Bitcoiners were visibly more positive on social networks today as the chances of a United States Federal Reserve rate cut in December almost doubled compared to simply a day previously.

Some crypto market individuals are hypothesizing that this might be the driver Bitcoin (BTC) requires to stop the possession’s down pattern.

” Let’s see if that suffices to discover a bottom here in the meantime,” crypto expert Moritz stated in an X post on Friday, as Bitcoin’s rate trades at $85,071, down 10.11% over the previous 7 days, according to CoinMarketCap.

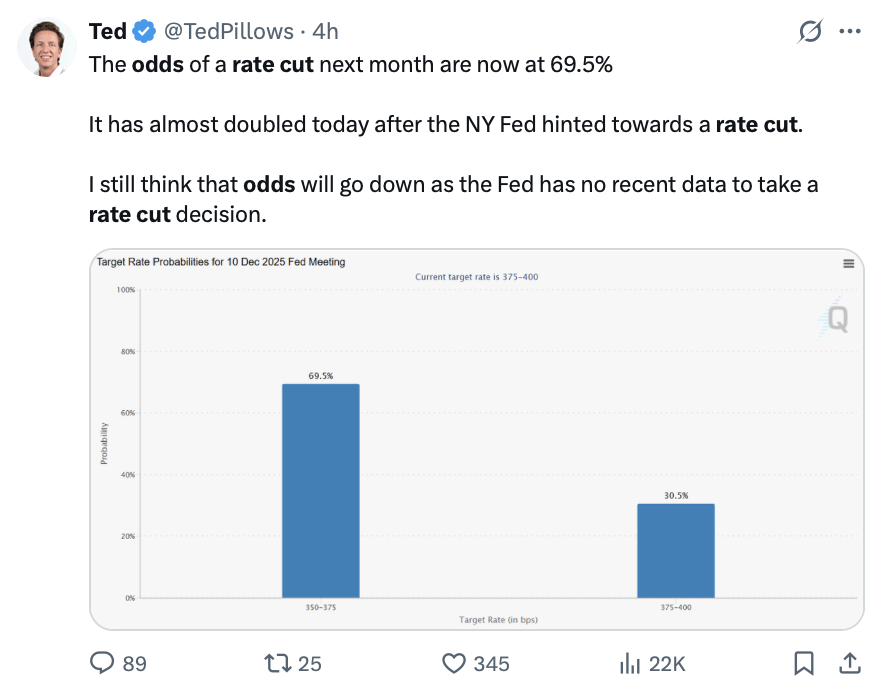

On Friday, the chances of a rates of interest cut at the December Federal Free Market Committee (FOMC) conference practically doubled to 69.40%, according to the CME FedWatch Tool. Simply the day in the past, on Thursday, it was almost 30.30% lower, at 39.10%.

Numerous in the broader market associated the spike a minimum of partially to dovish remarks from New york city Fed president John Williams, who stated the Fed can cut rates “in the near term” without threatening its inflation objective. Bloomberg expert Joe Weisenthal stated it was the factor the chances have actually “enormously increased.”

The setup is looking “unfathomably bullish,” states expert

Nevertheless, economic expert Mohamed El-Erian cautioned market individuals not to get “brought away” by the remarks. On the other hand, the more comprehensive crypto neighborhood has actually responded much more bullishly. “Generally this would be bullish,” Mister Crypto stated in an X post on Friday.

The Fed cutting rates is generally bullish for riskier possessions such as Bitcoin and the more comprehensive crypto market, as standard possessions such as bonds and term deposits end up being less profitable to financiers.

Crypto expert Jesse Eckel indicated the rising rate cut chances and stated, “If you zoom out, the setup is unfathomably bullish.”

” I do not understand why we keep going lower,” Eckel stated. “We are going from a tightening up cycle into a reducing cycle,” he included.

Crypto expert Curb stated, “Crypto will take off in an enormous rally.”

The chances of a rate cut were formerly “mispriced”

Coinbase Institutional stated in a X post on Friday, “While markets are favoring ‘no cut’ this time, our company believe the chances for a rate cut are in fact mispriced. Current tariff research study, personal market information, and real-time inflation indications recommend otherwise.”

Related: BTC ETF outflows are ‘tactical rebalancing,’ not institutional flight: Experts

” Given That the October FOMC conference, futures have actually moved from anticipating a 25bps cut to preferring a hold, generally due to increasing inflation issues,” Coinbase Institutional stated.

” Nevertheless, research studies reveal that tariff walkings can decrease inflation and boost joblessness in the short-term, imitating unfavorable need shocks,” it included.

It comes as belief throughout the whole crypto market has actually stayed weak over the previous 7 days. The Crypto Worry & & Greed Index, which determines total crypto market belief, published an “Extreme Worry” rating of 14 in its Friday upgrade.

Publication: Bitcoin whale Metaplanet ‘undersea’ however considering more BTC: Asia Express