Secret takeaways

-

The Bitcoin loudspeaker pattern functions a minimum of 2 greater highs and 2 lower lows, forming a broadening structure.

-

Linking these low and high with trendlines produces a megaphone-like look, showing market instability.

-

The development signals increased volatility, with cost swings ending up being more noticable with time.

-

Depending upon the pattern instructions, the pattern can suggest prospective breakouts either up (bullish) or down (bearish).

The loudspeaker pattern, likewise called an expanding development, is a technical analysis chart pattern that traders observe in different monetary markets, consisting of cryptocurrencies like Bitcoin.

This pattern is defined by its distinct shape, looking like a loudspeaker or a broadening triangle, and represents increasing volatility and market indecision. Here are its specifying attributes:

-

Greater highs and lower lows: The pattern includes a minimum of 2 greater highs and 2 lower lows, forming a broadening structure. Each subsequent peak is greater than the previous one, and each trough is lower, producing diverging trendlines.

-

Diverging trendlines: When trendlines are drawn linking the greater highs and lower lows, they diverge, forming an expanding pattern that aesthetically looks like a loudspeaker.

-

Increased volatility: The development of this pattern shows increased volatility as the cost swings end up being more noticable with time. This shows a battle in between purchasers and sellers, resulting in larger cost motions.

Did you understand? Bitcoin loudspeaker trading varies from conventional loudspeaker trading because no physical loudspeakers are associated with the procedure.

