Secret takeaways:

-

A whale bets $23.7 million targeting Bitcoin at $200,000 by year-end, indicating strong bullish conviction.

-

Experts state Bitcoin stays bullish, however $115,000 will be crucial for uptrend extension.

Bitcoin (BTC) got quote liquidity on Friday as an unidentified trader made a substantial bullish bet targeting a BTC cost of $200,000 by the end of the year.

Whale bets $23.7 million on much greater BTC rates

Information from Cointelegraph Markets Pro and TradingView revealed BTC/USD slicing through close-by resistance to strike $114,960.

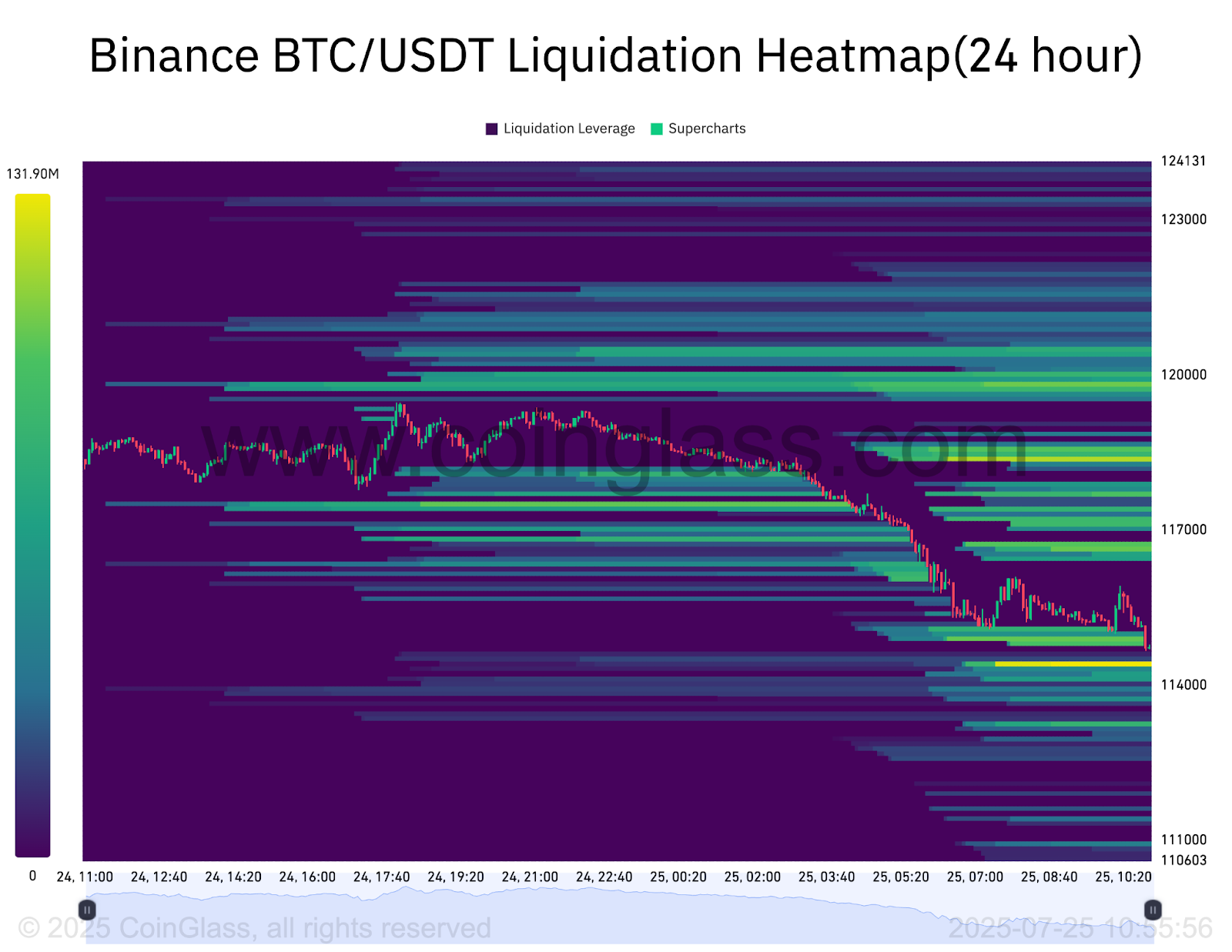

As Cointelegraph reported, the relocation triggered huge long liquidations throughout Bitcoin markets, amounting to $130 million in the previous 24 hr.

Related: Bitcoin debt consolidation anticipated to end with impulse transfer to $135K: Information

Keeping track of resource CoinGlass revealed liquidity being renewed lower down on exchange order books.

In spite of this drop, which brings a time out to Bitcoin’s rally, the bullish conviction stays. As Deribit experts kept in mind, a whale just recently went long BTC with a $23.7 million position targeting as high as $200,000 by the year’s end.

