Bottom line:

-

Bitcoin whales turn bearish on BTC rate action hours before Trump makes another White Home statement.

-

” Expert” market bets have actually included plainly considering that Oct. 10, when Bitcoin struck $102,000 on Binance.

-

Traders state that $107,000 is now the next line in the sand.

Bitcoin (BTC) ran the risk of fresh losses into Thursday’s Wall Street open as whales turned brief BTC.

Bitcoin whales overdo shorts once again

Information from Cointelegraph Markets Pro and TradingView revealed BTC rate action tapping however stopping working to hold $110,000.

Performing in a progressively narrow variety, BTC/USD used little cause for optimism ahead of some traditional volatility activates.

United States President Donald Trump was arranged to make a statement from the White Home at 3 pm Eastern Time, and large-volume Bitcoin traders were banking on problem.

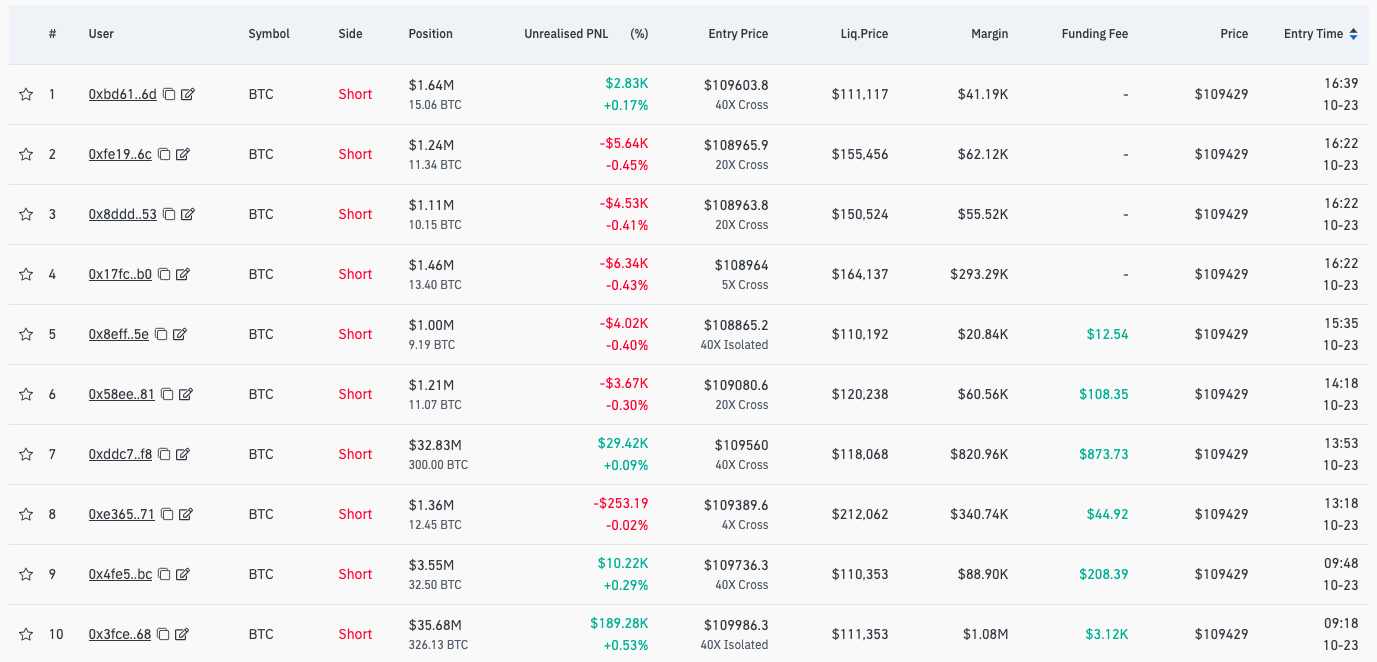

Bitcoin OG Kyle Chasse explained one whale’s 40X leveraged BTC brief as “ridiculous.”

OUTRAGEOUS!!!

This whale transferred $3M $USDC into Hyperliquid just recently.

Shorting $BTC with 40x take advantage of!!!

Trump is likewise making a statement from the White Home today.

