Secret takeaways:

-

Bitcoin’s $124,500 high is not likely to be the cycle top, with all 30 peak signs still neutral.

-

Current losses reveal brand-new financiers capitulating as experienced holders are unfazed.

-

Holding above the 20-week EMA keeps Bitcoin’s course open towards $150,000.

Bitcoin’s (BTC) retreat from its record highs is sustaining issues over whether the marketplace has actually currently peaked for 2025. However the so-called “$ 124K top” is absolutely nothing however “sound,” according to expert Merlijn The Trader.

30/30 signs hint Bitcoin has more space to increase

In a Tuesday post, Merlijn worried that none of Bitcoin’s 30 commonly followed peak signs have actually flashed red up until now.

Historically, Bitcoin cycle tops have actually accompanied numerous “getting too hot” signals throughout popular onchain tools.

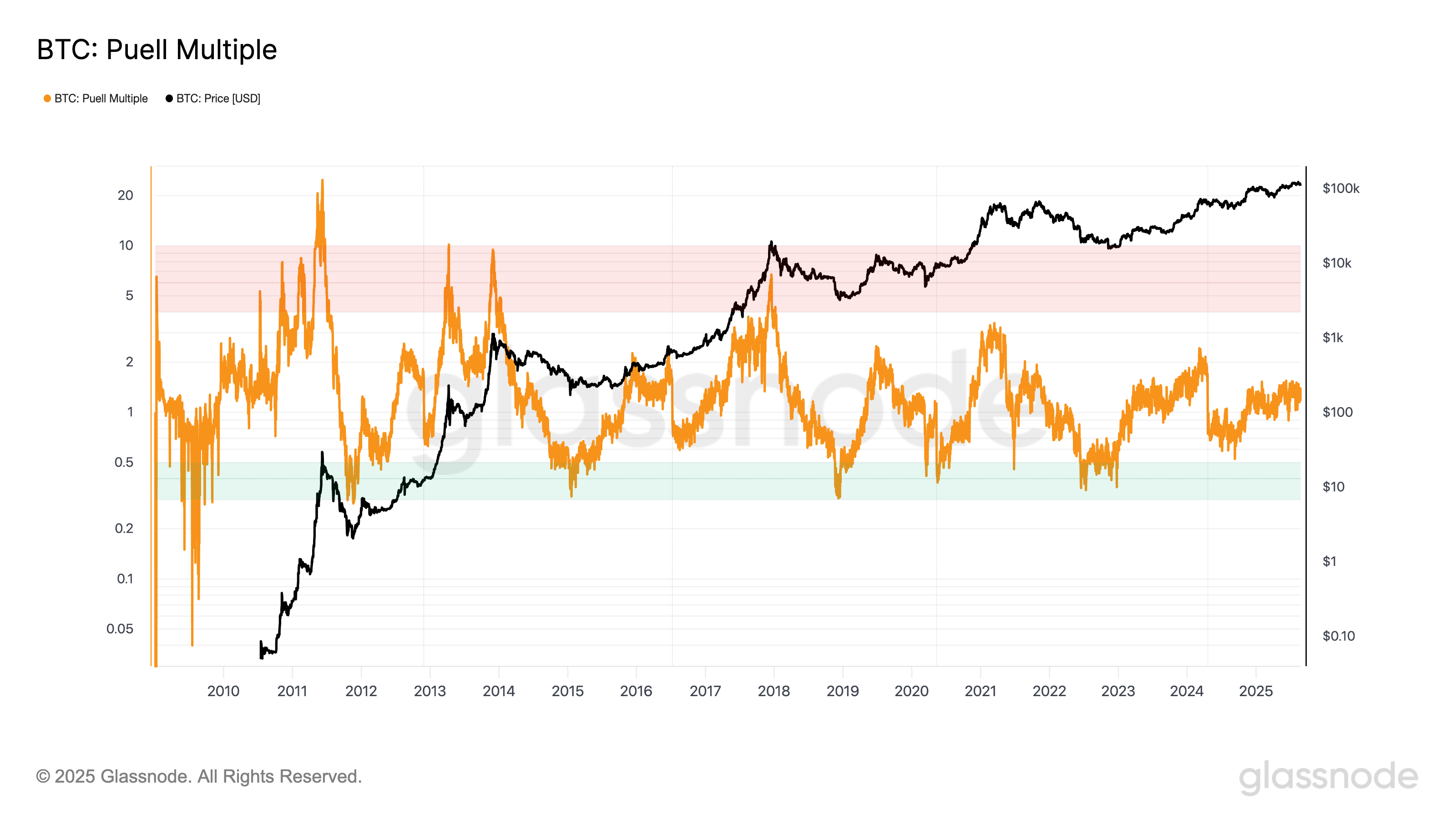

For example, the Puell Several, which increases when miners make unsustainably high profits, is sitting at simply 1.39, well listed below the 2.2 risk zone seen before previous rate peaks.

