Bottom line:

-

Bitcoin short-term holders are revealing traditional profit-taking habits, sending out BTC to exchanges.

-

Their existence amongst exchange inflows has actually reached a level connected with “regional bottoms” on BTC/USD.

-

A popular quote level on Binance now sits at $117,500.

Bitcoin (BTC) might be putting in its next regional bottom as retail financiers unload revenues, brand-new research study states.

In a QuickTake post launched on Wednesday, onchain analytics platform CryptoQuant considered a crucial occasion for BTC cost action.

Bitcoin exchange inflows trigger brand-new cost signal

Bitcoin retail financiers are minimizing BTC direct exposure as cost hovers around $120,000, CryptoQuant verified.

Exchange circulations, nevertheless, are nuanced; incoming deals are progressively originating from more recent financiers, frequently referred to as short-term holders (STHs).

” Increased Short-Term Holder (STH) Activity on Binance Signals Prospective Profit-Taking,” factor Amr Taha summed up.

Taha highlighted the Binance Exchange Inflow Ratio for STHs, which reveals the percentage of incoming deals to Binance originating from entities hodling for 6 months or less.

The ratio just recently crossed 0.4, something Taha reveals “frequently accompanies regional bottoms.”

” The most recent spike above 0.4 recommends that retail individuals might have begun transferring their Bitcoin holdings en masse to Binance, most likely in an effort to protect revenues following a strong upward cost pattern,” he stated.

” The STH associate– generally holding BTC for less than 155 days– tends to offer throughout upward patterns, and the existing ratio enhances this habits.”

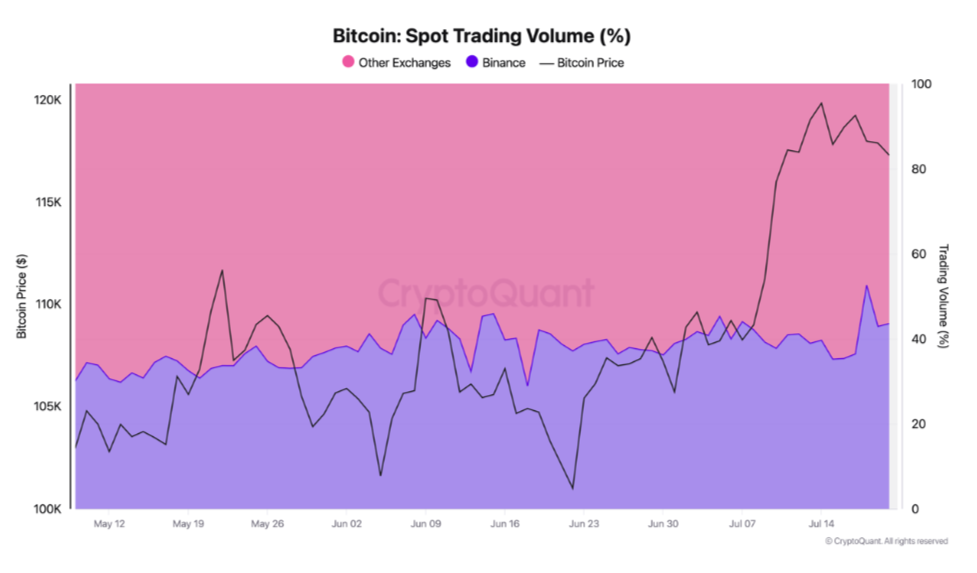

All-time highs recently triggered a mass rekindling of trading activity throughout crypto exchanges.

” Amongst all locations, Binance taped the biggest single‑day boost in area trading volume both on the day previously and the day after the brand-new high, therefore catching extra market share the days after the peak– 52% on July 18,” CryptoQuant reported in a different Quicktake post.

” Crypto.com, Coinbase, Bybit and OKX likewise revealed a reasonably high area trading volume.”

BTC cost quote interest puts concentrate on $117,500

As Cointelegraph kept in mind, analysis has actually currently called the start of “seller fatigue” after comprehensive profit-taking triggered BTC/USD to whipsaw in between $116,000 and $120,000.

Related: Bitcoin bull run ‘most likely near to over’ states trader as XRP turns McDonald’s

Traders still anticipate another upside leg for Bitcoin, even as attention and capital turn into altcoins.