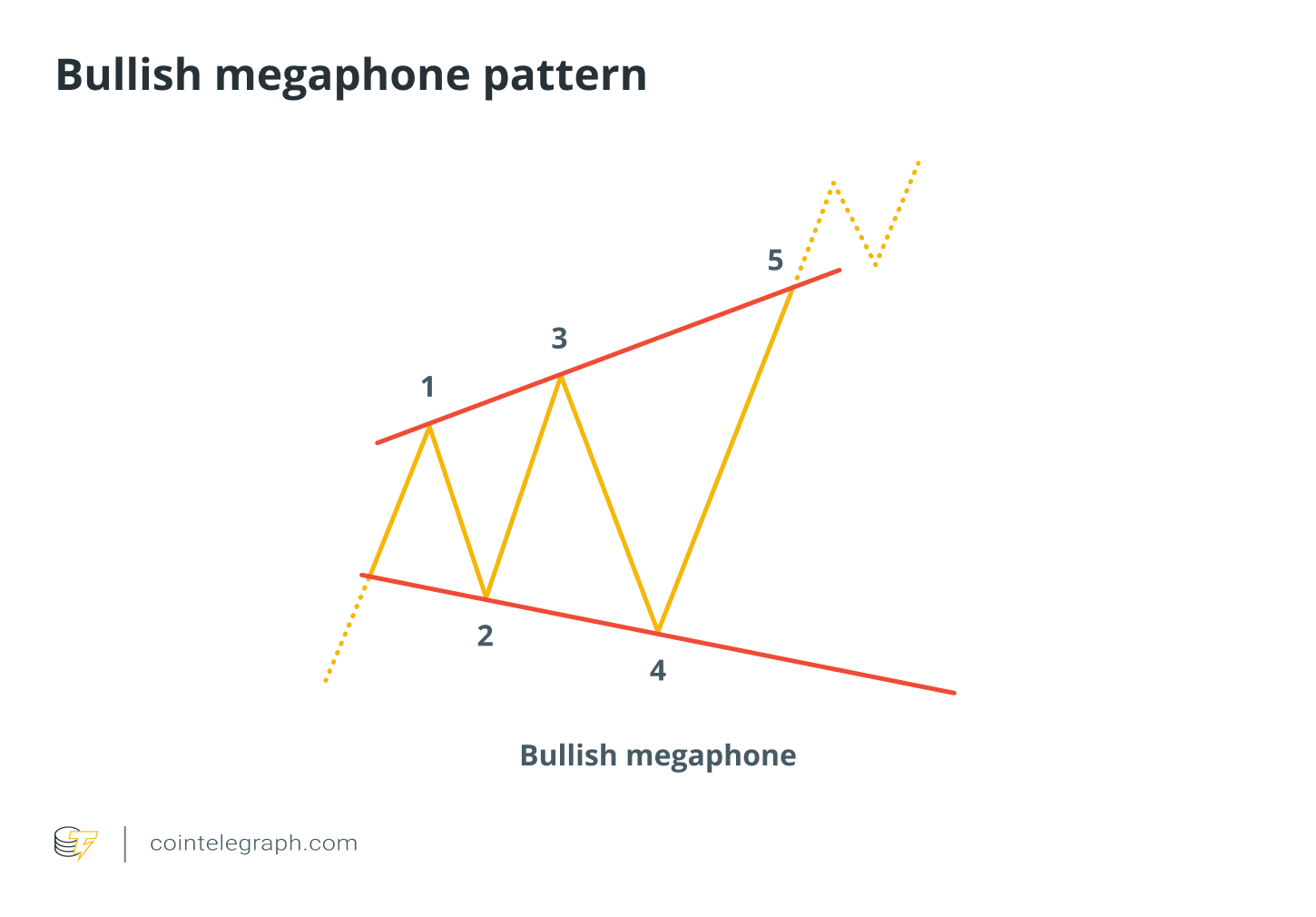

1. Bullish loudspeaker development

This variation of the pattern recommends a possible breakout to the advantage.

-

Preliminary uptrend: The cost starts in an uptrend, reaching the very first peak (point 1).

-

Very first retracement: A pullback happens, producing a lower low (point 2) that is still above the previous pattern’s beginning level.

-

Greater high development: The cost rallies once again, going beyond the previous high and forming a greater high (point 3).

-

Lower low growth: A more noticable drop follows, resulting in a lower low (point 4), extending the variety of cost changes.

-

Breakout and extension: The cost breaks above the resistance line (point 5), verifying a bullish breakout.