This was an intricate trade that included a bull call spread, which restricts both possible gains and losses.

” The Dec $140K-$ 200K call spread controls, purchasing low Dec $140K IV, moneyed by greater IV $200K calls,” Deribit Insights composed, including that the “Call spreads bank on an impending ATH break.”

2) The Dec 140-200k Call spread controls, purchasing low Dec 140k IV, moneyed by greater IV 200k Calls.

An absolutely no expense Jul25 124k – Aug29 140k Call spread bets on an impending ATH break.

However otherwise, 2-way (net selling) of 130 +150 k Calls, and Aug102-Sep150k Strangles pressure IV. pic.twitter.com/7zhLW41wHV

— Deribit Insights (@DeribitInsights) July 20, 2025

Market attention is constantly drawn to such positions, as comparable whale trades have actually affected the cost trajectory significantly in current weeks.

Just Recently, a Satoshi-era whale awakened after 14 years of inactivity and moved $9.6 billion worth of Bitcoin, triggering correction issues amongst market observers.

Bitcoin “stays bullish”

A break listed below the $115,000 variety low was what traders required to choose whether to include or decrease direct exposure.

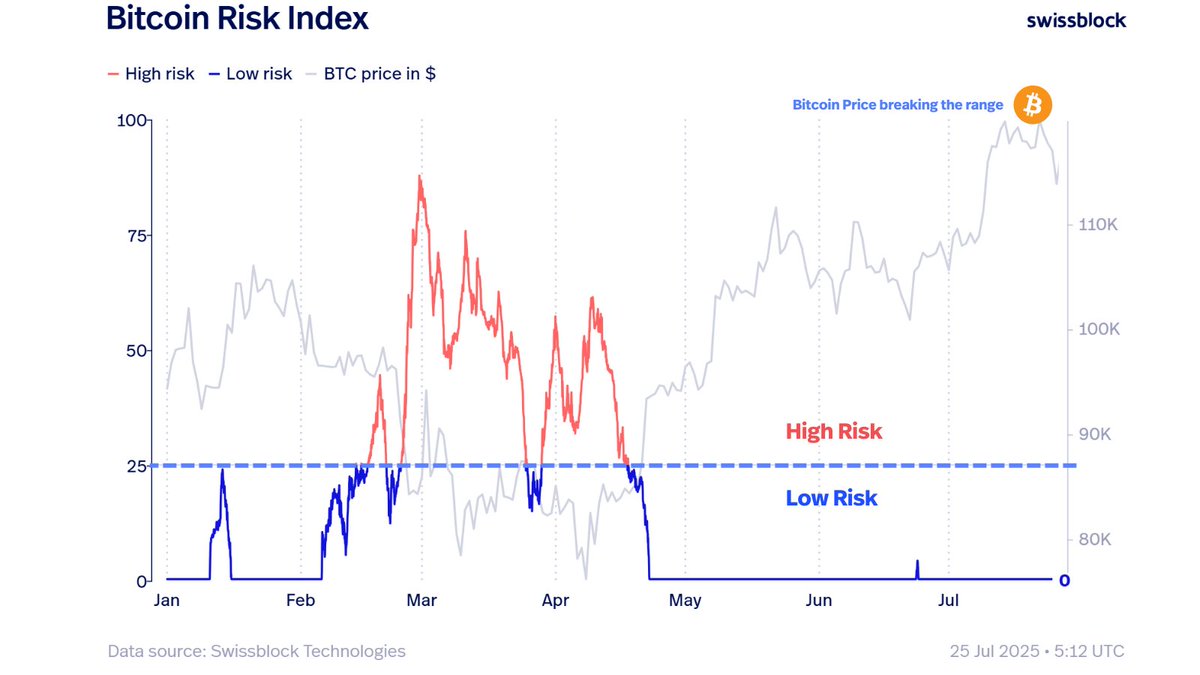

” Bitcoin lastly broke out of its variety, however this isn’t capitulation, it’s a rotation-led correction,” stated property supervisor Swissblock in a Friday post on X.

The Bitcoin danger index, a metric that evaluates the possibility of considerable BTC cost drawdowns, is presently at absolutely no. This shows that there is “no getting too hot” and the bullish structure stays undamaged, Swissblock stated, including:

” The pattern stays bullish. Corrections at low danger levels = chance, not exit.”

Popular expert Daan Crypto Trades stated that the $115,000 variety low required to hold to protect the uptrend.

” A breakdown from this variety must result in a retest of $113,500 next, which might be a good level to keep an eye out for if that takes place.”

As Cointelegraph reported, the $115,000 assistance level is crucial as an everyday candlestick break and close listed below it might speed up selling as short-term purchasers hurry to the exit. That might sink the set to $110,530, where the purchasers are anticipated to action in.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.