COINCIDENCE??? pic.twitter.com/9n6n0LKtf7

— Kyle Chassé/ DD (@kyle_chasse) October 23, 2025

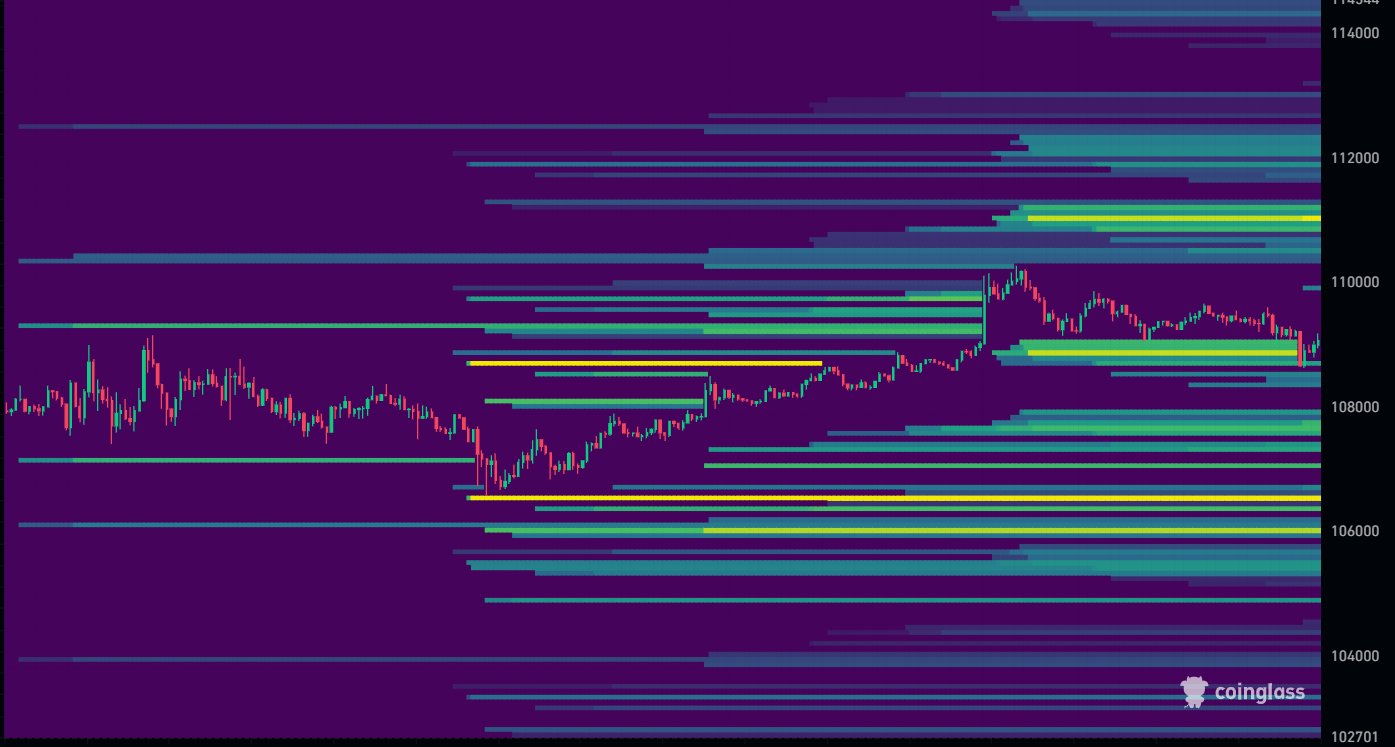

” We see rather a huge liquidation cluster simply above $106k,” he included a more post on X.

An accompanying chart revealed liquidation levels on exchange order books from keeping an eye on resource CoinGlass, with these typically serving as near-term rate magnets.

On The Other Hand, Extra CoinGlass information revealed different brand-new whale shorts opening on the day, consisting of those with a substantial quantity of take advantage of.

As Cointelegraph reported, suspicions have actually accompanied whale plays throughout October after particular entities appeared to front-run news headings and remarks from Trump. The phenomenon initially emerged on Oct. 10, when BTC/USDT fell from all-time highs to a low of $102,000 on Binance.