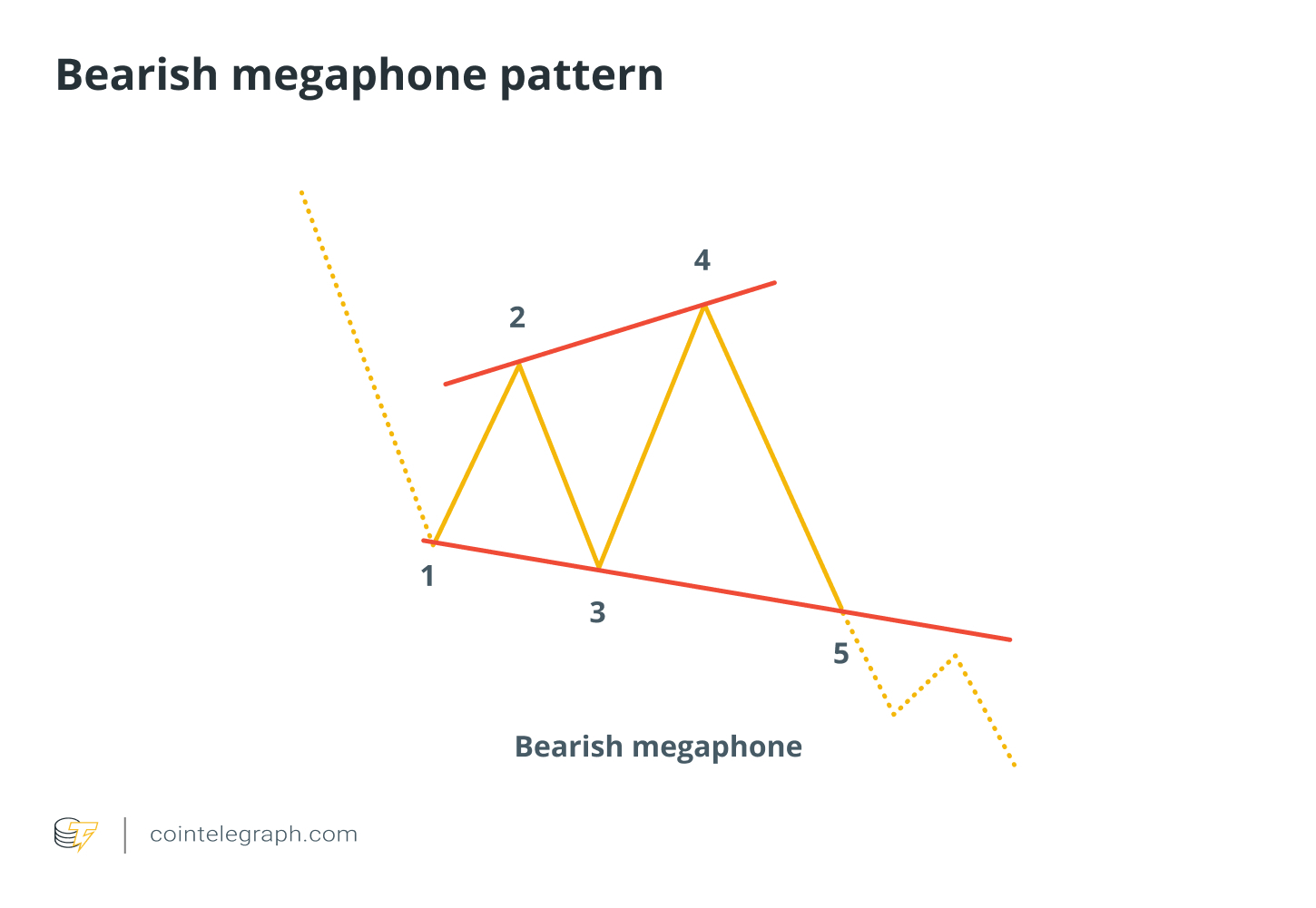

2. Bearish loudspeaker development

This variation of the pattern indicates a possible disadvantage breakout.

-

Preliminary sag: The cost starts with a down motion, setting a preliminary low (point 1).

-

Very first retracement: A small upward correction follows, forming a lower high (point 2).

-

Lower low growth: A brand-new low types (point 3), more expanding the variety.

-

Greater high development: The cost spikes once again however still has a hard time to hold above previous highs (point 4).

-

Breakout and turnaround: The cost breaks listed below the assistance line (point 5), verifying a bearish breakout.

Did you understand? A high-volume breakout from a loudspeaker pattern signals strong market conviction, verifying a genuine relocation. Low volume? It’s most likely a fakeout, with the cost reversing back. Keep in mind, wait on a volume spike before getting in.

Loudspeaker history in Bitcoin trading

The loudspeaker pattern, or widening development, has actually appeared at different turning points in Bitcoin’s trading history:

