Bitcoin (BTC) scratched brand-new lows listed below $73,000 on Tuesday as information reveals unpleasant macroeconomic obstacles bubbling listed below progressively unstable markets. New information highlights tightening up credit conditions, even as the United States financial obligation and loaning expenses remain raised, and one expert states this space in between credit prices and credit market tension might specify Bitcoin’s cost trajectory for the approaching months.

Secret takeaways:

-

The ICE BofA United States Business Option-Adjusted Spread is at 0.75, its most affordable level because 1998.

-

United States financial obligation stands at $38.5 trillion, while the 10-year Treasury yield is 4.28%.

-

Bitcoin whale inflows to exchanges have actually increased, however the rate of onchain profit-taking is alleviating.

Tight credit spreads contrast with increasing financial stress

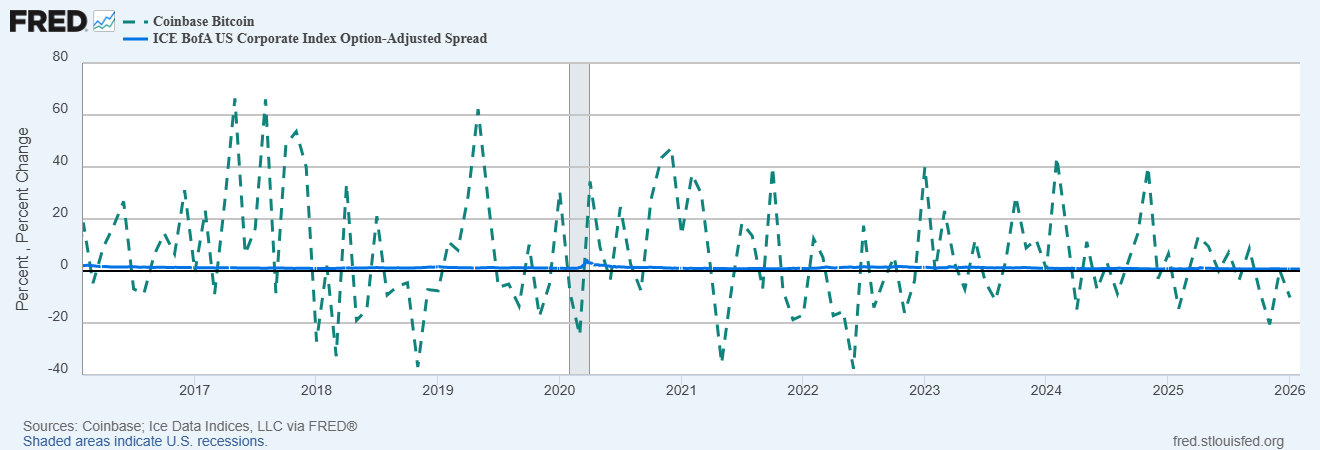

The ICE BofA Business Option-Adjusted Spread might serve as an essential macroeconomic signal for Bitcoin. The metric tracks the additional yield financiers require for holding the business bonds over United States Treasurys. When spreads broaden, it typically shows tension in the credit markets.

Presently, the spreads are compressed, recommending the danger is still underpriced. This is significant offered the existing market. United States federal government financial obligation reached $38.5 trillion at the end of January, and the 10-year Treasury yield, after briefly falling listed below 4% in October, has actually climbed up back to 4.28%, which is keeping today monetary conditions tight.

In previous Bitcoin market cycles, consisting of 2018, 2020, and 2022, BTC formed a regional bottom just after the credit spreads started to broaden. That procedure played out within a three-to-six-month hold-up, instead of an instant impact.

