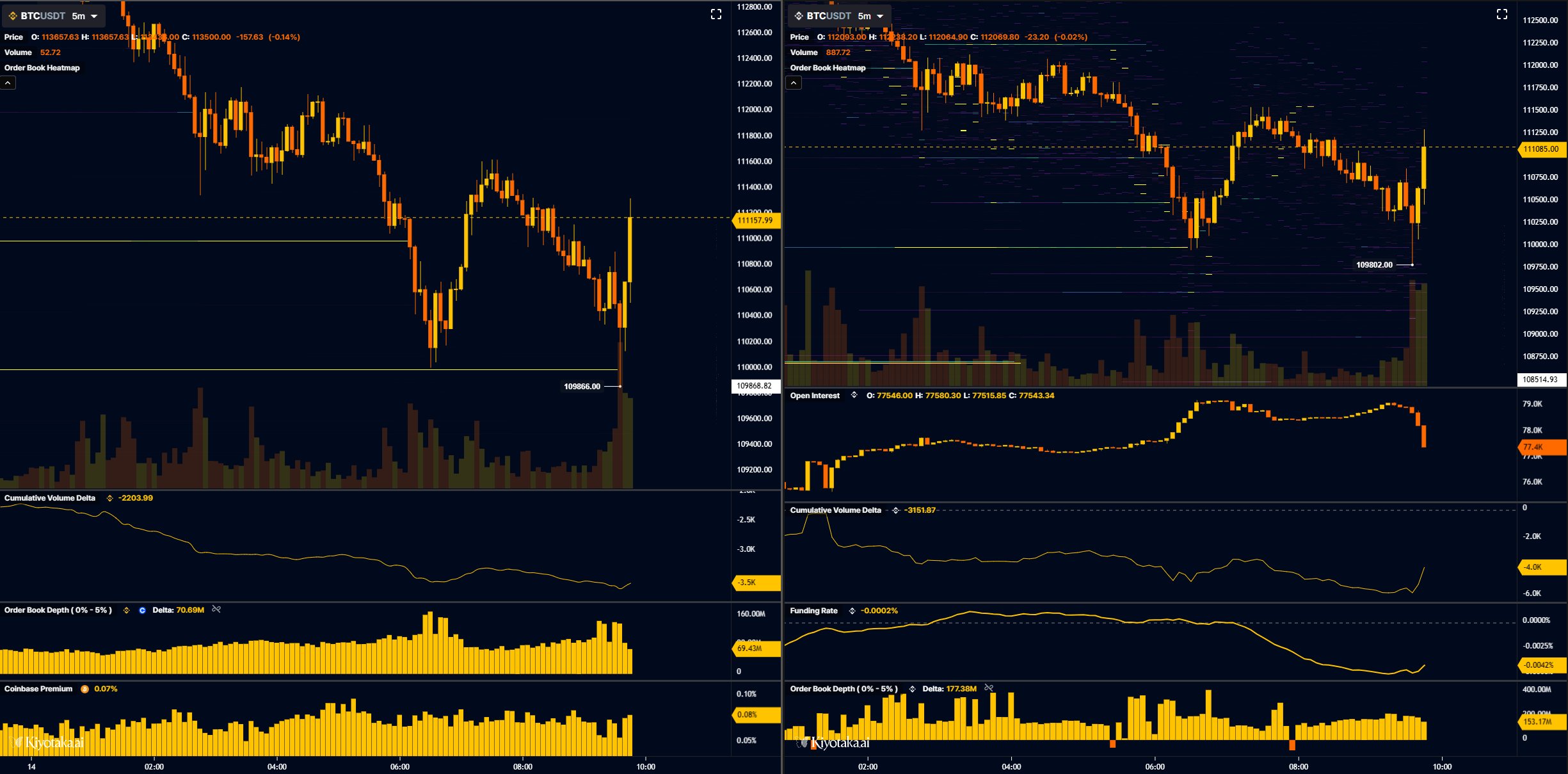

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD dropping over 3% to retest $110,000.

Amidst fresh volatility, Bitcoin checked hodlers’ nerves for a 2nd time in numerous days as suspicions of market adjustment continued to swirl.

” Barf from the United States market open resulted in another sweep of $110K which is still seeing passive purchasing & & a bit more absorption of market selling,” trader Alter composed in his most current post on X.

” In perps we have shorts from earlier in the day taking revenues.”

Attention remained concentrated on the actions of a crypto whale who shorted the marketplace right before Friday’s $20 billion liquidation waterfall.

On Tuesday, their BTC brief with 10x take advantage of deserved almost half a billion dollars.

The notorious Hyperliquid whale is back.

Last time

he shorted $700M BTC + $350M ETH, filching almost $200M throughout the crash.

This time

he’s opened a $494M Bitcoin short at 10x take advantage of.

Entry: $115,288

Present rate: $112,600

Latent revenue: +$ 11.8 M and climbing.