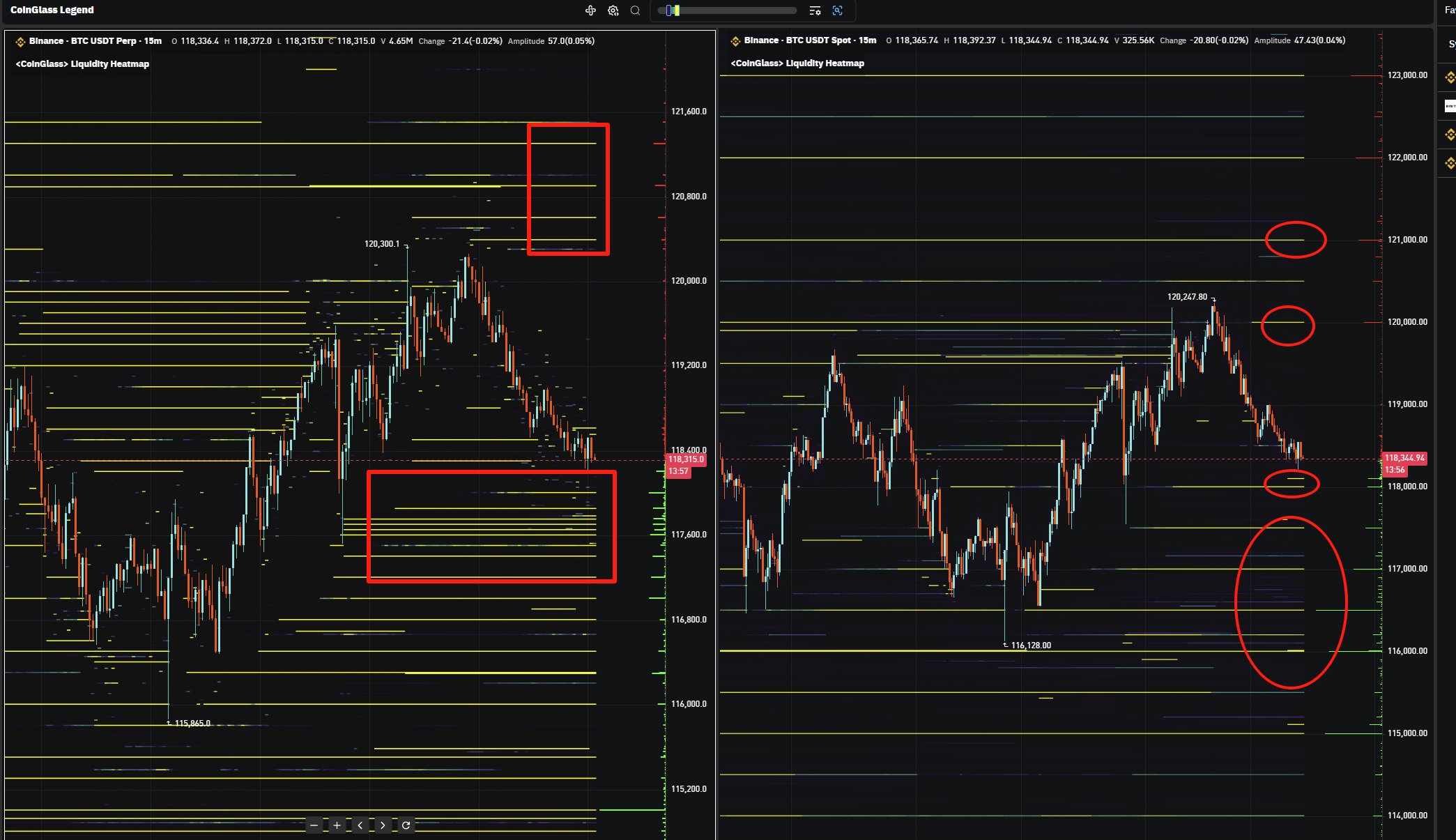

Exchange order-book quote liquidity prefers $117,500 as a cost “magnet,” keeping an eye on resource CoinGlass highlighted on X on Wednesday.

Big liquidity clusters continue to form low-timeframe proceed BTC/USD.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.