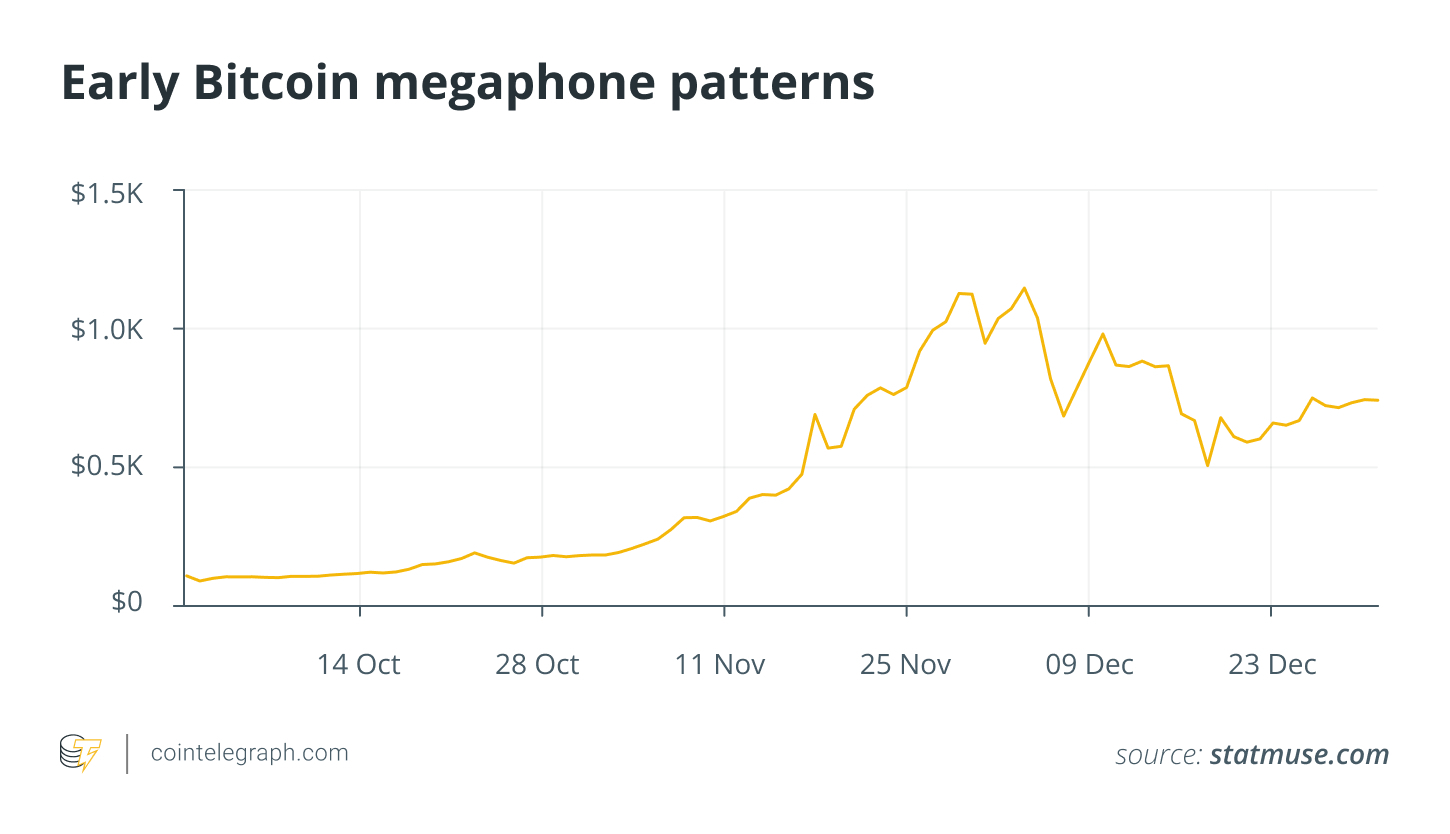

1. The early days: 2013– 2014

In Bitcoin’s (BTC) developmental years, severe volatility typically produced widening developments. Throughout this duration, traders kept in mind loudspeaker patterns– typically with a bearish tint– showing wild cost swings as the marketplace had a hard time to discover balance.

Although less recorded then, these early examples have actually considering that ended up being recommendation points for comprehending how disorderly market conditions can manifest as loudspeaker developments.