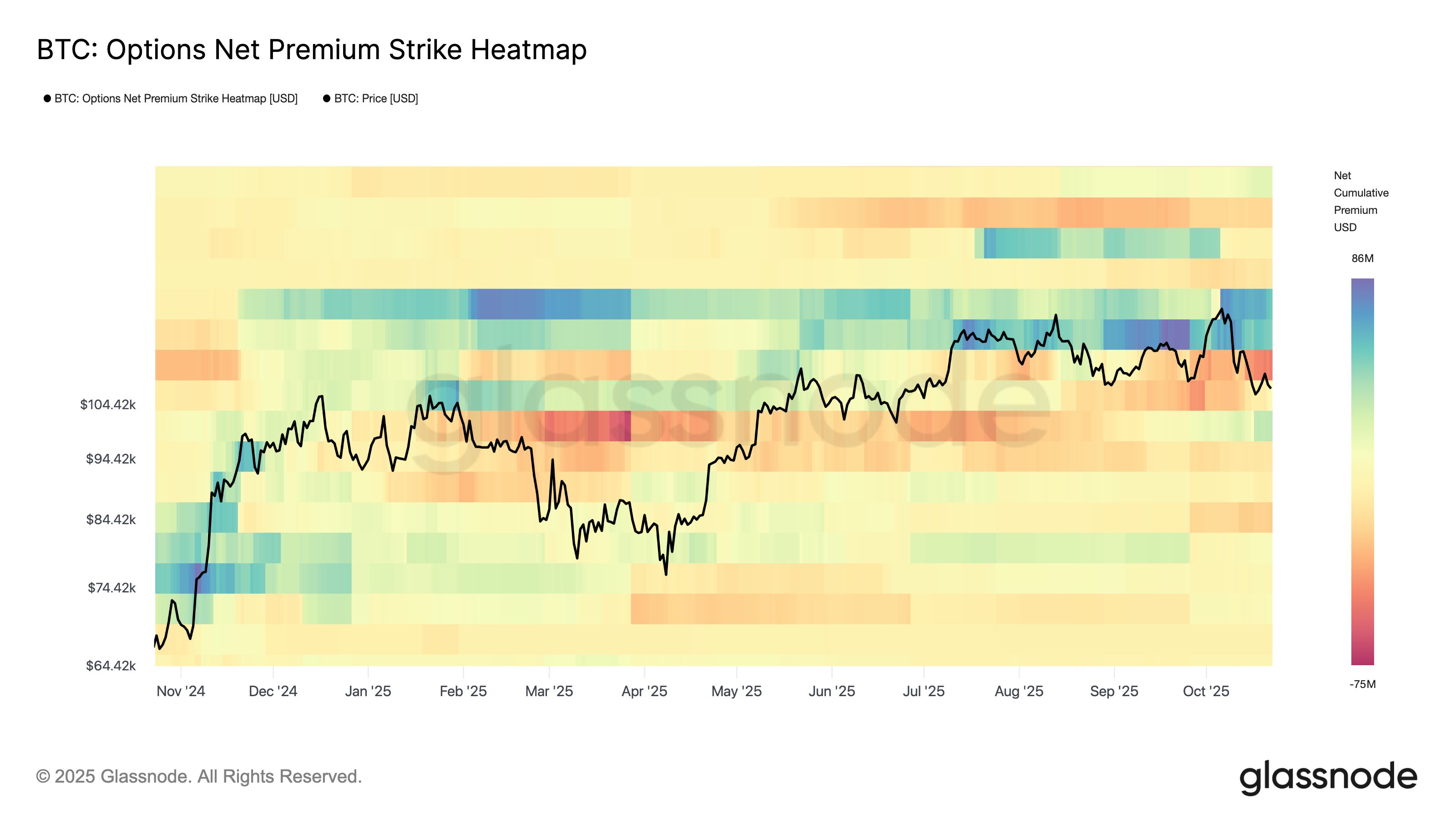

Focusing on general trader habits, onchain analytics platform Glassnode exposed “protective” positioning.

” Net-premium circulations expose focused selling throughout the $109K–$ 115K variety, showing that current relocations greater are being utilized to hedge,” it reported on Bitcoin alternatives markets.

” This recommends traders are placing defensively into strength while the marketplace combines.”

Bearish BTC rate forecasts remain in location

Currently bearish market individuals doubled down on their existing cautions.

Related: Bitcoin rate to 6X in 2026? M2 supply boom triggers COVID-19 contrasts

Trader Roman, worried about an absence of trading volume even at the all-time highs, stated that the circumstance would turn “get awful quick” for Bitcoin listed below $107,000.

” Up until now we have actually held however I wished to reveal that it’s not simply a horizontal assistance, it’s a diagonal assistance for a near year and a half long uptrend,” he informed X fans about the weekly chart.

Fellow trader Daan Crypto Trades concurred that volume in the existing variety was “quite thin.”

” The $111K level is what matters in the short-term. If rate can break and hold above that point, we can begin searching for greater,” he composed on the day.

” It’s excellent that the $107K level held throughout all this weak point likewise from stocks the other day. However that is a crucial assistance to hold moving forward.”

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.