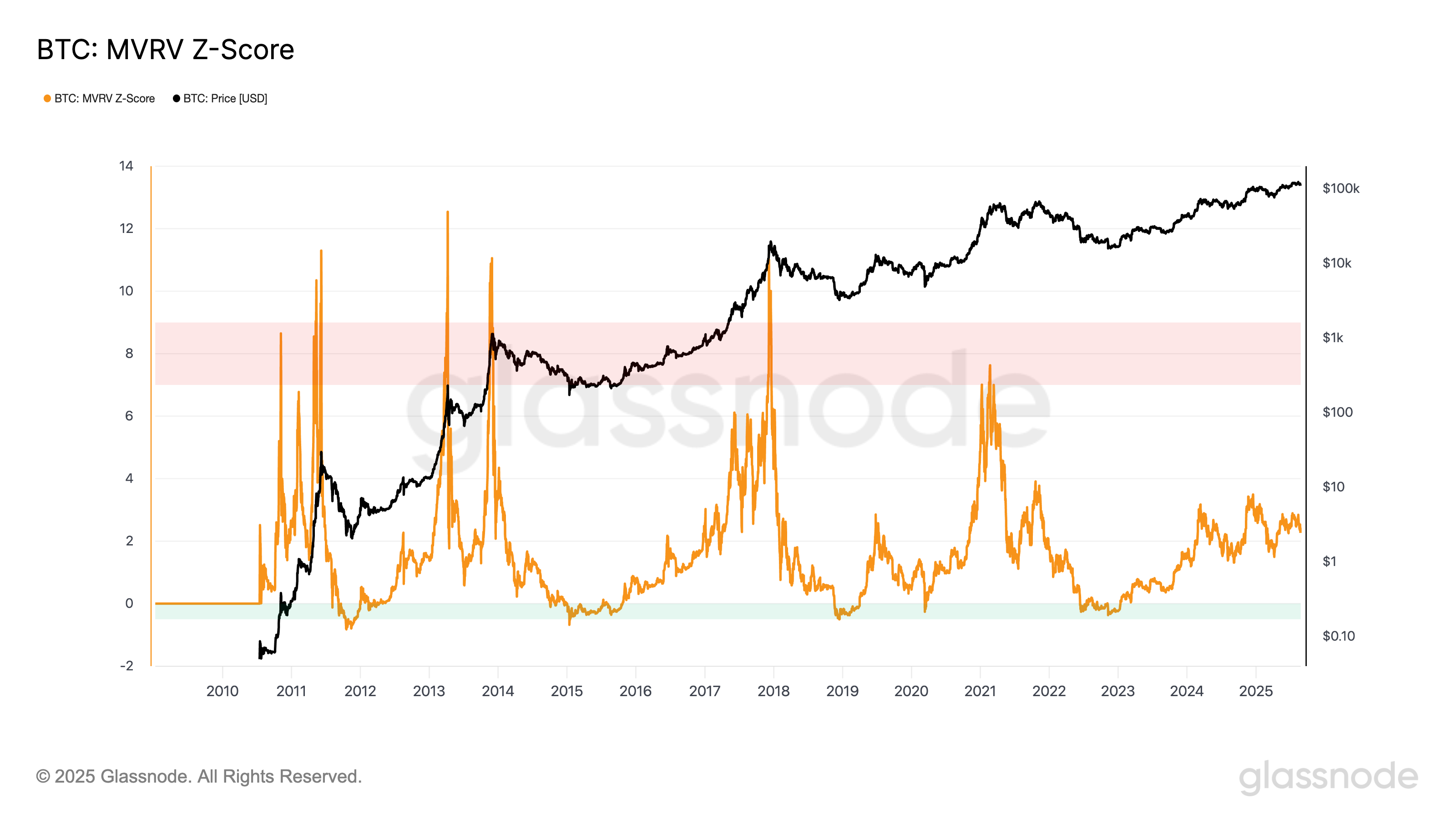

Likewise, the MVRV Z-Score, which compares Bitcoin’s rate to its real capital inflows, stays in neutral area instead of at the overheated extremes that marked prior tops.