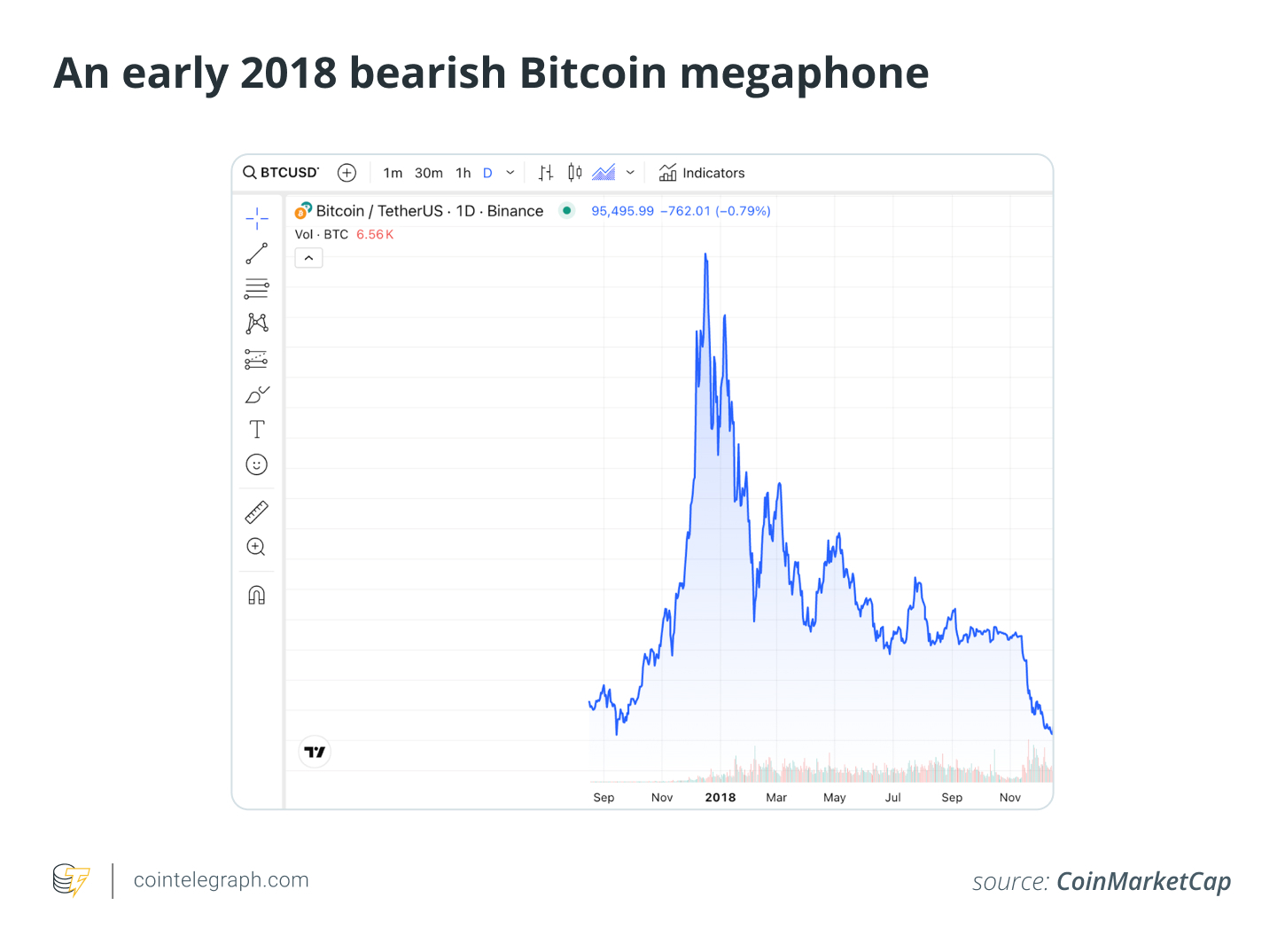

2. The late 2017– early 2018 bearish development

As Bitcoin rose towards its then-all-time high near $20,000 in late 2017, a bearish loudspeaker pattern appeared on everyday charts. This development, marked by diverging trendlines with greater highs and lower lows, signified increasing indecision and installing selling pressure.

Lots of technical experts saw it as an indication of an approaching turnaround– a projection that emerged with the significant correction experienced in early 2018.

3. The early 2021 bullish turn

In early 2021, as Bitcoin approached the $60,000 limit, traders observed a bullish loudspeaker pattern forming on numerous timeframes. Identified by a series of gradually greater highs and greater lows, this pattern suggested a duration of increased volatility integrated with careful optimism.

The subsequent breakout validated a strong bullish momentum, strengthening the pattern’s credibility as a predictive tool in a growing market.

Trading techniques for the loudspeaker pattern

In this area, we’ll check out a variety of trading techniques suitable with the Loudspeaker pattern.