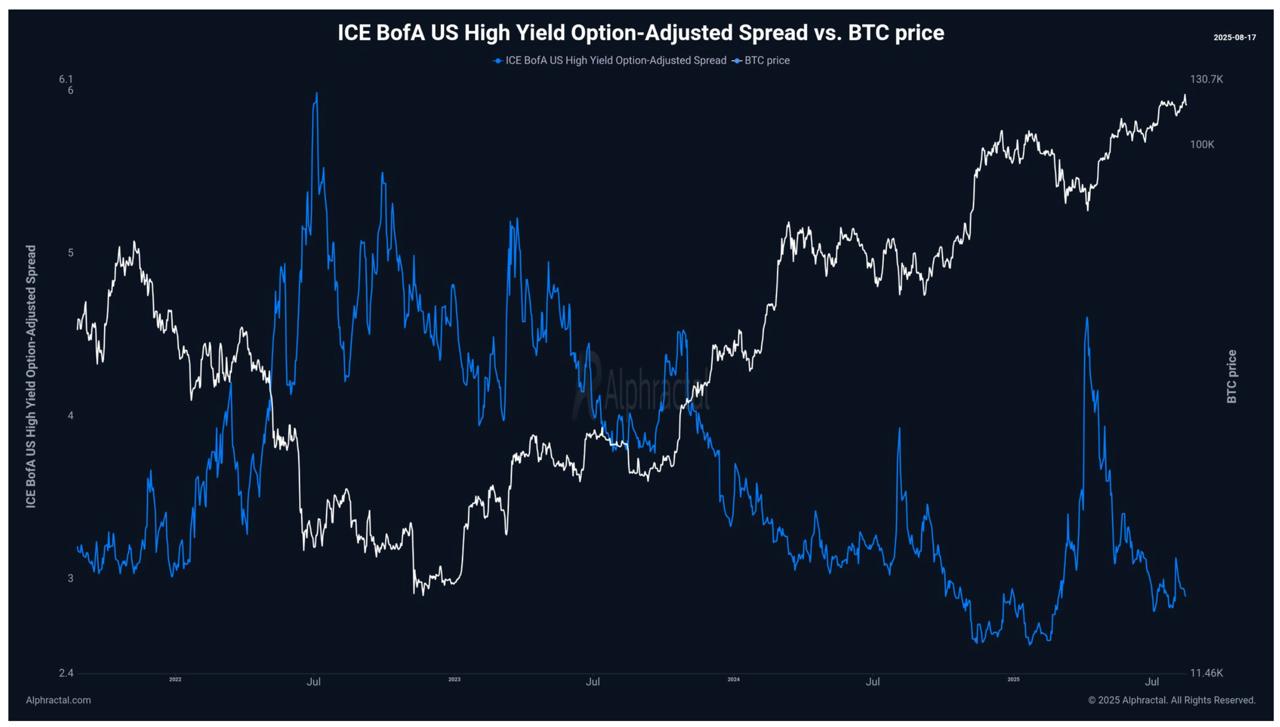

In August, 2025, Alphractal creator Joao Wedson argued that if liquidity tightens and credit spreads increase in the coming months, Bitcoin might go into another build-up stage before the more comprehensive market tension ends up being noticeable.

Related: Bitcoin, crypto ‘winter season’ quickly over, states BitWise officer as gold retargets $5K