Experienced BTC holders are unfazed

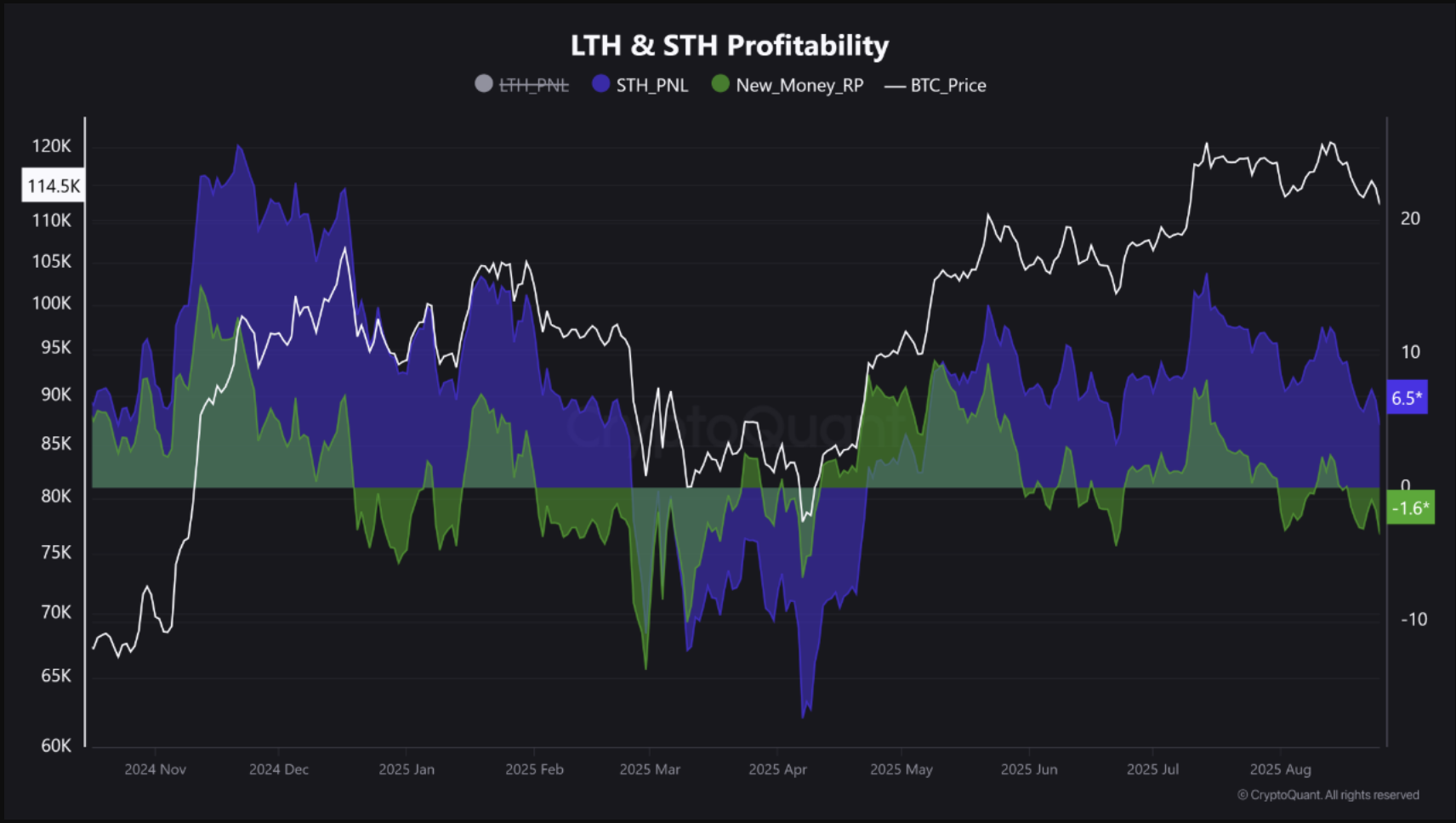

Onchain information supports the bullish view, revealing a timeless capitulation stage underway.

The most recent Bitcoin financiers, those holding BTC for less than a month, are resting on typical latent losses of around -3.50% and are now offering, according to information shared by expert CrazzyBlockk.