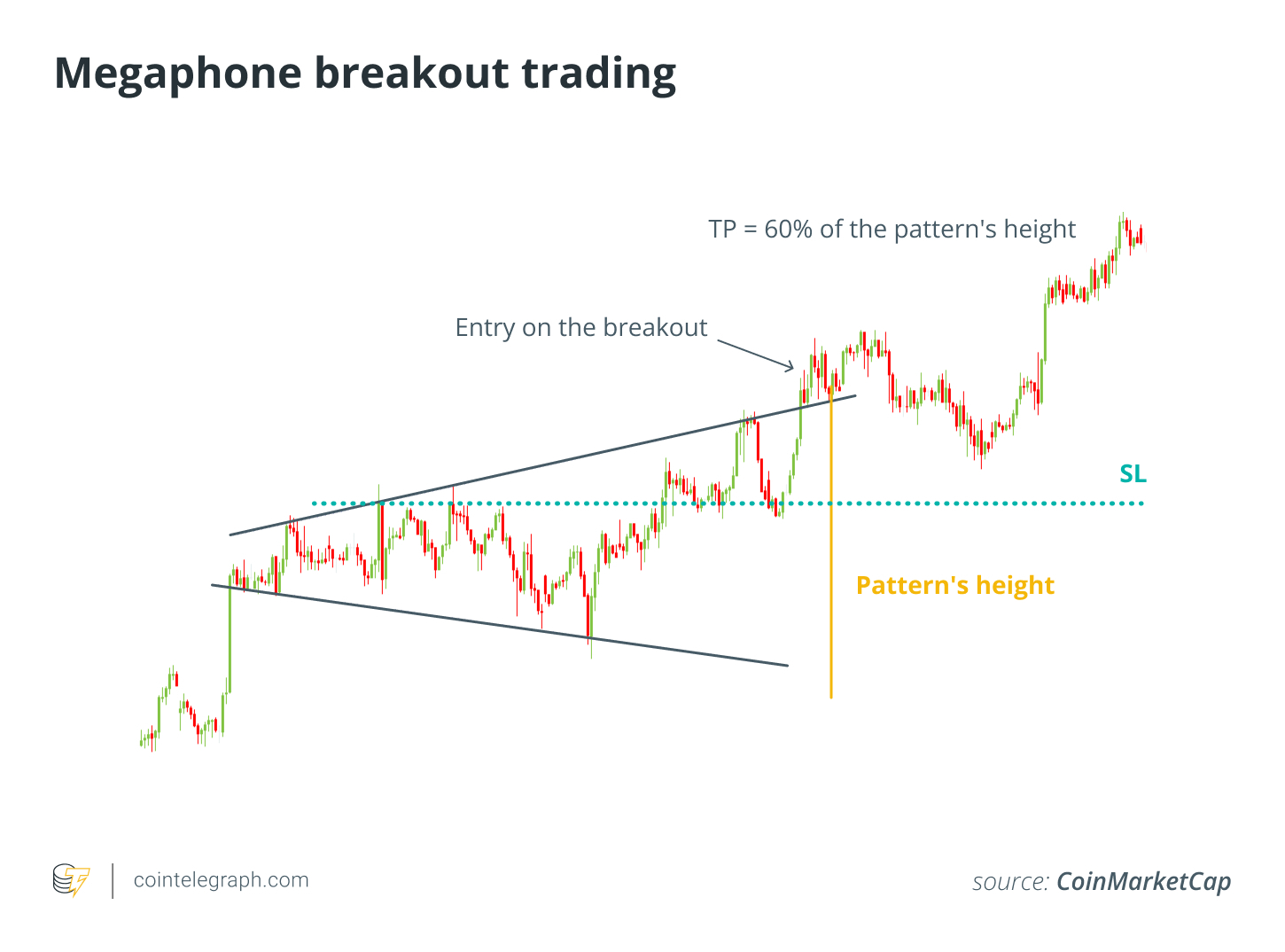

1. Loudspeaker breakout trading

Breakout loudspeaker pattern trading includes getting in a trade when the cost decisively breaks out of the pattern’s borders with strong volume verification.

a. Recognizing essential levels

-

Draw upper and lower trendlines: Link the pattern’s greater highs and lower lows to form the loudspeaker shape. These trendlines mark the important resistance and assistance levels.

-

Verify the breakout zone: In a bullish circumstance, the upper resistance line is the essential zone to expect a breakout. In a bearish circumstance, concentrate on the lower assistance line.

b. Volume verification

-

Try to find a volume rise: As the cost breaches resistance (bullish) or assistance (bearish), a spike in volume shows strong market involvement.

-

Minimize incorrect breakouts: If volume stays weak at the breakout, there’s a greater opportunity of a phony return into the pattern.

c. Entry points

Did you understand? Putting your stop-loss inside the loudspeaker can assist avoid extreme losses if the breakout stops working and the cost slides back into the pattern, offering you included security in unstable markets.

d. Revenue targets

Determine the pattern’s height by discovering the vertical range in between its most affordable and acmes, then utilize a part of this measurement (frequently around 60%) to identify a well balanced take-profit level.

By predicting that portion from the breakout point, whether above the upper resistance (for a bullish circumstance) or listed below the lower assistance (for a bearish one), traders can set reasonable targets while preserving a beneficial risk-to-reward ratio.

2. Swing trading within the pattern

Swing trading within a loudspeaker pattern includes profiting from the interim cost relocations in between its assistance and resistance borders– without always waiting on a conclusive breakout.

a. Determine essential lines

-

Upper resistance (R1, R2): These lines represent zones where cost is most likely to come across selling pressure.