Bitcoin whale selling increases, however longer-term pressure is cooling off

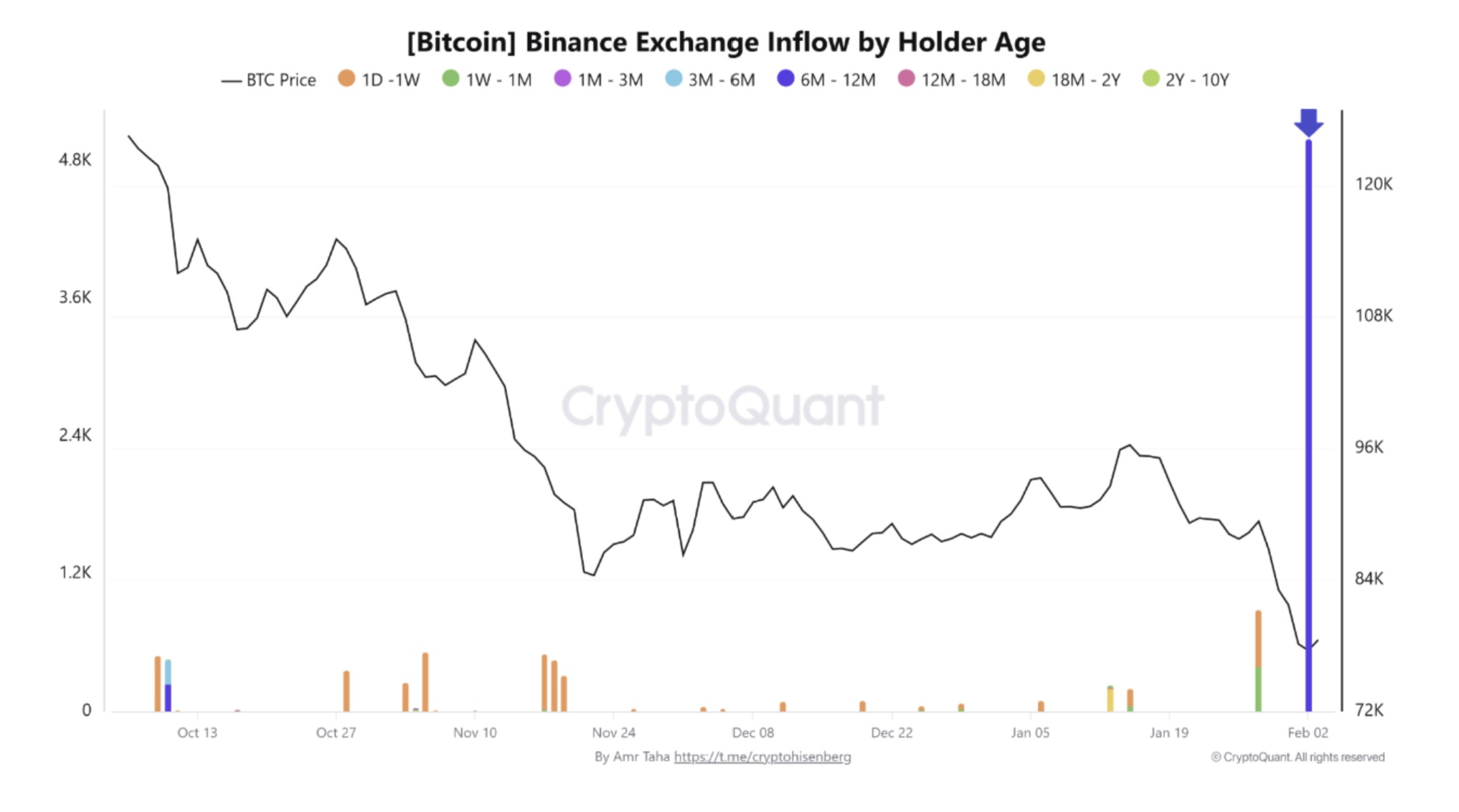

Short-term selling activity has actually increased for Bitcoin today. Crypto expert Amr Taha kept in mind that both whales and mid-term holders just recently moved a substantial quantity of BTC to Binance. On Monday, wallets holding more than 1,000 BTC transferred about 5,000 BTC, matching a comparable spike seen in December.

At the very same time, holders from the 6-to-12-month age likewise moved 5,000 BTC to exchanges, the biggest inflow from this accomplice because early 2024.

Nevertheless, more comprehensive selling pressure seems fading. CryptoQuant information reveals the used output earnings ratio (SOPR) has actually dropped towards 1, its most affordable level in a year, as Bitcoin dropped to a year-to-date low of $73,900 on Tuesday.

Historic patterns detail that a Bitcoin bottom has actually played out in between three-to-six months after credit spreads start to broaden. Increasing Treasury yields might push the credit markets, possibly driving spreads towards the 1.5– 2% variety through April.

This might result in a build-up window after July 2026, continuing into the 2nd half of the year, as the marketplace absorbs this tension, lining up with the existing SOPR information, signalling long-lasting seller fatigue.

Associated: Bitcoin flash crash healing to $100K might take months: Expert

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.