Alternatively, the wider Short-Term Holder (STH) associate, which has actually held for one to 6 months, stays rewarding with an aggregate latent gain of +4.50%.

” This is a bullish structural advancement,” composes CrazzyBlockk, including:

” The marketplace is purging its weakest hands, moving their BTC to holders with a lower expense basis and greater conviction […] This shakeout, while agonizing for current top-buyers, is specifically the type of occasion that develops a strong assistance base for the next considerable relocation higher.”

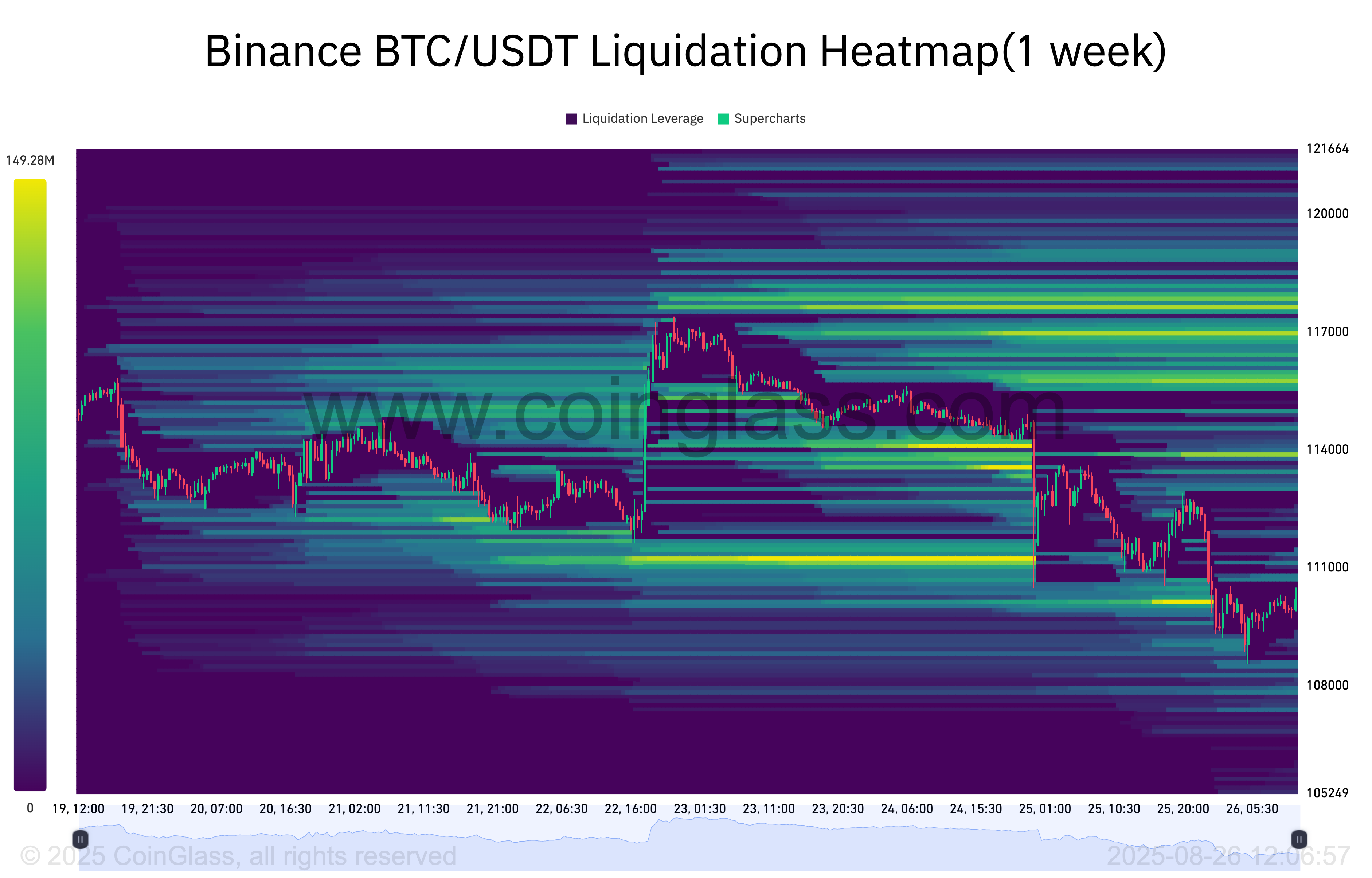

$ 70 million in BTC longs liquidated

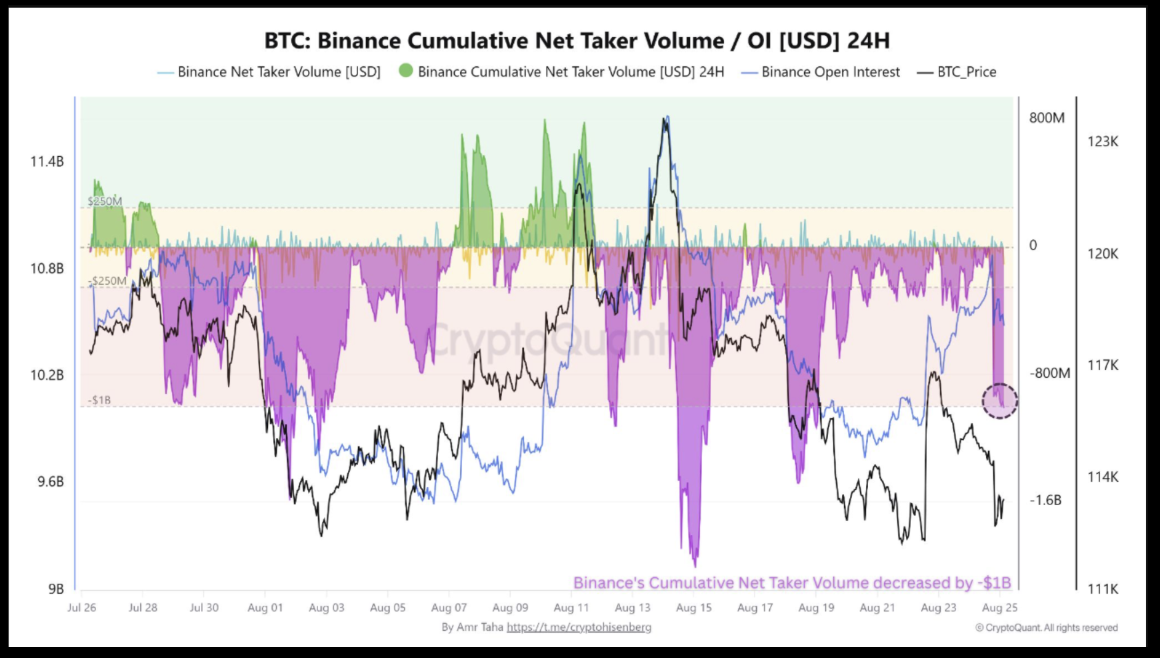

Onchain expert Amr Taha even more argued in favor of a healing next, pointing out the current $70 million flush of leveraged longs following BTC’s rate dip listed below $111,000 on Binance.

Open interest (OI) dropped substantially after the liquidation occasion. Binance Cumulative Net Taker Volume plunged by around $1 billion, suggesting aggressive sell-side supremacy and capitulation amongst late purchasers.

The next cluster of liquidity lies around $117,000–$ 118,000, which might serve as a rate magnet if BTC recuperates in the coming days. Listed below, there’s restricted assistance till around $105,000.

” With overleveraged purchasers eliminated and open interest reset, the marketplace is structurally much healthier,” Taha composed, including:

” The lack of a brief capture recommends hidden upside prospective, particularly if BTC recovers essential levels and sets off brief covering.”

Can Bitcoin rate still drop $100,000?

On the weekly chart, Bitcoin’s pullback looks less like a market top and more like a timeless booming market correction.

Given that early 2023, BTC has actually consistently published sharp drawdowns in the 20%– 30% variety before resuming its uptrend.

The most recent 12% decrease is relatively shallow and still sits above the 20-week rapid moving average (20-week EMA; the green wave) near $108,000, a level that has actually functioned as vibrant assistance throughout the rally.

A rebound from the 20-week EMA might put Bitcoin back on track to challenge its all-time high above $125,500, while keeping the door open for a more comprehensive rally towards $150,000, if not greater by 2025’s end.

Related: Technique purchases $357M in Bitcoin as rate drops to $112K

Alternatively, a breakdown listed below the 20-week EMA may lead to a much deeper correction towards the 50-week EMA (the red wave) near $95,300. This wave assistance has traditionally significant Bitcoin’s regional bottoms throughout previous booming market pullbacks.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding.