Big Bitcoin holders who collected the cryptocurrency early, frequently referred to as whales, are progressively moving their holdings into exchange-traded funds (ETFs), with possession supervisors such as BlackRock actively courting them.

In an interview with Bloomberg, Robbie Mitchnick, BlackRock’s head of digital properties, stated the business has actually currently assisted in more than $3 billion worth of these conversions into its iShares area Bitcoin ETF (IBIT).

After years of self-custody, numerous whales are acknowledging “the benefit of having the ability to hold their direct exposure within their existing monetary advisor or private-bank relationship,” Mitchnick stated.

This shift enables them to preserve Bitcoin (BTC) direct exposure while incorporating their wealth into the conventional monetary system, allowing much easier access to more comprehensive financial investment and financing services.

Mitchnick partially associated this pattern to a current United States Securities and Exchange Commission guideline modification that allows in-kind productions and redemptions for crypto ETFs. The change enables licensed individuals to exchange ETF shares straight for Bitcoin instead of money, making massive conversions more effective and tax-friendly for institutional financiers.

BlackRock’s IBIT has actually become the most effective amongst the lots or two area Bitcoin ETFs authorized in the United States. In June, IBIT ended up being the fastest ETF in history to exceed $70 billion in properties under management– a figure that has actually because reached over $88 billion, according to information from Bitbo.

Related: BlackRock sees record quarter for iShares ETFs as Bitcoin, Ether need rises

Not your secrets, not your coins?

The pattern recognized by Mitchnick highlights the growing institutionalization of Bitcoin, more than 15 years after Satoshi Nakamoto mined the genesis block and pictured a bearer possession developed on the concept of self-custody.

Early Bitcoin supporters have actually long argued that self-custody is the only sure-fire method to protect one’s funds– a core tenet recorded by the mantra, “not your secrets, not your coins.”

Yet the increase of area Bitcoin ETFs and business treasury holdings is challenging that perfect, signifying a shift towards more standard, custodial types of ownership.