His … pic.twitter.com/QxSThYpM8f

— Justin Wu (@hackapreneur) October 14, 2025

Other danger properties likewise had a hard time on the day, with United States stocks opening down and gold dropping from its most current all-time high of almost $4,180 per ounce.

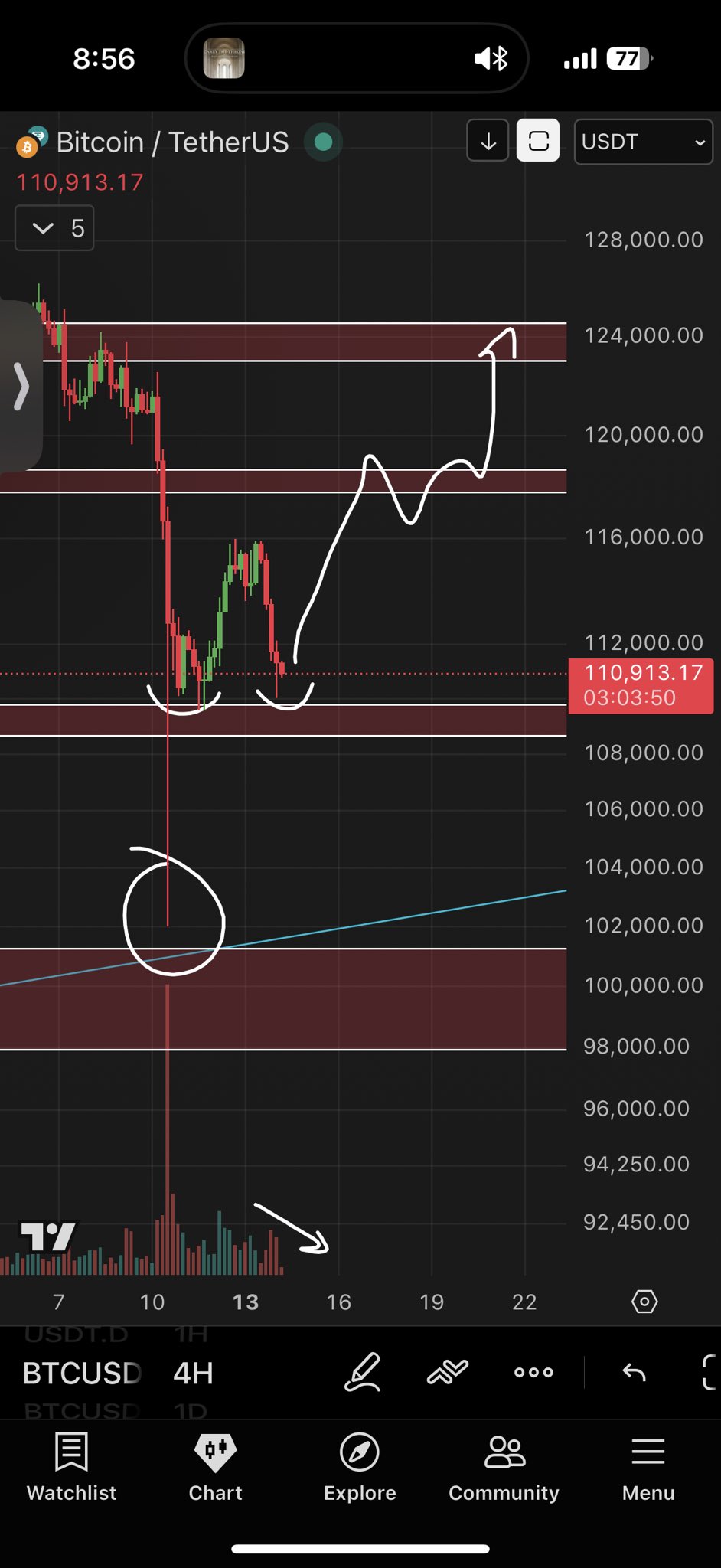

Continuing, trader Roman informed X fans to prevent too much exposure amidst weak market structure en route to $108,000.

” Now we have a prospective DB turnaround with volume dropping on significant assistance,” he composed along with a low-timeframe rate chart.

” My only problem becomes part of me thinks we fill that wick from our liquidation waterfall. I ‘d take low danger here.”

$ 107,000 following?

Taking exclusive information into account, on the other hand, Keith Alan, co-founder of trading resource Product Indicators, had lower levels in mind.

Related: $ 120K or end of booming market? 5 things to understand in Bitcoin today

“$ BTC is lowering for a fourth assistance test at $109k, however I’m not persuaded it will hold,” an X post confessed.

” Technical assistance is more powerful where the 200-Day SMA has confluence with the Q4/2025 Timescape Level at $107,100. If bulls lose that level, the annual open might enter focus.”

Bitcoin’s annual open lies simply listed below $93,500, and has actually formed a crucial level given that.

Previously, Cointelegraph reported on numerous crucial assistance trendlines in play, consisting of moving averages and the aggregate expense basis for short-term holders.

This post does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.