-

Pivot line: A midpoint recommendation that can function as short-lived assistance or resistance, depending upon the instructions of the cost relocation.

-

Lower assistance (S1, S2): Zones where purchasing pressure might emerge.

b. Try to find buy signals near assistance

In a bullish loudspeaker, think about getting in long positions near the lower assistance lines (S1 or S2), specifically when you see a bounce or bullish candlestick development.

Verify signals with oscillators (e.g., RSI, stochastics) or volume upticks suggesting a shift in momentum.

c. Offer signals near resistance

In a bearish loudspeaker (or perhaps within a bullish one, if you’re comfy short-selling), traders might search for brief entries near upper resistance lines (R1 or R2).

A candlestick turnaround pattern or a decrease in volume at these resistance levels can strengthen the probability of a cost turnaround.

d. Stop loss and take earnings

Location your stop-loss simply above the resistance line (e.g., somewhat above R2) to reduce losses if the cost breaks out greater.

For take-profit targets, think about leaving near the pivot line or the very first assistance (S1). In cases of strong down momentum, take partial earnings at S1 and go for S2 with the staying position.

e. Utilize the pivot line as a choice zone

The pivot line in the center typically functions as a short-term inflection point:

-

Above the pivot: The predisposition might be bullish, preferring long positions.

-

Listed below the pivot: The predisposition might be bearish, preferring brief positions.

If the cost regularly hovers around the pivot line without any clear instructions, wait on it to evaluate either an assistance or resistance level to verify the next swing.

f. Integrate volume and signs

Try to find volume spikes at each assistance or resistance test. An uptick in volume when the cost bounces off assistance or reverses from resistance can signify a more powerful relocation.

Likewise, tools like the relative strength index (RSI) or moving typical convergence/divergence (MACD) can assist verify overbought/oversold conditions, enhancing the case for a turnaround trade.

3. Incorrect breakout technique

Incorrect breakout loudspeaker pattern trading includes acknowledging when the cost briefly breaches the loudspeaker’s assistance or resistance, just to rapidly return within its borders– a circumstance typically accompanied by low volume.

In such cases, rather of going after the breakout, traders search for verification of the turnaround before getting in a counter-trend trade.

This technique needs determining essential trendlines that specify the pattern, keeping track of volume for weak breakout signals, and getting in a trade once the cost returns to the development, usually putting stop-loss orders within the pattern to restrict losses and setting earnings targets based upon the determined height of the development.

Danger management and factors to consider

Offered the fundamental volatility of Bitcoin and the wild cost swings particular of the loudspeaker pattern, robust danger management is necessary to securing your trading capital. Here are numerous essential techniques to integrate into your trading strategy:

1. Volatility awareness

-

The broadening variety of the loudspeaker pattern represents increasing unpredictability. Acknowledge that fast swings can result in both considerable gains and similarly substantial losses.

-

Screen market belief carefully and be gotten ready for abrupt turnarounds, specifically throughout incorrect breakouts where low volume may signify an absence of conviction.

2. Position sizing and take advantage of

-

Position sizing: Identify your position size based upon the optimum danger you want to take (usually 1%– 2% of your trading account).

-

Mindful usage of take advantage of: While take advantage of can enhance earnings, it similarly increases prospective losses. Usage take advantage of moderately and guarantee your danger criteria can accommodate enhanced swings.

3. Stop-loss and take-profit levels

-

Stop-loss orders: Location stop-loss orders simply within the loudspeaker development’s borders. This positioning assists restrict losses if the cost reverses suddenly.

-

Take-profit targets: Determine your earnings targets by determining the vertical range of the pattern and predicting an affordable portion from the breakout point. This guarantees you safe and secure gains while preserving a beneficial risk-to-reward ratio.

4. Adaptive danger controls

Market conditions can move quickly. Continually reassess your trades by:

-

Keeping track of volume and momentum: Usage volume spikes and momentum signs to change your stop-loss or take-profit levels dynamically, guaranteeing that your exit technique adapts to the developing market.

-

Utilizing tracking stops: Think about utilizing tracking stop orders to secure earnings as the cost relocations in your favor while still permitting space for prospective gains.

Which’s it– pleased loudspeaker trading!