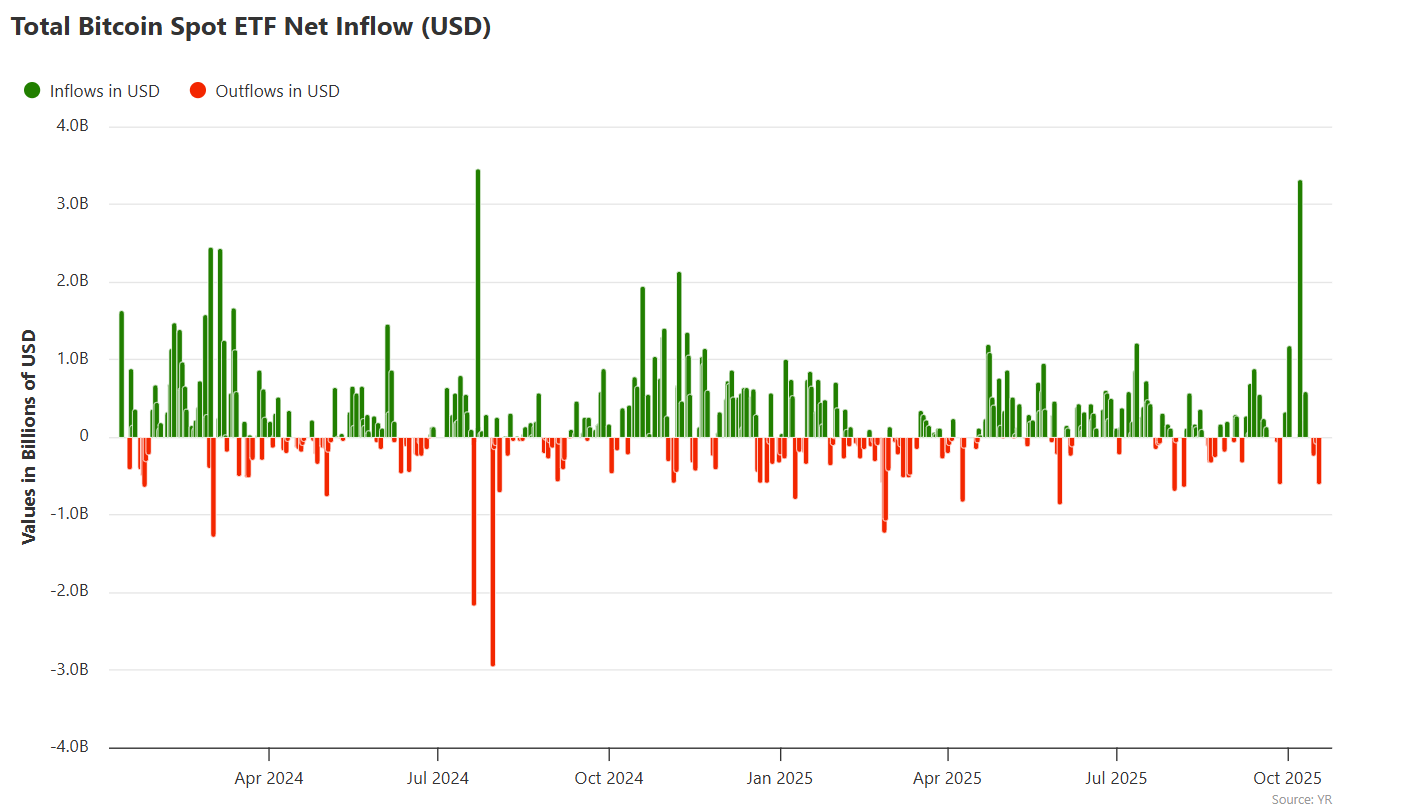

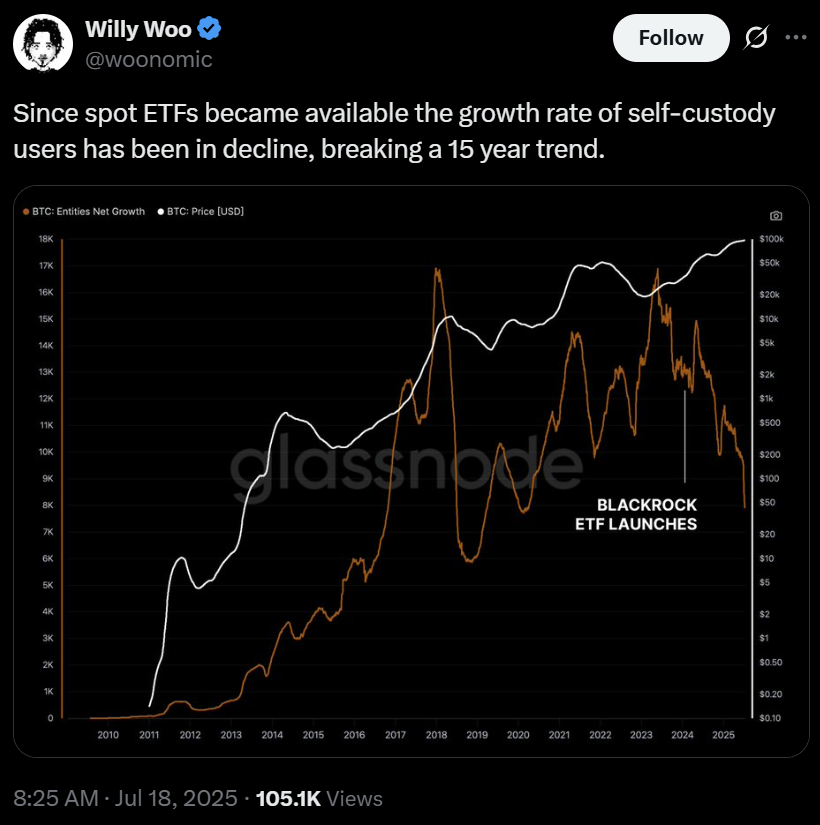

While area Bitcoin ETFs and direct holdings aren’t always in competitors– each serving various kinds of financiers– expert Willy Woo kept in mind in July that ETF need might have siphoned interest far from self-custody.

Onchain information, he stated, reveal that self-custodied Bitcoin just recently broke a 15-year uptrend, marking a prospective juncture in financier habits.

Still, ETFs have actually unlocked to a level of institutional involvement in Bitcoin that was formerly out of reach. The shift has actually affected early whales, who as soon as moved markets through their direct trading.

Related: Bitcoin developer Satoshi Nakamoto is the world’s 11th wealthiest individual